Written by

11th July 2019 – The recent SIIM 2019 show in Denver offered a unique opportunity to assess the progress of enterprise imaging (EI) adoption. Below, we outline our key takeaways in summary from a busy schedule of seminars, vendor meetings and industry expert discussion:

1. Enterprise Imaging Is Hard

Across many discussions, sentiment suggested many healthcare providers had hit pause to take stock in terms of their EI strategy. In the USA, the “hangover” from massive investment in enterprise Electronic Health Records (EHR), frantic hospital consolidation and a changing legislative environment has limited enthusiasm for embarking on complex EI implementations.

Elsewhere in the world, some projects were going ahead, either in smaller clusters or large regional deals, but again, progress has been slow. Why? Providers now better understand the concept of EI and are increasingly clued-up that EI is not something that can be purchased “out of the box”.

In large health organisations, EI implementation is a massive, risky undertaking. The variety of data types and standards, legacy applications, clinical user groups, changing care models, security concerns and potential vendor partners is difficult to navigate for any organisation. Moreover, the decision-making process is itself more complex, increasingly spread across hospital executive leadership, such is the scale and impact of EI on the broader operations of the health provider.

Therefore, some providers have held off making any progress on EI, preferring instead to continue with rolling on and extending departmental radiology and cardiology IT contracts. Some of these have extended to “enterprise radiology”, with multiple sites working from the same radiology IT platform. Others have dipped a toe in the water outside of radiology, embracing VNAs. These broadly fall into two categories, those that use VNAs to connect different PACS systems in the same segment (e.g. to connect different legacy PACS after a hospital acquisition or merger) or to start ingesting non-DICOM content in certain clinical departments or to support specific care models (see #2 below). However, very few have really started on driving towards a full EI strategy that encompasses all clinical groups.

2. Some Ology’s Are More Ready For EI; Others Are Really Not

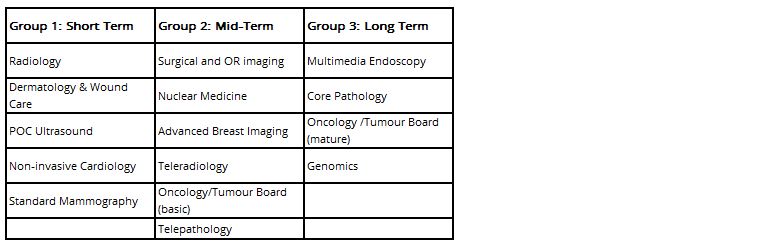

It is becoming clear where the “low hanging fruit” exists for vendors and providers alike in terms of which clinical departments and care areas to integrate into EI first. We can group these into three broad categories:

It was very evident at the SIIM exhibition that many imaging IT vendors have made progress in enabling “Group 1” data into their core EI platforms, either self-developed or through partnerships. What is less clear is whether this progression is being driven by providers identifying a need themselves, or vendors keen to highlight and demonstrate the value of their services and to capitalise on areas that are easier to support.

In terms of “Group 2” and “Group 3” data, progress for EI appears to be relatively slow. There are many reasons why, but the most common barriers to wider progression appear to be:

- Healthcare provider executive team pressure on clinical users to maximise use of clinical modules of EMR

- Provider wants to use dedicated best-of-breed functionality in a specific care area, or is tied into a broader contract including non-software equipment and services

- Multi-disciplinary care pathways or clinical governance surrounding multi-disciplinary access to imaging data is still in infancy at institution; no clear framework to support use in clinical practice

- No clear governance and leadership on EI implementation; dependent on decision by committee or across multiple departments

- Limited availability of EI platforms that can support native data from all care areas

It was however notable that there was more focused discussion at SIIM on two areas – pathology and oncology. From a pathology perspective it is evident that European health providers were increasingly including and weighting pathology more heavily than before in procurement documentation. This is unsurprising considering regulatory approval for Whole Slide Imaging (WSI) has been cleared in Europe for some time, but also points to its growing importance to providers. That said, few EI vendors have yet got to grips with the unique workflow, toolsets and standards associated with pathology. However, with the relatively new DICOM for Pathology standard slowly gathering momentum for more widespread use by major pathology hardware companies, we expect some movement from leading imaging IT companies in the near term.

In North America, the multi-disciplinary tumour board model in oncology has been one of the clearest case studies to champion an EI strategy, bringing together data from radiology, oncology and pathology. However, the method to implement has been less clear. We have split the tumour board approach into “basic” and “advanced” in our grouping above; “basic” adoption, in which the EI platform is used as a means to view imaging and content from multiple care areas, usually through a universal viewer; and “advanced”, which includes more dedicated features and tools to support multidisciplinary clinical review, such as decision support, and closer implementation and fetching of the patient record from the EMR. So far, we have only observed adoption of the more “basic” model, though in the last six months a few more specially targeted “advanced” products have been announced from EI vendors, suggesting there is growing momentum for more advanced solutions.

3. No Repeatable Blueprint for EI Has Been Established

Perhaps one of the most challenging aspects for providers assessing and planning for an EI strategy is the variety of different models. As no single vendor can offer functionality for EI across all care areas, there is no “out of the box” solution available. Moreover, leading healthcare providers in mature markets have all been approaching EI differently, so there has been no obvious blueprint to follow. Herman Oosterwijk, a well-known thought leader on imaging IT and health IT standards proposed three main groups for EI adoption so far, for which we broadly agree (http://blog.otechimg.com/).

We have observed most adoption in North America and Europe focused around the “top down” approach, using a VNA to support radiology and cardiology from an enterprise perspective first, before expanding its reach to other departments, usually with the VNA offered by the same vendor as the radiology IT solution. This “single vendor” approach has some benefits in limiting disruption for the main imaging departments but can fall short in terms of integration and workflow support in other clinical areas. The other main alternative, the “bottom up” approach, utilising a VNA to manage content outside of radiology and cardiology, is perhaps less common and generally has been restricted to academic providers who have generally been ahead of the curve in implementation of multi-disciplinary care pathways.

4. Widespread EI Adoption Will Take a Long Time

Perhaps the biggest question on the lips of most vendors at the show is how long it will take for EI to become adopted more widely. Considering one of the exhibit hall panel discussions at SIIM was titled “The Shift from Many PACS to One Enterprise PACS: Challenges” it appears the industry is also not quite ready to abandon traditional PACS and move to EI just yet. And behind this lies an unspoken consideration in EI adoption: many vendors are resistant to changing to EI too quickly too. “Traditional” PACS and imaging IT firms have large installed bases of PACS software, with long-term maintenance and professional service contracts making up a major proportion of their revenues. However, as a provider starts to assess EI strategies, the process of evaluation can often challenge the continuation of these contracts, especially if the vendor has limited ability to support EI extending outside of radiology and cardiology. Therefore, many vendors of imaging IT are treading a fine line, looking to protect their installed base while tentatively supporting the concept of EI to satisfy customers; no wonder then that the “top down” approach to EI, extending a platform from radiology and cardiology has been more commonly adopted thus far?

It is not all down to vendor protectionism though. As outlined earlier in this piece, EI adoption is a complex and nuanced challenge for healthcare providers. Moreover, in a healthcare climate focused on value-based care and multidisciplinary care pathways, there are few “quick wins”. Lack of early success for EI often leads to the early stifling of many projects, with few provider executive leadership teams willing to wait for the long-term ROI that EI can offer. Therefore, the positioning of EI has potentially been wrong from the start; it should have been framed as a 10 year plus roadmap for consolidation of imaging and associated diagnostic and clinical content, as opposed to a “product” that can be simply implemented in one hit. Considering that many imaging IT or broader imaging managed service deals are spanning to 10 years or more, the adoption cycle for EI is set to be long and slow. If there was one big take-away from SIIM this year, it’s that we’re only just getting started when it comes to EI.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

More Information

To find out more

E: enquiries@signifyresearch.net

T: +44 (0) 1234 436 150

www.signifyresearch.net