Written by

Last week saw the announcement that Medecision is to acquire 58 AxisPoint Health platform clients with the intention to transition these customers to Medecision’s Aerial population health management platform. The deal could potentially move Medecision rapidly up the rankings in terms of PHM market share, in particular within the payer-focused market. Here’s our analysis of the deal.

Medecision’s PHM Offering & Business

Medecision is a US-based provider of population health management technology and is a wholly-owned subsidiary of the US healthcare insurer Health Care Service Corporation (HCSC). The company’s Aerial platform is a modular platform that includes elements that support risk stratification, analytics, patient engagement and care coordination. The Aerial customer base is dominated by commercial payer organisations such as its owner HCSC, but also others including United Health Group. Its strengths lie in the large number of lives already managed by its platform, its strong relationships with the payer market (particularly the commercial payer market), but also the fact that its solutions are used by a variety of customer types beyond payers, such as care delivery organisations (CDOs) and employers. It also has a comparatively wide range of care management programs accredited by the National Committee for Quality Assurance (NCQA) and benefits from a comprehensive patient engagement solution that is supported via a strategic relationship with Emmi Solutions (owned by Walters Kluwer).

AxisPoint Health’s PHM Offering & Business

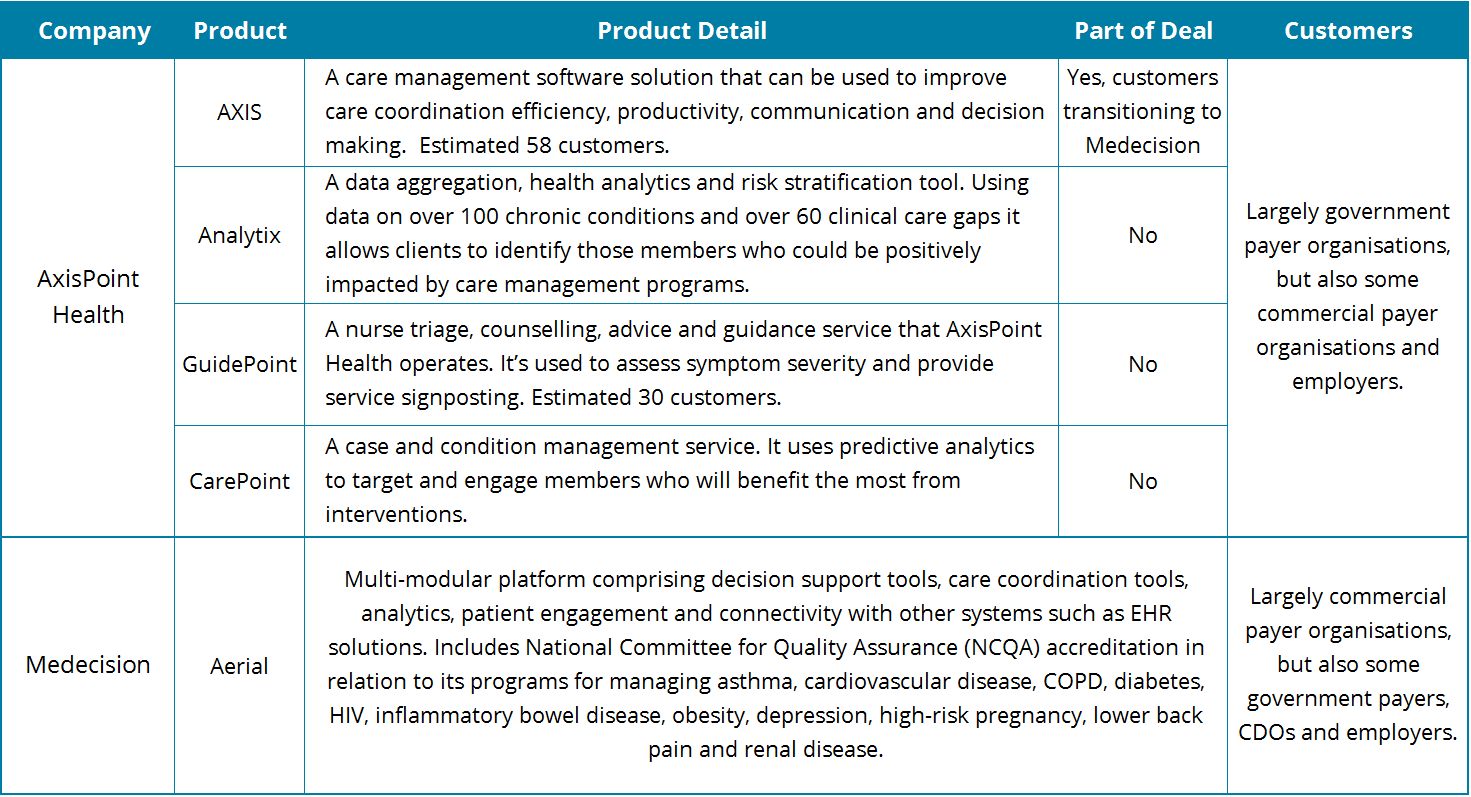

AxisPoint Health was formed when McKesson spun off its payer-focused care management business to Convest Partners in 2015. The company addresses the PHM market via four solutions, namely AXIS (a care management platform), Analytix (a data aggregation, analytics and stratification solution), GuidePoint (a nurse triage service) and CarePoint (a case and condition management service).

The AXIS platform has been the most successful of AxisPoint Health’s solutions in terms of customer numbers, and is the main product used by the 58 customers that Medecision is acquiring. By comparison, the GuidePoint service is estimated to have around half this number of customers, with Analytix and CarePoint representing a sub-set of that customer base.

AxisPoint Health’s business is driven largely by government payer organisations (e.g. Medicare, Medicaid), but the company has also had some success within the commercial payer market. In terms of customer numbers, its business is dominated by AXIS platform customers. Though the services elements of the company’s portfolio are estimated to account for around two thirds of sales revenues. This includes some platform support service revenues from the AXIS platform (which will now transition to Medecision). However, most of this services business is professional services (e.g. nurse triage services) driven from the GuidePoint and CarePoint offerings, which will remain with AxisPoint Health and is not part of the deal.

Why the deal is good for Medecision & AxisPoint Health

The fact that both companies’ PHM businesses are focused on the payer market (as opposed to the provider market) means that synergy already exists between the two businesses and products. With the Aerial platform already optimised for payer customers this should aid in the transition of AxisPoint Health customers from the AXIS platform to Aerial. AxisPoint Health’s success within the government payer market will also aid Medecision expand its business beyond the commercial payer market, while still allowing it to position itself as a specialist vendor for insurers.

Medecision has already established itself as a leader in the North American PHM payer segment where it is estimated to have been the 4th largest vendor in terms of revenues in 2016. AxisPoint Health is estimated to have been the 6th largest in terms of payer generated PHM revenues in 2016. Assuming the successful migration of the AXIS platform customer base to Medecision’s platform, it would propel Medecision to potentially the number two position in the payer focused PHM market, with just Optum ahead.

While AxisPoint Health will lose its main platform business it will allow the company to focus more on its services business (CarePoint and GuidePoint) where it has been able to differentiate and drive considerable success historically. A significant question will be around the extent to which it can drive additional Analytix business in the future, or even maintain its existing business. The Analytix module largely supports the AXIS platform and so without it, it may become increasingly difficult to attract and retain Analytix customers.

The North American PHM Market

The North American PHM market is forecast to grow at a CAGR of 16.1% from $3.7B in 2016 to $7.9B in 2021, with the payer market accounting for approximately a quarter of revenues in 2016. Growth is being driven largely by legislation that has been put in place via the affordable care act, that is intended to move health care provision in the US from a fee-for-service to a value-based care structure. The market is highly fragmented in terms of platform vendors and this recent acquisition marks a wider trend towards consolidation within the industry. Others over recent months have included Allscripts’ acquisition of McKesson’s Enterprise Information Solutions Business (albeit with only a small PHM operation transitioning), Optum’s acquisition of the Advisory Board Group’s healthcare business and with it its Crimson PHM offering, and NextGen Healthcare’s acquisition of EagleDream Health, a PHM analytics specialist. However, this Medecision-AxisPoint Health deal differs from those earlier in terms of its importance within the payer segment of the market.

Signify Research Coverage of the North American PHM Market

Signify Research has just published its 3Q 2017 report on the North American PHM market. This report provides market sizing and forecast data for the period 2016 to 2021 with segmentations for vertical (e.g. provider, payer, employer), product (analytics, care management/coordination, patient engagement) and market share data for the leading vendors. Please contact Alex Green – alex.green@signifyresearch.net – for more information on this report.