Written by

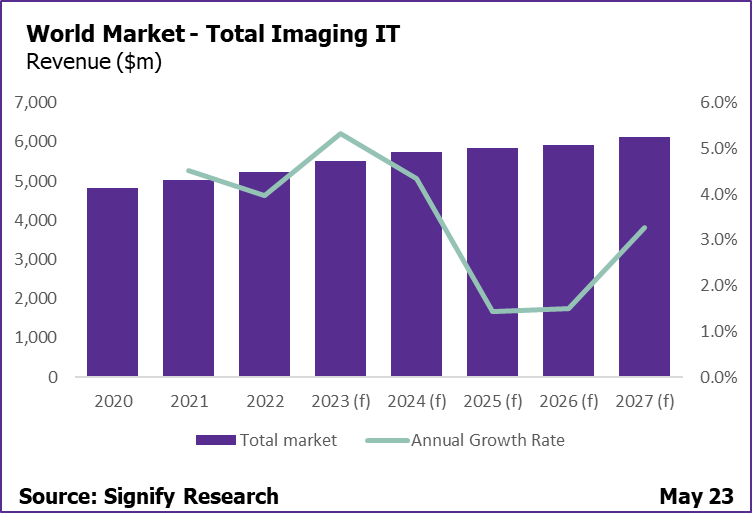

Cranfield, UK, 5th June 2023 – As the global pandemic fades into the periphery, investment was in full swing across many global markets, exemplified by the total imaging IT market growing to $5.2bn in 2022. The short-term outlook is expected to offer an abundance of opportunities for vendors, with the tail-end of a US radiology IT market replacement cycle, public investment bolstering markets in Western Europe and Latin America, and the Middle Eastern region ripened for double digit growth.

Beyond the strong growth prospects short-term, vendors must turn attention to 2025 onwards. Many markets globally are anticipated to encounter risk, whether that aligns to political elections, implications from the Russia / Ukraine war, or the ongoing economic instability offered by the global crisis. Rebuilding sales pipelines at the latter end of the forecast period is going to be unpredictable.

To mitigate future risk, alongside tackling increased business and staffing costs, vendors are evaluating and implementing price increase strategies. Although prospective rises could be between 5-20%, the reality is very context specific by product, customer, and geography. In actuality, it is expected parts of the imaging IT portfolio will be commoditised, such as operational workflow or analytics, so instead of the market inflating from price increases, vendor revenue will be redistributed across its portfolio.

*(f) represents forecast data. Total Imaging IT includes revenue from Radiology IT, Cardiology IT, Advanced Visualisation IT, Operational Workflow, and Business Intelligence Tools. This data is taken from our Imaging IT Core Report – World 2023, published May 2023.

Atypical Growth Across the Americas

Investment in imaging IT markets across the Americas will continue to intensify short-term. North America witnessed a significant volume of deals; across radiology, cardiology, and advanced visualisation IT, with several Canadian Provinces investing in enterprise solutions in 2022. As the market settles following the pandemic and procedural backlogs reduce, healthcare provider focus is shifting to prioritise mid- to long-term strategies, such as enterprise imaging. In recent years, the market has observed the combination of radiology and cardiology tenders, a trend expected to evolve to include specialities such as pathology, ophthalmology and point of care ultrasound.

Alongside enterprise imaging, cloud continues to play a pivotal role in vendor discussions, with the US at the epicentre of public cloud adoption in radiology IT. Hyperscalers and imaging IT vendors are coming together to improve market education, as well as both parties investing in innovation to bring cost-effective solutions to the market. As the market increasingly shifts from the acute into alternative settings such as imaging centres, retail providers or the utilisation of teleradiology, the technological and interoperable benefits that cloud offers, coupled with market education and innovation, will begin to accelerate the conversion from provider interest into deployment.

Performance in Latin America was strengthened by the growth in radiology IT, with public spending in Mexico and Colombia, alongside investment in the private sector throughout Central and Southern America in 2022. Short-term, the outlook is markedly optimistic. Recovery in the Brazilian market, coupled with pent up demand and continued investment from private equity across the region. However, investment is highly volatile in the region, as these markets are more susceptible to political and socioeconomical variables, with public investment extremely vulnerable to delays, a scenario expected 2024-2026. Many trends from North America are beginning to trickle down into Latin America. Government initiatives to improve healthcare infrastructure, as well as a shift in attitude at a provider level, with a growing willingness to invest in technology such as AI, cloud, and analytics, are also supporting growth.

Robust Outlook Across EMEA

A few key deals experienced further delay across EMEA, including the Wales and Scotland national tenders in the UK, investment in Italy and the long-awaited National Guard tender in Saudi Arabia, which was delayed once again. Despite this, the region grew 5% in 2022, a performance that will be dampened due to the exchange rate (EUR to USD). Short-term the region is primed for robust growth. National and regional deals for both radiology and cardiology IT are expected in 2023-2024, alongside government initiatives to replace aging modalities driving investment in AV IT across Western Europe. Emerging markets have witnessed a reinvigoration of funding and investment, as Eastern Europe (excluding Ukraine and Russia) and Middle East explore advanced technologies such as AI and cloud.

Beyond investment into the core imaging IT platform, providers across the region have placed a growing importance on operational workflow tools. As care pathways evolve beyond the acute hospital, alongside the amplification of financial pressured caused by the energy crisis in Europe, providers are turning to vendors and technology to improve productivity and efficiency across radiology.

Amongst private markets in Europe and increasingly so in MEA, the drive for efficiency is also steering an exploration of public cloud deployment. Primarily an “anti” public cloud market due to strict privacy laws and regulations on data-hosting, pockets of adoption are beginning to form, breaking away from the status quo.

The UK continues to double down on its cloud strategy, with NHS England’s recent “Delivering a net zero NHS” plan released, which details a roadmap to have a carbon neutral NHS, expected to accelerate investment even faster. Beyond Europe, Israel is another prime example, as the government invests $1.2bn to deliver cloud services under “Project Nimbus”.

Overcoming Inertia Across Asia Pacific

Regional growth across Asia Pacific was unusually soft in 2022, with regional performance effected by the notable slow-down in the Chinese market. Delving beyond China, pockets of the region offered solid growth opportunities, including Japan, which was bolstered by the tail end of post-pandemic government funding, as well as investment in the cardiology IT market in Oceania.

Growth across the region is expected to rebound in 2023, as China recovers with the expectation of high single digit growth across all product markets, in addition to the first of its kind, state-wide cardiology IT contract planned in Australia, which initially covers 30 sites. Many markets across ASEAN are expected to drive opportunities, once each country overcomes the relevant instabilities offered by politics. Due to the competitive dynamic across the region, with a heavy preference set to domestic or modality vendors, the question will soon become how do these vendors grow outside of their home market?

Investment priorities vary across the region, aligned to the digital maturity of a given market, regulatory and cultural differences. There are several parallels that can be drawn. China, Japan and Republic of Korea (ROK) are increasingly seeking and investing in AI tools for example, whether that is AI integrated into the PACS or advanced visualisation platform. With reimbursement and regulation amendments supporting providers exploration into advanced technologies.

Although enterprise imaging is a nascent trend in Asia Pacific, top-tiered hospitals are investigating the opportunity to consolidate not only radiology and cardiology, but in the example of ROK, digital pathology. One emerging trend, in markets such as Oceania is the transition from RIS-based to PACS-based workflows and the investment in operational workflow tools. As the penetration of EMR vendors flood new markets, the trend experienced in the US many years ago is slowly being mirrored.

Navigating Priorities to Secure Success

As economic uncertainty looms over the mid-term forecast of the global imaging IT market, vendors must seize the opportunity, taking advantage of the atypical growth offered post-pandemic, before deals are locked in and investment slows.

Providers are evaluating vendors, not only on technical competency today, but their roadmaps for delivering long-term strategies such as enterprise imaging, AI orchestration and cloud-native platforms. Due to competing R&D priorities, the market has witnessed a shift in approaches. Previously, vendors were driven to offer everything themselves, but now, many are doubling down on the investment in the core platform, leaning on partners to fill in the gaps for image analysis AI or additional service line capability. This trend has been evident in the last 12-18 months, especially when looking at digital pathology, for example, Siemens Healthineers partnered with Hamamatsu and Proscia, as well as Canon Medical and GE HealthCare both partnering with Tribun Health.

For many global vendors, their dominant markets are competitively saturated, such as Western Europe and North America, the key to securing success will lie in a vendor’s ability to deliver on the long-term strategy and accomplish the promised integration across its native, acquired, and partnered IT ecosystem. For those looking towards the lucrative emerging markets, vendors need to act with intention as these markets are high reward, but high-risk.

Related Research

Imaging IT Core Report – World 2023.

The Imaging IT Core Report – World 2023 is one of five deliverables associated to the Imaging IT Market Intelligence Service. The report provides full coverage of the global informatics ecosystem and is comprised of detailed global market data and forecasts, alongside qualitative analysis to evaluate key strategic questions.

About Amy Thompson

Amy joined Signify Research in 2020 as part of the Healthcare IT team, focusing on Imaging and Clinical IT. Prior to that, she brings four years’ experience as a Research Analyst; supporting business strategy and market sizing.

About the Medical Imaging / Imaging IT Team

Signify Research’s imaging IT service provides expert market intelligence and detailed insights across radiology IT, cardiology IT, and advanced visualisation IT, alongside operational workflow & business intelligence tools. Combining primary data collection and in-depth discussions with industry stakeholders, our thorough research approach yields credible quantitative and qualitative analysis, helping our customers make critical business decisions with confidence. Throughout the course of 2023/24, the imaging IT team will be further assessing developments in the market through its Imaging IT Market Intelligence Service.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net