Written by

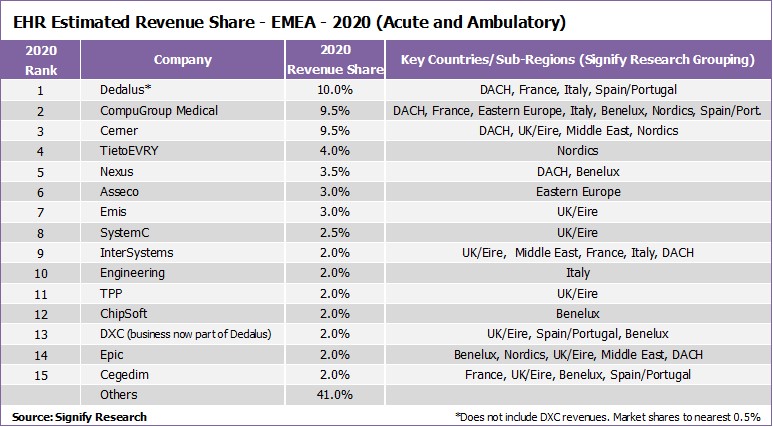

23rd September 2021 – The EMEA market for Electronic Healthcare Records (EHR) IT is estimated to have been worth $4.2B in 2020 (up by 5.5% on 2019) according to Signify Research’s latest global EMR Market Intelligence Service update. Due to a series of acquisitions and divestitures over the last 18 months, there is now a new leader in terms of overall EMEA market share in Dedalus.

As detailed in our April 2021 insight (Dedalus Completes Acquisition of DXC’s Provider Healthcare Business), Dedalus has grown rapidly over recent years via a series of acquisitions and to a lesser extent organic growth. The company is well-positioned to extend its leading share further in 2021 following the completion of the above-mentioned acquisition of DXC’s healthcare provider business (DXC is counted separately below as the shares are based on 2020 revenues).

In terms of other major movements compared to 2020, CompuGroup Medical moves up to second place owing to its acquisition of parts of Cerner’s European EHR business in 2020.

The table shows shares for vendors that serve primarily the inpatient/acute markets in EMEA (e.g. Cerner, Epic, Nexus, InterSystems), those that have EHR businesses largely dominated by primary care (e.g. Emis, TPP, Cegedim) and those that have a business where both play a major part in terms of revenues (e.g. CompuGroup Medical, Dedalus).

Whilst examining shares for both segments places Dedalus and CompuGroup Medical above Cerner, Cerner is estimated to have still led (just) in terms of revenue share in 2020 when only the inpatient/acute market is examined. However, this is likely to change in 2021 as the DXC business is absorbed by Dedalus, and the full-year impact of the Cerner/CGM deal is felt (only a partial year impact was felt by Cerner in 2020). That said Cerner has gained significantly in terms of new Millennium business in Europe over the last 18 months, particularly in the Nordics, UK, Middle East and Benelux, and this will compensate to some extent for the business lost via its deal with CGM.

Overall, the EMEA EHR market remains highly fragmented (as illustrated by the fact the top 15 vendors only accounted for 59.0% of the market in 2020) with only a gradual move toward consolidation over time (the respective figure for 2019 was 58.5%). However, this picture only rings true at a regional level, particularly for the acute market.

Once the competitive market is examined at an individual country level the market is relatively consolidated, particularly in terms of acute vendor market share. For most European countries five vendors accounted for more than 80% of revenue share in 2020, and in some the consolidation is significantly further advanced (e.g. Denmark and Norway).

About Signify Research’s EHR Market Intelligence Service

Signify Research’s EHR Market Intelligence Service provides regular data, insights and analysis on the global market opportunity for Electronic Medical Records. This includes a rolling publication program of deep-dive country specific market reports, alongside a market database that’s updated on a monthly basis and topical regional/global reports.