Written by

- Signify Research analysis and commentary from the North American Population Health Management IT Market Report

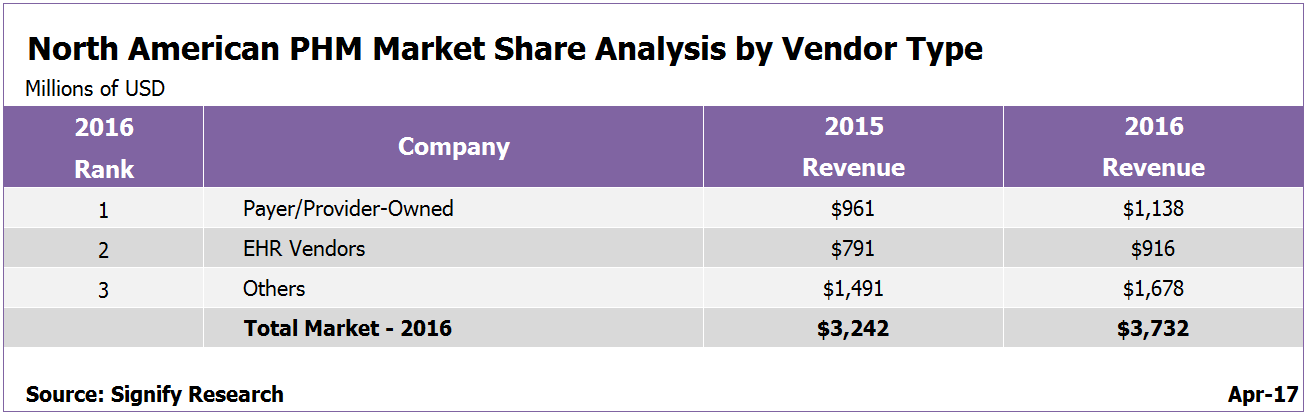

- In 2016 55% of the North American PHM market was accounted for by EHR vendors and payer/provider-owned vendors

- The remaining 45% was made up of a long list of vendors, with the market remaining highly fragmented

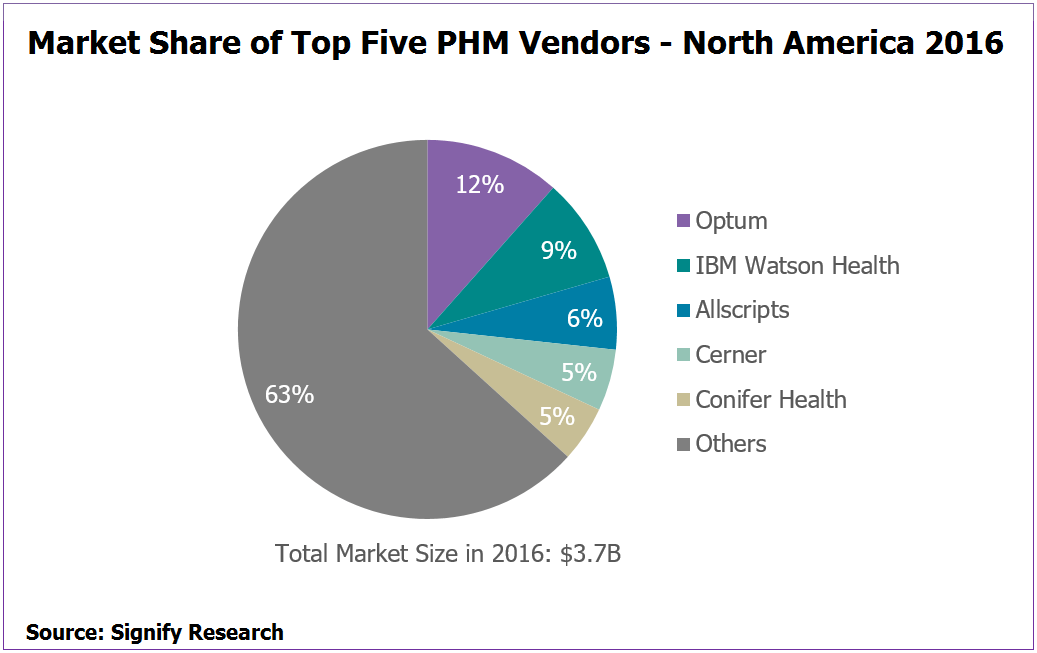

- Optum was the market leader in terms of revenue share in 2016. It was followed by IBM Watson Health, Allscripts, Cerner and Conifer Health.

Analysis

Data from Signify Research’s report “Population Health Management IT – North America – 2017” shows that in 2016, 55% of the North American PHM market was accounted for by EHR vendors and payer/provider-owned vendors. This was split further into 30% of the market being taken by payer/provider-owned vendors and 25% of the market taken by EHR vendors.

Those that fell into the payer/provider-owned category included companies such as Optum, Conifer Health Solutions, Transcend Insights, Aetna and Medecision. Optum and Conifer Health being the two that commanded the highest share of the market within this category. The EHR vendor list included Allscripts, Cerner, eClinicalWorks, McKesson, Epic, MEDITECH, NextGen Healthcare and athenahealth. Allscripts and Cerner being the two in this group with the highest market share in 2016.

Beyond these two groups, the market remained highly fragmented. Large health IT/technology generalists such as IBM Watson Health, Philips (including Wellcentive) and GE Healthcare (including Caradigm) accounted for approximately 10% of the market between them. IBM Watson Health, via its acquisitions of Truven Health, Phytel and Explorys, had the greatest share within this group.

The supplier base also consisted of a long list of specialists that have portfolios highly focused on PHM and related markets. Of note within this group were Orion Health, Evolent Health, Verscend, Health Catalyst, Enli, ZeOmega and SCIO Health Analytics.

Opportunities Going Forward

As the PHM market develops, both the EHR and payer/provider-owned vendors are expected to have somewhat of an advantage over others. The EHR vendors have an existing installed base of provider customers using their EHR technology that they can leverage as their PHM businesses are developed. However, historically there has been some criticism of EHR vendor PHM solutions. In particular, this related to the sophistication of features offered and the breadth of the datasets used during the data aggregation/risk stratification process. The EHR vendors’ initial patient engagement platform deployments, often designed around a tick box process of supporting meaningful use targets, also reinforced this criticism. The combined result was a perception that EHR vendors’ PHM solutions were simple “bolt-ons” to existing EHR offerings.

This has been addressed to some extent in more recent years. Many EHR vendors have acquired leading PHM vendors (e.g. Allscripts acquisition of dbMotion and Jardogs) to bolster their offerings and have also invested significantly in PHM platform feature-set development. This has resulted in a closing of the gap with the more specialist companies. Many EHR vendors now have business plans that have PHM at the core creating high levels of investment in portfolio development. For example, Cerner has stated it has targets where PHM will drive 20% of its total business by 2025, up from 5% in 2016.

The payer/provider-owned companies also have an advantage in that they have a captive market with their payer/provider owners. For example, Conifer Health is estimated to have generated approximately 80% of its 2015 and 2016 revenues from its two owners, Tenet Health and Catholic Health Initiatives. Optum generates a significant proportion of its revenues from its payer-owner UnitedHealth Group. However, payer/provider-owned companies will need to implement strategies to expand beyond their owner companies if they wish to maintain their positions in the PHM market, a process that is already well underway. For example, Optum’s purchase of Humedica and the subsequent development of its provider-focused Optum One solution, has enabled it to grow its business beyond UnitedHealth Group, and other payers, and develop a strong provider-focused PHM business.

Ability to Scale Business

For those vendors not in the EHR vendor or payer/provider-owned groups there is still a great opportunity to drive success and build share in the PHM market. However, as the market starts to mature it is forecast to consolidate in terms of the number of suppliers addressing the market.

Companies such as Philips Healthcare, GE Healthcare and IBM Watson Health have the scale and, for most, the legacy customer base to drive success in the PHM market. Both IBM Watson Health and Philips have gained PHM market share via acquisition. GE Healthcare is well positioned, through its ownership of Caradigm, to address the acute/enterprise-focused PHM market. To date, GE Healthcare has not yet leveraged its Centricity ambulatory EHR customer base. However, it will start to address this during 2017 as its ambulatory PHM offering (Project Northstar) is commercialised.

Of the specialists, vendors such as Orion Health, Health Catalyst and Evolent Health have gained significant market share which they can leverage to support product innovation in order to grow their PHM businesses. Assuming though that profitable business models can be maintained and/or established (with some doing better than others on this front).

Further consolidation within the PHM industry is expected over the coming years and some of the smaller specialist vendors are expected to disappear, either through mergers, acquisitions or market exit. That being said, Signify Research does see opportunities for the more innovative amongst the smaller vendors to succeed. Particularly those that have developed strengths in specific areas (e.g. patient engagement platforms or analytics) and have the potential to partner with the larger vendors looking to address the full PHM platform market.

Market Shares in 2016

The dominance of the EHR vendors and payer/provider-owned vendors is illustrated well in terms of overall market shares in 2016. Optum was estimated to be the overall leader, with a share of 12%. This was followed by IBM Watson Health taking an estimated 9% of the market. Allscripts, Cerner and Conifer Health followed with estimated shares of 6%, 5% and 5% respectively. Evolent Health is estimated to have gained the most in terms of share during 2016, partly owing to organic growth, but also boosted via its acquisition of Valence Health. Speculation has been abundant in recent weeks regarding a potential merger between Evolent Health and the Advisory Board (which already owns part of Evolent). Should this merger take place the company is well positioned to break into the top five ranking illustrated below.

New Market Report from Signify Research

The market data presented above is taken from Signify Research’s just published report on the North American PHM market. The report is a component of the Signify Research “PHM & Telehealth Market Intelligence Service”. Vendors tracked include Aetna, Allscripts, AthenaHealth, AxisPoint Health, Caradigm, Cerner, Conifer Health, eClinicalWorks, Enli, Epic, Evolent, HealthCatalyst, Humana/Transcend Insights, IBM Watson Health, McKesson, Medecision, Meditech, NextGen, Optum, Orion Health, Premier Inc., Verscend, ZeOemga and others. The report provides quarterly market estimates for 2015 & 2016, and annual forecasts by vertical, function, service type, platform delivery and country to 2021.

For further details please click here or contact Alex.Green@signifyresearch.net.