Written by

Last week saw EMIS Group Plc, the leading primary care EHR vendor in the UK, agree to be acquired by US insurance and healthcare IT giant UnitedHealth. The deal is expected to be worth ¬£1.24B ($1.52B) with EMIS recommending to shareholders that they vote the deal through. An affiliate of UnitedHealth’s Optum business in the UK, Bordeaux UK Holdings II Limited, is leading the bid and offering a 49% premium on EMIS’ share price as of closing on Thursday 16th June.

The Signify View

The announcement is about as monumental as it gets for the UK primary care EHR industry. EMIS has established itself as the dominant EHR vendor for NHS GP practices across the UK, serving an estimated 55% of practices with only The Phoenix Partnership (TPP) and French IT vendor Cegedim offering any significant competition (an estimated 32% and 12% of practices respectively). The lacklustre performance of the UK number four vendor, Eva (formerly Microtest), in primary care EHR over the last two years also offers EMIS the opportunity to incrementally increase its share further.

Not only is it a leader in the UK primary care EHR market but it leads the UK community pharmacy IT, inpatient EDIS and community EHR markets, as well as providing the patient-facing digital front door, booking management system and virtual care platform for many primary care practices via its Patent Access business.

In terms of revenue, the company has also continued to grow at a mid-to-high single-digit rate over the last two years. This period has also seen it expand its portfolio (via EMIS-X Analytics) into the integrated care market, offering a range of products aimed at supporting Primary Care Networks (PCNs) and Integrated Care Systems (ICSs) in terms of addressing care management analytics and population health management. It has also been central in supporting the NHS manage COVID vaccinations bookings over the last two years.

With an adjusted operating margin of 25.9% in 2021 (up from 24.6% in 2020) it seems an attractive acquisition for Optum. But why now and what’s Optum’s longer-term play?

To a large extent, the UK has been a side-project for Optum and UnitedHealth compared to its US business. It plays in several areas, particularly in relation to healthcare IT consulting/system integration, and some elements of PHM analytics.

It has also been the shared beneficiary (alongside First Databank) of a long-standing £100M ($123M), five-year contract with NHS Shared Business Services for medication cost-optimisation CDS solutions used in primary care, via its ScriptSwitch product.

Indeed, ScriptSwitch can be integrated into EMIS’ primary care EHR offering (along with First Databank’s OptimizeRX). However, Optum has lost share in this market over recent years. First Databank’s entry into this market several years ago was in effect on the back of demand from providers for increased innovation in drug cost optimisation solutions, after limited investment in ScriptSwitch from Optum. Before First Databank’s market entrance, more than 6,500 of the circa 9,000 primary care practices in the UK used Optum’s SwitchScript solution, a figure that is understood to have dropped since.

The Synergies

The above does highlight the potential synergies between the two companies. ScriptSwitch is already used by many EMIS primary care EHR customers and with recent efforts by Optum to upgrade its offering here, there is an opportunity for it to regain some of its lost share via the relationship with EMIS. EMIS itself has its own drug CDS solution, MKV (more focused on clinical optimisation and avoiding adverse drug events rather than cost optimisation), which is integrated into its EHR and used by nearly all its primary care customers. The two products offer the opportunity for the combined company to dominate this space and add value to the EMIS EHR product.

However, the much larger opportunity relates to integrated care and population health management. The UK is in the middle of a significant push to develop PHM solutions for the ICSs and PCNs that span the country. The ICSs have already signed contracts, leveraging the NHS’ ~$600M Health System Led Investment (HSLI) program, for data integration platforms that support developing regional shared or integrated care records and that provide a data pool of integrated, cross-setting EHR-based clinical data to drive risk stratification and cohort prioritisation.

However, neither Optum nor EMIS featured significantly in the major shared care record contracts given over the last two-to-three years (this was more the domain of Cerner, Graphnet, Patients Know Best, InterSystems and Orion Health). That said, Optum has been involved from an IT consultancy/system integration perspective throughout and EMIS has been developing its EMIS-X Analytics portfolio of solutions designed specifically for PHM and analytics used by ICSs, PCNs and other agencies involved in supporting a multidisciplinary approach to integrated care.

Although not yet a major player in the UK PHM market from an IT perspective, Optum is a leader in the US PHM market. However, it has not yet leveraged its wealth of US PHM products to address the UK market to any major extent. Often localisation can be a significant challenge for a PHM vendor looking to address a new geography and this is likely the main reason. However, leveraging Optum’s resources and existing PHM portfolio, alongside EMIS’ expanding local solution set, has the potential to position the combined company as a strong player in this space in the UK.

The Opportunity

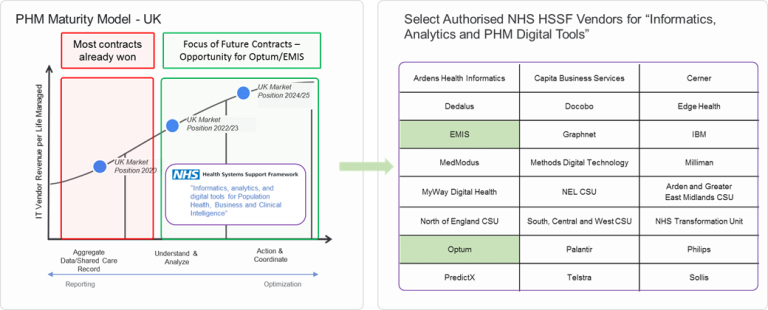

Both companies are listed as authorised vendors for “Informatics, analytics, and digital tools for Population Health, Business and Clinical Intelligence” under the NHS Health Systems Support Framework (HSSF), the authorisation framework for NHS entities looking to deploy PHM type solutions.

To date, the focus for PHM in the UK has been putting in place ETL and shared care record solutions, driven by the ICSs. However, once in place the focus will move to using the data pool that these have created to drive PHM. The ICSs, PCNs, acute trusts and other primary/community NHS providers will all be examining ways that this new pool of harmonised patient data can be leveraged to support integrated care and upscale the largely manual care management process. Investment in IT of the type Emis has developed with Emis-X will be top of mind. As illustrated in the diagram below, expect to see more contracts, supported by NHS funding streams such as the Unified Tech Fund, for PHM analytics and care management platforms where the combined Optum/EMIS entity will be positioned well to compete.

The Longer Term

In the US, UnitedHealth alongside Optum has developed a portfolio over the years, supported by many acquisitions, that allows the combined company to operate as a payer, provider, system integrator, revenue cycle management service provider, consultancy, and technology vendor. In recent times, it has not replicated that model in the UK, but the combined Optum/EMIS entity will now mean UnitedHealth is a leading IT vendor in primary, community and pharmacy markets and primed to be a serious competitor in the integrated care market.

However, there are few signs yet that it will replicate the model followed by fellow US payer/provider Centene, in becoming a primary care provider in the UK (Centene is the largest primary care provider in the UK, operating 67 UK practices – most other practices being small standalone private businesses). Indeed, UnitedHealth was the original owner of several of these practices before selling them to Centene more than a decade ago.

That said, is this investment in EMIS the first step in a broader strategy to emulate the position UnitedHealth has in the US?

Given the UK is a single-payer, publicly-funded healthcare system, the payer and RCM opportunities are limited and therefore an unlikely opportunity for UnitedHealth. The UK is also notoriously hostile to “US companies profiteering from NHS funding” in terms of healthcare provision. Centene has recently been at the end of media backlash, led by the BBC, in the way that it is alleged to be resourcing primary care in its practices, and this was on the back of several years of criticism of the UK government in allowing a US private provider to enter the primary care practice market. UnitedHealth suffered similar opposition when it played in this space more than a decade ago. Given this environment, it is more likely that UnitedHealth will remain focused on technology, system integration and consultancy in terms of its UK operations.

However, due to this this sizeable investment in EMIS, and the company’s recent form in terms of growth via acquisition, this may not be the last IT acquisition we see from UnitedHealth in the UK.

About Signify Research’s EHR Market Coverage

The above analysis is a summary of data and commentary from Signify Research’s EHR Market Intelligence Service. The service provides a rolling set of publications on 20 geographies providing deep-dive analysis of local, regional, and global EHR market trends. Please contact us if you would like further information on our EHR Service or our broader Hospital IT portfolio.