Analysis

In the build-up to Signify Research’s North American Population Health Management (PHM) market report publication at the end of May, we take a look at some of the highlights from the Q1 2018 results of the larger publicly traded PHM vendors.

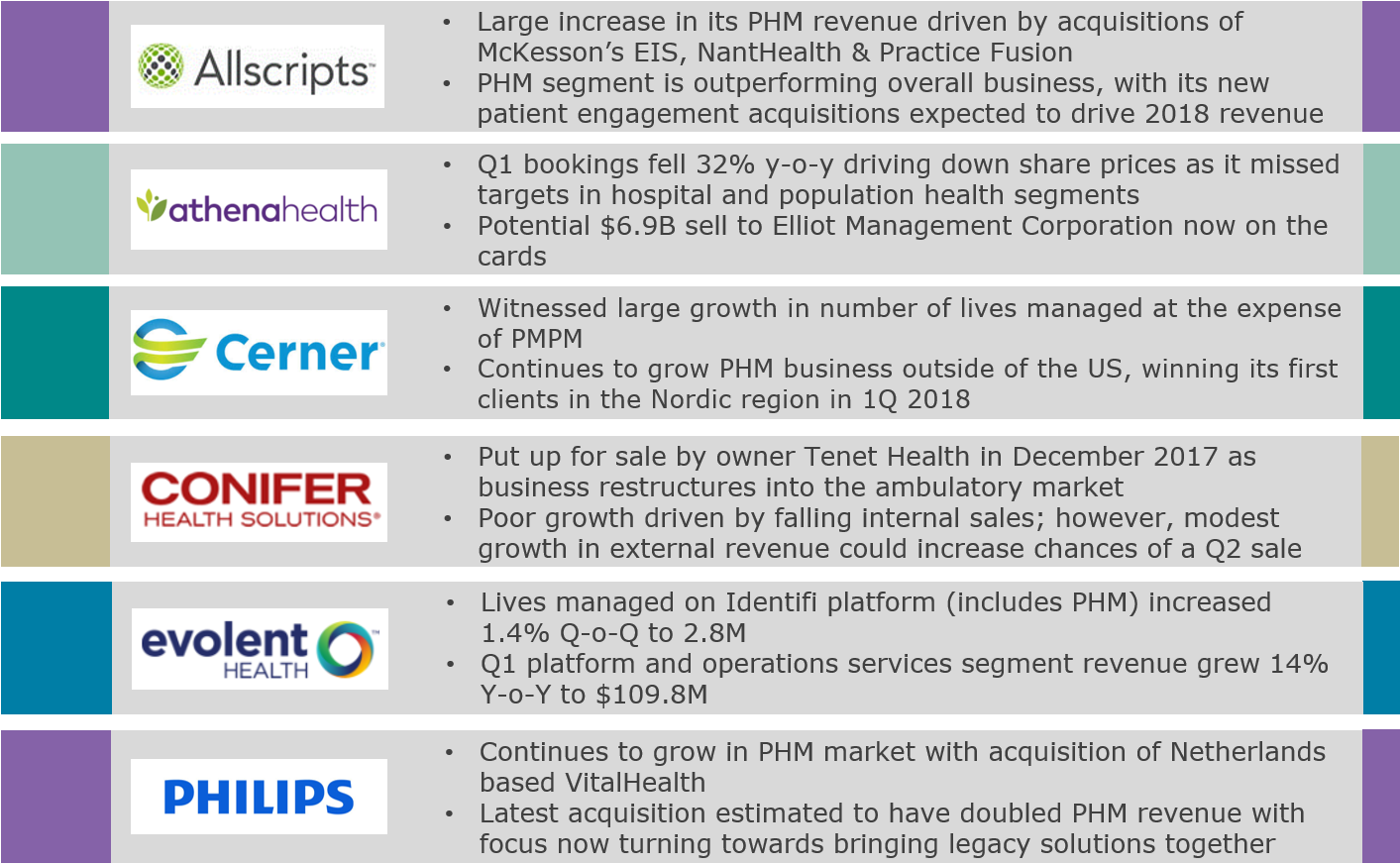

One of the biggest stories has been a weak start to the year from athenahealth resulting in a potential $6.9B sell to the Elliot Management Corporation. While we continue to see vendors such as Allscripts purchasing niche PHM players to increase their offerings, athenahealth’s latest results highlight just how challenging the EHR market has become in the US, and how important it is for EHR vendors to develop new revenue streams such as PHM.

It’s a buy or get bought world out there at the moment –

Allscripts

Allscripts’ PHM business has seen significant revenue growth due to the recent acquisitions of McKesson’s Enterprise Information System (EIS) business line and NantHealth’s patient engagement assets in Q3 2017. For Q1 2018, Allscripts reported 24% Y-o-Y growth for its full business, generating revenues of $514M, with its population health revenue growing 61% Y-o-Y to just under $70M (albeit with a significant downward adjustment being made to its Q1 2017 reported PHM revenues).

Allscripts has continued to push into the patient engagement market with the acquisition of HealthGrid, a patient engagement mobile enterprise platform, due to be finalised during Q2 2018. In addition, Allscripts finalised its Practice Fusion acquisition during Q1 2018, an EHR vendor to the payer and life science markets, offering a new client base to grow Allscripts’ PHM offerings.

While continued acquisitions expand its portfolio and drive its PHM business growth, integrating these legacy products and services will become a key goal and challenge for Allscripts as 2018 progresses.

athenahealth

athenaheath has had the shakiest start to 2018 out of all the major public PHM vendors. While overall business rose 15.4% Y-o-Y in Q1 2018, marginally outperforming growth from the same period between 16/17, Q1 bookings fell 32% Y-o-Y. This represents a potential short fall in long-term revenue growth for athenahealth, wiping off around 14% of its share value at the end of April.

The rocky start to 2018 was caused by a highly competitive market and a shortfall in its hospital and population segments. However, it was a continuation of the company missing its own guidance targets for a much longer period. Digging specifically into its PHM performance, at the end of Q1 2018 its PHM lives managed were finalised at just over 3.36M, a mere 2% Q-o-Q increase.

In its Q1 press release it attributed weak bookings (across all product areas) to evolving client needs and a fall in leads, with company focus now being shifted onto client retention and new investments into product development.

Evolving demands from clients are nothing new, but with a much slower turnaround in releasing and developing products to meet these needs, athenahealth’s PHM share could fall if it continues to struggle for the remainder of the year.

In light of the above, the Elliot Management Corporation has approached athenahealth for a potential $6.9B acquisition (it had already purchased a 9% stake in the company in May 2017). The potential sale of athenahealth will be the one to watch during Q2 2018.

Cerner

Cerner continues to report double digit growth for its PHM business (for 2017 over 2016), with particularly strong growth outside of the US. In Q1 2018 it signed its first Nordic contract in Sweden serving 1.3M citizens, helping to drive its global segment revenue. This was up 23% Y-o-Y (across the whole Cerner business) with stronger contributions from the UK, Germany and Canada. Top-line results for Cerner showed Q1 2018 revenue growing 2.6% Y-o-Y to just under $1.3B.

One of the key areas to focus on while looking into Cerner’s PHM performance is changes to lives managed and revenue per life managed (PMPM). At the time of the first edition of Signify Research’s North American PHM report (released in 1H 2017), Cerner was quoting its lives managed at around 6M with an average PMPM of $3. However, fast-forward a year and Cerner’s lives managed has soared to over 37M, without seeing the same increase in its PHM revenue (PHM revenue grew just over 20% in 2017 compared to 2016). This has resulted in PMPM dropping to under $1.

We have seen this trend across several PHM vendors who have either shifted to taking on much lower risk populations or are defining lives managed as anyone whose data is currently being used within their data aggregation/ risk stratification tools.

In our upcoming PHM report will be ranking vendors by lives managed; however, our definition of lives managed includes patients who are enrolled into a complete solution including data, care management and patient engagement modules. It will be interesting to see if we see a similar rise in quoted lives managed from competitors throughout 2018.

Conifer Health Solutions

In December, Tenet Healthcare announced it was considering selling Conifer Health to cut costs and drive its business towards the ambulatory market. Most of Conifer Health’s business has historically been driven through sales with its two owners, Tenet Healthcare and Catholic Health Initiatives (CHI), although its PHM customer base is more diversified. In Q1 2018, Conifer’s revenue reached $404M, a 0.5% Y-o-Y increase, driven by a 4.5% rise in third party revenue at $254M accounting for 63% of the business (note, this includes sales to CHI).

Following the announcement of the Conifer Health potential sale, Tenet Healthcare has restructured its business by selling several hospitals and, by doing so, limiting the intersegment customer base for Conifer Health. Uncertainty over the future of Conifer Health could limit the potential for it to grow its PHM business in 2018.

However, the latest Q1 results do show some promise, the diversification of its customer base will make it a more attractive acquisition.

Evolent Health

Evolent Health saw the number of lives managed by its Identifi platform increase 1.4% Q-o-Q to 2.8M; however, this is flat when compared to the same period last year. This contrasts to the 12-month period March 2016 to March 2017 when it doubled the number of lives managed.

Top line revenue for Evolent grew 31.5% Y-o-Y in Q1, driven by the recent formation of the True Health New Mexico business. Evolent finalised its acquisition of these managed services assets from New Mexico Health Connections (NMHC) at the start of 2018. This has the potential to drive further growth in Evolent’s lives managed as intersegment opportunities arise.

The fact that Evolent has driven significant revenue growth while lives managed has remained stagnant suggests the company is improving PMPM. It is estimated this is partly being driven by a wider number of products being taken per customer, but also increases in associated support service revenue.

Philips

Similar to IBM, Philips entered the PHM market via acquisition, namely that of Wellcentive. In December 2017, Philips added to its Wellcentive business with the purchase of VitalHealth, a leading PHM provider in the Netherlands specialising in interoperability and integrated care solutions.

Revenue generated in its Connected Care and Health Informatics segment (where its PHM business resides) fell 9.4% y-o-y in 1Q18 to $814.6M (€663M). However, with the addition of VitalHealth to its books, revenue generated through PHM should roughly double compared to 2016, with our estimates putting the combined Wellcentive and VitalHealth business in 2017 between $45-50M.

Philips has already started working on integrating its two legacy businesses into a complete solution. Looking back to Q1 2016 and the purchase of Truven Analytics from IBM, its curious to think what lessons could be learned for Philips.

Progress in the integration of Truven’s legacy business into IBM Watson Health’s Explorys and Phytel products has shown little sign of progressing after two years, no doubt limiting growth from Truven’s business. Potentially the Philips approach of working from a much smaller base and purchasing a major vendor outside of the US could pay off in the long run.

Key Takeaways

At this point last year, our key takeaway from the major PHM vendors focused on growing concerns over ACA reforms following the appointment of the Trump administration. Whilst this concern has decreased to some extent, legislative uncertainty did impact market growth in 2017, and the results from the public companies analysed here suggest some coped better than others.

Preliminary data from Signify Research’s upcoming report indicates that 2017 market growth was low double digit, as opposed to the high teens over prior years. However, those vendors that have been more innovative in product development (e.g. developing highly tailored solutions for specific customer needs) and those that have been more aggressive (e.g. following an ambitious acquisition strategy to develop their PHM portfolio), have fared better.

PHM Market Report from Signify Research

The market analysis presented above is taken from research compiled for the Signify Research report on the North American PHM market for May 2018 publication. The analysis is compiled from both discussions with over 30 PHM vendors in the market and investor reports. Using our expertise and numerous briefings with vendors, we build an accurate market sizing tool, providing quarterly market estimates and annual forecasts by vertical, function, service type, platform delivery and country to 2022.

This year’s North American PHM report will also be accompanied by a Rest of World report where we dive into national and regional projects undertaken by local champions or the global vendors. Due for release in June 2018, this report will also be accompanied with accurate market sizing and insight into initiatives and potential blockages for growth until 2022.

For further information about the PHM reports please click here or contact Michael.Liberty@signifyresearch.net.