Written by

- Philips Healthcare has acquired ultrasound image analysis software vendor TOMTEC Imaging Systems GmbH

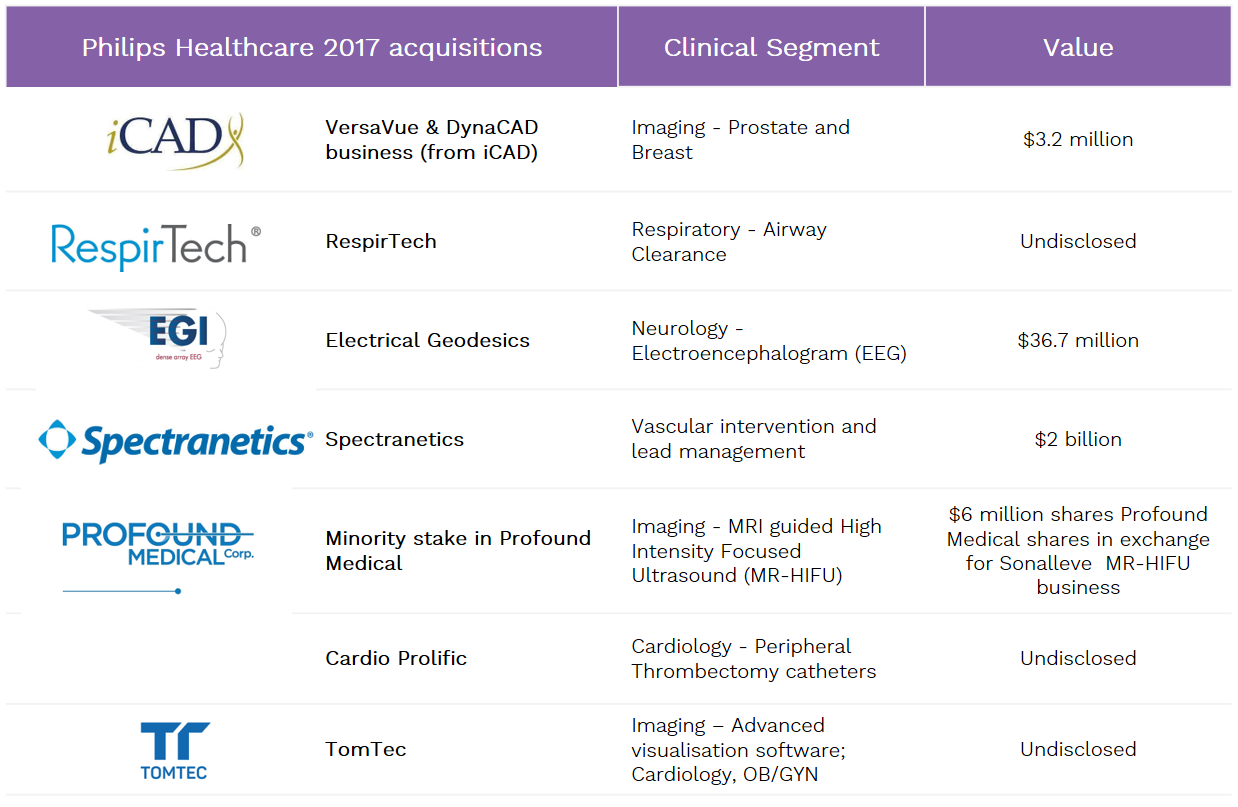

- The acquisition is the latest acquisition by Philips Healthcare in 2017, with more than $2B invested to date

- TOMTEC acquisition is designed to complement Philips’ strength in cardiology ultrasound and bolster its’ capability in radiology and OB/GYN ultrasound

- Philips Healthcare announced no intention to change to TOMTEC’s vendor neutral product supply to third parties (including Philips main competitors in ultrasound).

- Acquisition further highlights Philips Healthcare strategy to establish full complement of clinical hardware and software solutions that can be used in long-term managed service deals

Philips Healthcare has been making some major investments, with TOMTEC Imaging Systems the latest in a spree spanning the first half of 2017. So, what does this flurry of spending say about Philips’ strategy and its’ impact on the wider market? Here’s our take:

The Signify View

A protectionist endeavour?

TOMTEC Imaging Systems is one of the most widely used specialists for ultrasound image analysis software, especially in cardiology. Their core product line is used by many major ultrasound and healthcare IT software vendors, most of which are Philips’ direct competitors. A simple scan of the TOMTEC website boasts an impressive partner list:

All the vendors in this list compete with Philips in their core imaging and imaging IT markets, with GE Healthcare, Toshiba Medical Systems and Siemens Healthineers Philips’ biggest competition in their core ultrasound, interventional X-ray and healthcare IT business. While Philips was quick to clarify that the vendor-neutral business model for TOMTEC products would continue, it’s hard to see in the long-term that Philips will want to continue to supply market-leading analysis software to its closest rivals. This is even more unlikely given Philips’ current market leading position in cardiology ultrasound and interventional cardiology. Philips will no doubt argue that the TOMTEC acquisition is part of its broader push to offer a completely integrated clinical hardware and software offering (more on that below). However, the cut-throat nature of healthcare procurement today suggests that vendor-neutral supply will not continue indefinitely, especially if Philips’ market leading position is challenged. It may not be too long before Philips’ competitors start looking for a new partner to replace TOMTEC.

Splashing The Cash

The TOMTEC deal is the latest in a flurry of over $2 billion of acquisitions for Philips Healthcare in 2017:

It is well known that Philips has undergone a significant re-focusing in the last five years. Over that time, it has shed its TV, Lifestyle Entertainment and Lighting (via IPO) businesses, to focus on healthcare and personal health exclusively. And it’s a strategy that seems to be working; at the end of 2016 Philips posted solid revenue growth of between four and seven percent across its three core business lines (Diagnosis & Treatment, Connected Care & Informatics, Personal Health). At the half-year in 2017, growth continued, with three percent, two percent and six percent revenue growth. More impressive is that 1H 2017 has been challenging for most of Philips’ core product markets. Uncertainty in the US market about the repeal of Obamacare, combined with sluggish demand from emerging BRIC+ economies has supressed growth opportunities. While an unexpected boost to Western European demand has helped bolster 1H 2017 results, recent results from Philips are impressive.

However, there may also be more to the timing of Philips digging into its cash reserves. Two of its main competitors (Siemens Healthineers, Toshiba Medical) are undergoing major transitions. Toshiba is currently navigating a complex integration with Canon, pulling together disparate subsidiaries such as Vital Images, Delft DI and Olea Medical, while Siemens Healthineers is creeping towards a much-anticipated initial public offering (IPO). Even GE Healthcare, Philips’ biggest challenger in healthcare technology, is undergoing a major corporate change in direction towards becoming a “digital” company. Philips’ sudden investment flurry should be therefore viewed as both a calculated show of strength and a marker of future intention. Take note.

Long-term incumbent ploy

The breadth and variety of acquisitions Philips has made in 2017 also well suits its long-term strategy. Following Philips transition’ and re-focusing on healthcare, it has become apparent the company is positioning itself to become the “one-stop-shop” for clinical software and hardware to major health providers. By bringing in complementary, marquee acquisitions to its core business (think Volcano, Spectranetics) and expanding into new areas such as digital pathology (PathXl) and Population Health Management (Wellcentive), Philips is building a comprehensive portfolio of clinical, diagnostic and home care offerings.

For healthcare providers, a single-vendor option for providing comprehensive clinical hardware and software has many benefits, including reduced administration costs, simpler procurement and fewer implementation challenges. Moreover, it offers opportunity for contract innovation, with longer-term, managed service or risk-sharing agreements easier to implement.

Philips has been one of the “first movers” to this approach, with publicised, long-term (ten years or more) managed service deals announced in the last few years. In doing so, Philips can embed itself into the working practices of the healthcare provider and essentially “lock-out” competition long-term while guaranteeing predictable revenue. There is significant risk to providers in this approach, such as limiting adoption of best-of-breed technology from other vendors and the risk of being “locked-in” to future hardware and software upgrades regardless of capability or functionality. However, such agreements are becoming more common with other vendors following suit, suggesting that providers are willing to take these risks.

The recent spate of investment from Philips therefore appears to not only be adding further capability to its portfolio, but with it, greater impetus in their push towards the “one-stop-shop” model.