Written by

Written by Alex Green

- Signify Research preliminary analysis and commentary on the North American Population Health Management IT Market, which includes data for the quarter ending December 2016

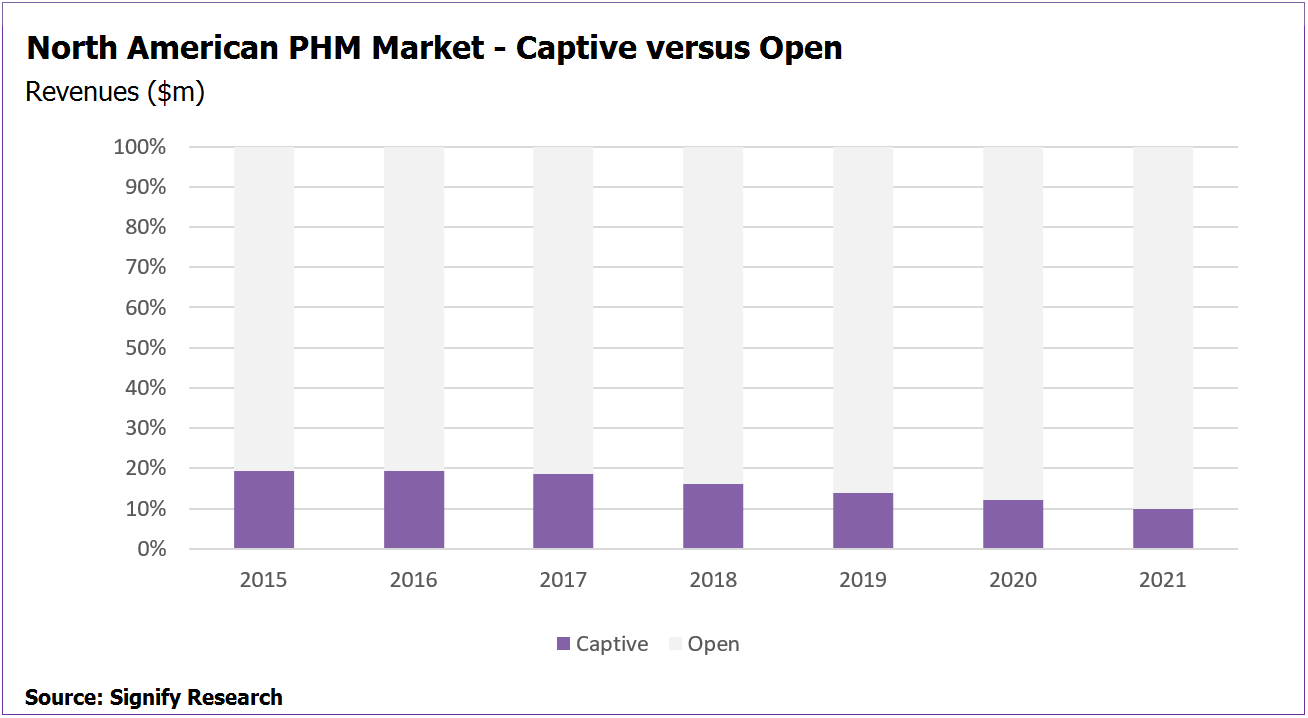

- 20% of North American PHM market in 2016 is accounted for by vendors supplying their own owners with solutions

- Optum, Healthagen, Medicity, ActiveHealth Management, Transcend Insights, Conifer Health, Medecision – all have owners who are also customers

Analysis

According to preliminary data from Signify Research’s report “Population Health Management IT – North America – 2017“, 20% of the North American PHM market is effectively locked out to competition as it is served by vendors supplying their owners with PHM solutions – i.e. it’s a captive market.

Many of the leading vendors of PHM software solutions are owned by major payer or provider organisations, who then purchase PHM products and services from their subsidiaries. In some circumstances these payers or providers were initially responsible for developing the PHM solutions offered and once successful, commercialised the products by establishing new operating companies or brands. There are also several examples of payers or providers acquiring vendors that had already developed successful PHM solutions and then ultimately becoming customers of these acquired companies.

The leading vendors that are driving this captive 20%, along with an overview of their businesses, are outlined below.

Optum

Optum, the market leader in terms of PHM IT revenues in North America, is owned by US payer UnitedHealthcare and is one of the companies that makes up the largest share of the captive market.

United is Optum’s largest customer across its entire portfolio. In 2016 Optum Insight, Optum’s health care technology business segment, generated more than 50% of its $9B sales via internal business. Specific to PHM, in 2016 United was a major customer for Optum’s payer-centric PHM solutions, such as Optum Impact Intelligence, Optum Impact Pro and Optum Symmetry.

Optum has also started to bolster its non-UnitedHealthcare business; in particular it has increased the share of its business that is driven by providers as opposed to payers. Its acquisition of Humedica in 2013 and the subsequent launch of its provider-focused PHM solution Optum One being the main enabler. As sales of this solution have ramped up, the share of the overall Optum PHM business generated by UnitedHealthcare has started to fall.

Conifer Health Solutions

From a leading payer-owned example to a leading provider-owned example – Conifer Health Solutions offers a broad range of provider-focused PHM solutions via its ConiferCore portfolio of products. It is estimated to have commanded a top five market share position in North America in 2016 (based on Signify Research preliminary market estimates).

Conifer Health Solutions is the principal operating subsidiary of Conifer, which is majority owned by the US health provider Tenet Healthcare. Further, US provider Catholic Health Initiatives (CHI) also holds a 23.8% ownership position in Conifer Health Solutions.

Tenet alone accounted for 37% of Conifer’s sales (all products) in 2016. Across both Tenet and CHI, the figure was between 75% and 80% in 2015 and 2016. These figures relate to business across all Conifer’s products, but its PHM business is also very much focused around Conifer Health’s two owners.

Healthagen

US payer Aetna has developed a broad PHM portfolio via several acquisitions over recent years. In 2005 Aetna acquired ActiveHealth Management for a reported $400M. ActiveHealth Management provided medical management and data analytics solutions at the time. In 2011, it completed the acquisition of Medicity, a provider of Health Information Exchange (HIE) solutions for $500M. Finally, in 2011, Aetna acquired Healthagen, at the time best known for developing the mobile symptom checking app iTriage. In 2013 Aetna consolidated all its PHM- products obtained via these acquisitions under the Healthagen brand.

Although Aetna is estimated to drive some internal business for Healthagen, unlike the previous two examples of Optum and Conifer, the internal business generated from Aetna is estimated to be relatively small.

Transcend Insights

A similar picture exists for Transcend Insights. As with the Healthagen brand, the Transcend Insights brand reflects the PHM offerings of another major US payer, namely Humana (until recently, itself in merger discussions with Aetna).

Transcend Insights was formed in March 2015 after Humana brought the businesses of its subsidiaries Certify Data Systems, Anvita Health and nLiven Systems together under one brand.

The combined entity is a top 10 vendor in terms of 2016 PHM market share and it addresses the PHM market via its HealthLogix portfolio. Humana is estimated to have been a significant customer for Transcend Insight’s PHM products in 2016.

Other Examples

Several other companies also contribute towards this 20% figure, such as Medecision which is owned by one of its largest clients, US payer Health Care Services Corporation (HCSC).

There are also examples of provider/payer-owned vendors where the owner relationship isn’t defined as customer/client. For example, Evolent Health, which addresses the PHM market via its Identifi portfolio, is part-owned by Pittsburgh-based provider UPMC. However, much of Evolent’s portfolio is based on IP developed by UPMC. In this set up, Evolent acts as a reseller of UPMC technology, rather than a supplier to UPMC.

That said, Evolent does contribute toward this captive market in other ways. Since February 2016 one of its top three customers, Passport Health Plan, owns a sizable share in Evolent. Passport Health drove 20% Evolent’s overall business in 2016.

Premier Inc, is also technically part-owned by its customers but the business is very different to the other vendors discussed in this section. It has been a publicly-traded company since its IPO in September 2013; however, at the end of 2016 64% of the company equity was held by its members which comprised its customers. This includes 3,750 hospitals/130,000 providers making the company technically a provider-owned business. However, unlike the others listed in this section it is not owned by one provider, but many, and the vendor/client relationships are very different to the other examples. For this reason, Premier’s business has not been included in the 20% captive market figure.

Steady Decline in ‘Captive’ Share of the Market

The share of the market represented by companies selling to their owners (or in some cases owned subsidiaries) is forecast to fall over the coming years. For the companies involved, although their internal business is forecast to grow, the share of business generated by external customers is forecast to grow faster. This, coupled with the growing PHM businesses of other vendors that don’t have internal customers, results in the captive share of the market falling to less than 10% by 2021.

New Market Report from Signify Research Publishing Soon

The market data presented above are the preliminary estimates and forecasts from Signify Research’s upcoming report on the North American PHM market which will be published in April. The report is a component of the Signify Research “PHM & Telehealth Market Intelligence Service”. Vendors tracked include Aetna, Allscripts, AthenaHealth, AxisPoint Health, Caradigm, Cerner, Conifer Health, eClinicalWorks, Enli, Epic, Evolent, HealthCatalyst, Humana/Transcend Insights, IBM Watson Health, McKesson, Medecision, Meditech, NextGen, Optum, Orion Health, Premier Inc., Verscend, ZeOmega and others. The report provides quarterly market estimates for 2015 & 2016, and annual forecasts by vertical, function, service type, platform delivery and country to 2021.

For further details please contact Alex.Green@signifyresearch.net.