Written by

Earlier this month, Philips Healthcare announced it had signed an agreement to purchase the IT business (HCIS) of Carestream Healthcare for an undisclosed amount. The deal, expected to close in the second half of the year, is one of the largest M&A moves in the imaging informatics market for some time. While it was one if the worst kept secrets in the industry that the owners of Carestream were looking for a buyer, the decision to split off the HCIS business of Carestream was more of a surprise. Below, we dig into the ramifications of the deal, speculate on how the deal will change Philips strategy in imaging informatics and assess what impact it will have on the market.

Eyes on the prize

The HCIS business, while not the largest business unit, has been viewed as an asset by industry peers. As one of the earlier PACS vendors to embrace the concept of enterprise imaging, it has built a strong reputation with customers worldwide as a solid and dependable imaging IT platform. Its approach in promoting modularity of its solutions from a strong foundational basis of enterprise archiving and storage solutions has been well received. The firm was also one of the earliest of the larger market competitors to offer cloud-based solutions for imaging informatics, as well as developing a strong enterprise viewer product.

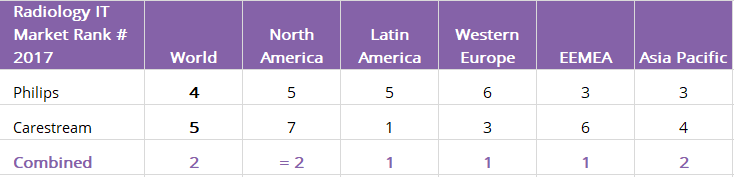

Combined with an often-aggressive price strategy, Carestream HCIS won a substantial customer base globally, especially in the small and mid-sized provider segment. From a regional perspective, its customer base is also truly global, ranking in the top 10 radiology IT vendors in every sub-regional market, with most of its business in Western Europe, North America, Latin America and the emerging Asia Pacific region. Our market share estimates placed the firm fifth globally for radiology IT (2017), with Philips fourth, one place above. Combined, based on the separate revenues of each business, the new entity will be firmly established in second position, closely challenging market leader Fujifilm Medical Systems, pushing GE Healthcare down to third.

A Good Fit?

As with any acquisition, there is substantial risk to customer base and revenue when attempting to integrate and this deal is no different. The three main challenges facing Philips Healthcare in its integration are customer cannibalisation, portfolio integration and whether to redefine core strategy for health informatics.

Customer cannibalisation, while at first glance could be viewed as a major issue, may in fact be the lesser of these three challenges. While there will be some instances in the short-term of Philips and Carestream products going “head-to-head” in current procurement deals, on closer inspection there is limited cross over between the two firms’ customer base; in fact, they are almost complementary. In North America, Philips has long pursued a strategy targeting larger hospital groups, integrated delivery networks (IDNs) and academic hospitals, resulting in a top 5 market share. In contrast, Carestream has predominantly focused on small regional community hospitals and mid-size providers, failing to gain any real market share traction in the larger customer segments, resulting in being ranked 7th. Thus, there is limited cross over in customer base today. Perhaps the biggest challenge lies ahead, when large IDNs or academics using the Philips Intellisite platform expand and acquire smaller providers that use Carestream Vue products. Will Carestream customers be forced to adopt the less flexible Philips platform, or will the combined entity find a means to integrate closely enough to reduce the need for rip and replace?

In Western Europe, a diverse market in which each country market has unique context and competitive make-up, the likelihood of customer cannibalisation is more limited, given the existing customer base of each firm. Carestream has a strong presence in Western Europe for radiology IT, with a business that is a third larger than that of Philips. However, its biggest market presence is in Northern Europe (UK and Nordics) and Southern Europe (Italy and Spain). In contrast, Philips’ customer base is more focused on western and central European markets, such as Benelux, France and DACH.

In emerging markets, the complementary nature of the two businesses is also evident. In Latin America, Carestream is market leader for radiology IT, with its product deemed to better suit the needs of the domestic market in Brazil and Mexico. It also has a strong presence in the emerging South East Asia market, while Philips has been targeting more mature markets in Japan, China and the Middle East. The limited cross-over between customer base thus makes the timeline for integration less pressing in many markets, with the acquisition unlikely to upset most customers in the short-term.

Short Term Transfer of Capabilities

Portfolio integration will also be no mean feat – both vendors have essentially the same core products for radiology IT. Philips has several options here, from killing off the Carestream Vue product line and pushing customers towards its own Intellisite portfolio, to running a dual product strategy based on customer needs. It is our expectation that Philips will approach this process cautiously, with a differing strategy based on regional and market context. In the short-term, we expect that a dual product strategy would be the best move, with the Intellisite portfolio remaining focused on top-tier academics, large regional networks and IDNs, while the Vue platform focused on its existing customer segments in mid-tier providers and smaller, along with emerging markets.

Given that many imaging IT contracts today are five years and lengthening, it would also be prudent for Philips to offer customers a timeline for integration and expected changes to the portfolio in the short term, ensuring that the update pipeline for the Carestream Vue platform is maintained at least for the next two years. This more gradual approach will also provide time for Philips to decide on the level of integration between the two platforms. At a minimum, integration of the best parts of each product portfolio will be most important; Philips Intellisite taking on more of the archiving and data management capability of the Carestream Vue product would be one such short-term move popular with Philips customers, while integrating the Philips radiology worklist into the Vue product line would also be a benefit to Carestream’s existing customers. Given the market is also increasingly focused on operational and workflow tools, roll-out of the Philips-agnostic PerformanceBridge toolset to Carestream Vue customers would also be a smart move in the short-term, offering new “value-add” without needing to significantly change the base Vue platform. Implementing these changes in the first two years of the new entity would go a long way to allaying the rip and replace fears of current Carestream customers, while also ensuring current Philips customers reap the benefits of the acquisition.

For Long Term Retention and Upsell

Longer-term, more questions remain as to how the Carestream HCIS business will fit with Philips’ overall healthcare strategy. Philips has been one of the earliest to adopt a strategy that targets the complete provision of clinical and diagnostic hardware, software and services in large, long-term managed service deals. This was highlighted by the recent announcement that the Philips imaging IT business line was to move into the modality hardware business unit. Moreover, it has set aggressive targets for transition of a large proportion of its business to operational subscription models.

Thus, when viewing the Carestream acquisition, we should also consider the wider context of the deal. From our perspective, the Carestream acquisition offers new opportunities for the broader Philips healthcare business, as well as points to a slight change in direction in terms of strategy. The key points are summarised below:

- The Carestream customer base will almost double Philips’ footprint in imaging informatics; given that the market is consolidating and stagnating with longer replacement cycles and few changes of vendor, inorganic growth in customer base is the only way to significantly increase market share quickly. It will also open the door in some markets to cross-sell the strong Philips Cardiology IT portfolio.

- Carestream’s experience in enterprise imaging (multiple departments), data management and cloud offerings should drive less proprietary and flexible future Philips informatics offerings. This is particularly important in large-scale enterprise deals that Philips is targeting.

- Transition of Carestream’s customer base towards managed service or operational expenditure deals will support Philips’ transition to more predictable revenue.

- The deal also provides several new customers for Philips to upsell consultancy and services around operational and workflow for imaging, a clear strategy founded on the establishment of the PerformanceBridge

- Addition of the Carestream customer base opens a “foot in the door” for the Philips Tasy EHR and other clinical informatics business, especially in Western Europe, Latin America and emerging Asia Pacific markets.

- The Carestream customer base opens the potential to sell into small and mid-size provider markets, something Philips has typically avoided in some markets; this may also provide a new opportunity for Philips modality imaging business, most notably ultrasound, general radiography and value-tier CT.

Underlying many of these trends is the ongoing focus from healthcare providers to establish improved efficiency and care quality, as well as reducing the number of vendors and products in the supply chain. As one of the earlier vendors to fully embrace this trend, Philips has for some time been marketing its capabilities as central contractor and partner for healthcare providers. In combining its breadth of diagnostic imaging, clinical care and enterprise informatics into managed service deals with substantial consulting and professional services support, it is looking to “lock-in” customers to long-term, predictable contracts. This has many benefits, particularly in ensuring ongoing demand for its large imaging modality business units that remain a significant revenue driver.

Philips has also been one of the first vendors in the market to actively promote itself as a single-vendor partner offering a consolidated central clinical IT platform for all diagnostic and clinical information. While it has yet to manage to incorporate its broader product portfolio into a seamless offering, the Carestream HCIS acquisition is unlikely to do any harm to this strategy. Instead, the Carestream technical expertise around multiple clinical department integration and data management should in the long-term improve the ability of the broader Philips informatics offering in interoperability, integration and data management maturity. This is no bad thing and should help move the current view of the existing Philips platform as being monolithic and proprietary towards a more open and agnostic solution. This will also better serve Philips’ long-term strategy which is to be viewed as a leading partner across clinical and diagnostic sectors.

However, the transition and integration will not be easy. Philips should tread lightly when it comes to the existing Carestream customer base in the short-term, as opposed to trying to immediately transition customers to the Intellispace portfolio. It must also have an adaptable strategy in terms of product portfolio, looking to maximise the best components of each platform to retain its existing base in this highly competitive marketplace. In the medium-term, we would expect Philips to maintain a two-tier strategy, with the Vue platform evolving into an “Intellispace Lite” product, enabling Philips to compete in lower-tier segments in North America and to address emerging markets with a more flexible, modular product line.

Thus, on paper, the combination of Philips and Carestream HCIS appears to offer a significant opportunity for Philips to primarily broaden its customer base and upsell from its broader healthcare portfolio. It will also put Philips right at the top in terms of global market share in imaging IT in terms of revenue, a daunting challenge to its largest competitors GE Healthcare, Siemens Healthineers, Fujifilm Medical Systems and Canon Medical. How long it stays there could well come down to the decisions it makes in the next two years; get it wrong and the competitiveness of the market means there will be plenty of vendors waiting to pounce.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

More Information

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 436 150

www.signifyresearch.net