Written by

27th July 2021 – Written by Kelly Patrick,

The trend toward value-based care is being seen in several publicly funded healthcare systems. In more recent years, healthcare reform has focused on improvements to health through employing digital health solutions. Specific measures have also been put in place to promote the use of digital health to ensure care provision is monitored and evidence is provided on clinical outcomes. Where healthcare costs are under increasing scrutiny, demand for digital solutions to assess cost efficiency and improve clinical workflow is increasing further. Consequently, the need for clinical information systems to support departments by providing workflow and clinical documentation is growing globally. The transition to include clinical modules within an EHR is subsequently increasing.

The US was the first to focus on “meaningful use” through its HITECH Act, which was used to encourage providers to rollout the use of an electronic medical record (EMR) solution enabling them to receive payments if they hit certain targets. This initially drove demand for EMRs and subsequently the supporting clinical IT solutions that could integrate with a wider system. The Affordable Care Act is now being used to incentivize providers to evolve their EMR in a specific way to support the progression to value-based care. More recently, quality measures have been established to assess hospital efficiency and analysis of avoidable hospital admission to determine value-based reimbursement.

Recent Healthcare Reforms

Several countries were already progressing toward digitising their health systems; however, the COVID-19 pandemic has triggered governments to jump-start their digitalisation plan, with large stimulus funds allocated to accelerate the necessary infrastructure. Some recent reforms of note include:

- In Germany, the Hospital Future Act (announced September 2020) will provide 4.3bn for developing the digital infrastructure of hospitals by 2024. Signify Research’s Alex Green recently provided his take on the German Futures Act here.

- In the UK, significant digital investment was made into the original National Programme for IT and is continuing through the more recent NHS Long Term Plan.

- Healthy China 2030 has promoted the need for health information and data to help facilitate progression toward a healthy China through improvements to health information service systems. There is now more focus on strengthening current IT infrastructure and promoting interoperability and data sharing between departments.

- As part of Japan’s Vision 2035, specific targets have been set to evaluate health technology for value-based outputs, such as efficacy, and set reimbursement rates based on these values and benchmark performance to compare outcomes by 2035.

Other governments are likely to follow globally, further driving demand for digital clinical solutions. Consequently, the international EHR vendors are increasing their focus on this opportunity.

Local EHR vendors and best-of-breed suppliers continue to dominate outside the US

For the High Acuity and Perinatal IT markets, there is a stark contrast in the leading players in the US compared to the rest of the world. There continues to be a global divide in the use of clinical modules/solutions from enterprise-wide EHR vendors such as Cerner and Epic and the use of best-of-breed solutions from vendors such as Philips, GE Healthcare, PICIS and SIS. The US market has a mixture of international EHR and best-of-breed (BoB) speciality vendors, but EHR vendors take the lion’s share. Outside of the US, local vendors and best-of-breed suppliers have more presence, specifically in Latin America, Benelux, France, Germany, China, India and Japan. This is often due to their ability to cater to their local market and their understanding of the local clinical protocols and languages required to support digital solutions. Many of the administrative IT tasks are being transferred to an EHR solution, with the best-of-breed solutions focusing on the advanced clinical aspects of the information systems. As integration continues to improve between solutions, there is still the flexibility of choice, however, cost often becomes the dominating factor in decision making; best-of-breed solutions tend to come at a higher cost.

As the US market reaches saturation, it is expected that international EHR vendors will increase their presence in countries outside of the US; Signify Research has noted an uplift in the presence of EHR vendors providing clinical modules globally. However, they will need to have a targeted approach to each country which will require significant investment and collaboration. Where budgets are less restricted, hospitals are expected to demand solutions that enhance clinical workflow, maintaining preference for best-of-breed vendors. It is likely that these solutions will work alongside the larger integrated EHR solutions to provide the best level of care.

Overview of Market Share

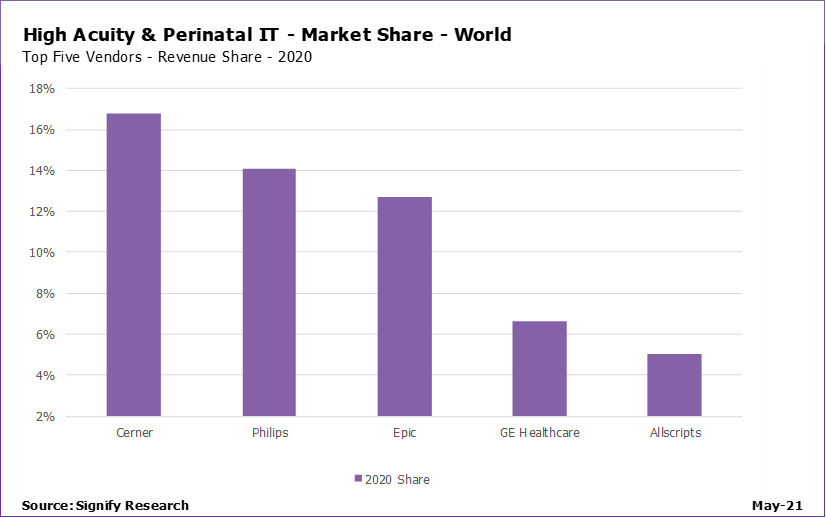

Signify Research recently assessed the presence of EHR vendors and best-of-breed speciality vendors in 2020 across the various High Acuity and Perinatal IT markets at a regional and country level.

Key findings were:

Globally:

- Cerner was estimated to be the global market leader overall for High-Acuity and Perinatal IT in 2020.

- Philips had the second highest market share for High-Acuity and Perinatal IT.

- Like Cerner, Epic plays in all product segments and in 2020 it was ranked third.

- GE Healthcare was ranked fourth in 2020.

In the US:

- With strong positions in the United States, the EHR vendors held a higher combined market share in all segments except the perinatal IT market, when compared to best-of-breed vendors.

Internationally

- The EMEA region has very different healthcare systems, with each country having its own clinical protocols and workflows. Across the region there is a large presence of local vendors due to their knowledge of local healthcare systems.

- International EHR vendors are starting to increase their presence in the more mature High Acuity and Perinatal IT markets such as the Nordics and the UK, however there is still preference for local vendors in the Netherlands, France and Germany. In these countries, providers typically partner with best-of-breed vendors to add more advanced clinical functionality.

- Like the EMEA region, the presence of international EHR vendors is limited in Asia; there is greater presence of local players in each of the larger Asian countries.

- The Asian market for high acuity and perinatal IT is projected to remain dominated by local suppliers, however there will be pocket opportunities for larger international EHR vendors that may be suited for enterprise-wide deals.

About the Report

“High Acuity and Perinatal IT Report – World – 2021” provides a data-centric and global outlook of the high acuity and perinatal clinical information systems markets. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net

More Information

E: enquiries@signifyresearch.net

T: +44 (0) 1234 436 150

www.signifyresearch.net