Written by

- Legislative uncertainty has had a tangible short-term impact on the PHM market environment during the first half of 2017

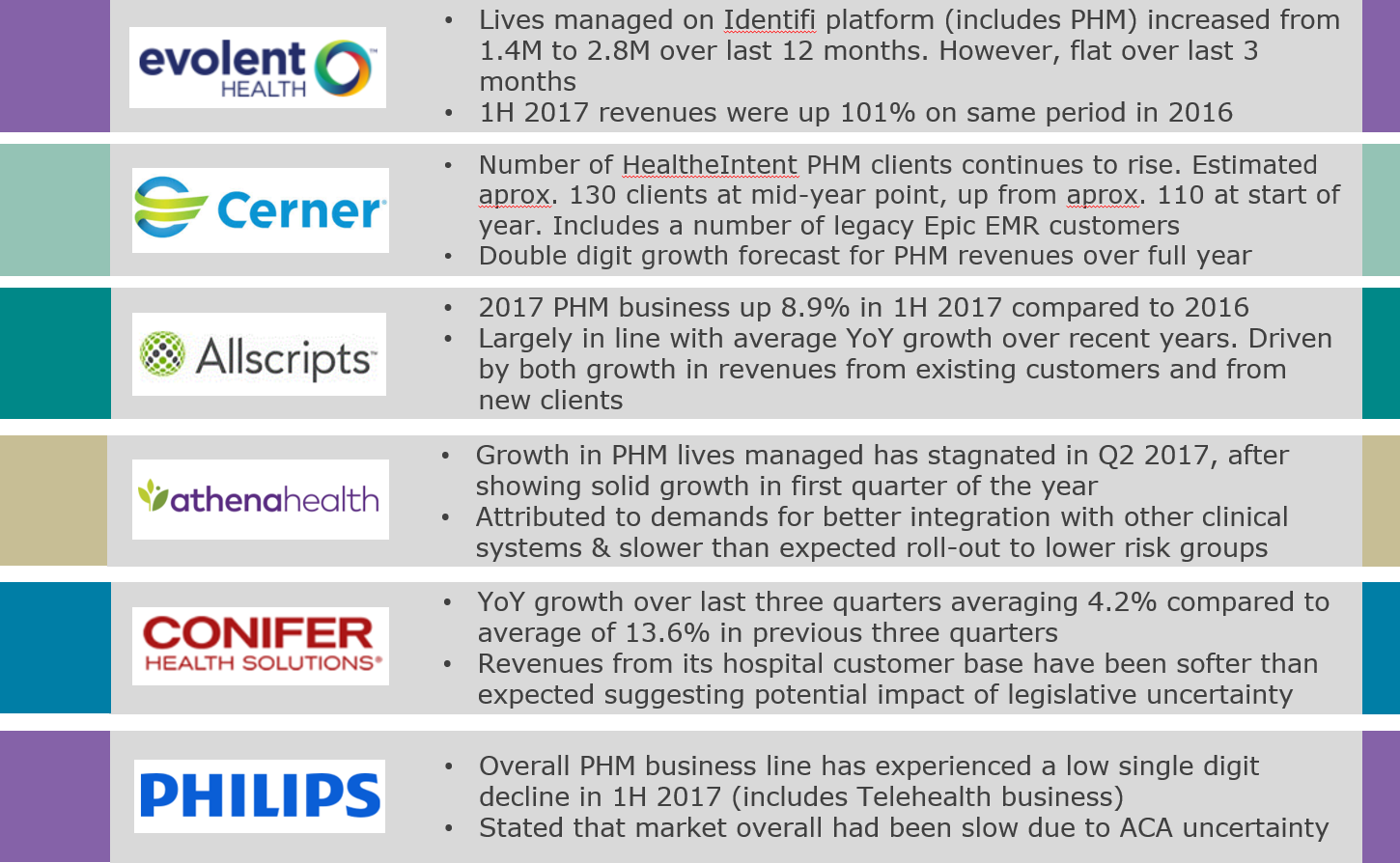

- Analysis of 1H 2017 results of six leading public PHM vendors (Evolent Health, Cerner, Allscripts, athenahealth. Philips and Conifer Health) provides a “mixed bag” in terms of public results.

- Full analysis of the market will be presented in Signify Research’s mid-year PHM market report in September

Analysis

Signify Research will publish its Q2 2017 North American population health management market report in the coming weeks. A key question that will be addressed is the extent to which uncertainly around US health legislation reform has impacted the PHM market in North America during the first half of this year.

The 1H 2017 results of several leading public companies with PHM businesses are discussed below as a scene setter to Signify Research’s upcoming report:

Evolent Health

Evolent Health saw the number of lives managed on its Identifi platform increase from 1.4 million at the end of June 2016 to approximately 2.8 million at the end of June 2017. Revenues for the company have more than doubled during the first half of 2017 compared to the same period in 2016; it has also nearly doubled the number of customer over this period too.

It should be noted that these revenue figures and the platform user numbers include business in other areas beyond PHM, such as delivery network alignment, financial and administrative performance and pharmacy benefit management. However, a significant proportion of Evolent Health’s business is estimated to be driven by platform customers utilising its population health management modules. This share has increased over the last 12 months via its acquisition of Valence Health.

The above results paint a relatively positive picture, but digging underneath there are some concerns. The business is still operating at a loss, and it is now not expecting to break even this financial year. Further, whilst the number of platform users has doubled over a 12-month period, they’re relatively flat compared to Q1 2017.

In terms of revenue Evolent continues to grow at a rate that out-performs Signify Research’s projection for PHM market growth in North American in 2017. However, the lack of growth in terms of lives managed on its platform over the last three months does raise some concerns for the remainder of the year.

Allscripts

Allscripts’ PHM business grew 8.9% in the first half of the year to reach $118.8M. Growth was driven by non-recurring software delivery revenue associated with client expansion, new client sales of population health solutions, and non-recurring project-related client services revenues. The company’s recent acquisition of McKesson will also give it an additional internal EMR customer base to expand its PHM solution into.

PHM revenue represented approximately 14% of the company’s overall revenues. This was slightly down on recent quarters and is reflective of the strong growth seen in the legacy Netsmart business line.

In terms of profile over the last two quarters, greatest PHM market growth was seen in the 2nd quarter of the year. Many of the PHM vendors that Signify Research has interviewed as part of the research process had reported that revenue growth was slower in the first quarter due to customer sentiment; however, growth rates bounced back in Q2 2017. It would appear Allscripts PHM business has followed a similar pattern.

Cerner

Over the first two quarters of this year Cerner has performed relatively well in terms of adding new PHM clients as well as expanding the range of HealtheIntent PHM modules that existing clients purchase. Its PHM customer based is estimated to have expanded from approximately 110 clients at the start of the year to approximately 130 at the mid-point. This was made up of mostly provider networks, but also employers, government agencies and payers. New additions/new contracts announced over the first half of the year include Carolinas Healthcare, St Joseph’s Health Care, Truman Medical Centre and San Juan Regional Medical Center. It can now also boast a number of Epic EMR customers that have chosen Cerner as their PHM solution provider.

Cerner’s overall business grew 6.3% in Q2 2017 compared to the same period in 2016. The share of this business that is driven by PHM is relatively small. However, over the last few years Cerner has gradually increased this share so that PHM contributed to 4.6% of business in 2016. It has been assumed that this trend has continued during the first half of 2017, although the change is not estimated to have been dramatic.

athenahealth

athenaheath’s overall business grew 15% in Q2 2017, compared to the same quarter in 2016. This was somewhat of a bounce back compared to a disappointing first quarter and is in line with the overall growth guidance for the company for the full year.

In contrast to the first quarter where PHM growth (in terms of lives managed) was strong, net additions to athenahealth’s PHM platform numbered less than 4,000 in Q2 2017, compared to over half a million in the previous quarter.

This does raise some concern after a particularly strong first quarter for PHM growth. The company attributed this slower growth in the last quarter to provider demands for better integration of PHM solutions with other clinical systems & the slower than expected roll-out of PHM within its existing customer base to lower risk groups of the population.

Conifer Health Solutions

Conifer Health has established a strong position in terms of revenue share within the PHM market, albeit with strong ties to its two owners, Tenet Healthcare and Catholic Health Initiatives (CHI). Combined these two owners/customers are estimated to have driven around 75% of Conifer’s overall business (this includes PHM and other product lines) over the last quarter.

Q2 2017 results show that the business has grown 3.6% compared the same quarter in 2016. This compares to respective growth of 4.4% in Q4 2017 and 4.7% in Q4 2016. These last three quarters demonstrate significantly lower growth than that seen during the first three quarters of 2016 where YoY growth ranged from 12.5% to 14.7%, suggesting that Conifer’s business has to some extent been impacted by legislative uncertainty. However, its reliance on its two owner-customers does blur the message to some extent.

Philips

Philips PHM business sits within the company’s Connected Care and Health Informatics business line. This business line has grown 2.7% in the first half of 2017. However, the PHM sub-segment of this business line was not the driver of this growth.

The PHM sub-segment (which includes Philip’s telehealth product lines along with the legacy Wellcentive business) represented approximately 8% of Connected Care and Health Informatics in 2016. This segment has seen a low single digit decline in the first half of 2017 compared the same period in 2016, with ACA uncertainty being given as one of the underlying reasons behind this decline.

Key Takeaways

Combined along with the reported PHM market date from other leading PHM vendors, these results do indicate that, with some exceptions, typically vendors have seen a tangible negative impact from the legislative uncertainty that has defined the US market place over the first half of 2017. Signify Research will be lowering its projections for 2017 PHM market growth in our market update from the low teens to high single digit in our forthcoming update.

Many PHM vendors have reported that the first quarter of the year did present a particularly challenging market environment, with some orders being delayed. Some vendors have continued to see a challenging environment continue in the second quarter, although in general a more positive sentiment has returned. Fundamentally, vendors and their customers expect the transition to value-based care to continue and the regulations and mechanisms that have been put in place to help drive this to remain. However, legislative uncertainty has resulted in a short-term slowing this process.

This analysis is focused on the results of a small (albeit important) group of PHM vendors, and specifically those that are publicly quoted. Signify Research will be publishing an update of its North American PHM market report in September and a more comprehensive analysis of all vendors active in this market will be presented then, along with a thorough analysis of market performance during the first six months of 2017.

New Market Report from Signify Research

This analysis is a scene setter for Signify Research’s mid-year update report on the North American PHM market. The report is a component of the Signify Research “PHM & Telehealth Market Intelligence Service”. Vendors tracked include Aetna, Allscripts, AthenaHealth, AxisPoint Health, Caradigm, Cerner, Conifer Health, eClinicalWorks, Enli, Epic, Evolent, HealthCatalyst, Humana/Transcend Insights, IBM Watson Health, McKesson, Medecision, Meditech, NextGen, Optum, Orion Health, Premier Inc., Verscend, ZeOemga and others. The report provides quarterly market estimates for 2015, 2016 & 2017, and annual forecasts by vertical, function, service type, platform delivery and country to 2021.

For further information about purchasing this report please click here or contact Alex.Green@signifyresearch.net.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

To find out more:

enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net