Written by

14th July 2022 – The development of digital devices for use in the diagnosis of cardiac arrhythmias has been outpacing the full understanding of their use in clinical practice. The European Heart Rhythm Association (EHRA) has now provided a practical guide on how digital devices can be used safely to detect and manage arrhythmias.

Why the need for practical guidance?

Over recent years there has been a consistent flurry of developments relating to various digital solutions such as patches, hand-held solutions and wearable devices that have gained regulatory approval for heart rhythm monitoring. Although developments have been ongoing for several years, the recent pandemic further accelerated the development of solutions that could be utilised outside of a traditional clinical setting. Many solutions have different perceived benefits for early detection of abnormalities and utilisation in patient management. As such, there has been a growing need for additional guidance to help clinicians choose the most appropriate solution for their widening patient base. The EHRA has focused on providing guidance on when a device should and shouldn’t be used including the following solutions:

- Electrocardiogram-based digital devices

- Handheld electrocardiogram

- Electrocardiogram patches

- Smartwatch electrocardiogram

- Photoplethysmography recorders

The EHRA has offered an overview of the available solutions on the market covering several factors such as: mode of detection, battery life, data storage capabilities, regulatory clearance and validation.

Highlighted benefits of digital solutions

The EHRA confirms the gold-standard in the diagnosis of arrhythmias is a 12-lead ECG, although highlights the availability of single-lead ECG devices also enables increased probability of identifying paroxysmal arrhythmias in earlier screening. The increasing number of patients with atrial fibrillation is also driving the demand for solutions that can identify cardiac abnormalities earlier to prevent associated stroke and reduce mortality rates.

Highlighted Risks of Digital Solutions

Although photoplethysmography solutions can be used to monitor and screen symptomatic patients, the outcome still needs to be confirmed by an additional ECG-based test. The wider use of digital devices has also highlighted the need for the supporting data infrastructure to accommodate and process the large abundance of information collected from devices. There is also a clear need for the patient to be ready for movement toward digital solutions, both in terms of their digital awareness in addition to their engagement and compliance with utilising such devices. Other barriers also include the varying reimbursement structures for the costs of screening solutions and the need for management of large data sets that can be in an abundance with the continual use of devices. With a plethora of devices coming to the market, the integration of data from various sources will need to be managed, to ensure important information is prioritised with ease into the patient workflow.

Hopeful Gear Change in Wider Adoption

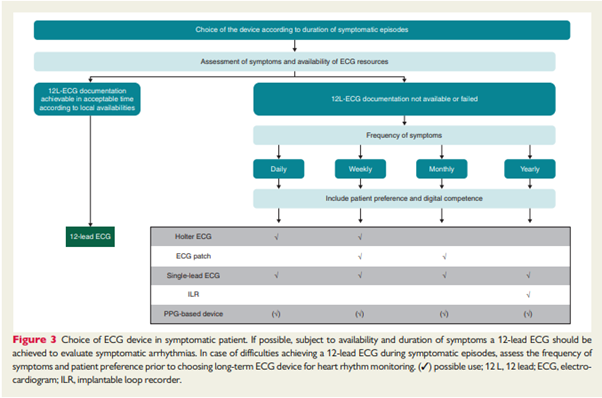

Within its guide, the EHRA proposes guidance on what digital ambulatory solution may be utilised in the absence of a full 12-lead ECG diagnosis for a symptomatic patient, with the caveat that a patient’s preference and digital competency should also be considered.

Source: How to use digital devices to detect and manage arrhythmias: an EHRA practical guide

In addition to their use in managing arrhythmia’s, the guide also discusses the potential use of digital devices in the following scenarios:

- Use in ventricular arrhythmias and syncope

- Use in class I and III antiarrhythmic drug therapy

- Use in patients with inherited arrhythmogenic diseases

- Use in athletes

The guide offers the EHRA’s consensus on when digital ambulatory cardiology devices can be used, and when they should be used with caution. However, it also highlights the lack of data to support use beyond patients with atrial fibrillation.

Potential Market Growth

Signify Research recently assessed the market size of ambulatory diagnostic devices, including event recorders, mobile cardiac telemetry, long and short-term holter ECG devices and implantable devices. Although the ambulatory diagnostic cardiology market is well established in the US, the market is much smaller in the European region. Signify projected revenues to the Western European region will increase from $73 million in 2021 to $85 million in 2026. Faster growth is projected for long-term ECG devices with growing interest in longer-term monitoring of cardiac patients. Although consumable wearable devices were not included in the analysis, Signify Research noted the growing interest in their use in screening for cardiac abnormalities amongst patients, in addition to healthcare providers now being able to integrate the information into their wider clinical diagnosis pathway.

Signify’s Thoughts

The guidance will be welcomed by the wider cardiac device community, enabling clearer distinguished parameters by which devices can be utilised in the screening and diagnosis of cardiac arrhythmias. The more traditional cardiac diagnostic device manufacturers are eagerly waiting to see how the development of wearable solutions in the utilisation of cardiac screening will progress. With healthcare systems in many countries now focusing on reducing the need for hospital visits, it is expected digital solutions will be increasingly utilised to ensure vulnerable patients are monitored whilst outside of the hospital. Further acceptance is likely with growing utilisation of digital solutions used in Telehealth. As such, this guidance is expected to further drive the growth and development of digital solutions, to help screen vulnerable patients. With fewer countries currently offering reimbursement for solutions in the ambulatory diagnostic cardiology segment, the usage of devices is still developing. However, Signify Research believes that the additional information to support their usage, will be the impetus to help device manufacturers to work alongside healthcare providers to establish a more developed structure in patient care pathways.

The pandemic has shifted opinion and patients are becoming more involved and aware of their own health status. This will further drive demand for low-end solutions used in cardiac diagnosis in physician offices, to confirm the next step for the patient in their cardiac pathway. More complex cases will be seen in the hospital where further demand for high-end solutions will be maintained. Overall, Signify Research projects that the traditional ECG market will see some benefit from the development of additional supporting devices in cardiac patient monitoring. This new guidance will further support this development within the European market. However, reimbursement of devices and associated services will remain the largest stumbling block for significant uptake in the near future. Patient engagement will also be fundamental in the success of utilising digital devices in the home, without the presence of a healthcare professional.

About the Report

“Diagnostic Cardiology” provides a data-centric and global outlook of the diagnostic cardiology markets. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market. Signify is expanding its coverage of the diagnostic cardiology market in its wider “Patient Monitor and Diagnostic Cardiology Service”.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net

More Information

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 436 150