Written by

To simplify supply chains and streamline budgets, hospitals are increasingly moving departmental IT and equipment procurement up the administrative river towards the C-suite. This can result in departmental-specific needs being displaced by enterprise-wide priorities. How should lab IT vendors evolve their strategy to address this?

The hospital of the future is interconnected, and whilst the journey towards realising this may take longer than most would hope; it’s clear even now that IT operating in siloes is a thing of the past.

However, facilitating smooth integration across departments is no easy feat. Whilst existing disparate systems can be connected via customised Application Programming Interfaces (APIs), these can be challenging to maintain (with issues related to security and ongoing management) whilst also resulting in a redundancy of resources and personnel.

To sidestep these issues, IT procurement is slowly beginning to coalesce. The most prominent example of this can be found via bundled clinical information system procurement occurring alongside EHR deployments, which is increasingly being facilitated via the broad number of ‚Äòmodules’ offered with EHR solutions from vendors like Cerner or Epic. Bundled procurement provides the advantage of reducing overall costs to the hospital whilst also alleviating administrative burden and ultimately providing a more integrated solution, with common UI and workflows across the hospital.

In these situations, stakeholders higher up in the hospital management chain are increasingly influential in decision making, bringing with them alternative priorities. Incumbent sales strategies employed by Best-of-Breed (BoB), departmental-specific, solution vendors run the risk of being less attractive to these personas.

So the question is, is how fast is lab IT procurement migrating, and how should incumbent BoB vendors react?

Migration Caused by Digitisation

One of the more aggressive forms of lab IT budget migration is the digitisation of pathology labs’ slide reviewal processes. The digital pathology market experienced an unexpected surge in the wake of the 2020 COVID-19 pandemic, as remote working prompted a more rapid transition to digital pathology than previously planned.

A by-product of this demand is that labs, particularly across Western Europe, have capitalised on alternative initiatives by ‚Äòpiggy-backing’ onto radiology budgets. By consolidating image storage through a single transaction, labs can make the ‚Äòleap’ and overcome the rather significant cost-related barriers to implementation.

This trend is now beginning to creep across the Atlantic into the US and is forecast to travel further. Vendors like Sectra, which straddles both product lines, have predictably profited from this. However, the progress of specialist digital pathology vendors should not be downplayed. These have been able to capitalise on this trend through pivoting to partner with major PACS providers. This allows them closer integration as well as an ‚Äòin’ to radiology departments. Whilst Proscia-Siemens Healthineers may be one of the more prominent recent examples of this strategy (see our previous analysis), Fujifilm-Inspirata has also been doing particularly well with this approach for some time in the UK.

Migration Through Consolidation

As consolidation of laboratories continues globally, inevitably decision-making is being driven from individual labs towards governing bodies or regional networks and health systems. The strongest example of this lies in the UK market, which has now announced a National LIS for Wales, Northern Ireland and most recently Scotland.

In these instances, decision making is facilitated not just by labs but by public bodies designed to extract the most value from products and services on the behalf of individual institutions. Here, cost-effectiveness, flexibility in payment models and ability to provide scaling services for future operations comes above individual departmental desires.

A sales strategy focusing on features that address these demands has certainly benefited Citadel Health, a relative newcomer to the UK market, and the beneficiary of NHS National Services Scotland’s recent national LIS contract.

Whilst national LIS contracts are relatively unique to the UK market, versus other part of Europe, it’s no secret that consolidation of labs into larger networks is occurring elsewhere. The highly competitive laboratory environment in France, for example, remains a bustling hive of potential for future transformation.

Vendors that participate in tenders of this nature must not rely too heavily on prior loyalties. Whilst established labs may be notoriously reticent to migrate legacy systems, the case for change will never be stronger than when procurement is consolidated.

The Value in Bundling

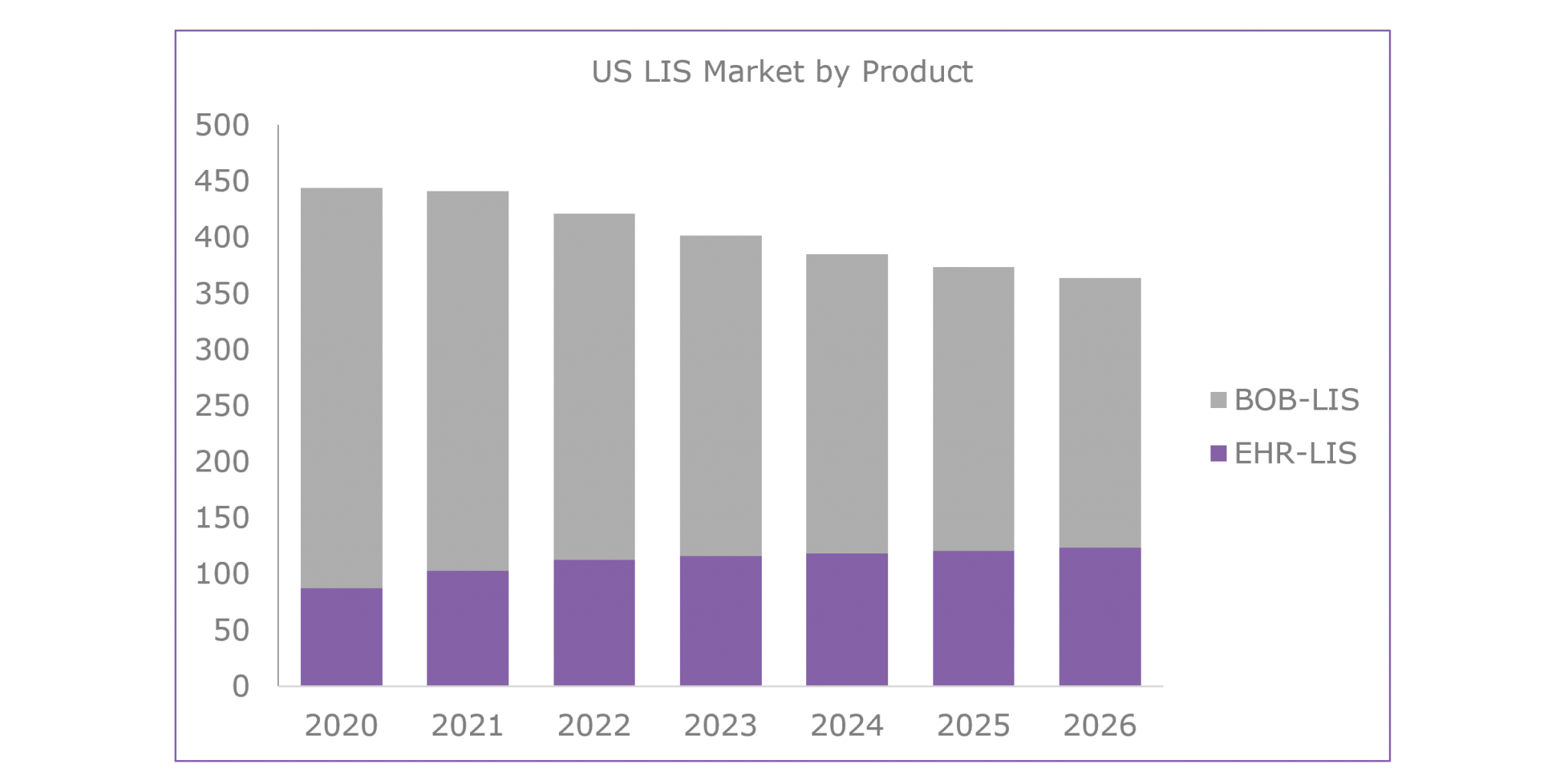

Bundled procurement is not limited to labs and radiology departments. LIS vendors are already acutely aware of the encroachment of the EHR-LIS, the effect of which has been felt most acutely within the US to date (as seen in Figure 1 below), but which is projected to increasingly impact the market in other geographies over the medium term.

Figure 1: Data from Signif Research’s report: Laboratory Information Systems – World – 2022.

The impact of these combined sales serves not only to mitigate overall market growth, but it also drives decision making towards the C-suite. Here, value-for-money and broader enterprise-wide IT priorities become much more of a priority over niche functions and form.

This effect is not limited to the US and bundled EHR-LIS procurement is projected to occur more frequently, with developing Asian and African markets in particular demanding value for money. Whilst these markets remain relatively small, such instances will serve to mitigate growth and are generally driven by cost above all else. The biggest challenge for vendors is getting a seat at the table. Not all EMR-LIS sales have proceeded to a full public tender, especially when occurring during an EMR deployment.

Doing the Hokey-Pokey and then…

Luckily for BoB vendors, with the exception of the US, this effect is not forecast to bleed significantly into some key geographies, in particular Western Europe.

Despite this trend it’s no secret that EMR-LIS cannot ‚Äòdo it all’. EMR-LIS IT often caters most effectively to pathology labs’ requirement, often leaving microbiology and toxicology departments wanting more. From the perspective of EHR vendors, there’s little financial incentive in spending the millions to develop the capabilities to satisfy these segments. Because of this, even as EMR-LIS has cannibalised parts of the hospital segment some BoB LIS vendors have retained aspects of contracts with prior LIS customers to retain previously valued functionality specific to these additional segments.

From here, we can expect these markets to evolve a new subsegment of specialist operational workflow tools, operating as satellites to larger LIS deployments. Such a trend has already been evidenced historically for radiology information systems (RIS).

Keep Up or…

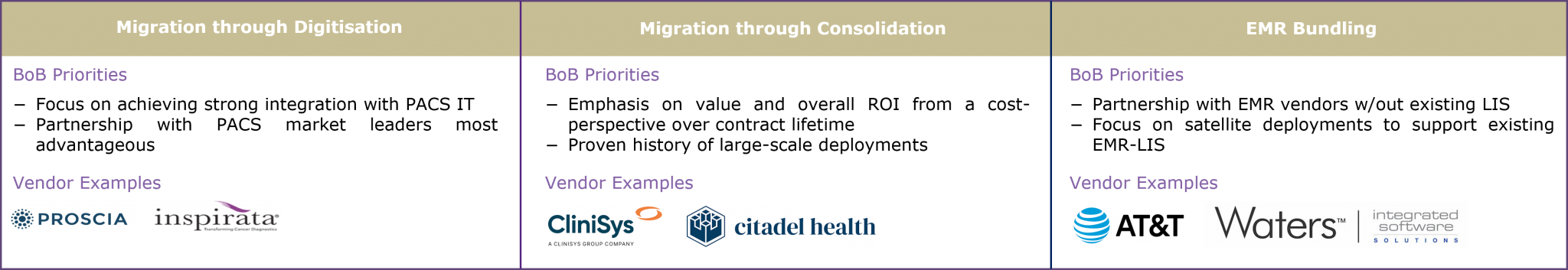

Signify Research has categorised three distinct forms of migration occurring in the market, these are summarised below.

Whilst each trend arguably occurs significantly in only one or two geographies today, the signs for change are already present worldwide and all Lab IT vendors will feel the impact over the short-to-medium term.

To survive, Lab IT vendors must respond quickly and meet these changes head on – or risk falling behind and losing share.

About the Report

Laboratory Information Systems – World – 2022 provides a data-centric and global outlook on the current and projected market for laboratory information systems in clinical settings. To find out more, please email the report author Imogen Fitt at Imogen.Fitt@signifyresearch.net.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net