Written by

Following an initial period of uncertainty, Vendor Neutral Archives (VNA) are now better understood by health providers, and more available. Moreover, their introduction and adoption signalled a market transition, expanding the focus of providers and vendors to the management and use of clinical content thus far excluded by electronic medical records.

However, after an initial uptake flurry, market momentum and provider focus has slowed. Based on the findings from our recent coverage of the global market for imaging IT and archiving management, we dig into the outlook for VNA and the biggest factors driving this market.

The Rise of Enterprise Imaging

Enterprise imaging products, which bundle together traditional PACS functions with enhanced clinical content management capability, are rapidly gaining momentum. Many of the major incumbent PACS vendors now offer enterprise imaging capability, usually through the addition of a VNA, universal viewer and specific enterprise features, such as federated case load management, operational analytics and business intelligence. This approach has appealed to the core customer base of traditional single-vendor PACS users, especially in mid and large-size hospitals and large provider networks, as a single platform can in theory handle their imaging IT needs while bringing in wider clinical content (e.g. non-DICOM data such as visible light images and .wav electrophysiology recordings) that until now was handled in separate, siloed applications.

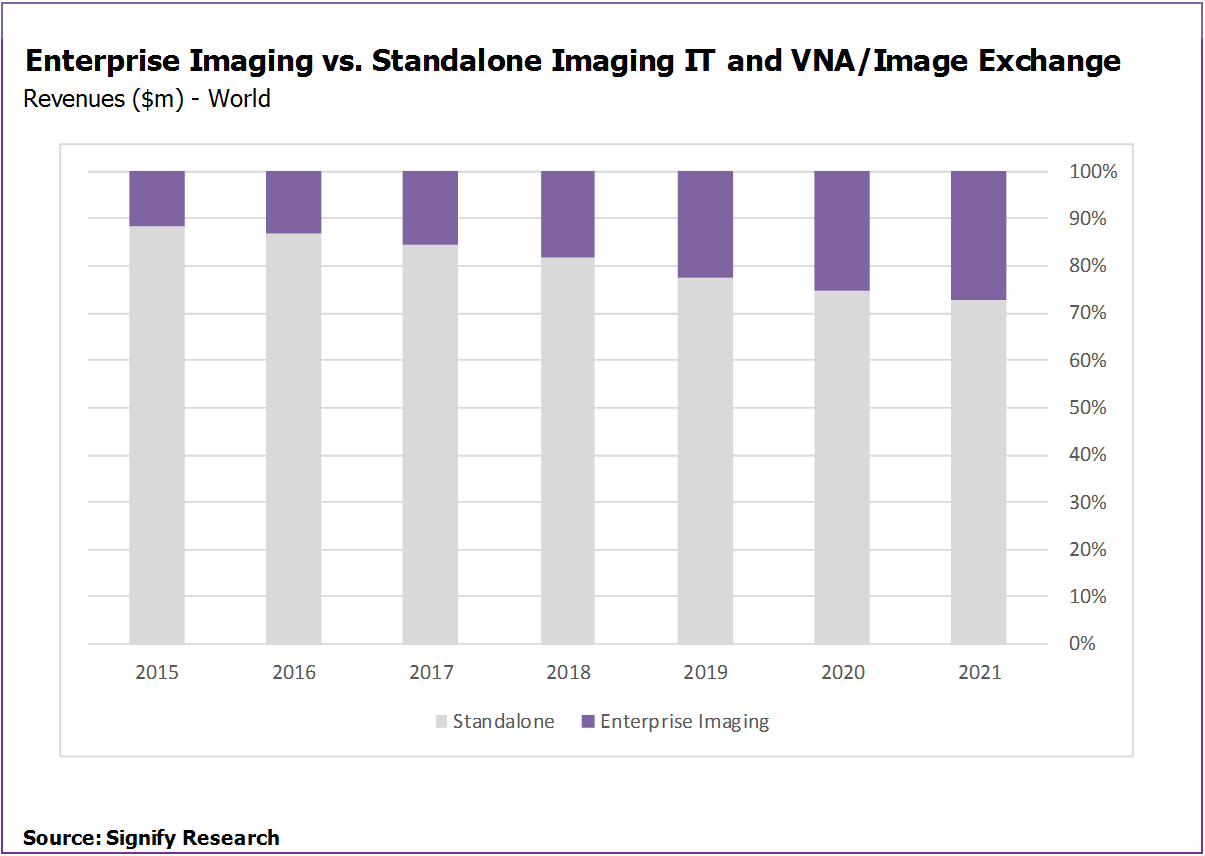

As the figure above shows, enterprise imaging is forecast to cannibalise global market revenue from standalone imaging IT and standalone VNA. While the nuances of adoption in each provider segment and geography are complex, three themes underlie this trend:

A large proportion of demand from mature markets for enterprise imaging is driven by upgrades of existing PACS and RIS systems, especially for the largest PACS incumbents.

Many providers favour a single vendor approach for the core imaging IT platform, especially due to concerns around interoperability and length of implementation of multi-vendor solutions.

The largest enterprise imaging vendors have influence in the wider clinical setting (e.g. modality hardware and clinical care products) and position themselves as a long-term clinical IT partner. This is also opening the opportunity for more innovative contracting (operationalised budgets or risk-sharing contracting).

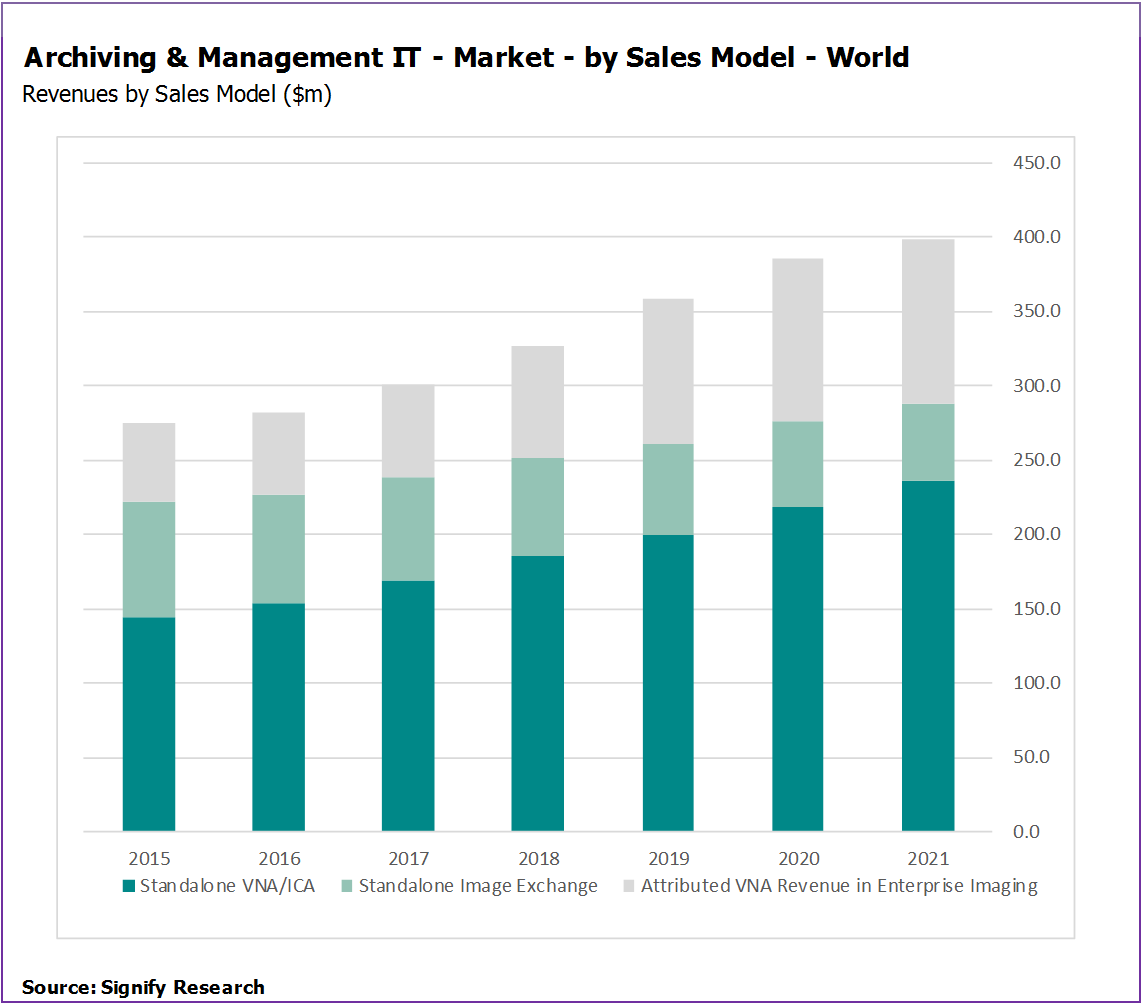

With almost all leading enterprise imaging products on the market today, VNA plays a significant role as the underlying enabler for storage and management of imaging and broader clinical content.

While it is very difficult to accurately capture the proportion of revenues from enterprise imaging deals attributed to the VNA (most deals are sold as a single platform), our analysis from extensive vendor discussions shows that enterprise imaging will be a significant contributor to future growth of VNA revenues.

Consolidation

A further notable market impact is the dwindling availability of “independent” VNA products on the market. Following a flurry of M&A activity in the last five years, the competitive structure of the VNA market has consolidated significantly.

Leading vendors such as Acuo (now part of the Hyland portfolio), TeraMedica (now Fujifilm), Karos Health (now Vital Images) and Viztek (now Konica Minolta) have all been integrated into much larger organisations, leading to greater opportunity to package their VNA capability into enterprise imaging platforms. This has had two major consequences in the last few years, notably a slowing of product innovation (due to having to integrate into a wider portfolio), and a shift in focus towards servicing and protecting the existing customer base of the acquirer, rather than winning new business.

The remaining independents, NTT Data (formerly Dell Services), Mach7 Technologies and Bridgehead Software, have also had to evolve to compete, expanding their focus from pure VNA. Some now boast portfolios including universal viewers, workflow tools and image exchange products, in a bid to cater for both the enterprise imaging demand and “deconstructed PACS” customer base.

Such market fluidity and blurring of vendor focus and product portfolios has certainly had an impact on the market. Providers have more choice, leading to longer assessment of vendor capability. Combined with expansion of clinical content handling and the required inter-departmental co-ordination, provider decision making is slowing, compared to single solution sign-off. VNA specialist focus has been expanded from just archiving and management, a challenge for small to mid-size specialists with limited R&D resources.

…at a cost?

Looking forward, consolidation is expected to continue, leading to a smaller pool of clinical content IT platforms for providers to choose from, mostly based on the enterprise imaging model. However, from a VNA perspective, this has a downside. Few of the integrated VNA solutions offered as part of these platforms lead the way from a technological standpoint.

Rigorous standards adoption (e.g. XDS) or more advanced technological capability (e.g. dynamic tag morphing, intelligent information lifecycle management, performance analytics, load balancing, etc.) is scarce in most solutions offered today, and some remain bugged by interoperability issues, a by-product of their being pieced together from disparate, legacy modules. Therefore, while enterprise imaging adoption looks set to dominate the VNA market over the next five years, much of the promise of VNA in improving cross-enterprise clinical content capture, access, management and storage will fail to be realised.