Written by

Following attendance at Clinisys’ inaugural customer summit in Texas this March, Imogen Fitt from Signify Research shares her thoughts on the current landscape for laboratory IT.

*Access the pdf of my presentation by clicking the link: Trends to Watch in Digital Imaging – Clinisys Customer Summit 2023.

After being invited to Dallas to present my thoughts on the evolution of imaging in the lab*, I was interested to see where Clinisys, the highest revenue generating clinical Laboratory Information System (cLIS) provider worldwide, would focus its efforts for future development.

The event marked the first US customer summit since Clinisys, Sunquest Information Systems, HORIZON Lab Systems and ApolloLIMS consolidated under one brand. The Clinisys Group is now composed of two formerly separate cLIS giants, Clinisys and Sunquest Information Systems, which had years previously been acquired by parent company Roper. However, despite sharing a parent, the two companies continued to operate independently for years.

After challenging times in the US market, COVID-19 related upheavals worldwide and further encroachment by Electronic Health Record cLIS (EHR-LIS), it was decided to move forward as a combined entity, working through market challenges together. The acquisition of ApolloLiMS and Horizon Lab Systems soon followed, adding both public health and environmental lab expertise to the clinical equation.

Below I assess the Clinisys Group vision moving forward and the connotations for the wider Lab IT market. As a market leader, is Clinisys leading its customers in the right direction?

Step 1: Spring cleaning ahead

As a result of previous acquisitions, the Clinisys product portfolio has several brands operating with several overlapping or similar products. Therefore, development efforts are being duplicated; The first step on the road ahead for the Clinisys Group had to be tackling this problem by streamlining and slimming down the portfolio.

This trimming of the product line is no easy feat, as customers often retain fondness for the software they originally adopted. However, this goal will help Clinisys reduce its expenditure on product development and maintenance and invest more in innovations that can bring the company new growth.

A bulky portfolio is also a problem faced by a few of Clinisys’ competitors and customers. The investment and effort required to upheave a clinical lab’s operations, where downtime can result in disastrous standstills, often means that customers and vendors remain hesitant to adopt new infrastructure, choosing the ‚Äòdevil they know’ instead to avoid temporary discomfort.

Part of the consequence of this reliance on older methods has also resulted in slower innovation than would otherwise be expected, which leads us to Clinisys’ next focus.

Step 2: Headed to the clouds

Industry consensus suggests that cloud architecture is set to play an integral role across healthcare IT markets; however, the industry has been slow to convert. This is due to several challenges, including a lack of clarity on what terminology such as ‚Äòcloud-enabled’ really means.

Clinisys’ choice to focus more heavily on cloud-based infrastructure, however, does reflect movement in the general industry.

A recent State of the Industry survey released by the Medical Laboratory Observer1 revealed that across those surveyed, there was a definite increase in those using cloud-based LIS infrastructure over the last year (28% today compared with 24% last year). Vendors are also seeing revenues slowly shift to reflect this trend year-on-year.

In short, the cloud conversion is happening, but slowly, and this slow pace might be to Clinisys’ benefit, giving the vendor time to tackle its large customer base without much fear of customer attrition, whilst it also seeks to build new software.

Building a laboratory ecosystem

Alongside software for individual labs, integration between labs was also a strong theme of the conference, with public health and environmental lab roles and responsibilities discussed in earnest.

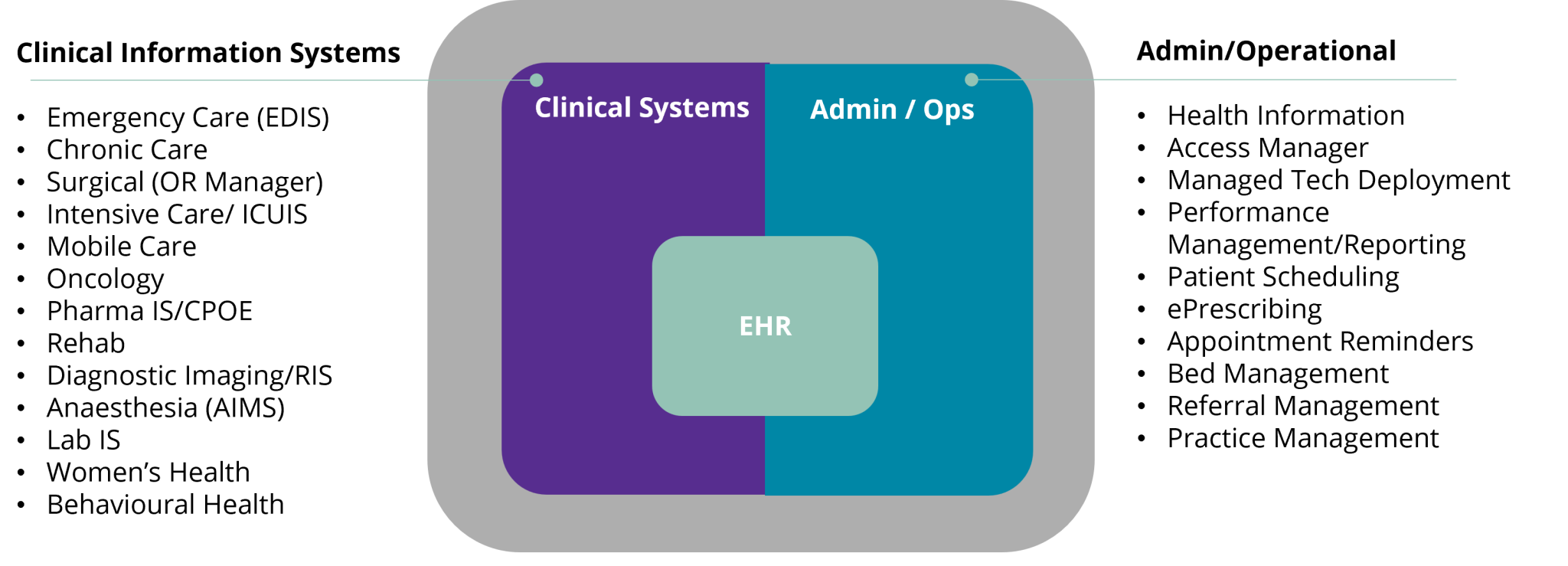

Best-of-breed (BoB) cLIS software has for some time in the US been losing out to EHR-cLIS deployments as healthcare IT procurement is slowly coalescing. Bundled procurement provide an advantage of reducing upfront costs to the hospital whilst also alleviating administrative burden, providing a more integrated solution (in theory), with common UI and workflows across the hospital, see Figure 1.

Figure 1: Healthcare IT components increasingly being drawn into EHR deployments.

However, it is no secret that EMR-LIS cannot ‚Äòdo it all’. EMR-LIS IT often caters most effectively to pathology labs’ requirements, but can leave other types of labs, like microbiology and toxicology departments, wanting more. EHR vendor Epic’s Beaker, for example, does not include functionality for Blood Bank and Transfusion management.

There are some indications that this trend is now beginning to slow in the US, as evidenced again in the survey conducted by the Medical Laboratory Observer1, which noted 39% of respondents reported using stand-alone systems compared to 38% in 2022.

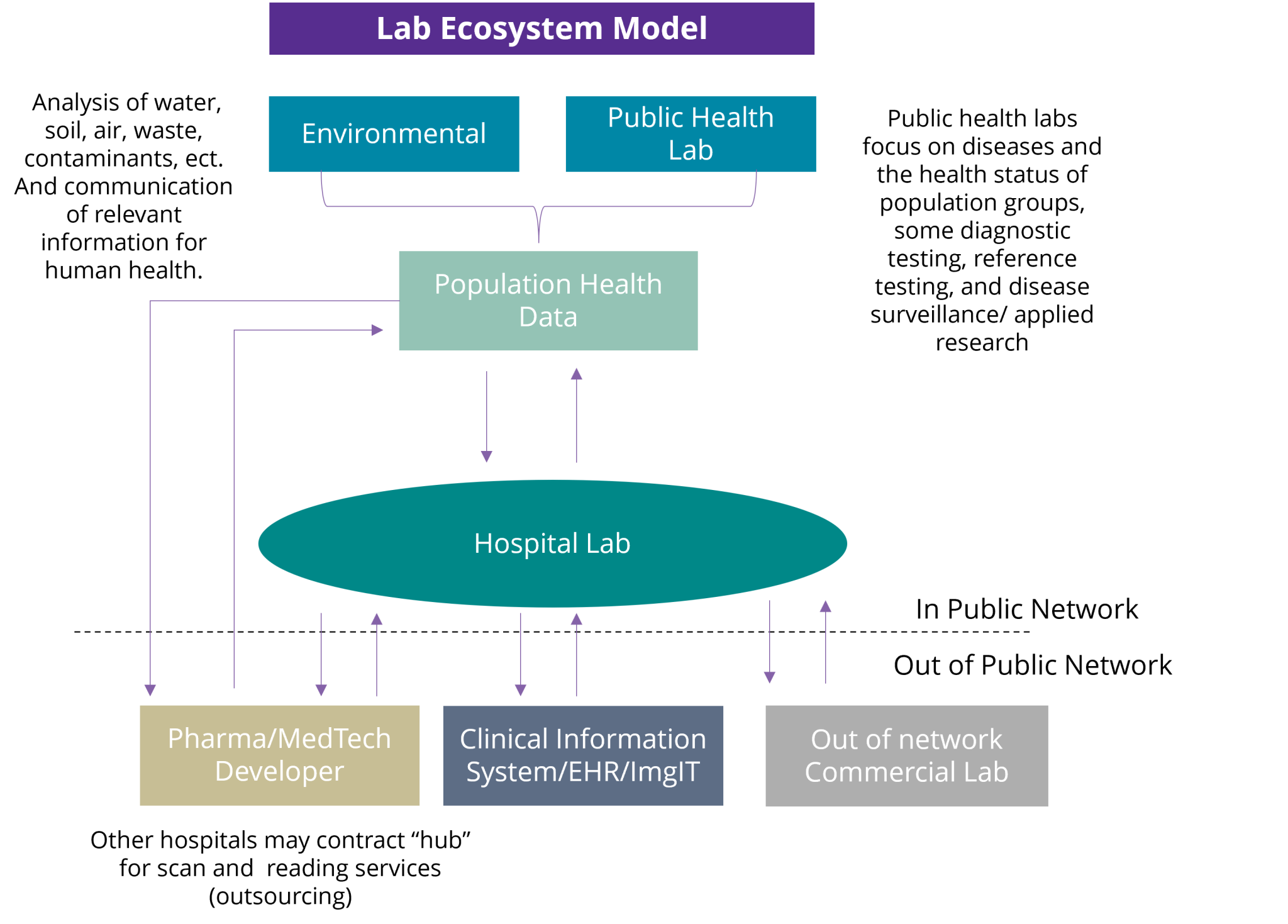

There is therefore an opportunity for Clinisys to capitalise on the value offered across its portfolio, by creating a laboratory ecosystem designed to support healthcare initiatives, see Figure 2 below.

Figure 2: The potential of an integrated lab infrastructure, exchanging information across a range of users.

The value each of these was on full display throughout the pandemic and whilst data initiatives and sharing schemes spiked, the difficulty in facilitating these activities was also prominent.

The need for aggregated sources of information is key, and Clinisys promise to unite its portfolio offers the company a chance to lead as requests like these become more common.

Opportunity everywhere, but innovation takes time…

Key takeaways from the event indicate that Clinisys is heading in the right strategic direction; and the company was blunt about its challenges and refreshing in its honesty. Clear instructions were provided to customers, as was a development timeline.

As such a prominent vendor in the healthcare lab market, Clinisys has certainly made a step in the right direction for its customers; whether it can lead the way towards tackling some long-held challenges in the industry will depend on its ability to execute its new plan.

*You can access the pdf of the presentation by clicking the link below:

To learn more about Clinisys’ Customer Summit please click here.

To learn more about Clinisys’ Customer Summit please click here.

About Imogen Fitt

Imogen joined Signify in 2018 as part of the Healthcare IT team. She holds a 1st class Biomedical Sciences degree from the University of Warwick where her studies included molecular biology and pharmacology. Since joining the team Imogen has studied the medical imaging software and hardware markets and pre-clinical software sector.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.