Written by

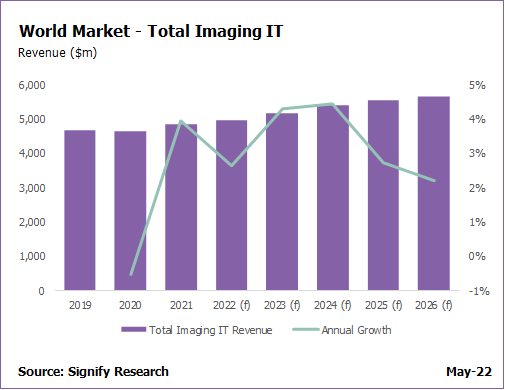

The global imaging IT market has recovered swiftly from the slight downturn experienced in 2020. A second, strong performing year in the advanced visualisation IT market, due to healthcare providers continued investment in modality and tools that aided Covid-19 care delivery, was the main driver underlying this performance.

However, following unprecedently robust market performances, the impact of supply chain issues, production delays and increased component costs on imaging modality sales channels for AV from vendors such as GE Healthcare, Philips and Siemens Healthineers, will have a negative impact on market performance near-term, causing a softer AV IT market in 2022, with “normal” low-single digital growth expected to return in 2023.

Investment and deals have also returned in radiology and cardiology IT, although deal volume is yet to match pre-pandemic levels. In many instances, vendors reported opportunities for add-on sales such as image exchange, universal viewers, operational workflow and BI tools, offsetting the shortfall in larger enterprise imaging platform deals.

Short-term, vendors are “gearing up”, hoping to capitalise on the atypical spending expected across mature markets in 2022-2024. This predicted surge will be driven by multiple variables; pent-up demand, government injecting funding into healthcare to drive digitalisation and support providers in managing the extensive procedural backlog caused by the pandemic, as well as growth in market segments such as outpatient and ambulatory care.

Across emerging markets, the outlook is mixed, with intensifying risk. Presidential elections across Latin America will create near-term uncertainty on healthcare investment and priorities. The regional effect of the Ukraine and Russia war across Eastern European markets is also unclear, though severe market contraction and impeded economic activity for several years is the most likely scenario. However, the Middle East and Africa offer growth, with investment and digitalisation observed across the Gulf region and South Africa, while key national tenders are planned in Saudi Arabia for 2022.

*(f) represents years in our forecast period. Total Imaging IT includes revenue from Radiology IT, Cardiology IT, Advanced Visualisation IT, Operational Workflow and Business Intelligence Tools. These numbers have used our Imaging IT Core Report – World 2022 preliminary data, and are subject to change when we publish the full report in May 2022.

The Importance of Collaboration

Government funding and initiatives across Western European markets are expected to create opportunities for tools that drive collaboration and productivity; NHS England’s Unified Tech Fund, the French Healthcare Innovation 2030 strategy and the Gara Sanit√† digitale in Italy are good examples.

These initiatives will drive short-term investment across imaging IT markets, with products such as image exchange, enterprise imaging and cloud, a priority for providers. With the drive for collaboration, it is expected that workflow tools such as federated worklists will increasingly be sought by healthcare providers. Furthermore, new workflow products to drive better care outcomes and cross-team collaboration are expected to become available, such as teleradiology referral management, triage, or Tumour Board functionality.

Alongside funding, the pandemic created a shift in how and where patients want care to be delivered, with the growing use of outpatient and ambulatory providers. This directional shift to outpatient is also driven by government and payers; in the USA for example, some payers have placed restrictions on where non-emergency imaging can be conducted. In public markets such as the UK, the government is injecting money into outpatient centres to reduce waiting time for backlog procedures. Imaging IT vendors are slowly evolving to consolidate disparate systems to drive interoperability, as there is a clear emphasis on the need for connectivity across networks and capturing all data along the patient care continuum.

For emerging markets, the focus for investment remains on the core radiology platform, with much of the market procuring standalone solutions; in some pockets of Asia Pacific and Latin America, “enterprise radiology” is increasingly preferred. Trends towards interoperability and collaboration, will be a longer-term ambition for these markets with first adopters expected 2024-2026.

Roadmap to Success

Due to the shift in where images are acquired and read, vendors need to consider the role of the outpatient and ambulatory settings and develop a strategy to adapt solutions to meet the need of the market, with emphasis placed on productivity and efficiency. Competition will be stiff. In the last 12-18 months vendors have released products directed at outpatient imaging centres; Change Healthcare and GE Healthcare for example, as well as new entrants to the USA radiology market, Sirona Medical.

In addition to the market drive towards consolidation and interoperability, alongside the emerging growth in outpatient imaging centres, imaging IT vendors cannot lose sight of the renewal cycle expected imminently in mature markets. To capitalise on new deals, it will be crucial for vendors to evaluate broader platform strategies and how they plan to address the long-term drive towards a rounded multi-ology enterprise imaging portfolio, including competencies for AI integration, cloud native architecture and functionality to support operational efficiency and productivity.

When selecting an imaging IT vendor, providers are looking for a partnership, a company that aligns to their goals and has a roadmap for development to address any current portfolio gaps. It’s understood by providers that a consolidated EI platform takes time and money to develop – the necessity for imaging IT vendors is conveying ambitions to prospective customers and clarity over timescales and expected future costs.

The Opportunity is Now

The mature markets of imaging IT are saturated and cost-competitive, offering limited opportunity for organic growth from the core platforms. However, with funding injected to aide recovery from the pandemic, digitalise healthcare and reduce pent-up demand, the market is entering an unprecedented opportunity for growth.

To take advantage of the short-term opportunity, vendors must look ahead. Evaluating how to evolve current solutions to meet the needs of the market, which will require priority placed upon interoperability, collaboration and productivity. Providers are no longer wanting to rip and replace imaging IT software unless absolutely necessary.

Success will be determined, not only by the vendors portfolio today, but their aspirations and roadmap to acquire, partner or build the solution for the future.