Written by

The news last week that digital pathology pioneer Proscia and the multi-billion-dollar healthcare giant Siemens Healthineers had inked a multi-year OEM agreement certainly raised industry eyebrows.

For Siemens, the deal marks its first foray into digital pathology, with Proscia filling what is arguably a rather prominent hole in the German vendors diagnostic portfolio. For casual onlookers, it also signals growing acceptance for digital pathology in the clinical market, which has been famously slower than anticipated to adopt digitilisation since whole slide imaging (WSI) scanners first became available over twenty years ago.

This agreement comes as the digital pathology market is evolving quickly and several changes are occurring. Below we examine what this deal means – specifically for the Proscia and the wider digital pathology community – and contrast this move with other recently announced competitive shifts.

Partner of Choice

During its press release, Siemens Healthineers cited an extensive evaluation process before deciding upon a partner, and it’s not hard to see why the company choose Proscia out of all potential candidates.

For starters, between three core product types, hardware, image management and viewing software (IMVS) and AI, IMVS is set to drive growth in the digital pathology market over the next five years as BOB vendors profit off the back of the pandemic, which highlighted the benefits in remote viewing.

Proscia has itself benefited heavily from this surge, experiencing impressive expansion in the US market during 2020 which continued onward into 2021. Over the last year the establishment of several contracts with European digital pathology pioneers, such as LabPON in the Netherlands, it has become clear that Proscia’s sights were starting to zero in on the European market.

In this market, a partnership with Siemens Healthineers offers a considerable ‘leg-up’. The European market is famously tiered towards public hospitals and is heavily influenced by large tenders. Within digital pathology, an increasing trend towards ‘pathology enterprise imaging’ – a radiology enterprise imaging contract which includes a provision for the storage and management of digital pathology images – is starting to emerge, and in this context synergies in the two companies’ portfolios start to become clearer.

As a part of the deal, Siemens Healthineers has specifically agreed to expand its Enterprise Imaging offering (under the Carbon brand) towards using Proscia’s Concentriq¬Æ Dx platform, opening the opportunity for both companies to participate in these radiology/pathology tenders.

It’s about time too, as direct competitors like Inspirata-Fujifilm have benefited in recent years through this strategy, whilst Sectra had long since launched its own combined radiology and pathology offering and regularly announces the expansion of its pathology solution to existing radiology customers.

Beyond these tenders, Siemens Healthineers also already has a solid customer base of radiology clients across Europe. These, whether already converted to enterprise imaging or not, are a potential haul of rich pickings for Proscia, who will be able to leverage Siemens’ credibility to persuade its customers to digitise (or convert).

Lastly, whilst the press release made no mention of leveraging Siemens Healthineer’s considerable IVD business to expand Proscia’s customer base, it’s almost a sure bet that if the next few months bode well, exploration of a multi-channel approach will surely be on the cards, giving Proscia a direct presence in labs, which already bundle other software purchases (like that of a Laboratory Information Systems) with IVD contracts.

The Wider Impact

Panning-out to look at the wider impact of this deal, it’s expected that this partnership will help drive standard adoption in digital pathology. As the number of enterprise imaging deals increases, it’s likely that DICOM as a pathology standard will also gain more traction and move towards a more prominent and harmonised market; however, there is still a long way to go based on the sluggish progress of the DICOM for pathology working group in technically maturing the standard beyond basic functionality.

Certainly, it’s within Siemens Healthineers’ best interests to push wider adoption of digital pathology, as the transition will facilitate its own interest in pursuing personalised medicine. As pathology images become more available across enterprises, they will increasingly become used in practices such as multi-disciplinary tumour boards (MDTs) and further multi-modality research collaborations, areas which the German vendor is aiming to lead the market.

A Networking Bonanza in the Market

However, despite the focus of this piece, the Siemens Healthineers announcement is not the only partnership Proscia have achieved recently.

Earlier in March the firm announced the expansion of an existing partnership with scanner vendor Hamamatsu, which allows the vendor to target siloed pathology adopters who want to streamline supply chains. This was preceded by a similar report early January concerning Datavant, which points towards the company’s interest in developing research partnerships. Proscia is not resting on the laurels of its recent success, instead adopting an approach targeting every breed of potential customer in clinical and pre-clinical sectors.

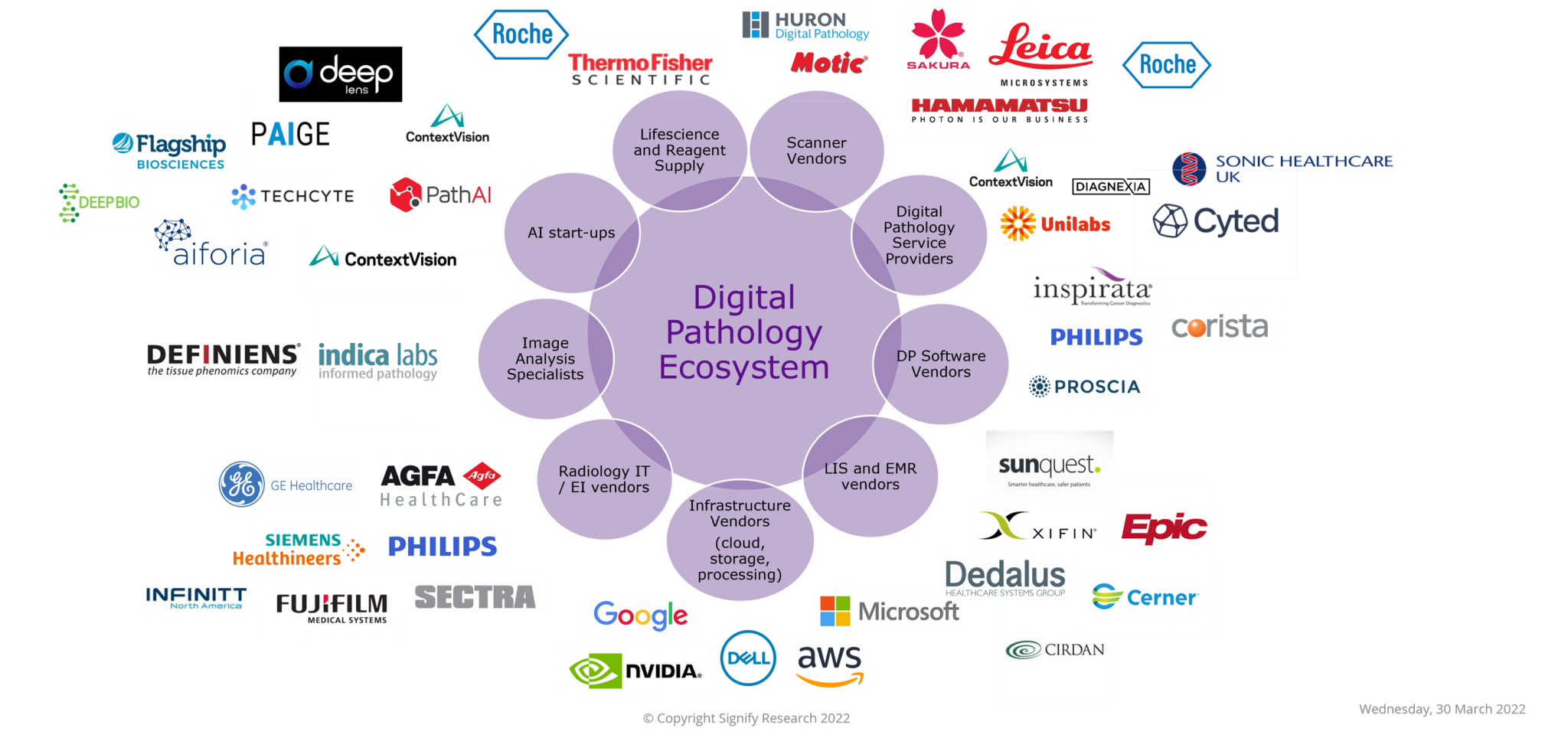

The digital pathology ecosystem, detailed below in Figure 1, is a certainly a complex environment with many types of potential partners influencing the market currently.

Figure 1: The Digital Pathology Competitive Ecosystem

Whilst existing partnerships have been established over the years, we at Signify Research expect many more to emerge in the next few months as vendors try to pin down the best strategy for their own businesses.

For example, vendors who previously exited digital pathology, like GE Healthcare, may be considering carefully how to re-enter, whilst Proscia competitors like Tribun Health may be wondering how best to begin scaling outside of domestic markets.

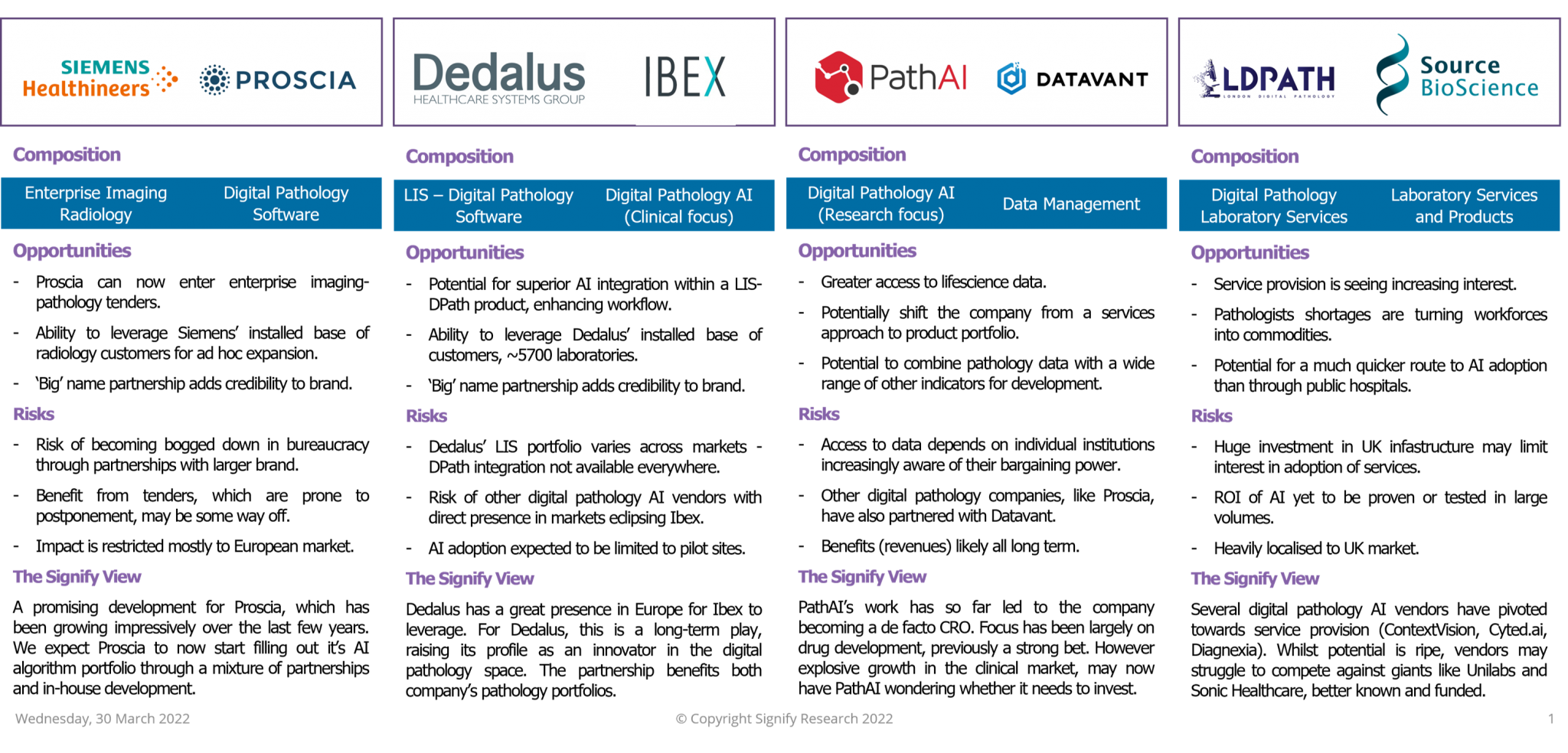

Below, we examine a few of the most recently announced partnerships in digital pathology and the implications they may have.

Figure 2: Recent Competitive Changes

There are certainly many opportunities for digital pathology vendors. With the market moving so quickly, stakeholders will be challenged to react quickly to the evolving market ecosystem and growing healthcare provider focus.

Whichever way you look at it, the Proscia-Siemens Healthineers news can only be taken as a good sign, for both vendors and the wider digital pathology and diagnostics market. The question now remains if the two vendors can take this positive start and execute on building a strong long-term partnership, perhaps re-shaping the digitalisation of pathology market as they do.

About the Report

Digital Pathology – World – 2021 provides a data-centric and global outlook on the current and projected uptake of digital pathology in both clinical and research settings. To find out more, please email the report author Imogen Fitt at Imogen.Fitt@signifyresearch.net.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net