Written by

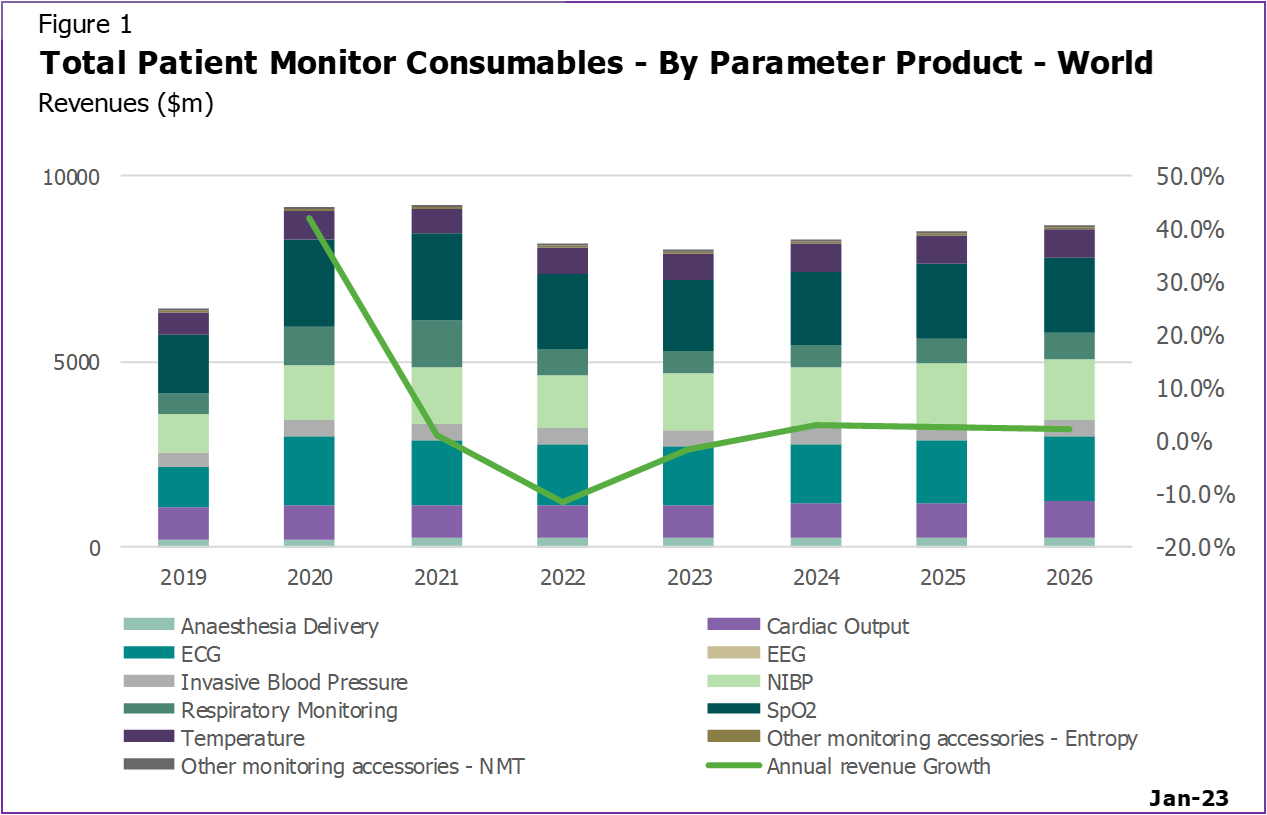

27th March 2023, Cranfield UK – The market for patient monitor consumables is estimated to have been worth $9.2 billion in 2021 (inclusive of multiparameter and single parameter monitoring accessories). This is forecast to fall to $8.6 billion at a CAGR of -1.2% by 2026. The market saw a swift uptick in demand (42% annual growth) in 2020 as a direct result of the global COVID-19 pandemic, driving significant demand for respiratory monitoring consumables. As COVID-19 case rates fell in 2021, demand shifted from the ICU setting to the OR. Revenues overall are projected to remain well above 2019-levels through to 2026 as clinical practice has further developed on a global level to ensure a higher level of patient monitoring is provided.

Product trends:

The COVID-19 pandemic highlighted the need to ensure patients were monitored appropriately, driving a surge in demand for monitoring of parameters that were associated with the symptoms and diagnosis of COVID-19. Fastest growth was seen in respiratory monitoring, SpO2 monitoring in addition to ECG. Whilst the capacity in ICU facilities and additional emergency wards was maximised, the OR saw reduced demand. As such, demand monitoring consumables used in surgical procedures fell in 2020, including anaesthesia delivery, NMT and Entropy.

In 2021, the patient monitor consumable market was affected by the changing demand for solutions from the ICU to the OR, to help monitor patients undergoing surgical procedures that were delayed in 2020 as a result of the pandemic. Revenues for anaesthesia delivery monitoring consumables subsequently increased in 2021. Global demand for respiratory monitoring continued to be heightened in 2021 as several regions saw delayed surges in COVD-19 cases. With increasing awareness for sufficient infection control, demand for disposable single-use solutions is forecast to be much higher than 2019-levels over the next five years, with many countries adhering to new clinical practices. Countries that largely preferred reusable solutions have now shifted toward single-use solutions, especially in invasive techniques or if there is a higher-risk of the spread of infection. Healthcare providers are much more aware of the need for appropriate infection control, to ensure both the patient and caregiver are protected, to reduce the subsequent impacts on both physician and financial resource.

However, in care settings that the risk of infection is low, reusable solutions are once again gaining preference. The economic impact on financial budgets has driven cost efficiency forward, resulting in price often outweighing product preference in purchasing decisions. Development of solutions to be utilised in low-acuity settings have been a focus of leading vendors, with several products being launched in recent years. As such, the utilisation of consumables with these devices is expected to increase, with increasing demand for basic parameters such as NIBP, temperature and SpO2.

Regional Trends:

Americas:

- With a well-established monitoring market, the North American market was the largest for monitoring consumables in 2021. Prior to the pandemic, infection control was already of high importance, to reduce adverse events in the hospital.

- In 2020 and 2021, demand for disposable solutions increased in the North American region specifically due to increased respiratory monitoring in COVID-19 patients. Revenues overall dipped in 2022, as the high demand on monitoring facilities subsided. Healthcare providers in the US are expected to continue to favour disposable solutions and not move toward sustainable practices like that seen in the European region. As such, the proportion of disposable solutions is projected to remain higher here.

- The Latin American market was one of the regions most affected by the COVID-19 pandemic, largely due to a delayed reaction to rising cases. As such, demand for disposable solutions to reduce risk of infection increased significantly here, driving the fastest sub-regional revenue growth from 2019 to 2020. Demand was sustained in 2021 due to additional surges seen. With new guidelines supporting appropriate use of disposables, the fastest CAGR (6.2% from 2021-2026) for patient monitoring consumables overall is projected for the Latin American region.

EMEA:

- Similarly to the US, the use of disposable solutions in the Western European region is well established, with use expected to continue in clinical indications that pose the greatest risk to the spread of infection.

- However, with restricted financial budgets, cost is becoming an important factor in purchasing decisions. This is subsequently driving healthcare providers back toward lower-cost reusable solutions in indications where infection risk is lower.

- Sustainability is also becoming an important factor in purchasing decisions, with several countries in Western Europe advocating for a greener healthcare system. As such, the need for solutions that help to reduce carbon waste in its manufacture and use will be prioritised moving forward. The drive toward reusable solutions, and greener energy usage will place greater pressure on manufacturers to remain profitable, which may increase pricing of reusable solutions in the short-term. As such, sustainability will result in an impact on product choice, rather than reduce the market size overall.

Asia Pacific:

- Prior to the pandemic, several of the countries in the Emerging Asia Pacific region were utilising a large proportion of reusable solutions. With growing awareness of the importance of infection control, the use of disposable solutions vastly increased.

- The Asia Pacific region continues to be dominated by local Asian vendors, which has driven down the cost of consumables here. With a number of the countries in the sub-region also moving toward local-made solutions, the accessibility of branded solutions from international vendors is reducing. Conversely, due to their lower cost, the presence of Asian brands is growing significantly internationally.

Future Outlook

Despite the market declining in 2022, demand for monitoring consumables will remain above 2019-levels through to 2026. The need to ensure patients and caregivers are protected from potential infection risk is now of global importance, with many countries improving clinical practices significantly. The economic repercussions are expected to last for a few more years, affecting product choice due to budget restrictions. Low single digit (1.4%) average annual growth is projected for the global market for patient monitor consumables market from 2022 through to 2026. Product preferences will continue to evolve with additional guidance on clinical practice in addition to sustainability developments. Vendors will need to ensure their products offer the most cost-efficient option but maintain a high level of monitoring care, which may result in profit margins being challenged in future years.

About the Report

Patient Monitor Consumables – World – 2023‚ provides a data-centric and global outlook of the reusable and single-use/disposable solutions used with patient monitors. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net