Written by

Contributing / co-writer – Amy Thompson, Senior Market Analyst.

The US retail health clinic sector is expanding fast. Billions of dollars are being spent by household pharmacy names to offer primary care services to larger swathes of the population than ever. CVS Health’s acquisition this month of VBC-focused provider Oak Street Health for $10.6B is the latest big money move here, and follows its Signify Health acquisition.

So, are primary care providers in the US finally achieving the necessary scale to deliver on broader goals to improve patient experiences and reduce total healthcare costs?

The Signify View

The US retail health clinic market has significant forward momentum. Commentators suggest that retail clinics will account for double the share of the US primary care market this year than in 2022. Household names such as CVS and Walgreens, along with Optum-United Health, have come to the game, as has Amazon (albeit with mixed results to date). Overall, this big retail/big tech push promises to rapidly transform the face of US primary care, which will achieve unprecedented scale as more of the US population accesses care via neighbourhood pharmacies.

Beyond primary care, retailers have also started to extend into diagnostic imaging. As payers pushed back on how much they were willing to cover for non-emergency imaging within a hospital, alongside patients’ preferences for convenient care, outpatient imaging demand has surged. Care provision is rapidly evolving and, with healthcare budgets and economic pressures magnifying, it is anticipated that non-emergency diagnostic imaging will continue to be directed to the cheapest provision; retail. Walmart Health was among the first to move beyond primary care, announcing it “Walmart Supercenters” in 2019, offering primary and urgent care, labs, x-ray, EKG and diagnostics. Optum-United Health also invested in diagnostic imaging (alongside its expanding primary healthcare network), acquiring imaging centres across the US . As an emerging trend, diagnostic services is not anticipated to be mainstream among retail and pharmacy providers. At least in the short-term.

Transition to Value-based Care

Recent acquisitions by retail providers all have Value-Based Care (VBC), and Population Health Management (PHM) at their core. The acquisitions represent attempts by retail chains to reduce patients’ long-term healthcare costs, while also taking advantage of new reimbursement streams offered under VBC contracts. For example, by enabling clinicians to intervene at an earlier stage, or help an individual better manage a chronic condition.

Primary care has struggled, to some extent, to make the transition to VBC. Technology and workflow investment required to take advantage of alternative payment models is prohibitive in some cases. While integrated delivery networks (IDNs) and large health systems are in a position to transition how they operate (and have the funds to invest in technology to take advantage of VBC reimbursement structures), independent practices and smaller physician groups are not.

By investing in providers such as Signify Health, Oak Street Heath, VillageMD and others, retail pharmacies can leverage primary care providers that have already scaled and are already focused on this operating model. Either via partnerships with technology vendors, such as Innovaccer and Health Catalyst) or via self-developed solutions, these providers have the technology in place to maximise returns under both government and commercial VBC structures.

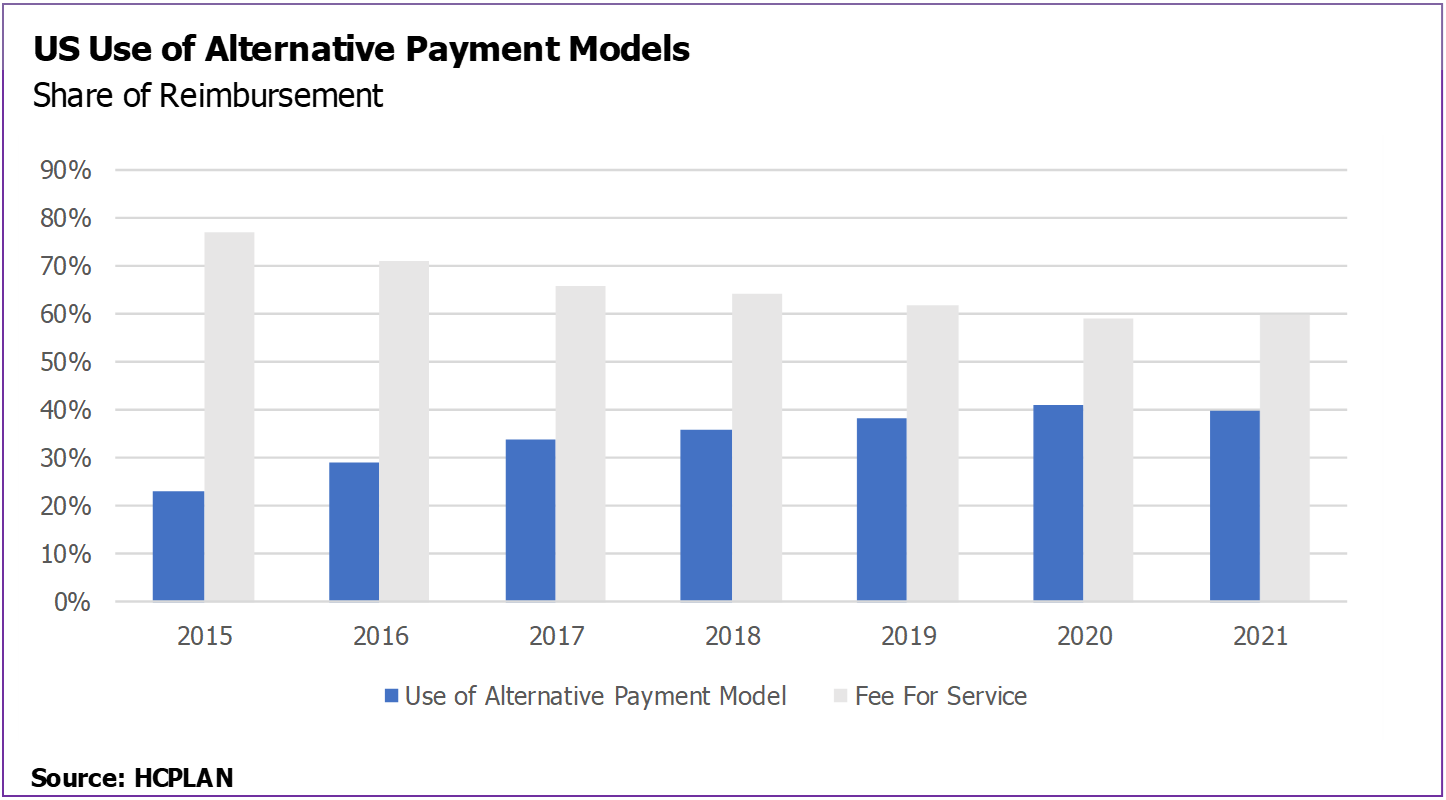

That said, the transition to the alternative payment models that underpin VBC has occurred more slowly than many in the industry would have hoped. Data over the last couple of years even suggests that the transition to VBC has stalled. The figure below illustrates the share of US healthcare reimbursement using Alternative Payment Models (APM). It shows that while the share increased relatively quickly from 2015 to 2019, the rate of change has slowed and even flat-lined in the last two years.

However, the share of Medicare Advantage payments based on two-sided risk VBC models continues to increase. Thirty-five percent of Medicare Advantage payments fell into this category in 2021, up from less than 25% four years prior. Medicare Advantage is the main mechanism that many retail, pharmacy, and big tech companies are looking to leverage in terms of their primary care provision.

IT Requirements

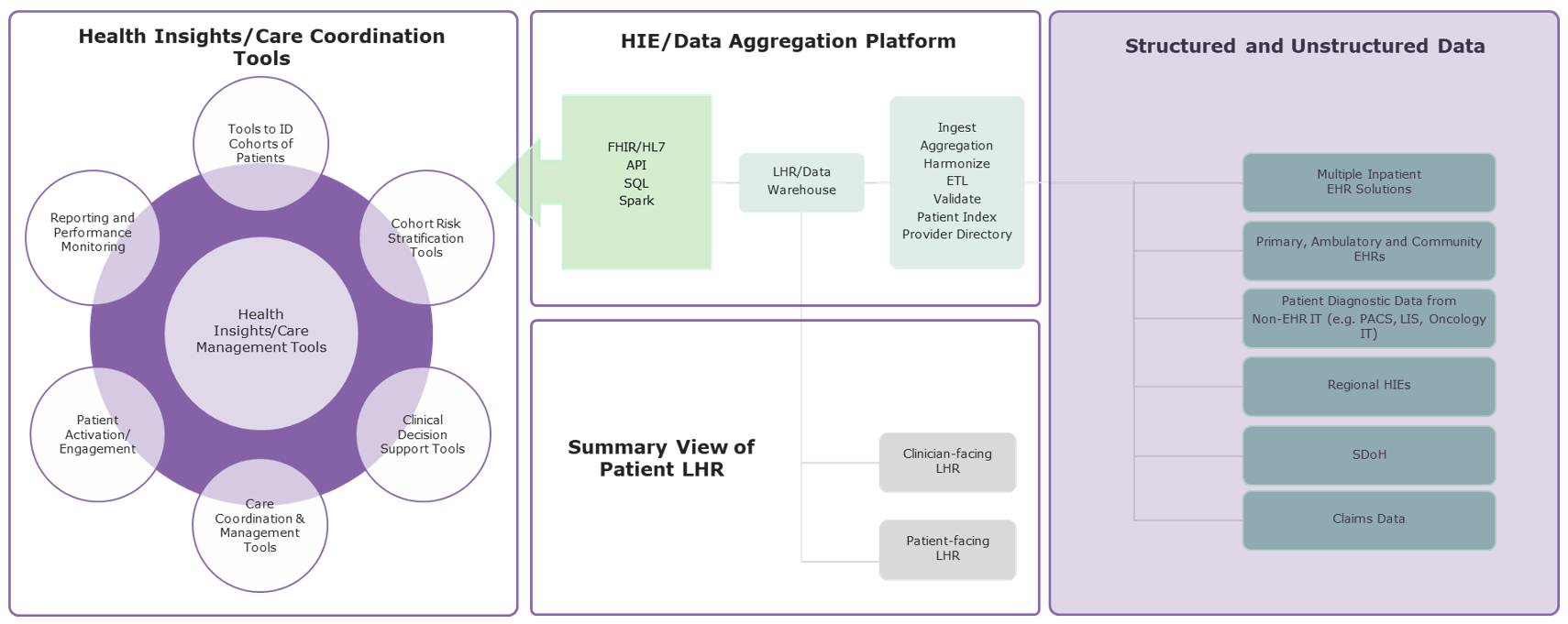

To successfully operate in a VBC environment, retailers need to implement IT that supports the provision of a comprehensive patient view. Not only in relation to the direct healthcare services that they provide, but also their patients’ wider healthcare interactions. To achieve this, an interoperable IT platform is essential, centralising patient data beyond a single provider to include external EHRs, regional HIEs, payer data, social determinants of health and diagnostic reports. This provides a longitudinal health record for each patient and also provides a data lake of information on the provider’s population that allows it to be more strategic in how it manages the health of the population under its care (illustrated below).

In most cases (e.g. Signify Health) the healthcare providers that retailers, pharmacies, and big tech have acquired have already either developed their own solution, or partnered with IT vendors, to address this need. That said, the implementation challenges of such solutions should not be underestimated, and execution will continue to be the barrier to maximising revenues under VBC contracts.

As healthcare models transition and care provision moves beyond the acute sector, the provider dynamic transitions and becomes inherently more complex. A greater drive towards interoperability to optimise the patient care pathway and improve patient outcomes will lead to a need for investment in advanced technology to boost efficiency and productivity across the workforce, curate data and drive standardisation while fundamentally supporting collaboration. Discussion with buyers of solutions, as per those described above, back up this point. While broader population health initiatives are key, buyers also indicate that a key operational use case is to improve efficiencies, in particular relating to diagnostics.

Public cloud infrastructure offers unique benefits over on-premise solutions within the ever-changing healthcare landscape, such as the ability to deploy, securely store, analyse and share patient information at scale. Many hyperscalers hope to rise to the occasion and prove themselves as the preferred partner for healthcare providers, with many announcing healthcare strategies and investing in bespoke services and solutions for the healthcare sector. Examples include Amazon’s HealthLake, as well as a dedicated service for medical imaging, Oracle’s acquisition of EHR vendor Cerner and Microsoft’s acquisition of voice dictation developer Nuance Communication, both in 2022.

Opportunity for Healthtech Vendors

This rise in importance of retail in primary care, alongside the longer-term prospect of diagnostic imaging, offers several vendor groups substantial opportunities going forward:

- EHR vendors such as Epic, Oracle Cerner, Allscripts/Altera, athenahealth and NextGen Healthcare. As well as purely EHR, these vendors also all have solutions to support the above diagram in terms of supporting VBC operation. Their challenge will be displacing self-developed solutions and best-of-breed solutions offered by specialist vendors specifically to support VBC operation.

- Best of breed VBC vendors, such as the above-mentioned Innovaccer and Health Catalyst, as well as a much longer tail that spans Arcadia, Lightbeam, Inovalon etc. Many providers that Signify Research has interviewed in relation to this subject indicate that their EHR vendor is not always their first choice. Procuring the solution that aligns with their priorities to the greatest extent is the priority for many, and often this is where the specialists win.

- Virtual Care and Remote Patient Monitoring (RPM) vendors. The “last mile” for supporting and managing patients under VBC contracts is key, and whilst in-person care is paramount, virtual care is increasingly viewed as an essential in-patient activation, support, education and management. RPM use has increased dramatically in the US over the last few years, largely owing to fee-for-service reimbursement structures being put in place. However, RPM’s opportunity to really scale will only be realised under VBC reimbursement structures.

- Cloud infrastructure vendors such as Google, Amazon AWS and Microsoft have the opportunity to leverage partnerships with IT vendors or primary care acquisitions to drive a larger business opportunity – For these vendors, the true revenue driver will come as markets transition from on-premise solutions to the cloud, and the associated storage and compute costs. With no clear winner among cloud vendors, many may hope recent acquisitions will give them a competitive advantage. That said, the journey to the cloud remains only a long-term strategy for with many barriers remaining across healthcare IT markets.

Walls Come Tumbling Down

The arrival of retail in primary care marks another chapter in the US VBC story. With primary care being performed at scale for the first time, many of the barriers that were blocking the growth of VBC, at least pre-Covid, are finally being dismantled.

While driving this transformation, the large retail chains are moving further away from their roots. Ironically, however, it is their traditional advantages – physical reach and brand names – which will continue to determine their success in primary care provision.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net

More Information

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 986111

www.signifyresearch.net