Written by

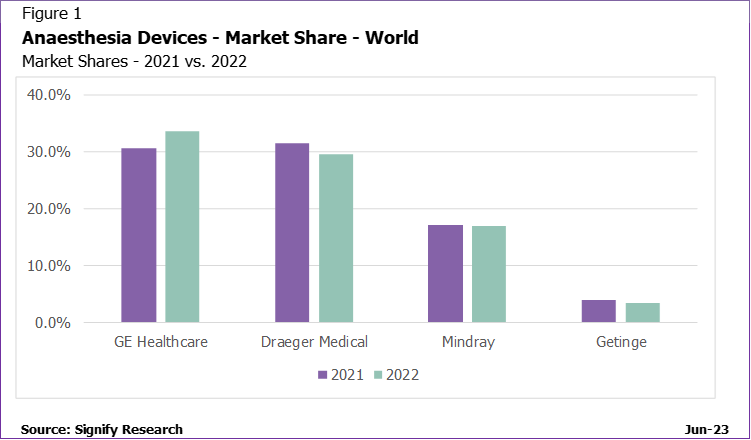

Cranfield, UK, June 2023 – Despite a short-term dip in market demand in 2021, the anaesthesia market is projected to bounce back with digitalisation being the driving force required. While budgetary and regulatory restrictions continue to limit growth opportunities for regions and vendors alike, new and old players are leveraging opportunities as they expand their portfolios to meet the growing demands for digital healthcare provision. However, the world anaesthesia market remains consolidated as GE Healthcare, Draeger Medical and Mindray monopolise the market, aided by projections of market growth revenues reach $1.3 billion by 2023.

GE Healthcare

GE Healthcare was the leading vendor of anaesthesia devices in 2022, holding 34% share of the world anaesthesia market. This share was largely propagated by its dominance of the premium anaesthesia market where they held leading share globally in 2022.

GE Healthcare has maintained a strong foothold in the anaesthesia market. Its global presence and prioritisation of high-quality care and devices ranks the company as the top provider of anaesthesia devices. It is becoming increasingly necessary that vendors provide a full portfolio of anaesthesia devices to cater to a wide variety of budgets. GE Healthcare has shown the benefits of providing a flexible and accessible fleet of solutions to meet developing customer demand, providing customers with the ability to select devices appropriate to their needs. GE Healthcare has continued to invest in digital initiatives and software to enhance its product offerings. Recognising the importance of sustainability within anaesthesia and the growing demand for greater clinical workflow and operational support, the Aisys CS end-tidal control software provides anaesthesiologists with the ability to set and maintain patient-specific gas targets, alleviating staff burden. As discussed in Signify Research’s insight on automation in anaesthesia, GE Healthcare was the first to introduce end-tidal control to the US market through its Aisys C2 end-tidal software. The US now begins to recognise the economic, operational, and environmental benefits of end-tidal control. GE Healthcare has also been cognisant of the increasing need for clinical decision support and robust data analytics in healthcare. The US launch of the Carestation 750 Anaesthesia Delivery System in 2022 caters towards the heightened demand for low-flow anaesthesia and lung protective ventilation. This is coupled with its adjacent software, Carestation Insights, providing analytic and patient data support.

Draeger Medical

Draeger Medical was ranked second in the global anaesthesia market leading boards, occupying approximately 30% global share of anaesthesia device revenues in 2022. Its highest share was in the EMEA region as sales were propagated by domestic sales. The partial removal of GE Healthcare’s MRI compatible anaesthesia device has also enabled Draeger to occupy the majority of the global MRI market. As GE Healthcare and Draeger continue to compete for the position at the top, brand loyalty and perception will become a greater necessity.

Draeger Medical has capitalised on the rapid movement towards digital solutions. With the 2022 launch of the Draeger Atlan A300/A300 XL, Draeger Medical offers physicians with clinical decision support, coupled with personalised patient data analytics and lung protective ventilation. This device is currently available worldwide, with the exception of the US where FDA approval continues to delay product innovation and development. Draeger’s Atlan provides buyers and users with interoperability that facilitates hospital-wide communication and visibility. As the digitised anaesthesia market develops, demand for interconnected solutions is expected beyond high and premium-end devices. Draeger Medical anticipates that anaesthesia devices of all functionalities and performance levels will soon require some form of analytical capability.

Further to digital health initiatives, Draeger Medical has taken strides in supporting and prioritising sustainability and eco-consciousness in the anaesthesia market, a detailed insight on the development of sustainability in the anaesthesia market can be found here. This is echoed in Draeger Medical’s recent distribution agreement with SageTech Medical to promote and implement its anaesthesia gas capture solution, SID-Dock to its NHS Supply Chain customers in the UK. This collaboration reflects current developments in sustainability as a greater number of hospitals implement environmental protocols and guidelines to reduce the release of anaesthetic gases.

Mindray

Mindray has been rightfully labelled as ‘the one to watch’ across all clinical segments. Mindray’s rise in share percentage is posing a significant threat for well-established American and European vendors. This has in turn sparked increased recognition and improved perception of Chinese, and more broadly Asian medical device manufacturers. Mindray has proved it is capable of expanding its share beyond its domestic shores as it maintained its global position comfortably at number three in 2022 with an almost 17% share. Mindray’s low-cost, high-quality solutions have caught the eyes of many hospitals worldwide. As Mindray continues to expand its portfolio, it can accommodate those that are looking for high end anaesthesia devices, available at a lower cost without compromising functionality and capability. As pricing remains a key factor for many hospitals amid the current economic situtation, Mindray has benefitted from its more affordable high-end anaesthesia devices, as its share for this segment rose in 2022. Furthermore, Mindray provides a highly connected platform across its portfolio of clinical care solutions that spans the full continuum of care. As Mindray continues to offer robust and interoperable solutions that anticipate customer needs, the company is predicted to gain further recognition and praise, continuing to rise higher in the share rankings. The rapid and imminent emergence of Mindray in the anaesthesia market is expected to propel the penetration of more Asian vendors into the global anaesthesia market as they piggyback off Mindray’s success.

Getinge

Getinge was ranked fourth in the global anaesthesia market, occupying 3% of the market in 2022. Getinge continues to focus on product development and expansion despite its slight loss in its global market share in 2022. Getinge, known to specialise in premium devices, has begun to increase its product offerings to include high-end anaesthesia solutions (its Flow-e and Flow-c devices). Environmental impact is also of strong interest to Getinge, the company’s Automatic Gas Control solution is available worldwide with the exception of the US. Greater penetration of the US anaesthesia market is necessary for Getinge to increase its market share and maintain its position as a well-established vendor.

Smaller Vendors Must Work Hard to Keep Up

The remaining anaesthesia market is more fragmented, comprising of smaller vendors with product specific and regional focuses. Connectivity and improved IT systems still remain a priority for these vendors as they focus on software updates and digitalisation of their anaesthesia solutions. Despite this, many smaller vendors have begun to gradually lose market share as larger vendors consolidate the anaesthesia market. In order to sustain their presence, a greater emphasis on digital health initiatives, sustainability, and innovation will be required from all vendors.

Future Projections

The anaesthesia market has experienced a myriad of challenges and changes throughout the pandemic and thereafter. Despite the impact of the pandemic diminishing, local-made policies, regulatory bodies, and budget constraints remain obstacles for the growth of the anaesthesia market. Local-made initiatives continue to contribute to the boost of the Chinese and Indian markets and their domestic vendors, while threatening the growth of international vendors within these regions. It is expected that more countries will adopt local-made regulations, as also seen in Brazil and Indonesia. As more regions follow suit, smaller domestic vendors are predicted to obtain larger market shares in their specific regions. Beyond Asia and Latin America, the opposite seems to be in effect in Europe, as smaller vendors are predicted to fade into the periphery as the market becomes increasingly monopolised by large vendors who can foot the cost of regulatory approval.

Digitalisation is here to stay, and companies need to adapt and anticipate the ever-growing technological needs of their customers to ensure their position is maintained.

Related Research

Signify Research has recently published its Anaesthesia Devices -World – 2023 report, which builds on our 2021 editions of the report. The report provides a data-centric and global outlook of the market and blends primary data collected from in-depth interviews with healthcare professionals and technology vendors to provide a balanced and objective view of the market. objective view of the market.

About Tosin Alex-Duduyemi

Tosin joined Signify Research in 2022 as a Market Analyst within the Clinical Care team. She holds a bachelor’s degree in Biological Sciences from the University of Birmingham & has prior experience working in primary and secondary education.

About the Clinical Care Team

The clinical care team provides market intelligence and detailed insights on the clinical care equipment and IT markets. Our areas of coverage include patient monitoring, diagnostic cardiology, infusion pumps, ventilators, anaesthesia devices, and high-acuity IT. Our reports provide a data-centric and global outlook of each market with granular country-level insights. Our research process blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net