Written by

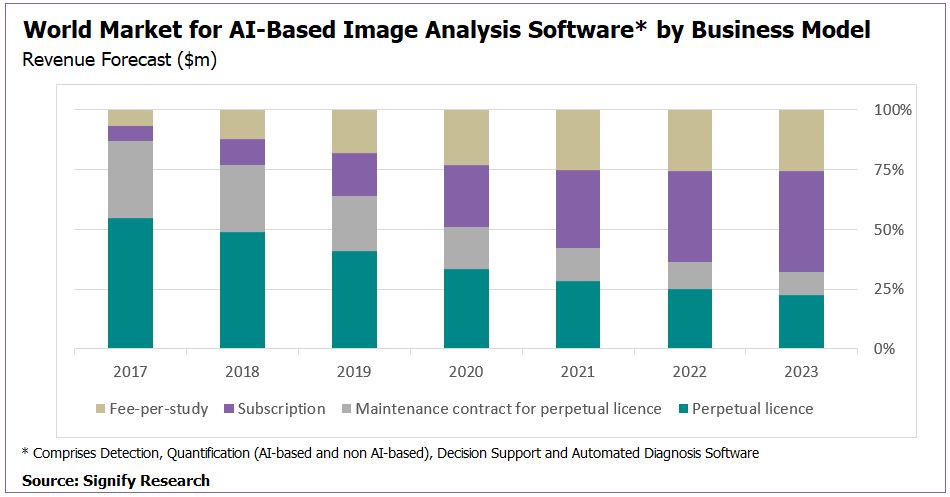

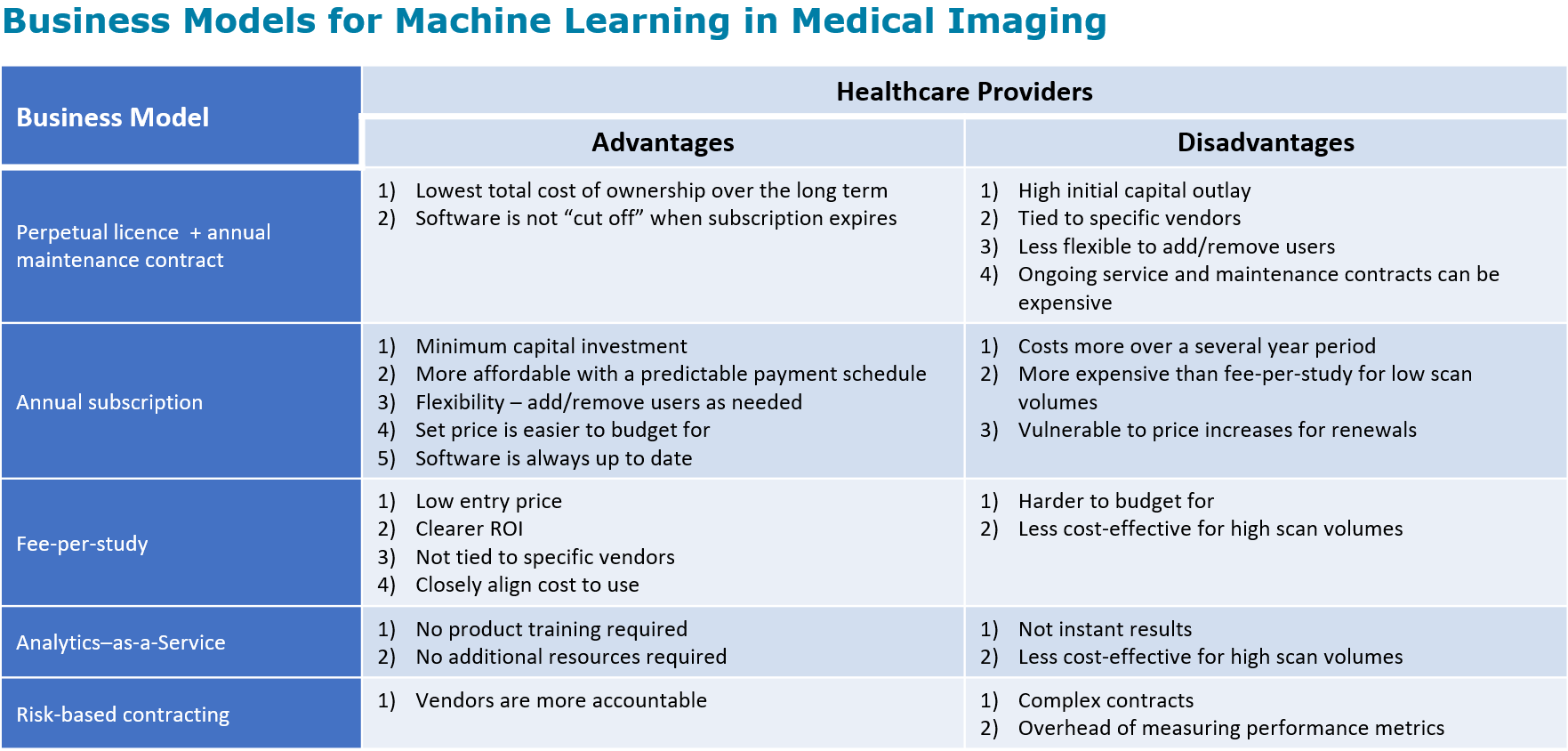

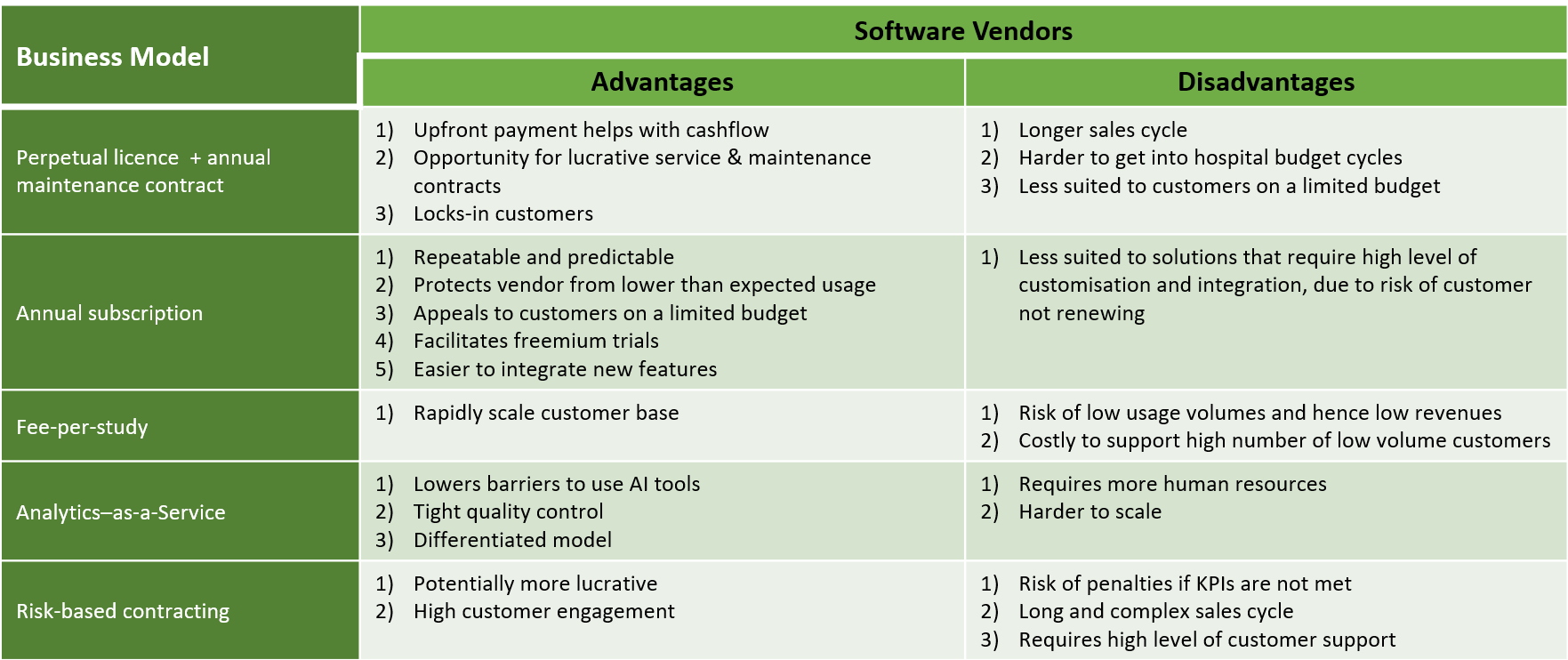

Until fairly recently, most medical image analysis software was workstation-based and sold with a perpetual (one-time) software licence. However, with the introduction of cloud-based AI solutions, subscription and fee-per-study models are becoming more prevalent and are forecast to account for an increasing share of the market in the coming years – see chart below. Subscription models are typically preferred by vendors as they create sustainable, recurring revenue streams.

Whilst the general trend is towards software-as-a-service (SaaS) licencing models, this does not necessarily mean the end of the perpetual licence, and for some customers this is still the best option. SaaS models replace the upfront capital outlay of buying software licences with ongoing subscription or adhoc fee-per-study payments. This can be appealing to smaller customers with lower scan volumes. However, subscriptions typically cost more over a several year period and for that reason many medium and larger sized customers still prefer to purchase software outright. To maximise their market reach, vendors should consider offering both perpetual licence and SaaS options, ideally with a strategy to convert perpetual licence customers to a SaaS model over time, to take advantage of the more sticky and predictable business.

Subscription Pricing Strategies

Vendors who adopt a subscription model then need to set a pricing strategy. The price of Imaging IT systems, such as PACS, is often based on the number of users allowed to access the system at any one time, i.e. concurrent users. As many customers are already familiar with this pricing strategy, it lends itself well to AI-based image analysis software, particularly for established vendors who are looking to upsell AI tools to their existing customers. Pricing can also be based on scan volumes, a strategy that works well for smaller customers and for customers who want to start small and scale-up if the software proves to be of value. Many customers prefer a volume-based pricing model with fixed prices for pre-agreed scan quotas, as this is easier to budget for. Volume-based pricing can work well for nascent markets, such as AI tools for medical image analysis, as it’s more affordable and lowers the risk of investing in new technology. However, with the general trend in medical imaging towards longer contracts, it can be challenging for providers to predict longer term scan volumes at the start of a multi-year contract.

An alternative is an unrestricted usage subscription, will all potential users of the software given unlimited access. This can be a useful strategy for start-ups and new market players, as it maximises the vendor’s exposure and engagement with customers, and hence the perceived value of the software. Assuming the software is widely and routinely used, this strategy helps to support customer retention and renewals.

From Freemium to Premium

Subscription-based licencing also lends itself to the freemium licencing model, where customers can access a free version of an application for a limited period, or a version with restricted functionality, for evaluation purposes. Whilst a useful strategy, particularly for new market players, it comes with its challenges and needs careful management. Non-paying customers on a freemium trial may still require technical support, diverting resources that are perhaps better focused on paying customers. Moreover, the conversion rate from freemium trials to paying customers can be low. As such, the freemium model tends to work best for plug-and-play software and is less suited to more complex solutions, particularly those that require integration with other systems.

Pay as You Go

The fee-per-study (FPS) model, where customers are charged based on their usage of the software, is well established in medical imaging, particularly for neurology image analysis where several vendors offer this, with pricing typically in the region of $200 per scan. The FPS model gives customers maximum flexibility, the lowest entry costs and de-risks investing in new technologies. It is also well suited for solutions targeted at less developed countries, due to the lower costs involved. For vendors, the benefits for the FPS model are much the same as with volume-based subscriptions, in that the lower cost (compared with perpetual licences) can help to build brand awareness and seed the market. Often vendors will offer both FPS and subscription options, with customers starting out on the FPS model and switching to a subscription as usage increases.

As the market for AI-based image analysis software ramps-up and more solutions come to market, we expect fee-per-study pricing will fall. Zebra Medical Vision has taken an early lead in this respect with its AI1 (“All in One”) business model, whereby it charges a flat fee of $1 per scan for access to its algorithms. Whilst this strategy is somewhat unproved in medical imaging, the low price point is expected to be attractive to customers, particularly those with lower scan volumes, and it is likely that other vendors will adopt similar pricing strategies. Vendors considering this strategy need to be mindful that it will likely require significant capital investment in the early years, as a high number of low volume customers can be expensive to support, not to mention the increased administrative and billing overhead.

Who Dares Wins

In the broader healthcare IT market, there is growing interest in risk-based contracting, whereby software vendors receive a share of the cost savings from using their software, or by meeting pre-agreed performance metrics. If the vendor’s technology or software solution fails to meet the agreed targets, financial penalties are incurred. For vendors, the attraction of risk-based contracting is the potential for more sizeable and lucrative contracts when compared with the business models described above. For example, a successful risk-based contract with a single payer public health system could result in multi-million dollar returns for the vendor. They can also foster closer customer relationships and lock-in customer long term.

On paper, this model is well suited to AI tools for medical image analysis, as the main value proposition of these products is typically improved radiologist productivity. Additionally, key performance indices (KPIs) can be developed around a variety of operational and clinical metrics, such as increased modality utilisation rates, reduced diagnostic error rates and improved clinical outcomes. However, most health providers do not have robust systems in place for measuring KPIs, let alone return on investment (ROI). Without accurate and robust data, it may prove challenging for providers to hold their vendors to account when KPIs are missed, or for vendors to prove the real value of their solutions.

One Size Does Not Fit All

At this early stage of the market development for AI-based medical image analysis tools, most customers will be reluctant to commit to complex risk-based contracting and the more traditional business models outlined in the previous sections are better suited. However, as confidence in the technology grows, and more clinical validation on the benefits of these solutions becomes available, the case for risk-based contracting will become more compelling. In the short-term, vendors are encouraged to offer a variety of licencing options, including perpetual licencing, fee-per-study and annual subscriptions, in order to appeal to the wide array of customer needs.

Related Market Report

“Machine Learning in Medical Imaging – 2018 Edition” provides a data-centric and global outlook on the current and projected uptake of machine learning in medical imaging. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

More Information

To find out more:

E: simon.harris@signifyresearch.net

T: +44 (0) 1234 436 150

www.signifyresearch.net