Written by

11th January 2022 – Written by Kelly Patrick – COVID-19 had an unprecedented impact on the ventilator market in 2020. Significant shortfall in ventilator supply resulted in panic buying globally to source provisions to help with the rising numbers of patients requiring respiratory support. The emergence of new vendors was witnessed with significant deals secured by manufacturers that had never been seen before. Existing vendors that were able to uplift production were also winners in gaining share of the market. In its Ventilators Report – 2021, Signify Research recently assessed the global ventilator market and the impact the pandemic had on the competitive environment within the various ventilator product segments.

How did existing players fair?

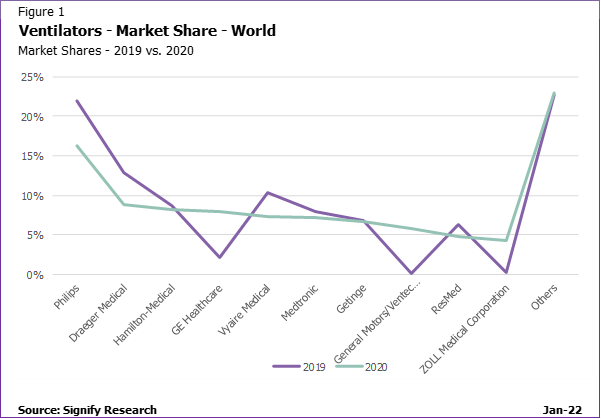

On a global level, the players that were in the top 3 of the overall ventilator market in 2019 all lost share in 2020. Each of these players was impacted by late changes in order agreements that were initiated at the beginning of the pandemic.

Philips

Philips was the leading ventilator supplier in 2019, having significant share in the home care market, the largest ventilator product segment in 2019; it also held significant share of the mid-range critical care and sub-acute segments. However, with increased demand for ICU and emergency ventilators during the pandemic, Philips’ share of the overall market dropped. Philips was also impacted by partially cancelled orders by the US Department of Health & Human Services (HHS) and the German Government, for which it had already committed to supply. Although the home care segment still grew, the demand for other ventilator types was much higher during the pandemic, resulting in a change in product revenue mix and an uplift in share for vendors active in other segments. Recent product recalls of Philips’ DreamStation and specific Trilogy solutions is expected to temporarily affect Philips’ supply to the market in 2021. As such, it is expected that there will be a short-term impact in markets where Philips is strongest while other vendors attempt to capitalise and meet the shortage in supply.

Draeger Medical

Draeger Medical’s focus is on the adult and neonatal critical care segments and the transport & emergency market. These segments were impacted the most during the pandemic due to the increasing presence from new vendors, in addition to country-specific purchase mandates affecting the supplier mix in various countries. Draeger Medical was also committed to supply the German Government, which was subsequently reduced part way through the contract, impacting its opportunity to sell elsewhere. Draeger Medical subsequently lost market share in 2020.

Vyaire Medical

Vyaire Medical was formed in 2016 after Apax Partners acquired Becton Dickinson’s (BD) respiratory solutions business. Since its inception, Vyaire Medical has struggled to gain the market share it previously had as part of BD and it has lost share to other vendors. Vyaire Medical was a leading supplier to the emergency and transport ventilator market in the US in 2019, but during the pandemic the company was subject to a reduction in the demand of ventilators from the HHS, subsequently affecting its overall share of the US market. The BellaVista solution is gaining traction in many markets, helping Vyaire Medical to regain its presence in the market. It also appointed Gaurav Agarwal as its CEO in 2020 who previously led the respiratory and sleep group at GE Healthcare. Vyaire hopes that Gaurav will drive innovation further.

Hamilton Medical, Getinge and Medtronic all managed to maintain similar shares in 2020 to what they achieved in 2019. These vendors are leading players in the critical care ventilator market and were able to maintain share in this segment. Like Draeger Medical, Hamilton Medical lost share in the transport and emergency segment, which subsequently pulled down its overall share in 2020.

New contenders on the block

GE Healthcare

Although not technically a new player in the ventilator market, GE Healthcare has seen sizeable upswings in market share in recent years. It has managed to gain share in the critical care and neonatal care ventilator markets, and more recently gained share of the emergency ventilator market in 2020 due to the sizeable orders it fulfilled during the pandemic. GE Healthcare was able to work with the Ford Motor Group during the pandemic to help uplift production and fulfil the large orders placed. Although its share is expected to drop in 2021, especially in the transport and emergency segment, GE Healthcare is expected to remain a key contender in the critical care and neonatal ventilator markets.

Zoll Medical

Zoll Medical also saw an upswing in its overall share of the ventilator market in 2020 due to the orders placed in the US for stock piling during the pandemic. Historically a smaller player in the transport and emergency ventilator market, the company climbed the ranks to second place globally in 2020. Its focus is likely to remain in the transport and emergency ventilator market and as such Zoll Medical is subsequently expected to lose share of the overall ventilator market in 2021.

General Motors/Ventec Life

General Motors formed a temporary partnership with Ventec Life, who prior to the pandemic was a smaller player in the ventilator market. General Motors helped to increase production of Ventec Life’s VOCSN critical care ventilator to 30,000 units in 2020 to supply the HHS under the Defense Production Act. The partnership resulted in them gaining a leading position in the global transport and emergency ventilator market in 2020. It is expected that their share will fall in 2021 as other dominant suppliers regain share of the transport ventilator segment.

Other players were able to gain share of their local markets through country mandates to supply ventilators to the emergency segment. Consequently, Penlon Medical, Skanray and Mindray all increased their share of the ventilator market in 2020.

The transport and emergency ventilator market is expected to see most decline in 2021 due to significant oversupply to the market during the peak of the pandemic. As such, the market is expected to be increasingly competitive in the coming years.

What does the future hold?

The ventilator market saw a huge uplift in demand in 2020. It is uncertain how the market may recover from the pandemic and whether budgets will be available for additional ventilator purchases. Due to restricted supply in many regions, many ventilators were purchased that were not adequate. Vendors may have the opportunity to replace this new installed base of inferior products quicker than the typical replacement cycle if provider budgets allow. The surplus of inadequate ventilators purchased during the pandemic may be shifted to lower-acuity settings, subsequently reducing demand for sub-acute or home care ventilators in the mid-term.

The supplier mix to the transport and emergency segment is expected to return to that seen in 2019, with smaller suppliers expected to be pushed out by the more dominant vendors with comprehensive product portfolios. However, interest in the critical care ventilator market is expected to attract vendors who have smaller share and can offer a wider solution offering to those purchasers looking for more innovative technological features.

Closing remarks

Although access to ventilators was one of the major issues in treating COVID-19 patients, the pandemic also highlighted the shortage in clinicians able to help ensure ventilated patients were safe and patient care was optimized. Significant investment is being made in many countries to employ and train more healthcare professionals to flex-up coverage of the ICU when required. Ventilator solutions with simple workflows and easy to use interfaces will be increasingly important. Further integration with connected devices and information systems will enable the greater use of analytical solutions to help healthcare professionals to make the most clinically effective and cost-efficient changes to care provision. In the meantime, products that have integrated analytical solutions to improve the clinical workflow and offer more support in easy-to-use dashboards, interfaces and tools will be in most demand. This will inject some life into the ventilator market and provide a silver lining for ventilator manufacturers that will otherwise see significantly lower revenues compared to 2020.

About the Report

The recently published report Ventilators Report – 2021 provides a data-centric and global outlook of the market. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net

More Information

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 436 150