Written by

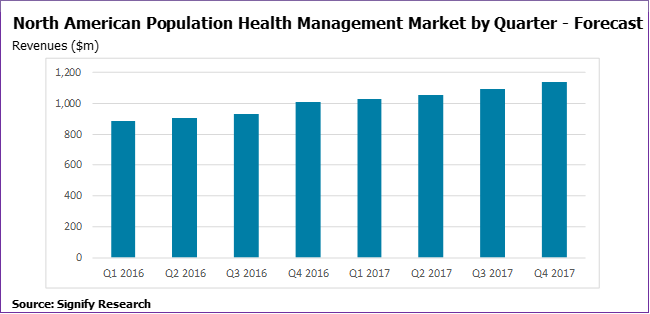

- The North American Population Health Management (PHM) market is projected to grow by 15.7% in 2017 to reach $4.3B. This is up from $3.7B in 2016.

- However, uncertainty around the future of Obamacare is forecast to have some short-term negative repercussions over the coming quarters, resulting in lower QoQ growth than that seen in 2015 and 2016.

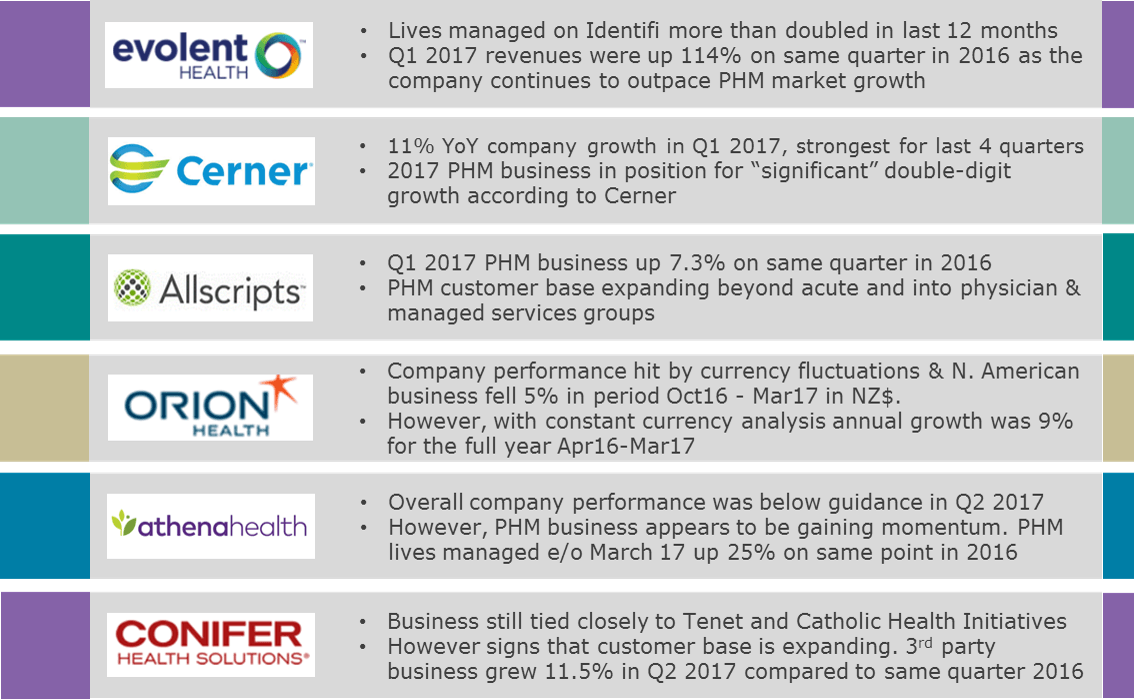

- Analysis of the Q1 2017 results of six leading PHM vendors (Evolent Health, Cerner, Allscripts, Orion Health and Conifer Health) is presented in this insight to test this market projection.

Analysis

In Signify Research’s recently published North American population health management (PHM) market report, uncertainly around the impact of the Trump administration’s changes to the Affordable Care Act (ACA) was forecast to have some short-term negative impacts on PHM market growth in 2017. However, the negative impacts were projected to be minimal, with growth forecast to remain relatively strong as many of the underlying factors driving the market would persist. As several leading public companies involved in the PHM market have now published Q1 2017 results, now is a good time to test this assumption and examine what these early indicators mean for the overall PHM market in 2017.

The results of several leading public companies that have PHM driving a significant share of their businesses are discussed below:

Evolent Health

Evolent Health saw the number of lives managed by its Identifi platform increase from 1.2 million at the end of March 2016 to approximately 2.8 million at the end of March 2017. During this period it has also more than doubled the number of “revenue-producing partners” with revenues for the company up 114% in Q1 2017 compared to the same period last year.

It should be noted that these revenue figures and the platform user numbers include business in other areas beyond PHM, such as delivery network alignment, financial and administrative performance and pharmacy benefit management. However, a significant proportion of Evolent Health’s business is estimated to be driven by platform customers utilising its population health management modules. This share has increased over the last 12 months via its acquisition of Valence Health.

The performance of Evolent Health PHM business over the 12 month period to March 2017 outpaced the market. It is estimated to have jumped from being the eighth largest PHM vendor at the start of 2016 to the fourth largest by the end of the year. This first quarter’s performance suggests that it is continuing to gain share during 2017, but this alone does not give a clear indication as to how the market as a whole is performing.

Allscripts

Allscripts’ PHM business grew 7.3% in Q1 2017 to reach $59.1M. During the quarter, the company continued to add to its CareInMotion PHM customer base and expand its CareInMotion clients beyond the acute market and into physician practices and managed services organisations.

Allscripts also expanded the functionality of the patient engagement component of its PHM solution, FollowmyHealth, which is also assumed to have aided it to drive additional business.

However, YoY PHM business growth of 7.3%, while strong, is below the Signify Research projection for 2017 and lower than that seen by Allscripts in the previous two quarters, suggesting that it is feeling some of the effects of the negative sentiment that healthcare reform is bringing.

Cerner

Cerner’s overall business grew 11% in Q1 2017 compared to the same period in 2016. This was much stronger YoY performance to that which it experienced over the previous three quarters.

Over the last few years, Cerner has gradually increased the share that PHM contributes to its overall business, reaching 4.6% in 2016. It has been assumed that this trend has continued as we move into 2017 and that Cerner’s overall PHM business grew slightly faster than the 11% rate seen for the whole company.

Cerner stated that Q1 2017 has put its PHM business in a position to deliver “significant” double-digit growth over the year and that despite the uncertainty of exactly when a broader shift from fee-for-service to value-based care will occur, there continues to be significant interest in its population health solutions. It went on to state that this has largely been driven by providers understanding the benefit of preparing for the shift to value-based care, well in advance of it occurring. But also in clients using PHM tools to optimise performance in their fee-for-service business model too.

In summary, it is estimated that Cerner’s Q1 2017 PHM business performance was largely in line with the Signify Research prediction for market performance during this period.

Orion Health

Orion Health is another major player in the PHM market. An initial glance would suggest that it has lost share over the last six months. For the six-month period October 2016 to the end of March 2017, the company’s North American revenues fell 5% to NZ$59.8M (US$42.5M). However, this was more due to currency fluctuations and if a constant currency analysis was applied, its North American business grew 9% over its last financial year. That being said, Orion Health is experiencing some challenges as it attempts to implement a rapid transition of its customer base to cloud-based solutions, which to some extent is expected to impact revenue recognition cycles. However, even with the constant currency analysis, growth was below Signify Research’s PHM market growth projection.

athenahealth

athenaheath’s overall business grew 11% in Q1 2017, compared to the same quarter in 2016. This represented a slowdown in YoY growth compared to the last four quarters and performance was below that of the guidance previously given. However, indicators suggest that its population health management business performed better than the wider business. The number of lives managed by its population health management solution reached 2.78 million at the end of March 2017, up 25% on the same quarter in 2016. A clear indication that it’s progressing well in selling the ‚Äòathenahealth Population Health’ solution.

Over the quarter the solution was further expanded in terms of functionality, with the launch of the patient-facing mobile app, athenaWell (a component of its PHM solution). During the quarter athenahealth expanded the rollout of its PHM solution to Dignity Health and went live with Tandigm Health.

The slower than expected overall company growth is estimated to have been more a result of the performance of its athenaOne ambulatory revenue cycle & EHR business where only low single digit growth was achieved.

athenahealth is focusing on expanding its customer base into the acute sector and indications suggest this is proving successful. However, the results further emphasise the importance for EHR vendors in expanding their business beyond traditional EHR and into other areas, such as PHM, if they hope to maintain the growth levels seen over recent years.

Conifer Health Solutions

Conifer Health has established a strong position in terms of revenue share within the PHM market, albeit with strong ties to its two owners, Tenet Healthcare and Catholic Health Initiatives (CHI). Combined these two owners/customers are estimated to have driven around 85% of Conifer’s overall business (this includes PHM and other product lines) during 2015 and 2016. However, Q1 2017 results suggest that despite comparatively slow growth (4.4% compared to the same quarter in 2016), it is starting to have success in expanding its customer base. Revenue from 3rd parties grew much faster at 11.5% in Q1 2017.

For Conifer to continue to hold share as the PHM market grows it’s imperative that it continues this expansion of its customer base. In fact its revenues from Tenet fell 5% in Q1 2017, reinforcing this message.

As an indicator of wider PHM market growth during the quarter, its success in driving 11.5% growth in terms of 3rd party business is perhaps the better metric to use than its internal business with Tenet. The fact the company’s PHM success is so tightly aligned to its business with just two companies also makes its financial performance less telling than other companies presented in this insight when attempting to judge overall market performance.

Key Takeaways

Combined, these results indicate that the PHM market is still enjoying solid growth. However, the uncertainty around legislation is without doubt a concern and our forecast that QoQ growth during 2017 will be slightly down compared to previous years looks accurate. That being said, the projection for double digit growth in 2017 still appears on track.

Although the Trump administration’s intention to repeal the ACA has brought with it some uncertainty, the assumption that the underlying factors driving PHM growth (such as the move to value-based care) would persist, appears to be holding true so far. With most of the dialogue around changes to Obamacare and the Republican alternatives being focused on insurance reform, not care delivery reform, we expect the PHM market to continue to experience strong growth into the medium term.

This analysis is focused on the results of a small (albeit important) group of PHM vendors, and specifically those that are publicly quoted. Signify Research will be publishing an update of its North American PHM market report in September and a more comprehensive analysis of all vendors active in this market will be presented then, along with a thorough analysis of market performance during the first six months of 2017.

New Market Report from Signify Research

The market data presented above is taken from Signify Research’s just published report on the North American PHM market. The report is a component of the Signify Research “PHM & Telehealth Market Intelligence Service”. Vendors tracked include Aetna, Allscripts, AthenaHealth, AxisPoint Health, Caradigm, Cerner, Conifer Health, eClinicalWorks, Enli, Epic, Evolent, HealthCatalyst, Humana/Transcend Insights, IBM Watson Health, McKesson, Medecision, Meditech, NextGen, Optum, Orion Health, Premier Inc., Verscend, ZeOemga and others. The report provides quarterly market estimates for 2015 & 2016, and annual forecasts by vertical, function, service type, platform delivery and country to 2021.

For further information about purchasing this report please contact Alex.Green@signifyresearch.net.