Get in touch

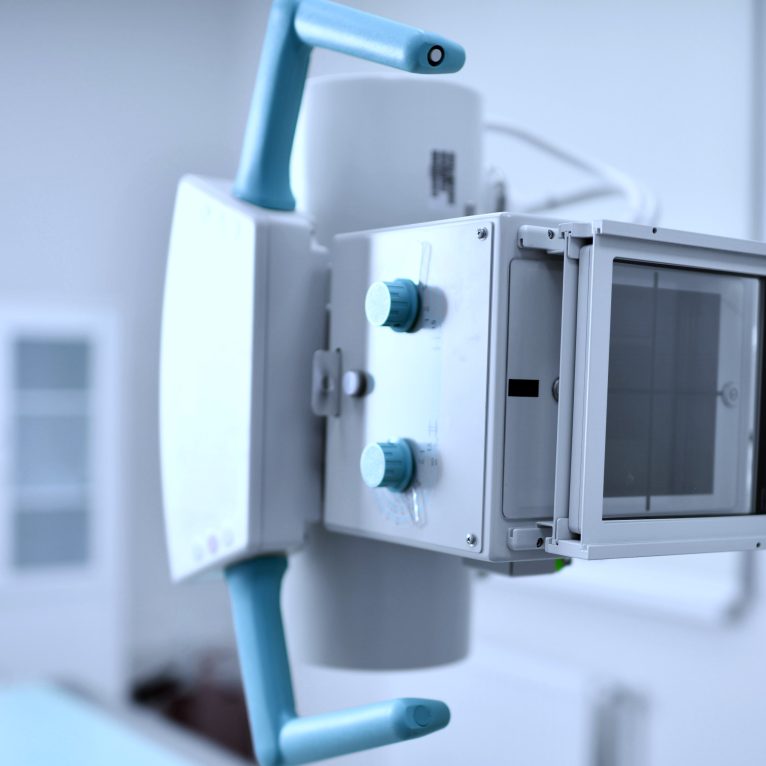

Contact usBhvita joined Signify Research in 2020 as part of the Medical Imaging Team focusing on the X-ray market. She brings with her 3 years’ experience covering X-ray, MRI and CT research at IHS Markit. Bhvita also has three years’ experience in digital and offline marketing and was previously an assistant clinical psychologist. She received her bachelor’s degree in Biology and Psychology from Aston University. Bhvita has a passion for travelling, photography, kickboxing and salsa.