Written by

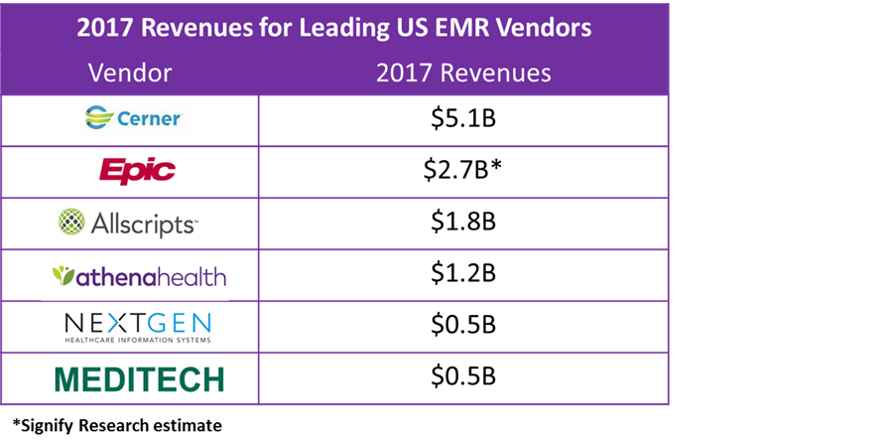

Three weeks ago Signify Research published an insight outlining opportunities for growth for EMR vendors as the US EMR market reaches maturity. I recently attended the Allscripts’ Customer Experience conference, that was collocated with their industry analyst Influencer Summit, two weeks ago in St Louis, and there was plenty of evidence of Allscripts following many of the strategies outlined in our insight. That said, significant challenges remain if it wants to challenge the top two vendors in terms of revenue (Cerner and Epic).

Our earlier insight suggested four core growth opportunities for EMR vendors, and Allscripts gave evidence during the summit of action on all four fronts:

- Diversifying product portfolios into related areas

- Expanding what is provided within “standard” EHR offerings

- Geographic expansion

- Aggressive acquisition strategies that drive market share expansion

Product Diversification

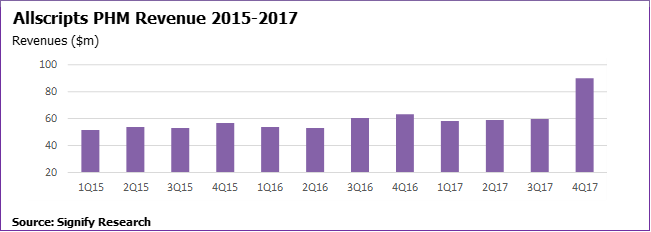

Allscripts has been a leader to some extent here with an aggressive push into population health management via its acquisition of dbMotion and Jardogs five years ago, subsequent product development and a further acquisition, CarePort Health, in 2016. Its publicly reported financial data shows that PHM accounted for nearly 16% of company revenues during 2017 (much higher than many of its peers). PHM revenues were also up 15% on the previous year, underlying how important the area has become to the comMpany. However, top line revenue performance hides some of the challenges its experiencing with PHM.

Whilst its success has been partly fuelled by organic growth, it’s also been a product of its aggressive PHM acquisition strategy (point 4 above). Over the last twelve months for example it has added to its initial three acquisitions via product acquisition from McKesson, NantHealth, and HealthGrid. This has given the company a very broad portfolio in terms of modules and products targeted at PHM; however, few (if any) of its PHM customers are using the whole portfolio, and in many ways its PHM portfolio is more of a collection of modules inherited from its various acquisitions, instead of a coherent, unified product offering.

This point was recognised to some extent during the conference, with Allscripts’ outlining a future strategy that involved pulling its various product offerings into a more structured platform under the umbrella of CareInMotion. After 12 months of significant M&A activity on the PHM front, a period of stability and focus on product integration would certainly be a sound strategy.

PHM is just one area of product expansion for the firm though. Another that was highlighted during the conference was expansion into precision medicine and genomics. 2bPrecise, a wholly-owned subsidiary of Allscripts, offers a platform that uses clinical patient data, social determinants of health, along with “pedigree” data (family history data) to allow providers to stratify populations into those that would benefit from genomic tests (particularly in relation to drug-matching).

During the conference 2bPrecise CEO, Assaf Halevy, outlined that he believed there were three key barriers to the wider use of genomics:

- Knowledge – health practitioners just don’t know enough about how genomics can help them

- Healthcare providers don’t know which populations to target with genomics programs

- In general, healthcare professionals would struggle to interpret a typical genomics report if they ordered a test (typical reports being 20-30-page pdfs that don’t always highlight specific actions or key take-aways).

The 2bPrecise platform aims to address each of these challenges, particularly point two and three with the stratification tools outlined earlier, along with the use of AI and NLP to translate the genomic report into understandable data, e.g. a list of medicines that an individual patient would respond well to, or have a reduced response to, based on the genetic test. Allscripts places the 2bPrecise platform as central to its plans going forward with the intention to integrate the solution into its Sunrise EHR platform and other products (e.g. PHM). However, it’s unlikely that 2bPrecise will drive significant revenue in the short-term – Signify Research expects this to be a long-term play for Allscripts.

Widespread use of genomics and precision medicine is still in its infancy. Allscripts has just a small number of initial partner providers using the solution such as Mayo Clinic, National Institutes of Health and University Hospitals Cleveland Medical Center. While we don’t expect the initiative to drive significant revenue in the short term, it positions the company well as market focus on precision medicine increases.

Evolving EHR

Over the last 12 months, Allscripts’ challenges in relation to core EHR have been very much focused on integrating the products and services brought into the company via its acquisitions of McKesson’s EIS business and Practise Fusion. Feedback from some customer conference attendees was that support for the legacy McKesson Paragon platform had certainly taken a step forward compared to pre-acquisition. Although, it was felt this was very much a work in progress.

In terms of Sunrise development, conference presenters pushed enhancements in areas such as UI, security, maintainability and migration to Microsoft Azure. Particular focus was given to addressing clinician burnout by improving product usability and workflow integration. However, areas of notable innovation were:

- The aforementioned planned integration of 2bPrecise into the Sunrise platform

- The integration of a Lyft app into the Sunrise platform

- Development in Allscripts’ Avenel cloud-based EHR

Whilst the integration of a cab-hailing service into an EHR was certainly interesting and had the potential to improve hospital appointment no-shows and transitions of care, the developments with Avenel are perhaps the more disruptive and will have the greater impact on Allscripts’ long-term business. Several providers sat on panels during the two days of the Allscripts event, and on numerous occasions, passing comments were made as to the limited number of differentiators between the EMR solutions of different vendors and the somewhat “dated” nature of the UI. Avenel has the potential to address both issues.

The product was announced with great fanfare earlier this year at HIMSS. In short, it’s a web-based EMR (hosted on Microsoft’s Azure cloud), designed (at present) only for use on iOS devices (specifically the Apple iPad), and that uses AI to support workflow, treatment plans and clinician preferences. The product is still some way from general release; however, Allscripts does have one test-bed hospital (e.g. Carlinville Area Hospital) where Avenel is already being used, with more to follow as part of its pre-commercialisation strategy.

In summary, Allscripts is addressing well our second category for growth “expanding what is provided within ‘standard’ EHR offerings”, particularly for its Sunrise clients. However, it’s unlikely to see significant revenue from its Avenel product in the short-term, and whilst it is addressing the evolving needs of its Sunrise client-base, the challenge going forward will be how to translate this innovation to its newly acquired Paragon customer base.

Geographic Expansion and Growth Via Acquisition

Whilst not so much of a focus of the conference, both geographic expansion and growth via acquisition have been addressed by Allscripts over the last 12 months. Prior to the acquisition its EMEA operations had largely been limited to the UK. McKesson brings customers across a range of other EMEA regions such as Benelux, France, and the Middle East. And as documented above, Allscripts shopping spree over the last 18 months has not been limited to McKesson’s EIS business. Practice Fusion, HealthGrid and NantHealth have also been brought into the fold.

Conclusion

In summary, the Allscripts Customer Experience conference and Influencer Summit illustrated that the company was active on all fronts in terms of the four areas of expansion that Signify Research had outlined for EMR vendors looking to drive future growth. With several highlights in terms of success or innovation (e.g. PHM, precision medicine and web/AI-EMR). However, the aggressive acquisition strategy employed by the company over recent years has left it with an extremely large and somewhat unwieldy portfolio, and, in some cases, duplication of products.

During his keynote speech, Paul Black, Allscripts’ CEO emphasised the message that the company is now clearly the third largest health IT vendor serving the EMR market. Key to cementing this position and maximising the success of its acquisition and product development strategy will be bringing this large product set into a more streamlined, cohesive offering.

Related Reports from Signify Research

Signify Research will be publishing a new market report in January 2019 examining the Global EHR/EMR Market across both acute and ambulatory settings. The report will provide in-depth profiles of 20 country/regional markets providing market size estimates, forecasts and a competitive vendor analysis for each. It will also examine the market by product, with particular focus on the level of success that EHR vendors are having driving additional business from these adjacent markets such as PHM and RCM. Click here for more information on this report.

Signify Research has also been tracking the population health management market for several years and has recently published market reports on the North American PHM Market and the PHM Market in EMEA, Asia and Latin America.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

To find out more:

E: Alex.Green@signifyresearch.net , T: +44 (0) 1234 436 150