Written by

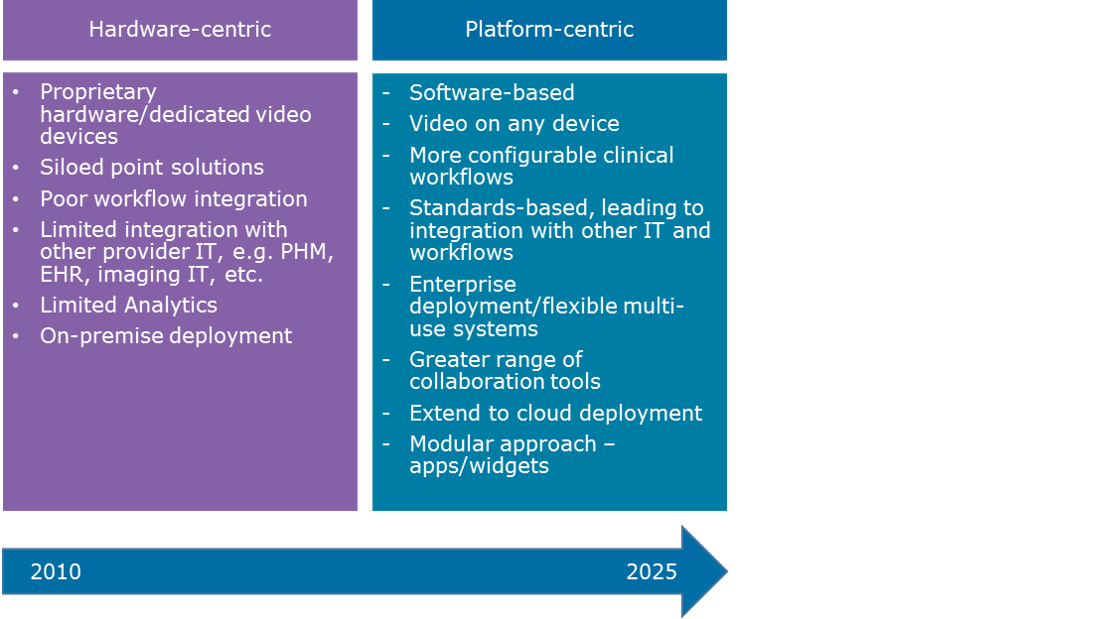

The telehealth market has historically been addressed with very much a “hardware-centric” approach in terms of solutions. Typically, solutions have been based around proprietary hardware (e.g. carts, viewing equipment, peripherals), with limited clinical workflow and IT integration and poor functionality in terms of clinical and process analytics.

This has resulted in providers having restricted choices in video viewing devices and other peripherals, siloed deployments due to systems being limited in terms of their integration into other healthcare IT and provider workflows, and a scarcity of information to support process improvements.

Recent years have seen the market start to make the shift towards a more “platform-centric” approach to telehealth. The main drivers being that it will enable the short-comings above to be addressed, but it also coincides with the move of the market out of pilot stages and single department service roll outs, to a stage where scaled, cross-departmental enterprise-focused solutions are required.

A platform-centric approach will:

- Allow solutions to be developed that are hardware agnostic, meaning viewing hardware (monitors, tablets, smartphones, etc.) can be used from any supplier and a wider range of device types can be employed.

- Take a standards-based approach to allow integration into other health provider IT such as a hospital EMR, PHM and clinical IT solutions. This will also allow clinical users to access the telehealth solution from familiar workflows and systems and for outcomes to be fed back into central patient administration systems.

- Allow the use of business analytics that provide insight into solution utilisation, physician adoption, patient satisfaction, clinical outcomes, process improvements and return on investment.

The key enabler in this transition has been the development of off-the-shelf, enterprise-scale telehealth platforms.

Over recent years several vendors have developed solutions that now make it easier for health providers to roll out services using dedicated telehealth platforms. Many of these platforms were initially developed to target specific use-cases (e.g. telestroke) and were aimed at departmental telehealth initiatives. However, over the last 24 months demand has moved away from these point solutions as more vendors look to address the needs of enterprise-scale telehealth initiatives.

It is forecast that this segment of the market will become increasingly important. To some extent the hardware elements of the telehealth market are starting to be commoditised and it is becoming more difficult for vendors to differentiate and add unique value. Whilst at the same time the move to enterprise telehealth and the demand from providers for lower-cost, quick-to-install and easily-scalable telehealth solutions means that off-the-shelf platforms will gain an increasing share of the overall telehealth market.

Vendors that are taking advantage of this trend include Philips, InTouch Health, Avizia, Vidyo, TruClinic (now owned by InTouch Health), Carena Health (now owned by Avizia), Polycom, American Well, Reach Health, Cisco and SnapMD.

These vendors have typically taken one of three routes in terms of establishing themselves as leading platform providers.

- Companies such as InTouch Health and Avizia have historically derived most of their business from telehealth hardware (e.g. telehealth carts and peripherals). They have used this installed base of customers and solutions to support the development of their platform businesses. This has often been supplemented by acquisitions (e.g. InTouch Health’s recent acquisition of TruClinic and Avizia’s acquisitions of Emerge.MD and Carena Health).

- More generalist video conferencing suppliers, such as Cisco, Polycom and Vidyo, have invested heavily in developing their generic video conferencing platforms into platforms that specifically address the healthcare/telehealth market. E.g. Cisco’s development of its Extended Care Platform and Vidyo’s development of VidyoWorks.

- There are also several pure-play platform providers such as Reach Health and SnapMD that initially came to market with point solutions aimed at specific departmental needs (e.g. Reach Health’s original solution was purely targeted at telestroke applications), but then expanded the breadth of their solutions to address the enterprise platform market (e.g. REACH 5.0 can be used for neurology, behavioural health, paediatrics, pulmonology, cardiology, home health, clinic, and long-term care telehealth applications). American Well also sits in this segment to some extent, although its physician support services, hardware offerings and scale make it a little different to the others.

There is also a significant proportion of the telehealth market that is addressed via platforms that aren’t sold as commercial off-the-shelf solutions but have still been developed to address enterprise-scale, multi-application needs. Teladoc is a prime example of a telehealth service provider that has built its own platform which is then used exclusively to support its own telehealth services. It’s not possible for a provider to license just the Teladoc platform without also purchasing its physician support services. Babylon Health is another example of a similar business model outside of the US, although one more focused on just primary care physician settings.

Signify Research’s just published market report “Acute, Community and Home Telehealth – World – 2018”, forecasts that the share of the telehealth market taken by commercial off-the-shelf platforms is projected to increase significantly over the forecast period. Revenues for platforms are projected to reach $1.7B by 2022, and this transition toward a more “platform-centric” approach is one of the main drivers.

The evolution in demand is driven by a maturing of the market in terms of the scale of telehealth initiative undertaken by providers. This is particularly so as telehealth roll-out programs move from pilots and smaller-scale, single-department initiatives to connected, multi-department programs. As more advanced markets have started to approach this point the demand for enterprise-scale platforms has really started to kick in. This point of deployment maturity also represents the point where the greatest market growth is forecast. Platform vendors that are already supporting departmental level deployments or pilot deployments, but that can also support a provider as it starts to scale up and connect telehealth offerings across the enterprise will be well positioned to capitalise on this growth.

As this transition occurs, It is essential for vendors that are looking to be able to serve markets at high levels of maturity that they follow a standards-based approach that allows for their telehealth platform to be integrated with other core healthcare IT solutions. Often this will entail developing strategic relationships with EHR, PHM and imaging solution vendors or, via merger or acquisition, bringing this capability in-house.

About the Report

The information presented in this insight is taken from Signify Research’s just published market report “Acute, Community and Home Telehealth‚Äî2018 Edition”. This report will present the market for telehealth platforms, hardware and services and will include projections and market sizings for more than 20 countries.

The report is available as a stand-alone product, but it is also a component of Signify Research’s “Population Health Management and Telehealth Service”. This is a year-round service that provides ongoing data, insights, and analysis on the global population heath management and telehealth markets. The service includes four market reports delivered over a 12-month period, regular updates of key market metrics, competitive environment and market share analysis by product type and region and quarterly analyst briefings to each subscriber firm.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

To find out more:

E: Alex.Green@signifyresearch.net , T: +44 (0) 1234 436 150

www.signifyresearch.net