Written by

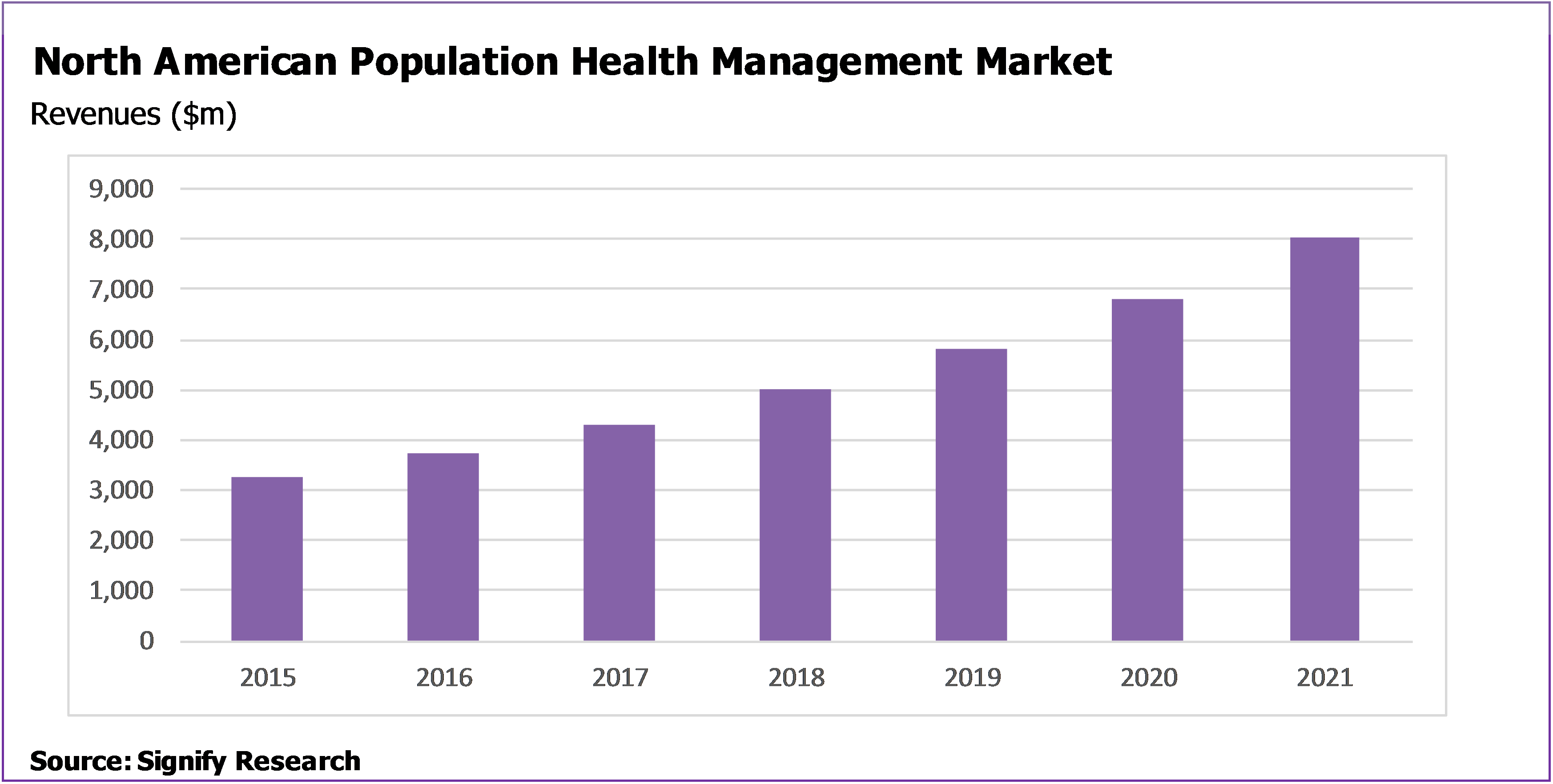

- North American Population Health Management (PHM) market projected to grow at a CAGR of 16.6% from $3.7B in 2016 to $8.0B in 2021.

- Lives managed by PHM solutions will increase from 135 million at the end of 2016 to 245 million at the end of 2021 (Note: one life can be managed by more than one organisation, e.g. a payer and a provider, and would be counted twice in this scenario).

- Analysis and commentary taken from the Signify Research North American Population Health Management IT Market Report

Analysis

Data from Signify Research’s report “Population Health Management IT – North America – 2017” shows that the North American PHM market is forecasts to grow at a CAGR of 16.6% from $3.6B in 2016 to $8.0B in 2021. Over this period, the number of lives managed by PHM solutions is projected to increase from 135 million at the end of 2016 to 245 million at the end of 2021. Solutions will be implemented by a range of organisations such as providers/ACOs, payers, government organisations and employers, in some cases leading to individual lives being managed by more than one entity. The provider/ACO vertical is projected to represent the largest market in terms of both managed lives and platform revenues, with the acute sector driving the lion’s share of the provider market.

Defining Population Health Management

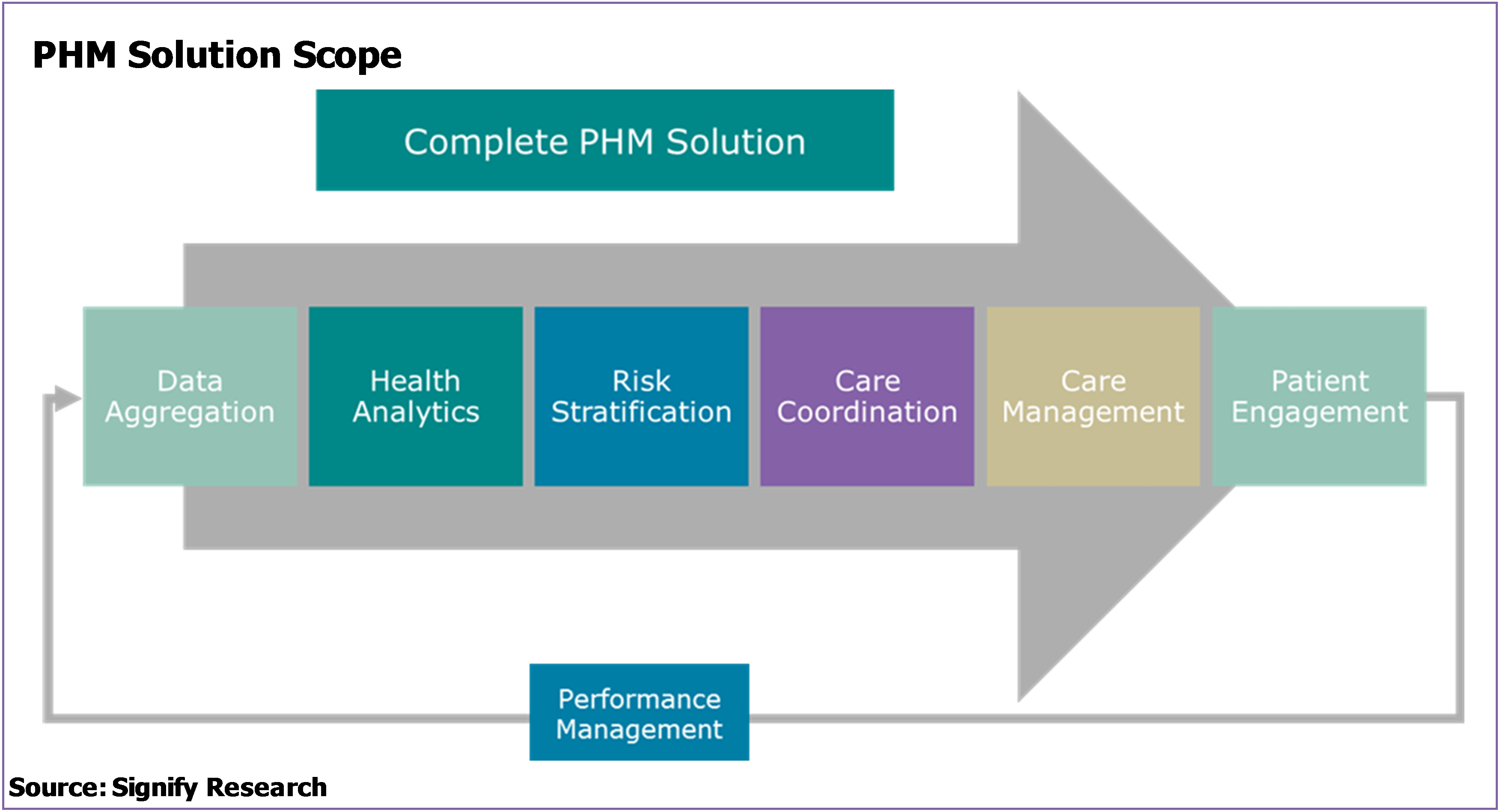

Before digging into the main factors will drive this growth, it’s important first to define what’s included in a PHM solution and in our analysis.

In recent years, a standard structure has evolved in terms of the required components of a population health management platform, and this is a structure that most vendors now adhere to, or are at least working towards, in terms of solutions offered. The structure comprises seven core functional modules:

- A solution to pool and normalise data from multiple sources so that it can be interrogated as one – data aggregation

- A solution to interrogate the normalised data to obtain meaning – health analytics

- A solution that allows the analytics to then be used to drive strategy. Normally by segmenting the population into groups based on health conditions being managed, costs and behaviours – risk stratification

- A solution that allows standard evidence-based care plans and workflows to be developed for specific segments of the population depending on the conditions they are managing, their risk and their likely behaviours – care management

- A solution that allows the specific work flows and care plans to be executed across different health care continuums and care teams – care coordination

- A solution that allows simple, secure electronic communication with patients for messaging, education, data collection, etc. – patient engagement

- A solution that allows for the impact of each work flow and care plan strategy to be measured and fed back into the overall management system – performance management

It’s the market for platforms that support these functions, and the associated implementation and support/maintenance services, that Signify Research has included within its definition of the PHM market and within its projection of an $8.0B market in 2021.

Factors Driving Growth

The factors positively affecting the uptake of PHM solutions in North America are focused heavily on US legislation and attempts to modernise health care provision, such as.

- Elements of the Affordable Care Act that are expected to remain in place

- The move from fee-for-service to value-based care

- Providers taking on risk and the rollout of ACOs

- MACRA

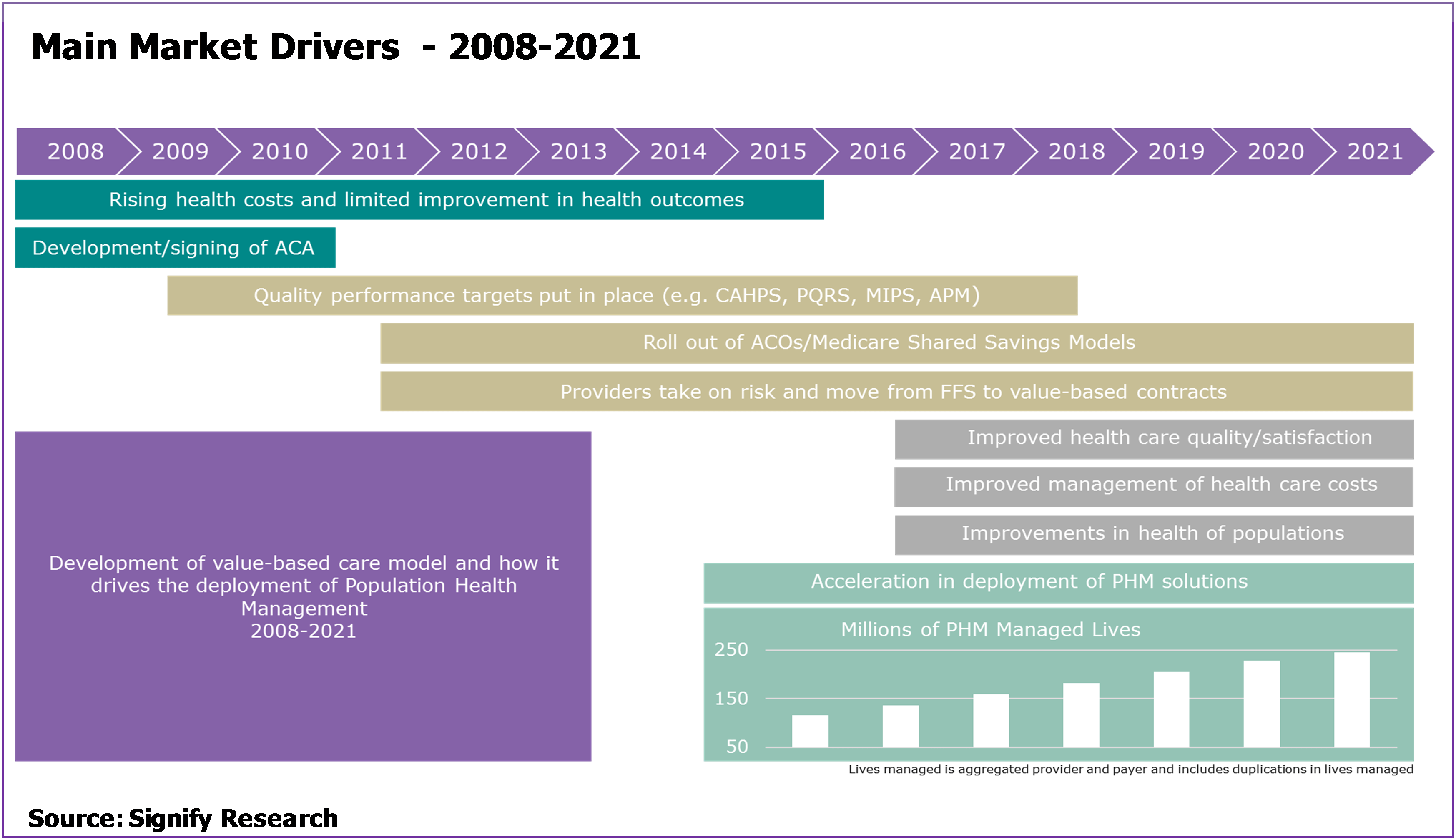

The figure below and the following summary explanation outlines the development of these main themes.

Leading up to 2010 – Poor health outcomes and spiralling health care spending in the US contributed to the development of the Affordable Care Act (ACA).

2011-2015 – To implement ACA, the CMS establishes ACOs and shared savings programs. This encourages providers to better manage their entire population’s health. ACOs receive a share of the financial savings they make from the move to new models of care, assuming quality targets are met. PHM solutions are a key enabler in achieving and measuring these quality and financial targets. Key elements of the ACA that PHM solutions address include supporting wellness services, reducing hospital readmission rates and developing community-based care transition programs.

2016-2019 – MACRA/MIPS targets are established to encourage non-ACO providers to accelerate the move to value-based care. For example:

- MIPS ‘quality measures’ include targets focused on areas such as improving screening rates and controlling blood pressure of those with hypertension.

- MIPS ‘improvement activity measures’ include targets related to the increased use of care plans for chronic condition management (e.g. diabetes management) and the increased use of longitudinal care management for high risk patients, such as those recently discharged from hospital.

- MIPS ‘advancing care measures’ include targets focused on attaining better patient engagement and better care transitions.

PHM platforms provide a range of management tools that have been designed to aid providers and other health care organisations in developing their services in order they improve and report on these measures.

As a note of caution, significant changes to the ACA from the Trump Administration over the period 2017 and 2018 could impact the transition to value-based care. However, the assumption within our market forecasts is that the underlying drivers remain in place.

Beyond 2020 – As the transition to a value-based care model progresses, the triple goal of improved outcomes, improved value for money and improved health of populations starts to be realised. PHM platforms remain a fundamental tool in driving continued quality and financial performance.

New Market Report from Signify Research

The market data presented above is taken from Signify Research’s just published report on the North American PHM market. The report is a component of the Signify Research “PHM & Telehealth Market Intelligence Service”. Vendors tracked include Aetna, Allscripts, AthenaHealth, AxisPoint Health, Caradigm, Cerner, Conifer Health, eClinicalWorks, Enli, Epic, Evolent, HealthCatalyst, Humana/Transcend Insights, IBM Watson Health, McKesson, Medecision, Meditech, NextGen, Optum, Orion Health, Premier Inc., Verscend, ZeOemga and others. The report provides quarterly market estimates for 2015 & 2016, and annual forecasts by vertical, function, service type, platform delivery and country to 2021.

For further information about purchasing this report please click here or contact Alex.Green@signifyresearch.net.