Written by

Cranfield, UK, June 2022 – Many hospitals were at breaking point during the pandemic, with healthcare staff pushed to their limits, desperately seeking support to help care for the large influx in patients. Hospital admission was restrictive, with only the most critical patients entering the hospital. Since then, healthcare providers have reflected on their care-provision capabilities, and as such have accelerated plans to improve patient monitoring capacities both in and out of the hospital.

Patient monitor demands are changeable

The pandemic highlighted the need to ensure patient monitor devices were capable of monitoring specific respiratory parameters, with demand for CO2 and SpO2 modules increasing the most. With ICU capacity overstretched, patients were also cared for in alternative departments, transitioning demand for ICU-level continuous monitoring outside of the traditional setting. Now the pandemic has subsided, the demand for ICU monitors has reduced, with more demand for solutions to be used in the OR to help monitor the surge in patients expected because of the surgical backlog. This will also filter to lower-acuity settings to ensure patients are continuously monitored after discharge from surgical wards. With demand varying so significantly, hospitals are now seeking more flexible modular solutions, which can flex up or down the level of functionality depending on the patient’s requirements or the demands on the hospital facilities.

Healthcare providers see the benefit of continuous patient monitoring to ensure patient deterioration is identified quickly. There is also a greater need for data to be integrated into digital information systems to help improve patient diagnosis and subsequent treatment plans. Prior to the pandemic, there was some movement toward integrated care and movement of patients to low acuity and ambulatory settings in mature regions. Following the pandemic, this is expected to be expediated, with other emerging countries also following.

Flexibility is in greatest demand

There has been a definite gear change to configurable modular monitors that enable greater flexibility and can be adapted according to the acuity setting required for patient upsurges. The utilisation of flexible portable solutions is further fuelled by the increasing demand for solutions in lower-acuity settings and in remote capacities. There will be more demand for solutions that can be altered easily to the care setting required. The next stage in the market will be to develop cloud-based solutions that can enable parameters to be switched on or off as required. This will also increase demand for associated software and add-on modules that increase functionality.

Newer solutions accelerate market growth

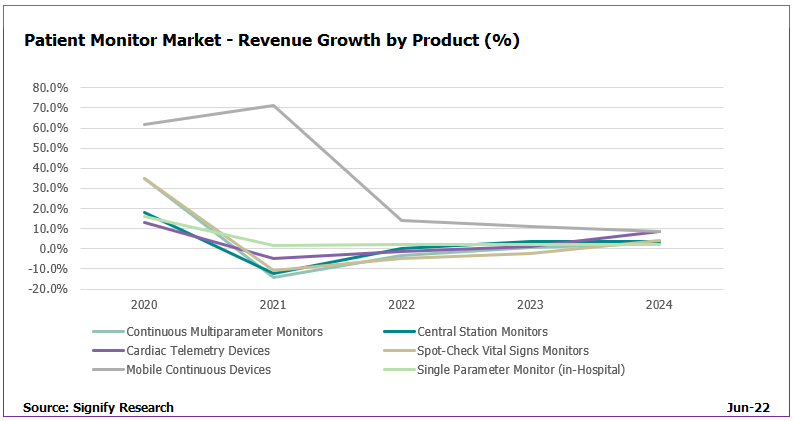

Devices such as mobile continuous monitors are continuing to gain traction in many countries; their portability and small size benefit patients who need continuous monitoring but need to remain mobile to aid their recovery and to ensure any deterioration is identified quickly. The need for greater flexibility has also resulted in a decline of demand for patient monitors specifically designed for transport, as new developments allow devices to be flexibly adapted to different care settings and different levels of acuity.

Fastest growth is projected for the mobile continuous devices market due to the increased demand for continuous solutions in low-acuity settings to help maintain consistent monitoring throughout the patient’s care provision. Pricing will become more competitive as more players enter this market. The US market for mobile continuous monitors is more established than other regions and it is likely to experience the fastest price erosion of all regions due to movement toward lower-cost patch solutions.

Purchasing models are further developing

With many healthcare providers focusing on cost efficiency and return on investment (ROI), the interest in OPEX (operating expenditure) purchase models is increasing. Healthcare providers are rethinking the cost model to enable a more sustainable healthcare system. OPEX-based solutions enable providers to outsource responsibility of maintaining and supporting solutions. The shift in patient care from hospital settings toward the home or ambulatory settings has been historically challenged by financing issues. The movement to OPEX purchasing will to help maintain the flexibility of healthcare provision; however, it will require consideration from both manufacturers and care providers before it is commercially viable globally. OPEX purchasing has been most successful in the remote patient monitoring model, and more specifically in the US. Further developments will be seen in hospital settings, where the aim is to improve clinical outcomes, diminish the pressure on over-stretched staff and reduce the overall cost of care.

Philips leading the movement to ‘monitoring as a service’

The growing interest in the movement from capital expenditure (CAPEX) to OPEX is also linked to the movement from the concept of patient monitoring to broader patient management. ‘Monitoring as a service’ is being driven by Philips which has been developing an end-to-end monitoring ecosystem with its Enterprise Monitoring as a Service (EMaaS). EMaaS allows clinicians to follow their patients throughout the entire care journey from admission to discharge, and their transition across care settings and different levels of acuity. The ecosystem enables data acquisition and access, integrated clinical services, and clinical process optimisation. These elements aim to improve workflows, facilitate early deterioration detection, build clinical capabilities, scale up processes through agile cloud-based solutions and subsequently help clinicians make complex clinical decisions. Other vendors will follow Philips footsteps if this model proves successful.

Closing Remarks

The pandemic has injected new life into what was a saturated patient monitor market. Demand has transitioned toward innovative solutions that help to facilitate healthcare providers to:

- Offer flexibility to changing healthcare demands

- Increase the level of patient safety and reduce avoidable errors

- Empower healthcare professionals with actionable information to ensure patient care is optimised

- Help to improve cost efficiency

With new solutions and cost models coming to the market, the patient monitor market will be a dynamic market moving forward. Vendors will need to ensure their monitoring portfolio meets the demands of the expanding customer base with new, innovative solutions and cost models.

About the Report

“Patient Monitor – World – 2022” provides a data-centric and global outlook of the patient monitor markets. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net

More Information

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 436 150