Written by

My key PHM-related takeaway from three days touring the booths of the leading vendors at HIMSS 2018 was the increasing importance of prediction.

The scene was set during the opening keynote speech from Eric Schmidt, Technical Advisor and former Chief Executive of Alphabet (owner of Google) who stated “The really powerful stuff is prediction. What I want is prediction to be able to intervene earlier.”

Within this wider theme of prediction, developments in two areas of PHM analytics were the talk of the show, namely:

- AI/Machine Learning

- Social Determinants of Health (SDOH)

Social Determinants of Health

A complete PHM solution includes risk stratification tools that enable a provider or payer to segment a population into different groups based on risk. PHM solutions typically use a range of analytics tools to segment populations into different groupings based on several different factors.

At its most basic level this involves defining patient cohorts based on administrative codes relating to conditions or procedures associated with each patient. EHR data supplemented with claims data has been the traditional source of data used for this process. However, it misses a huge proportion of information that can heavily influence the future health of a patient. This includes data relating to behaviours (e.g. exercise, tobacco use, alcohol consumption), physical characteristics of patients and patients’ ease of access to healthcare services. Vitally, it also misses social determinants of health (SDOH) such as data on patients’ living arrangements, family support groups, community support networks, education levels and safety in workplaces. Expanding the datasets used for risk stratification to include SDOH was a key theme at HIMSS with several companies such as Caradigm, Innovacer, SCIO Health Analytics and LexisNexis pushing this theme and/or showcasing new solutions that heavily expand the sources of data used in the stratification process. For the first time a specific conference educational topic was also set aside for “Social, Psychosocial and Behavioural Determinants of Health”.

Just How Important is SDOH

Vendors have started to compete with each other in terms of stating just how important SDOH are in the care process, with claims that social determinants account for anything from 15% to 80% of health outcomes. The processes used to come up with these estimates aren’t always clear; however, it is clear the use of SDOH will be an increasingly important battleground for differentiation between vendors in terms of their PHM analytics and stratification tools.

Remaining Challenges

As healthcare providers implement PHM solutions that utilise SDOH, they will need to start to interact with a wider range of social services organisations in order to address given social problems that may be impacting the health outcomes of specific patient cohorts. Some providers that have a history of working with large Medicaid populations have developed some of this resource in-house or have developed links with community organisations and social services agencies. But for many this will present a new challenge, both in terms of establishing relationships but also in terms of ensuring the IT put in place to support communication and execution of care plans can be accessed by this wider group of agencies involved. This wider group of out of network agencies may need at least partial access to EHR and PHM information to track the patient’s progress or to respond to care plan actions.

AI/Machine Learning’s Place in PHM

Once a broad pool of data is aggregated that includes SDOH, EHR data, claims data and behavioural data, the next challenge is to put in place algorithms that can provide the most useful data that will enable healthcare organisations to improve outcomes and better manage costs. Historically, algorithms were used to associate risk and likely outcomes for different cohorts based on simple rules or scoring systems. These rules and systems are fixed and can often be based on old data, or evidence based on data that has been gathered from populations that are less relevant to the cohort a specific provider is trying to manage. Further, they do not learn and cannot adapt to new evidence that is gained from care management programs that are put in place. AI and machine learning based algorithms differ in that they can learn and develop based on the experiences of outcomes for specific populations that a healthcare organisation is managing. A big theme for many of the PHM vendors exhibiting at HIMSS was outlining their plans for how machine learning and AI algorithms would be offered as part of their PHM solutions in the future.

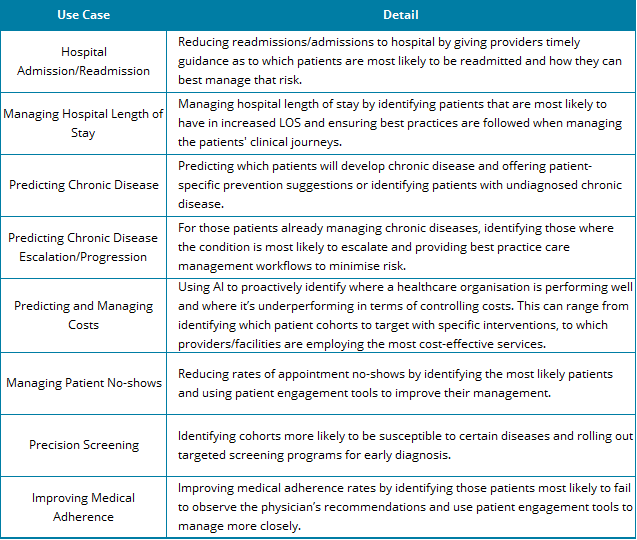

Areas of focus for vendors using AI algorithms in PHM solutions include:

There were several AI product launches relating to PHM solutions during the show. The below summarises the products announced alongside our views on their likely impact on the market.

Orion Health announced its new machine learning service, Amadeus Intelligence. This was developed by Precision Driven Health (PDH), a New Zealand partnership between Orion Health, the University of Auckland and Waitemata District Health Boards. The solution focuses on how AI can be used to minimise wastage in healthcare, predict patient costs, help clinicians make more accurate decisions at the point of care and support organizations in reducing hospital readmission rates.

It is also intended to be used to support precision screening. For example, Orion has used its machine learning models to develop the Health Outcome Prediction Engine (HOPE). HOPE is designed to identify patients at risk of an Abdominal Aortic Aneurysm (AAA). Based on epidemiological studies, 800 New Zealanders were identified through data analysis of patient records as likely candidates for AAA during a precision screening trial. All the patients identified during the precision screening trial were contacted and 632 took up the offer of an ultrasound exam. 36 were found to have AAA, a prevalence rate of 5.5% and almost exactly the rate that was predicted by the data analysis.

Allscripts announced AvenelTM, a Microsoft Azure-hosted tool designed to create community-wide shared patient records and that uses machine learning to reduce time for clinical documentation, support improvements in care coordination, and to provide analytics at both a patient and population level. Avenel is positioned as an EHR interface app, and while it has been developed to address clinician frustrations in relation to EHR workflows, its functionality around population level analytics and integration into Allscripts FollowMyHealth patient engagement module mean that it has the potential to significantly add to Allscripts’ overall PHM offering.

Health Catalyst introduced Touchstone, an analytics application that focuses on benchmarking and prioritisation capabilities using AI technology. The company claims Touchstone is able to review over 300 billion patient facts generated by more than 600 million patient visits, across 125 million distinct patients. Touchstone has been launched with a population health specific module that focuses on enabling healthcare organisations to track performance against risk-adjusted benchmarks for metrics such as cost, utilisation, hospital length of stay and hospital readmissions. It can also be used to obtain insight into chronic condition populations for whom care can be improved, viewing primary care physician performance and supporting health plans when looking for opportunities to adapt workflows to reduce expenditure.

Philips launched its Healthsuite Insights marketplace which allows users to access curated AI-based assets from Philips and others through its own private ecosystem. Initially the solutions on offer within the marketplace are more focused on other healthcare applications such as diagnostic imaging, patient monitoring, oncology and genomics. However, it is expected that Philips will leverage the marketplace and its expertise in other areas of AI to develop solutions that support the PHM portfolio that it has brought in house via the acquisition of Wellcentive and VitalHealth Software. Indeed, the company has stated that it sees PHM as one of four primary applications for AI in healthcare, with a focus on using predictive analytics to support healthcare providers take preventive action, reduce health risk and save unnecessary costs.

Announced well in advance of HIMSS, Lightbeam has also recently set out its plans for AI. Towards the end of 2017 it announced it was integrating AI technology provided by DocSynk (a provider of AI solutions targeted at supporting care delivery organisations) into its PHM product offering. Initial applications targeted by Lightbeam include supporting the identification of prediabetics and undiagnosed diabetics in support of programs such as the Medicare Diabetes Prevention Program (MDPP).

Will Vendors Make Money from AI/Machine Learning in PHM?

There is no question that AI is going to become an increasingly important component and differentiator of future PHM offerings. However, a key question that came up during many of my discussions at HIMSS in relation to PHM is whether vendors will make money directly from the development of AI algorithms. My discussions with several vendors revealed they did not all expect to charge extra for AI. A typical view was that over time AI would increasingly be used as standard in risk stratification algorithms – it would be a differentiator and one that increasingly customers will expect to be offered at no extra cost.

Certainly, for the PHM platform providers, this model could well be the one that is used in the medium term. However, revenue opportunities exist for specialist analytics vendors that are developing point solutions using AI algorithms targeted at the PHM platform vendors, as the example between Lightbeam and DocSynk illustrates. The model deployed by Philips also offers revenue generating opportunities both for Philips (in terms of charging for accessing its marketplace) and for third-party vendors that sell their solutions through the marketplace. Medium-term, questions remain as to whether that business model can endure as AI becomes a standard feature of risk stratification modules.

About the Report

The information presented in this insight is taken from Signify Research’s coverage of the population health management market. During 2017 two reports were published providing insight into the North American market, this will be updated early in 2018, alongside two further PHM reports. The first covering PHM outside of North American (i.e. EMEA, Asia and Latin America) and the second examining the use of AI and machine learning in PHM solutions.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

To find out more:

E: Alex.Green@signifyresearch.net , T: +44 (0) 1234 436 150

www.signifyresearch.net