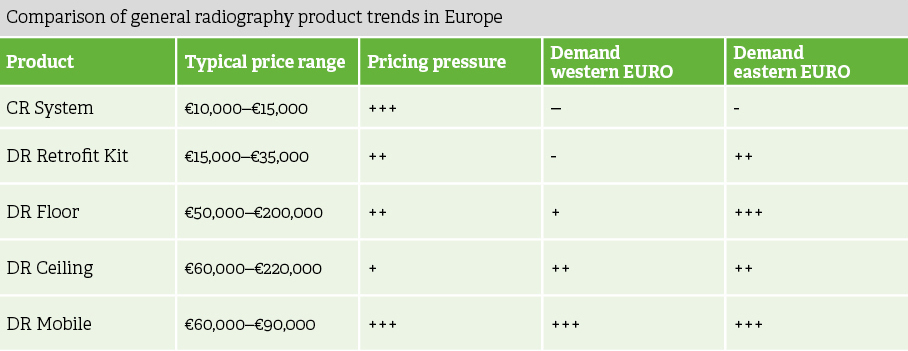

So, heading into ECR 2020 what product trends can we expect to see?

The CR and retrofit market is tapering off but opportunities remain

Europe’s conversion to digital radiography started in the late 1980s, primarily through the addition of computed radiography (CR) systems to existing analogue equipment. More recently, these CR systems have been replaced with flat panel detectors, either DR retrofit kits or direct digital radiography systems, causing a rapid decline in CR sales. DR retrofit kits comprise a flat panel detector and software to allow analogue radiography systems to be upgraded to digital radiography at a fraction of the cost of purchasing a new direct digital system. Entering the market at around €60,000 at the time, today, many hospitals have completed their upgrade to digital radiography and prices for these kits have plummeted to between €20,000-€40,000 as demand begins to peter out and competition between vendors intensifies.

In Europe, vendors of CR systems and DR retrofit kits are now beginning to place more focus on private clinics and veterinary centres, many of which have yet to convert to digital. The few remaining pockets of CR sales, primarily in smaller hospitals and clinics in southern and eastern Europe, are expected to disappear over the next few years as they convert from CR to DR, most likely with DR retrofit kits.

Fixed systems driving growth through premium sales

In order to meet customer needs and in face of increasing competitive pressures, vendors are increasingly adapting their product portfolios into tiered structures, positioning their products as ‘premium’ or ‘value’ systems. Several value-based systems have been launched over the last few years, targeted at smaller hospitals and academic centres which have lower imaging volumes. While this strategy has achieved some success, the market for value systems is extremely competitive, with prices as low as €35,000 in some instances and consequently margins are often lower.

Meanwhile, the premium market has focused on providing advanced software-based functionalities. Capabilities like angiography, auto tracking and autocollimation have been added to premium systems, to enable customers to do more with less. This two-tier strategy enables vendors to compete in the lower end of the market, while protecting margins at the more lucrative premium end.

In the future, this is likely to stratify further into value, performance and premium-based segments. Whereas value-based products will provide only basic functionality for routine imaging, performance products will feature workflow efficiency tools such as auto-positioning and auto-tracking to increase the throughput of systems. Premium systems will then continue to provide top-end functionalities like tomosynthesis.

Mobile catching on in eastern Europe as prices decline

The conversion to digital mobile radiography is a few years behind fixed systems and this has led to strong demand in recent years. When compared with fixed systems, there are fewer opportunities for vendors to differentiate their mobile radiography solutions, as customers typically do not require advanced features for bedside imaging applications. This has led to strong pricing pressure.

However, the market remains favourable, and it continues to grow at high single digit annual rate, rather than the fixed systems market which is currently experiencing low single digit growth. As prices fall, eastern European providers who are now looking to digitise their old analogue systems are increasingly finding prices more attractive. Comparatively, analogue systems sell at around ~25% of the value of digital equivalents in Europe.

It’s likely that in the future we will also begin to see portfolio stratification in the mobile market, much like the value-premium structure of the fixed systems market. Premium systems will focus on improving image quality and manoeuvrability with advanced software applications, whilst value systems remain low-cost.

Conclusion

While outwardly the situation for general radiography vendors looks challenging, overall growth in the market is likely to continue to remain stable. Whilst value vendors are focusing their efforts on emerging markets and stragglers in DR conversion, premium vendors are hoping to provide efficiency upgrades and premium capabilities to give providers more bang for their euros.

Our prediction for ECR is that the word on every customer’s lips will continue to be value; what else can I get for my money?