Written by

Cranfield, UK, 3rd April 2023‚ The use of wearable technology in healthcare is continuing to evolve with high interest, driving technology innovation and advancing solutions to enable clinical grade measurements to support patient care in the home. This is becoming prominent more so than ever in the field of diagnostic cardiology, where there is a convergence of smart watches and fitness bands with more traditional diagnostic solutions. However, as the consumable device manufacturers scramble to lead the race with their new product launches, so are the number of infringements and subsequent lawsuits. One of the most recent lawsuits that many have been watching attentively is that between big tech giant Apple and consumable diagnostic cardiology vendor AliveCor. This insight delves into the ongoing battle and provides Signify Research’s take on its wider impact in the market.

AliveCor vs. Apple who will win in the patent war?

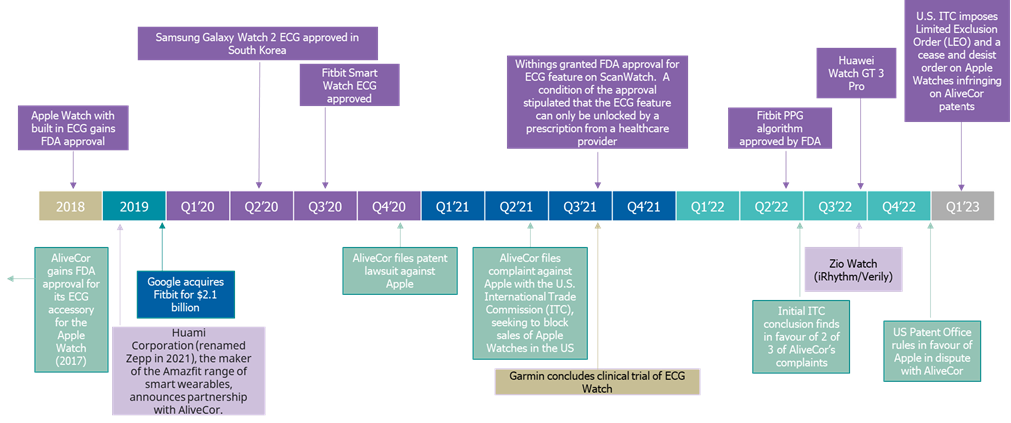

Apple and AliveCor have been locked in battle for the last two years over various infringements of patents. AliveCor initially gained FDA approval for its ECG accessory to be utilised with an Apple Watch in 2017. In 2018, Apple subsequently gained FDA approval for its inbuilt ECG. In 2020 AliveCor filed its patent lawsuit against Apple and subsequently launched a complaint with the international trade commission (ITC) in 2021. The war continued into 2022 when the US patent office ruled in favour of Apple, with the conclusion that three of AliveCor’s claims against Apple were unpatentable. However, in the most recent ruling issued on the 22nd December 2022 by the U.S. International Trade Commission (ITC) Apple was found to be in violation of section 337 and issued a limited exclusion order (LEO) and a cease and desist order. This set a bond at the amount of $2 per unit of covered articles imported or sold by Apple during the period of Presidential review. It was announced on the 21st of February 2023 that President Biden subsequently upheld the ruling by the ITC. As such, the LEO will be in effect once resolutions to existing appeals are made. This will include the previous appeal made by AliveCor on the decision by the US patent office.

AliveCor has nodded its head to the ITC and hopes that the case will provide an example to other technology vendors, that their technology is protected if patents are registered. Apple has not yet commented on the announcement but is expected to appeal the decision in federal court. So although AliveCor is currently seen to be on top, the final decision will not be made for some time. AliveCor has also stated it will continue its antitrust case in the Northern District of California, which is expected to go to trial in early 2024.

Development of wearables in diagnostic cardiology

The diagnostic cardiology market has seen several new vendors entering the market, with many of the leading mobile manufacturers updating their smart watches to include technology that also monitors changes in heart rhythm. Some examples of developments in the last five years include:

Signify Research reported last year that the European Heart Rhythm Association released guidance to help clarify appropriate use of digital solutions in diagnostic cardiology. Within its guide, the EHRA proposed guidance on what digital ambulatory solution may be utilised in the absence of a full 12-lead ECG diagnosis for a symptomatic patient, with the caveat that a patient’s preference and digital competency should also be considered. With this additional guidance, both vendors and healthcare professionals are now clearer on what solutions can be utilised to help bring remote cardiac monitoring technology to the patient in a non-clinical setting, and how data from these solutions can help supplement more official diagnosis. It is expected that interest in wearable solutions in the field of cardiac diagnosis will continue to develop and as such, vendors will need to be clearer on whether their technology is unique enough not to infringe on existing patents.

Signify’s Thoughts

With the tightening of budgets for new equipment and dwindling physician resource, the healthcare market is expected to progressively move care provision out of higher-cost settings to the home. As such, developments in technology are expediating toward wearable solutions that enable the diagnosis and treatment of patients in a less invasive and obtrusive manner. The utilisation of wearable solutions will be advanced not only by healthcare professionals, but also by patients that are increasingly interested in their own well-being. Preventative care is climbing higher on the agenda to reduce the subsequent longer-term implications on health and budgets.

As interest in wearable solutions increases, so will the number of vendors that actively develop devices that promise ‚’something new’. However, the recent law-suit highlights the need for manufacturers to be well informed of existing technology and prepare the necessary due diligence to ensure their solution is not infringing on existing technological patents. AliveCor is expected to continue to battle with Apple and although AliveCor is much smaller in size, it has managed to put up a fight for what it believes to be right. Others will need to ensure they have the clout to be able to do so if the time comes for them in the future.

About the Clinical Care Team

The clinical care team provides market intelligence and detailed insights on the clinical care equipment and IT markets. Our areas of coverage include patient monitoring, diagnostic cardiology, infusion pumps, ventilators, anaesthesia and high-acuity IT. Our reports provide a data-centric and global outlook of each market with granular country-level insights. Our research process blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net