SIIM 2018 saw the attendance of Imaging IT leaders from around the world and Signify Research was also in National Harbor to see the latest technologies to get a sneak peek into what the future of imaging IT might bring. As our report on advanced visualisation and viewing IT is finalised, the latest trends in universal viewing and enterprise imaging were of special interest. Walking from booth to booth, it became quickly clear that most universal viewing vendors had a common focus; workflow. While this may not come as a surprise to many industry observers, it does show that many of these firms have realised two things:

- In-house development of advanced clinical and diagnostic tools is too expensive to compete with the largest incumbent vendors in advanced visualisation

- High expectations from diagnostic users requires a narrowing of focus and investment around a specific application or subset of the market to compete

Therefore, most universal viewing vendors have concluded that in today’s market of growing network scale and scrutiny around operational efficiency of imaging departments and accessibility of clinical content, the most lucrative opportunity lies in promotion of their products as part of a full enterprise imaging solution, be it own brand or in partnership.

Universal Viewers Getting Workflow Support

Universal viewers were initially developed to offer freedom from proprietary platforms and standards limitations, functioning as additional clinical review viewers between sites and departments, while diagnosis was still done on PACS or advanced visualisation (AV) platforms. However, healthcare providers quickly became accustomed to these viewers and their zero-download multi-content nature, and increasingly expected more functionality and breadth of content. The market had quick initial growth earlier this decade, often tied to the roll out of vendor neutral archives (VNA), although the revenue numbers have some way to go to reach comparable levels to AV or PACS.

The development of clinical tools for universal viewers to compete with AV and PACS platforms for diagnosis is an expensive and time-consuming process; most PACS and AV firms have spent decades and millions of R&D dollars developing and refining their extensive portfolio of tools. Therefore, many universal viewers still only have relatively basic functionalities such as MIP/MPR, 3D reconstruction and simple measurement tools. Consequently, providers often viewed universal viewers as a non-essential additional viewer, especially when decision making was made from within radiology, who often scoffed at the simplicity of feature-set in comparison to their full-featured PACS. There are outliers to this trend though, exemplified by the recent success of Visage Imaging, showcasing how a clinically capable universal viewer can compete in the market, most notably the academic provider segment.

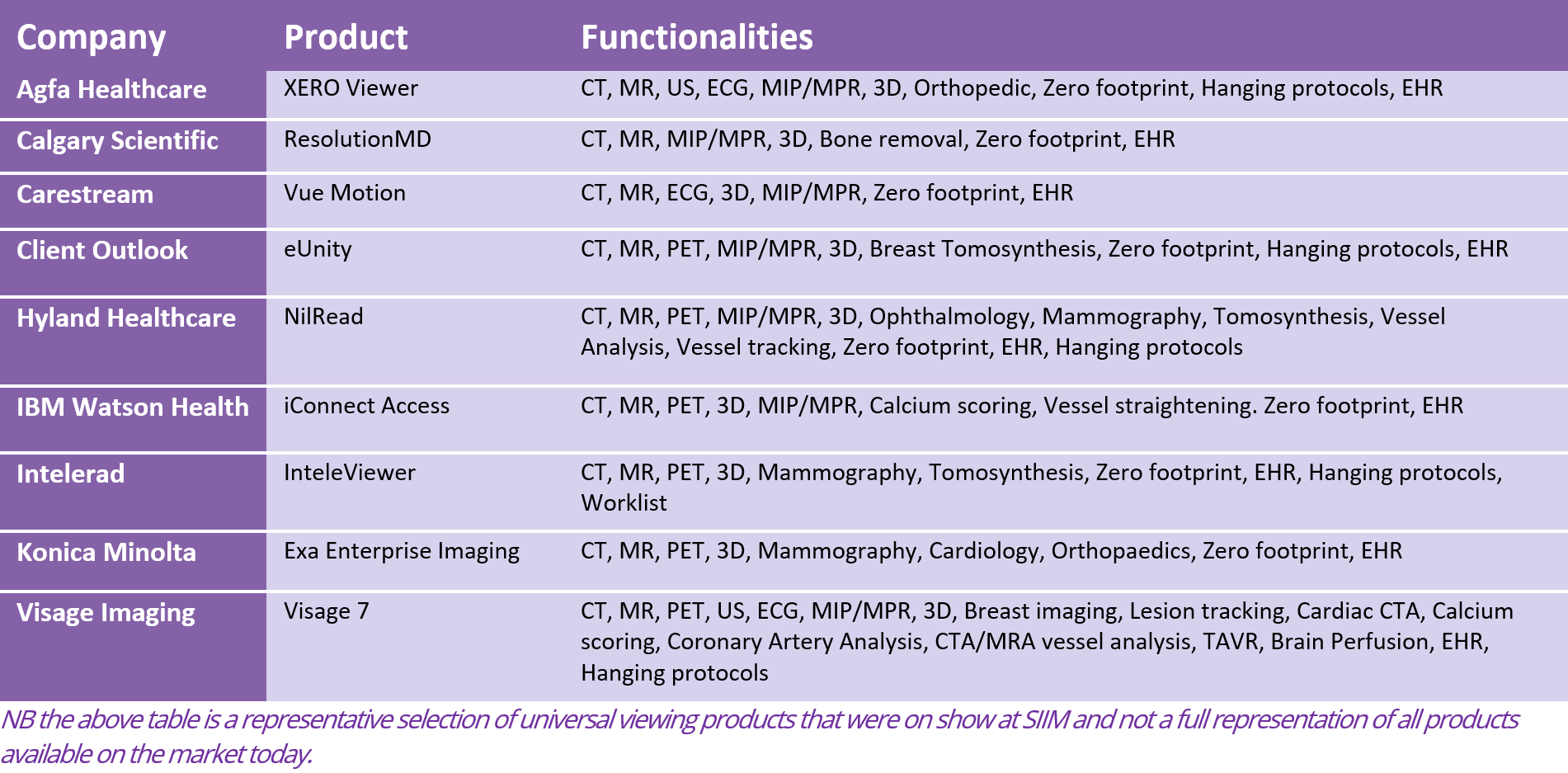

Most recently, universal viewing vendors have been adding additional functionalities to increase the value of these viewers to users, targeting integration to the EHR and patient timeline as the most important. Vendors today are focusing on viewers that can form part of a full enterprise suite, either from their own portfolio, or through partnership with other third parties. In doing so, they hope to support providers in consolidating the patchwork of legacy viewers and applications currently in use, towards a single viewing and reporting environment. Other examples of this trend are evident from a selection of the products on show at SIIM:

When it comes to the current focus on workflow tools, Intelerad introduced InteleOne Maestro, which is their new enterprise workflow orchestration solution for study assignment, order management, worklist, workload balancing and reporting. This will add valuable workflow capabilities previously associated with their IntelePACS to their InteleViewer universal viewer. Client Outlook and Mach7 announced a partnership for a vendor neutral framework combining Mach7’s workflow management and Client Outlook’s universal viewer for diagnostic reading, which will make Client Outlook’s standalone universal viewer an integrated part of a full enterprise solution.

Other universal imaging products released at shows prior to SIIM have also exhibited common characteristics, namely collaborative working tools to allow remote consultations and cross-discipline collaborative working, intuitive user interfaces and adaptive menus for tools based on study type and improved integration into reporting and wider clinical record. Moreover, larger vendors have also been focusing on more seamless integration with specialist third-party tools from within their user interfaces, though more work here is required in many cases.

Workflow Important Part of Overall Strategy

These developments and new product releases are intended to meet the changing needs of the market today, most notably: growth in scale of healthcare networks, creating a challenge for providers with interoperability of clinical content, something that traditional PACS and AV vendors have been poor at for non-DICOM data in the past; increasing demand for clinical context in diagnosis, pulling in priors and related diagnostic information, especially as radiology diagnoses moves towards use of decision support; providers wanting to limit the number of viewers and user interfaces within their organisations and simplify their supply chains to fewer vendors.

Universal viewers have gained great popularity from their initial role as a link between disparate PACS systems and providing viewing capabilities as additional viewers. But to turn this popularity into revenue, the UV vendors are now making clear strategic decisions to try and blur the line between clinical review and diagnostic reading and reporting. They also want to tap into AV and PACS revenue streams by incorporating some of those capabilities into their popular viewers and transform these into the main interface for a full scalable enterprise platform.

Moving deeper into diagnostic imaging IT requires heavy lifting and skills many of the standalone UV companies don’t yet have, but some may be able to overcome this through extensive third-party partnerships. Although the larger modality and imaging IT companies may have a head start, given their depth of diagnostic experience and functionality of their solutions, a more prominent position of the universal viewer as an interface to the whole system, is here to stay.

Radiologists want a simple interface with advanced capabilities, which they can access from their office or their home, as well as the reading room. For many of them, the viewer and interface represents the system. At the same time, broader clinical use and integration with EHRs will also create a new customer base for vendors; satisfying multiple user types will be difficult for vendors, but the rewards for viewer supremacy will have significant bearing on longer term success in enterprise imaging.

Related Market Report

“Advanced Visualisation and Viewing IT – World – 2017” provides a highly detailed, data-centric analysis of the world market for Advanced Visualisation and Viewing IT. Key features include market size estimates, annual growth rate forecasts for 2017 to 2021 and vendor market share analysis.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

About The Author

Dr. Ulrik Kristensen is a Senior Market Analyst at Signify Research, a health tech, market-intelligence firm based in Cranfield, UK. He can be reached at ulrik.kristensen@signifyresearch.net.

More Information

To find out more:

E: ulrik.kristensen@signifyresearch.net

T: +44 (0) 1234 436 150

www.signifyresearch.net