Written by

In recent years AliveCor has been actively developing its solutions and relationships across the digital cardiac diagnosis space. Last month it announced a collaboration with Biotronik to integrate its KardiaMobile 6L and KardiaMobile Card ECG technology with Biotronik’s BIOMONITOR Injectable Cardiac Monitor. The collaboration is said to enable clinicians to access data from both wearable and implantable cardiac solutions to provide a longitudinal view of the patient’s condition, and to help improve clinical decision making. This collaboration is the latest in a series of initiatives from AliveCor, highlighting its eagerness to help shape clinical diagnostic pathways for cardiac patients.

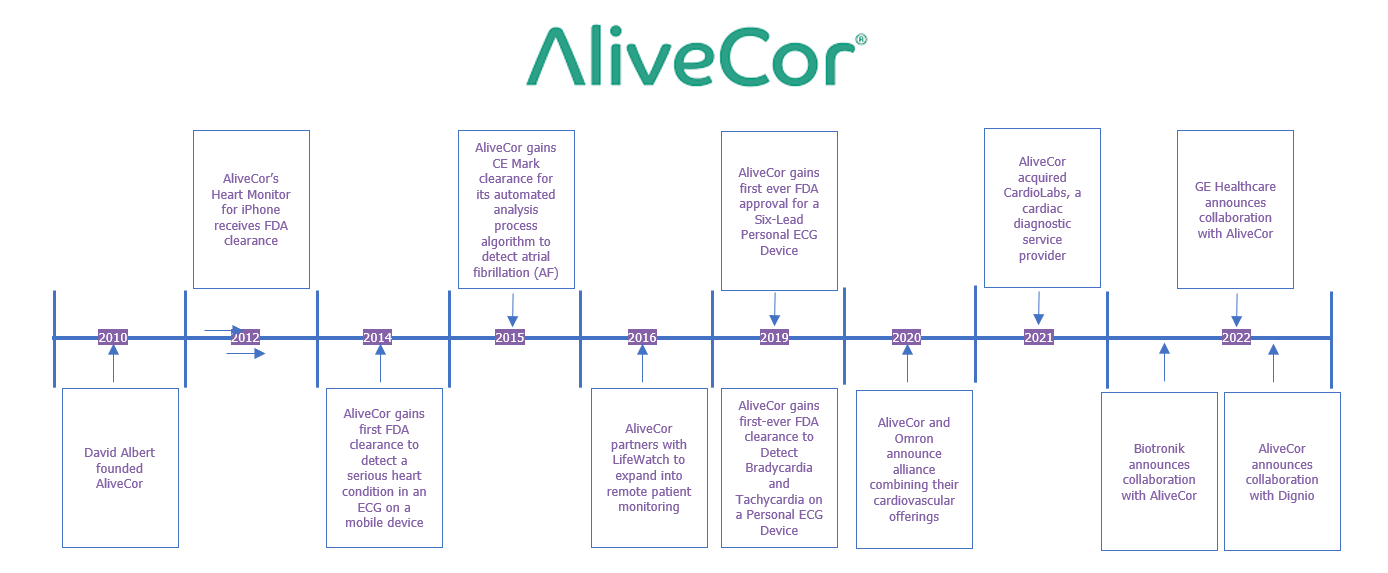

- AliveCor was founded by David Albert in 2010 and received its first FDA clearance, in 2012, for its heart monitor for the iPhone.

- Subsequently, it has gained several FDA clearances and CE markings for its personal ECG device.

- AliveCor also formed several partnerships with leading cardiac device manufacturers to expand the use of its personal ECG device and the subsequent data it produces, with the overall aim of streamlining and strengthening clinical decision processes in cardiac patient management.

- The company has also worked with leading cardiac societies and associations to improve the awareness of digital solutions and their capabilities to further develop and improve cardiac diagnosis.

The Signify View – Impact on the diagnostic cardiology market

AliveCor has been the dark horse of the cardiac diagnostic market for several years. Although not currently competing directly with other ambulatory or traditional diagnostic cardiology devices, AliveCor’s sophisticated approach to increasing awareness of its solution hasn’t gone unnoticed. For now, its solution is seen as a screening tool to enable earlier detection of atrial fibrillation (AF) and QT management, resulting in a quicker diagnosis than via traditional routes.

Recent developments and partnerships have also focused on integrating AliveCor’s solutions and the patient data generated with solutions from other vendors. Its partnership with GE Healthcare has enabled the integration of patient data collected through the AliveCor KardiaMobile 6L ECG device into GE Healthcare’s E Cardiac Management System. This will enable physicians to view and evaluate this data alongside their existing workflow, to expand information on their patients, ultimately leading to improved patient diagnosis.

In a similar vein, the Biotronik partnership enables integration of ECG data from AliveCor’s KardiaMobile 6L ECG device with data from Biotronik’s BIOMONITOR Injectable Cardiac Monitor to provide a more comprehensive overview of the patient’s cardiac patterns.

Another AliveCor partnership, with Omron, resulted in the launch of the KardiaPro web-based portal, which combines its KardiaMobile 6L ECG device and Omron’s blood pressure monitoring solution to remotely monitor cardiac patients. This solution can be reimbursed in the United States through the CPT billing system for remote patient monitoring.

As recently as last week AliveCor announced yet another partnership, with Norwegian Remote Patient Monitor (RPM) vendor Dignio, which will see the integration of AliveCor’s KardiaMobile device with Dignio’s smartphone app. The collaboration will underpin an atrial fibrillation (AF) project being run by University Hospitals of Leicester NHS Trust, which had already been operating one of the UK’s first AF virtual wards with Dignio.

A gamechanger in the market?

While all vendors are aware of the developments from AliveCor, most believe that, for now at least, the solution will be supplementary to wider clinical diagnostic solutions available. That said, the market is evolving at a pace, with many healthcare systems transitioning toward increasing the provision of broader remote patient monitoring. A vendor (or partnership of vendors) that can offer solutions across the continuum of care, from medical grade external screening solutions to implantables and injectables, will be well placed in this rapidly changing environment. However, Signify predicts that acquisitions and partnerships will continue to enable core vendors to remain competitive through a complete solution offering. It is expected that through these relationships, new in-house solutions will be further developed, through their combined expertise, to meet the growing demands of the ambulatory cardiology space.

As part of its Diagnostic Cardiology Market Report, Signify Research recently assessed the global ambulatory diagnostic cardiology market and estimated it to be worth $2.1 billion in 2021, after a spike in demand during the COVID-19 pandemic. Global revenues are projected to increase at an average of just under 5% annually over the next five years. Signify Research did not include personal ECG devices, such as those from AliveCor in its analysis, but expects that in the coming years their presence will intersect with other solutions such as mobile cardiac telemetry devices, long-term ECG devices and event recorders. Signify Research is currently preparing a deep dive into the Ambulatory Diagnostic Cardiology market to analyse this market further.

In the short-term the patient diagnosis pathway is expected to be enhanced rather than disrupted by these solutions. This was a key conclusion from our recent insight examining how the roadmap for diagnostic cardiology devices will evolve in the face of developments from home health solution vendors such as AliveCor, Apple, FitBit and Samsung. The enhancements these solutions offer will result in speedier diagnoses while still following traditional approaches, i.e., the quicker that Doctors can be alerted to an underlying cardiac issue, the quicker additional tests can be carried to confirm an official diagnosis.

As with all at-home medical solutions, patient engagement will also be a key factor in their continuing development, ensuring that the patient remains compliant in using their assigned solution to enable consistent reporting. With limitations relating to the type of arrhythmias that can be detected by home health solutions, more complex patients are expected to continue to utilise other solutions in the longer term. Lack of reimbursement will also remain a stumbling block for global adoption, with limited provision outside of the US.

Closing remarks – what next for AliveCor?

It is still uncertain whether in the future, solutions from AliveCor will be classed as directly competing with other clinical ambulatory diagnostic cardiology solutions. However, AliveCor has made significant progress toward integrating its solutions with other vendors, enabling a more comprehensive approach to patient diagnosis. By combining data collected at home through a patient’s personal device with other cardiac diagnostic devices and data platforms, a more holistic offering has been created. It is expected that AliveCor will continue to develop its solutions and increase its capabilities through these partnerships, keeping the rest of the diagnostic cardiology device market on tenterhooks, eager to learn what is coming next. This will only be further highlighted if reimbursement does expand and improve, both in the United States, which accounts for the bulk of the current market, and elsewhere. We believe AliveCor will continue to be one to watch in the diagnostic cardiology market.

About the Report

The Ambulatory Diagnostic Cardiology – World – 2022 report will be assessing the ecosystem for ambulatory diagnostic cardiology. It will be assessing the market drivers, barriers and future development. The report will blend primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market. This report will be an expansion of its coverage of the diagnostic cardiology market previously published in its Diagnostic Cardiology – World – 2022 report.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net

More Information

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 436 150