Written by

- In June 2017 Teladoc announced it would acquire Best Doctors

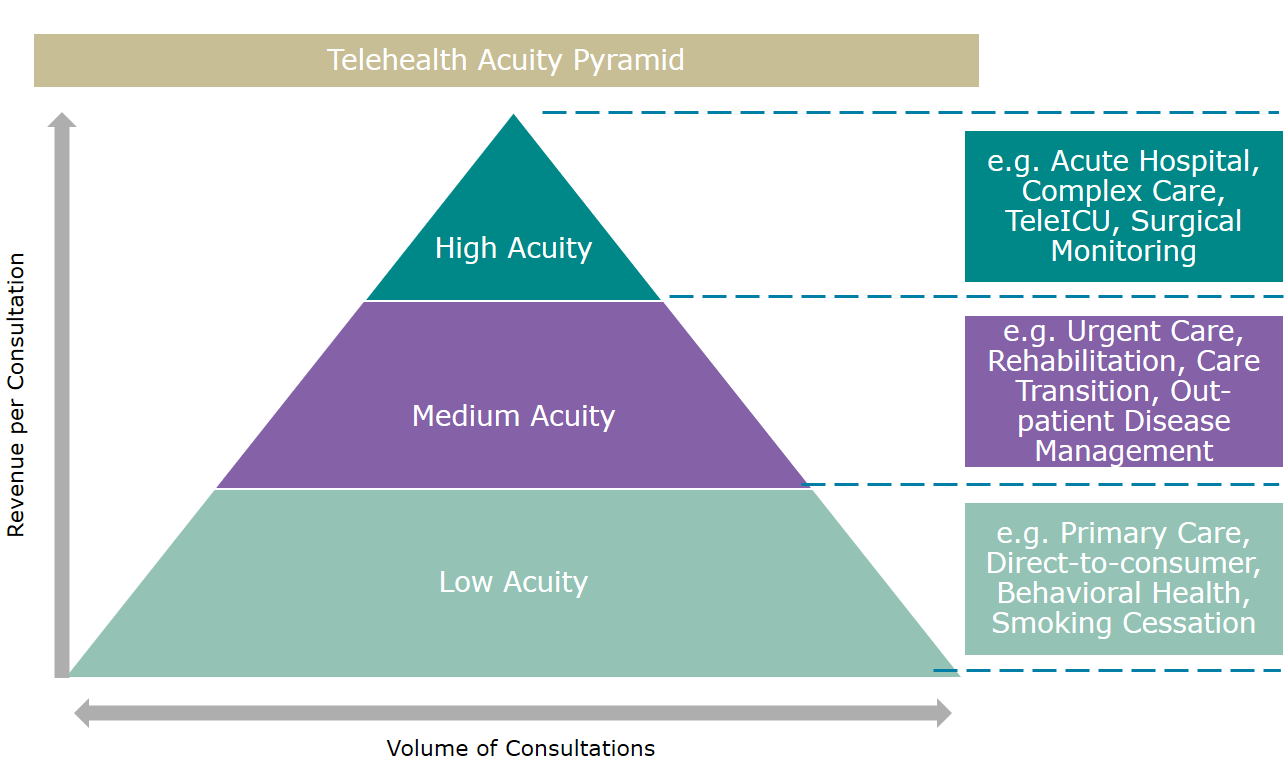

- This represented the latest development in a wider trend across the telehealth industry of platform vendors and service providers expanding their coverage to different levels of the acuity pyramid

- At the same time platform vendors are grappling with which strategy to follow, especially whether to expand their offerings horizontally to include services such as physician support

Teladoc’s recent acquisition of Best Doctors last month was a clear indication that Teladoc was embarking on a strategy to expand its coverage to higher levels of acuity.

With revenues of $123M in 2016, Teladoc has achieved widespread success in developing its brand and services addressing the low-acuity level telehealth needs across the US. Its services and capabilities were particularly well suited to areas such as behavioural health, general medical advice, sexual health and tobacco cessation. Of the varying levels of acuity addressed via telehealth this is perhaps the most mature area and crowded sector in terms of service providers and platform vendors. It is also an area of telehealth where consultation volumes are high, but the cost savings that it provides are lower, as are the revenues per consultation. Many companies such as American Well, Doctor on Demand, Babylon Health and MDLive target this sector of the market and it’s becoming a crowded space. Consequently it’s becoming increasingly difficult to offer clear differentiators whilst mantaining competitive pricing. The fact that despite its success Teladoc is still operating at a net loss illustrates this dynamic well.

In contrast, Best Doctors’ services sit at higher levels of acuity and are focused on improving health outcomes for the some of the most complex, critical and costly medical issues. This includes cancer, musculoskeletal disease and cardiovascular conditions. The company’s long-standing strategy has always been to focus on high complexity cases at the top of the acuity pyramid.

This results in a far lower volume of cases. For example, Best Doctors has only completed approximately 60,000 consultations since 2009, compared to Teladoc’s 950,000 in 2016 alone. However, the costs savings provided and the revenue per consultation have been much higher. Again, illustrated well by comparing Net Doctors $92M revenues in 2016, with these much lower volumes, and Teladoc’s aforementioned $123M.

This acquisition marks a wider trend that is being seen in telehealth, as companies that have tended to operate at a specific level within the acuity pyramid look to expand their business into other areas, both in terms of a move to higher levels of acuity and going down the pyramid to lower levels of acuity.

In contrast to Teladoc, InTouch Health has for some time been offering platforms and services at high levels of acuity in hospital settings, addressing needs such as TeleICU and TeleER. However, its plans to address the direct-to-consumer, at-home monitoring and care coordination markets over the coming 12-18 months illustrates a direction of travel down the acuity pyramid.

This does beg the question which direction is easier for a platform vendor or service provider, and where are we likely to see companies having greatest success as they embark on this move? Will those at the top and making the jouney down find it easier, or those at the bottom heading up?

When moving down the acuity pyramid, vendors and service providers face the challenge of a much more competitive market place and one that is likely to become increasingly commoditised. Differentiation will become an increasing challenge as will competition in terms of pricing. That-being-said, the specialist expertise required to support these services tends to be much less demanding. In summary, although barriers to entry can be lower, driving a profitable business model as a company heads towards the bottom of the pyramid is a much greater challenge!

Moving up the pyramid presents its own challenges as a greater depth of expertise in complex issues is required, as is closer relationships with health systems. Barriers to entry when moving up the pyramid therefore tend to be more complex, but the returns in terms of profitable business models can be much greater.

However, whichever direction a company is heading, the need to broaden coverage appears to real. As health systems look to expand their telehealth coverage and move out of trial deployments to service-wide deployments, it will become increasingly important that telehealth platform providers and service providers have a wider breadth of services across the acuity pyramid to address the complete set of needs of a provider. This journey is one that few can avoid.

In addressing this trend, Teladoc’s strategy to expand via acquisition does represent a logical approach, particularly for a company heading up the pyramid. Instead of relying on developing the expertise and relationships in house it can instead leverage that which is already in place within Best Doctors. So expect more M&A activity as other service providers and vendors broaden their coverage across the pyramid.

The trend to expand coverage across the acuity pyramid is also coupled with another trend; expanding offerings to also include physician support services. Providers are increasingly looking for telehealth platform vendors that can not only offer them a software solution but also the physician support services to aid them deploying telehealth offerings. This can be to either completely support the telehealth services of a provider’s physician coverage, or as a compliment to their internal resources (e.g. to provide capacity relief or specific condition expertise).

Platform vendors have two options in addressing this demand: either they can acquire service providers and develop the service offering in-house; or they can form strategic partnerships with existing telehealth service providers. InTouch Health is a good example of a company that has addressed this via the second option. It has both developed its capability internally and via its acquisitions over the last 12 months. This includes acquisitions of telehealth service providers C30 Medical Corporation and AcuteCare Telemedicine (ACT). In contrast Avizia is an example of one that has followed the strategic alliance route via its partnership with telehealth service provider MLS Telehealth. Indeed, MLS Telehealth has benefited considerably from this trend as it now supports many telehealth platform providers’ requirements in this area.

Again, the question begs as to which approach is better. Developing services in house presents a multitude of challenges. Being a software platform provider demands an extremely different set of internal skills to being a healthcare service provider. Furthermore, the range of specialisms required to address the plethora of conditions that could potentially fall under the remit of a telehealth service means that any attempt the bridge these demands is a huge undertaking. The partnership route means that platform providers can instead focus on their core compentency and leverage capacity and specialism where needed, without having to develop it in-house. So, we expect only those with the scale and finances required to undertake the internal development to follow the InTouch Health example.

About the Report

The information presented in this insight sets the scene for Signify Research’s upcoming market report “Acute, Community and Home Telehealth‚Äî2017 Edition”. This report will present the market for telehealth platforms, hardware and services and will include projections and market sizings for more than 20 countries.

The report is available as a stand-alone product, but it is also a component of Signify Research’s newly launched “Population Health Management and Telehealth Service”. This is a year-round service that provides ongoing data, insights, and analysis on the global population heath management and telehealth markets. The service includes four market reports delivered over a 12-month period, regular updates of key market metrics, competitive environment and market share analysis by product type and region and quarterly analyst briefings to each subscriber firm.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

To find out more:

enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net