Written by

Max Street

Kelly Patrick

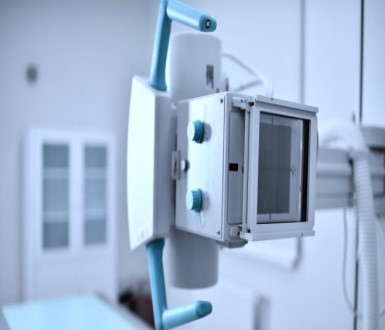

This is the 6th edition of our General Radiography and Fluoroscopy market report, releasing May 2024.

The 2024 General Radiography and Fluoroscopy report and accompanying dataset help you to:

•Inform your geographical decision making and identify growth market using our extensive market segmentations, complete with a five-year forecast.

•Explore the key technological and AI trends to ensure the competitive edge of your product portfolio.

•Evaluate your market standing by comparing vendor market shares through collaboration with the leading general X-ray and fluoroscopy vendors.

•Align your strategic planning with the key competitive developments, including partnerships and product launches in the market.