Written by

February 21st 2022 – In January 2022, ICU Medical announced that it had completed its acquisition of the Smiths Medical Division from Smiths Group Plc.

- Smiths Medical’s business includes syringe and ambulatory infusion devices, vascular access, and vital care products. It generated just under £1 billion in revenue in 2020. It had been part of Smiths Group plc prior to the acquisition.

- ICU Medical was formed in 1984 by George Lopez and acquired the Hospira infusion line from Pfizer in 2017. ICU Medical’s infusion therapy line includes infusion systems, infusion sets, IV solutions and associated software and services. ICU Medical’s wider product offering includes oncology, critical care, and speciality solutions. Its net sales in 2020 was just over $1.2 billion.

- The combination of ICU medical and Smiths Medical business will generate an estimated pro forma combined revenue of approximately $2.5 billion in 2022.

- The acquisition aims to support the expansion of ICU Medical’s infusion therapy product line and expand the portfolio into newer clinical care markets.

The Signify View – Impact on the infusion pump market

ICU Medical has been increasing its global share of the infusion pump market for several years. Its acquisition of Hospira’s critical care business in 2017 enabled it to gain a strong foothold in the large-volume infusion pump market and boost its presence both in the US and internationally. Its broader offering in monitoring and oncology has also enabled it to expand its reach into wider clinical markets.

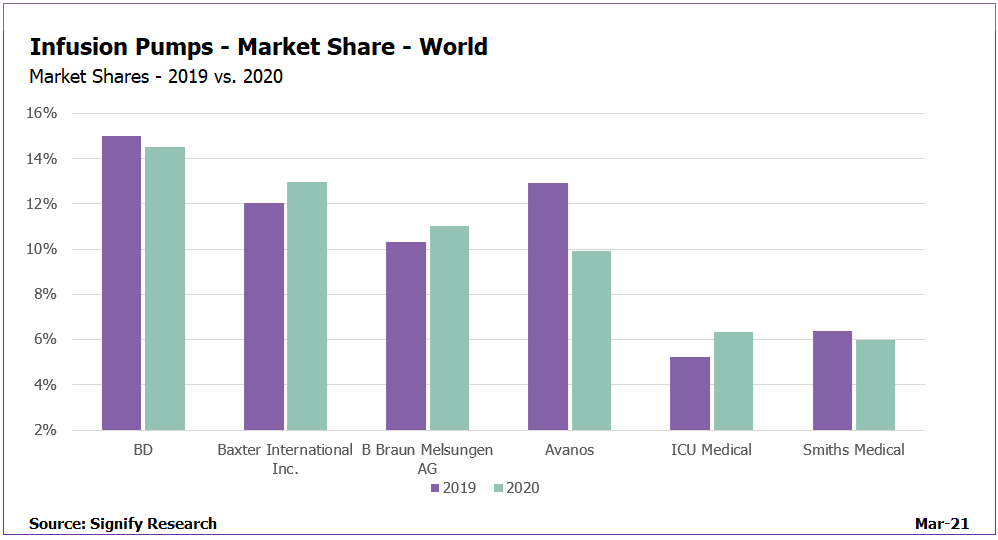

COVID-19 has impacted the infusion market significantly over the last two years and Signify Research estimates that ICU Medical gained share in 2020 over 2019, partly owing to COVID’s impact. ICU Medical has a strong presence in the North American infusion pump market due to the legacy position of Hospira’s solutions. Smiths Medical has also been a core player within the infusion pumps market for several years and held a strong position in the syringe, patient-controlled analgesia (PCA) and ambulatory infusion markets. Smiths Medical also had a strong presence in the North American region.

Smiths Medical has a broader offering of solutions, ranging from infusion to patient monitoring and respiratory care. The company has held spin-off discussions for several years and was planned to be separated from the Smiths Group PLC in 2020. However, the pandemic halted this movement temporarily. In August 2021, initial announcements were made that Smiths Medical was to be acquired by Trulli Bidco Limited, a wholly owned subsidiary of funds advised by TA Associates LLP. However, this was soon replaced by the offer from ICU Medical and subsequent closure of sale in January 2022.

Impact on market share

Signify Research estimates that the combined infusion product offering from both Smiths Medical and ICU Medical will position the combined company well to gain share, and it is expected to compete with BD, Baxter, and B Braun for a leading position of the global infusion market.

How will the wider clinical care market be impacted?

The combination of product portfolios from both ICU Medical and Smiths Medical will enable the company to expand its offering not only within the infusion market but also across other clinical care markets. Developing a broader product offering to enable more comprehensive purchases across the care continuum has been one of the drivers of several other recent acquisitions and was a key element in this deal. Movement toward value-based care has resulted in healthcare purchasers assessing the complete offering each company is able to make, in addition to their return on investment. Digital solutions have become increasingly important to help record and monitor real-time patient data. This has also driven the need for interoperable solutions that can communicate with other devices in addition to electronic health records, both in the hospital and the home. By developing a stronger product offering across clinical markets vendors can support a wider number of clinical practices and support streamlining not only purchasing processes, but also clinical workflow.

The two companies are also likely to not only assess their infusion operations, but their wider offerings in the patient monitoring and information systems markets. Movement toward digital solutions has created opportunities for vendors to further enhance clinical practice with newer advanced solutions and supporting services. Similar movements have been made within the infusion, patient monitor, cardiology, and respiratory markets, where acquisitions have been made to enhance and increase the clinical offering from the purchasing company. Signify has discussed several of these in recent insights and is taking note of their impact on the market positioning of these players in upcoming market intelligence reports. Some of those discussed include:

- Baxter Healthcare’s acquisition of Hillrom (who had acquired several companies prior to its acquisition)

- Nihon Kohden‘s acquisition of AMP3D

- Philips acquisitions of Cardiologs and Biotelemetry (and Capsule Technologies)

- Getinge‘s acquisition of Talis Clinical LLC

Closing remarks

Interest in the clinical markets has been increased following on from the pandemic, leading to several companies looking to enhance their product lines with additional solutions. Investment into research and development is often costly, and the addition of a well-established solution via acquisition seems to be an easier route to market for international vendors. There are fewer developments of new product launches that have triggered as much discussion. However, launch of solutions from smaller vendors that largely serve just their domestic market, especially those in China, have been more frequent. Once the acquisition trend settles, the launch of new products is expected to come from these newly established organisations to help compete in the increasingly competitive environment.

Related Reports

Signify Research has assessed the infusion, patient monitoring, ventilator, anaesthesia and diagnostic cardiology markets in its report Clinical Care Devices Market Impact Report – World – 2021. The report provides a regional and global outlook on the current and projected uptake of clinical care devices. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the specific markets. Signify is also about to start the scoping for its new deep-dive analysis of the infusion pump market. If you would like to learn more about this research, or discuss your specific research requirements, please do get in touch.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net

More Information

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 436 150