Written by

- Agfa-Gevaert Board of Directors requests a study on the reorganisation of its healthcare business unit, with the healthcare IT business as a standalone legal entity

- Announcement comes 8 months after failed approach from CompuGroup Medical to acquire Agfa-Gevaert

- First half results for Agfa Healthcare show a dip in revenues and EBITDA, caused by a slow-down in sales of traditional film hardcopy, in addition to a temporary slow-down in Imaging IT

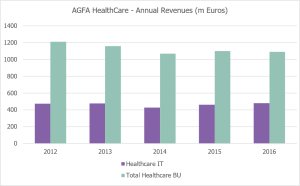

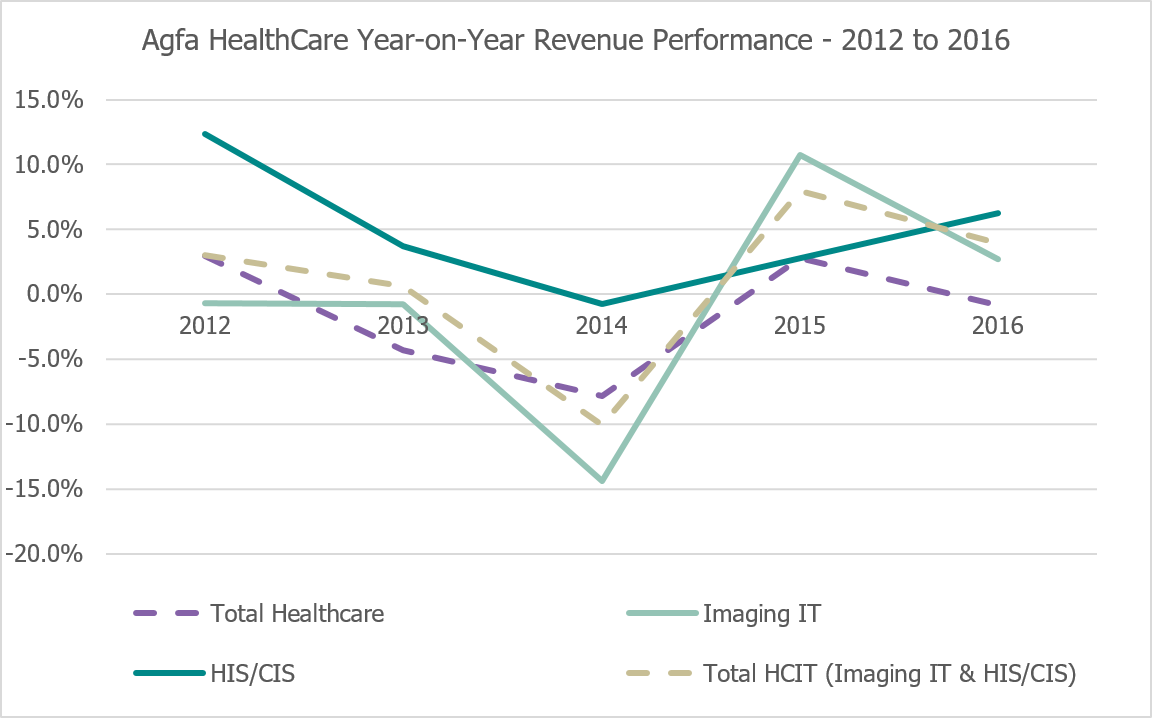

- This new announcement comes in the wake of relatively weak healthcare business performance, with revenues for the total healthcare group down 10% since 2012

The Signify View

No Hiding From The Top Line

The announcement that Agfa will investigate options to separate its healthcare IT business from the rest of the healthcare unit is not surprising. It’s two core sectors, Imaging IT and Healthcare IT Solutions (mostly Electronic Medical Records (EMR) and Hospital Information Systems (HIS)) have been steadily growing in importance for Agfa, against a backdrop of steadily declining film and printer sales. Digital Radiography (DR), in which Agfa remains one of the leading vendors, continues to be a major revenue stream. That said, the business is under greater pressure in recent years due to stiff competition from low-cost system and flat panel detector panel manufacturers forcing prices to plummet.

The result? A slow erosion of healthcare business revenues, declining 10% over the last 5 years. Over this time, healthcare IT revenues have remained resilient and today they account for a greater proportion of the healthcare unit (44% for 2016 versus 39% in 2012). Moreover, the last three years has seen a steady increase in demand for Agfa health IT products, in part due to a successful launch of enterprise imaging platform (Agfa Enterprise Imaging), growth in the EMR and hospital IT segment (ORBIS, Hexagon HIS, Hexalis LIS, HYDMedia ECM) and the establishment of a new product line (Integrated Care Suite).

Consequently, the Agfa-Gevaert board are looking to capitalise on Agfa’s strength in diagnostic and clinical IT software by unshackling it from the rest of the group. By doing so, they hope the newly formed Agfa HealthCare IT entity can bring new growth impetus to an otherwise stalling corporation. But it won’t be easy.

Stuck Between A Rock And A Hard Place

A traditional stalwart of the X-ray industry, AGFA has transitioned its portfolio into the digital era with reasonable success. It has used its X-ray equipment business as a stepping stone to build a sizeable IT software unit, reaching third position globally in terms of radiology IT software revenue. It has also established its EMR/HIS business, with solid foundational customers on its doorstep in Western Europe.

While it has been undergoing this transition, a lot has changed in the market. Digitalisation has rapidly spread across healthcare, shifting decision making at providers away from Agfa’s base of strength in radiology. The lucrative US market has also been forced by legislation into massive provider consolidation, creating a market with fewer, larger customers. As provider scale has grown, so too has focus on procurement value. Demand for vendors to fulfil tenders including multi-modality imaging and multi-application software IT platforms has also proliferated, not to mention new means of delivering these solutions (managed services, risk-sharing contracting).

For Agfa, this poses a problem. As a single-modality specialist, lacking a portfolio of MRI, CT, interventional X-ray and ultrasound automatically limits its ability to compete with vendors such as GE Healthcare, Philips Healthcare, Siemens Healthineers and Toshiba Medical in these deals. Moreover, its core imaging IT business has also been required to expand its’ capability, from departmental radiology to imaging across multiple departments (cardiology, nuclear medicine, dermatology, etc.). At the same time as this expansion, it has had to compete with a growing cohort of competitors, with vendors in the enterprise EMR, Vendor Neutral Archives (VNA), Enterprise Content Management (ECM) and analytics sectors all vying for the same deals.

Worse still, diagnostic imaging and clinical analytics is fast becoming and arms race, with the biggest vendors investing hundreds of millions to establish viable artificial intelligence platforms for diagnosis as well as establishing agnostic clinical enterprise IT platforms (ACE platforms). This is only going to intensify in the coming years as clinical IT usage in healthcare spreads across global markets.

The Agfa healthcare business is therefore fighting on multiple fronts, without the financial firepower or breadth of product portfolio to compete on a level playing field with the biggest healthtech vendors.

Not Alone, But Well Overdue

Agfa is not alone in its current predicament. Other mid-tier healthtech vendors are in the same boat. A number have made proactive moves to either expand their portfolio or re-organise to meet the demands of the new market era:

- Canon: previously an X-ray specialist, acquired Toshiba Medical Systems business, adding a full modality hardware portfolio and advanced visualisation capability (Vital Images)

- Fujifilm Medical: the market leader in general radiography X-ray and radiology IT has expanded its portfolio with the acquisition of ultrasound (Sonosite) and VNA (TeraMedica)

- Carestream Health: launched self-developed ultrasound portfolio to complement general radiography X-ray, dental X-ray and imaging IT product lines.

- Siemens Healthineers: while it already has a full imaging and imaging IT portfolio, it is slowly extracting itself from Siemens Corporate for a much-anticipated IPO, expected in 1H 2018

Given Agfa’s current position and market environment, the decision to separate the healthcare IT business therefore has some merit.

- It will allow the Agfa health IT business greater freedom to partner with other vendors. This will have significant impact both in terms of its ability to partner on specific deals (e.g. less conflict of interest with Digital Radiography business), but also added functionality for its diagnostic and clinical IT products (artificial intelligence, analytics, operational IT software)

- It allows greater focus on the strategic direction for healthcare IT. Expressly, whether to push to build its own platform that can act as a central “ecosystem” for providers clinical IT needs, or focus on becoming a “best of breed” specialist in diagnostic imaging IT.

- It opens the possibility for a future sale. As a separate entity, the potential for a lucrative sale will no doubt also be in the minds of the management and shareholders. With a large installed base of imaging IT customers globally, a solid foothold in Western European EMR and lengthy experience in the complex world of diagnostic imaging, the timing for a sale could be ripe before Agfa’s market share is eroded by stiffening competition.

While the separation is by no means a done deal, we believe the above factors will be enough to sway the decision to separate the healthcare IT business. If anything, given the lack of revenue growth from the healthcare IT business over the last five years (and AGFA Healthcare), this decision is already too late.