Medical Imaging

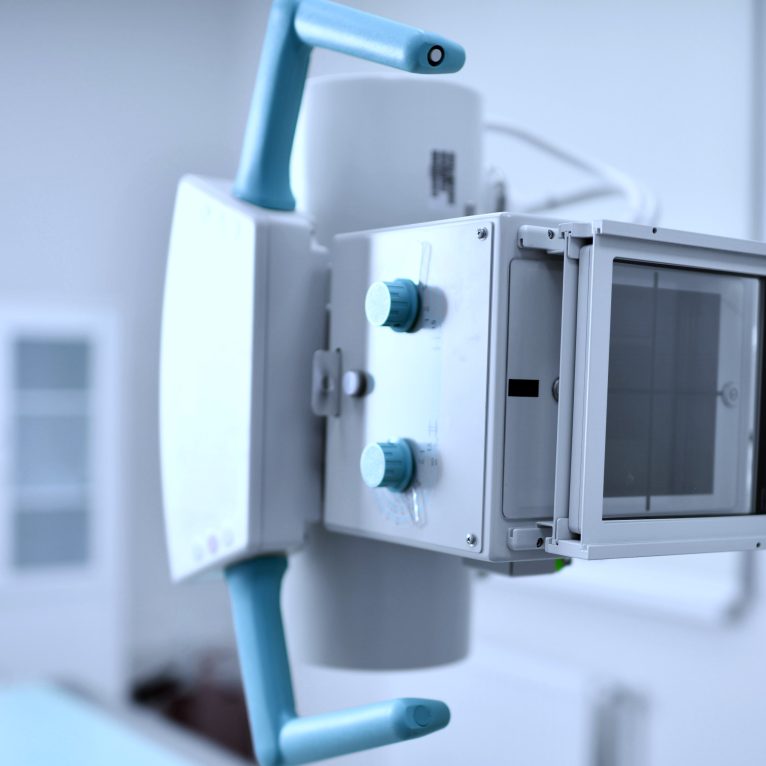

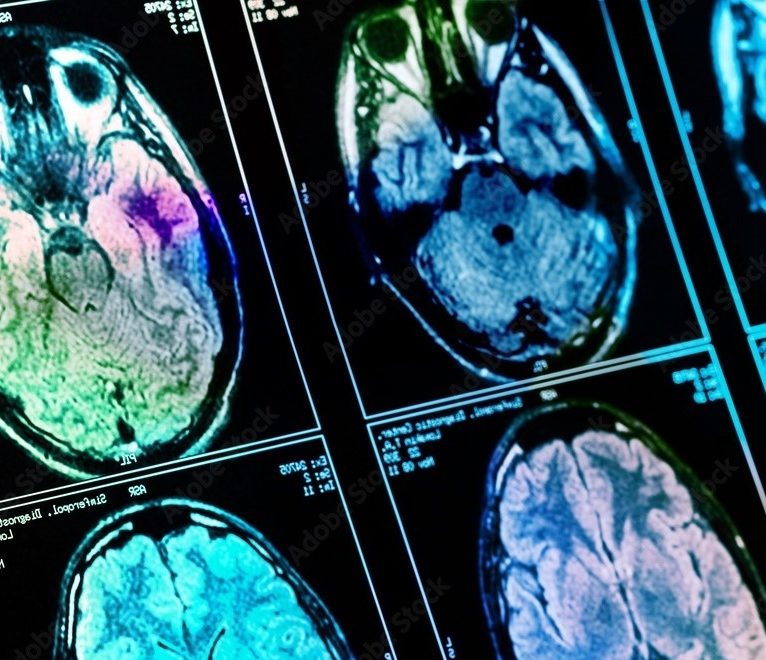

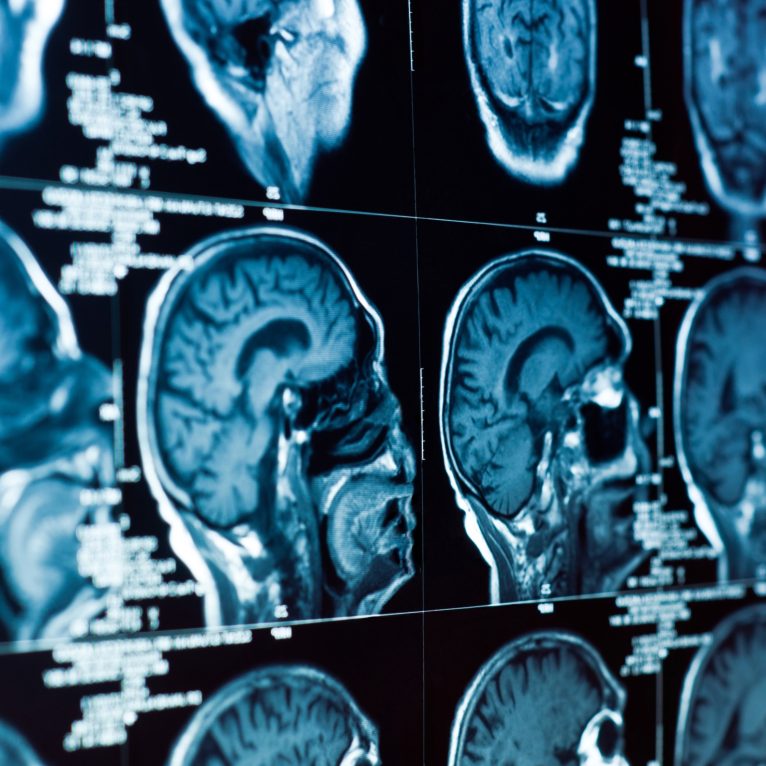

Market intelligence and detailed insights on the imaging modality hardware markets including ultrasound, general radiography & fluoroscopy, breast imaging, MRI, CT and X-ray, as well as associated software markets such as imaging IT and AI in medical imaging.