Following in-depth interviews with over 30 Population Health Management (PHM) vendors, Signify Research published its 2018 PHM report at the end of June. This insight will be the first part of two articles sharing data from the report. This one covers the overall market sentiment and trends seen throughout 2017 and 2018. Later in July we will also release an overview of our competitive environment findings, touching on the top-line trends for some of the major groups of vendors.

Below we have broken out some of the key highlights and market trends from our research:

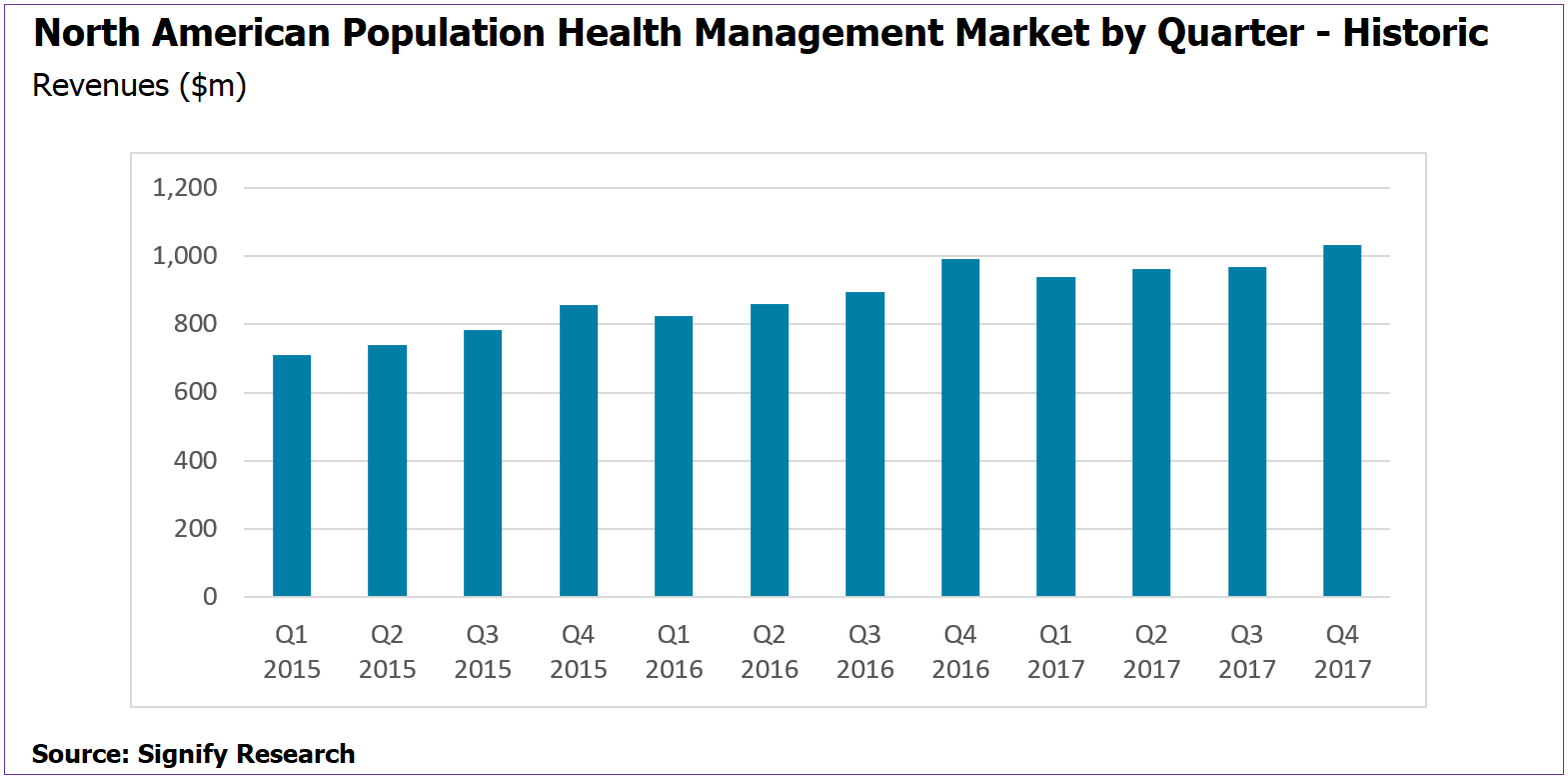

- North American market growth fell below 10% YoY in 2017 for the first time since Signify Research started tracking the market

- Market estimated two be worth $3.9B in 2017. Within the report market share estimates for more than 30 vendors are presented.

- CAGR 2017-2022 forecast at 11.6%

- Q1 2017 saw the market decline QoQ, although growth resumed for the subsequent quarters of 2017

- The market remains fragmented but is slowly consolidating around a smaller group of leading vendors

The General Consensus

Overall, 2017 ended up being quite a disruptive year for the PHM market. The market is maturing, with growth starting to slowdown and only a handful of vendors able to maintain the >20% YoY revenue growth which had previously been the norm. Consolidation at the top of the market has continued to pick up pace through M&A activity, while at the bottom, VC funding is slowing down from its peak in 2016.

Moreover, the future of the Affordable Care Act (ACA) still remains uncertain half way through 2018. Payer and providers have opted to push on with their move away from the current fee-for-service (FFS) models despite the uncertainty, with any ACA reform expected to continue the push towards value-based care.

This uncertainty around ACA reform was one of the key challenges vendors discussed during our research, with many sharing mixed results and thoughts on future trends. The general consensus was that the momentum that had been building from 2016 was frozen in Q1 2017 as healthcare procurement opted for a ‚Äòwait and see’ approach.

However, healthcare procurement picked up over the remainder of the year with some of the smaller solution specialist vendors able to navigate this period of uncertainty particularly well. Vendors employing a one-size-fits-all solution strategy were often less able to adapt to the more demanding market environment. More nimble vendors that specialise in specific PHM functions and verticals were, in many cases, better positioned to maintain the growth rates seen in previous years.

Changing Focus for Market Leaders

Key focus areas for product development announced at HIMSS 2018 were the increased use of Social Determinants of Health (SDOH) and the addition of AI/machine learning into analytics solutions. Providers or payers looking to enhance their risk stratification strategy are increasingly looking for solutions that use data beyond just claims and clinical data and SDOH has a key role to play here. Several companies, such as Caradigm, Innovaccer, SCIO Health Analytics and LexisNexis are developing new solutions that heavily expand the sources of data used in the stratification process. Signify Research forecasts that the breadth of information used to support risk stratification will be a key battleground for vendors over the next two years.

While the use of AI algorithms in analytics and risk stratification modules for PHM is still in its infancy, those vendors experimenting with machine learning believe they can drive further cost savings for their customers against their competitors. AI solutions are being rolled out to the market, with the growing potential to bring together care management pathways and outcome measurement data to further enhance the effectiveness of these models. Some of the PHM vendors first to market with AI solutions for PHM include Orion Health, Allscripts, Health Catalyst, Philips and Lightbeam. While more are forecast to follow over the short-term, there is still uncertainty as to whether vendors will be able to charge extra for AI-based modules. It is Signify Research’s view that in the medium-term AI will become a standard feature of risk stratification tools and it will be used more as a product differentiator than a direct additional revenue generator.

We have also observed some vendors changing their mid-term growth strategy in 2017 and 2018. Many vendors are quoting large increases in lives managed on their platforms, without seeing like-for-like increase in their PHM revenue. These vendors have typically taken on much lower-acuity populations at the cost of falling Per Member Per Month (PMPM) revenue. Vendors adopting this model are underpinning long-term growth against their ability to upsell the higher-value care coordination, care management and patient engagement solutions to increase disease prevention and future cost savings within these populations.

Providers’ Tastes are Maturing

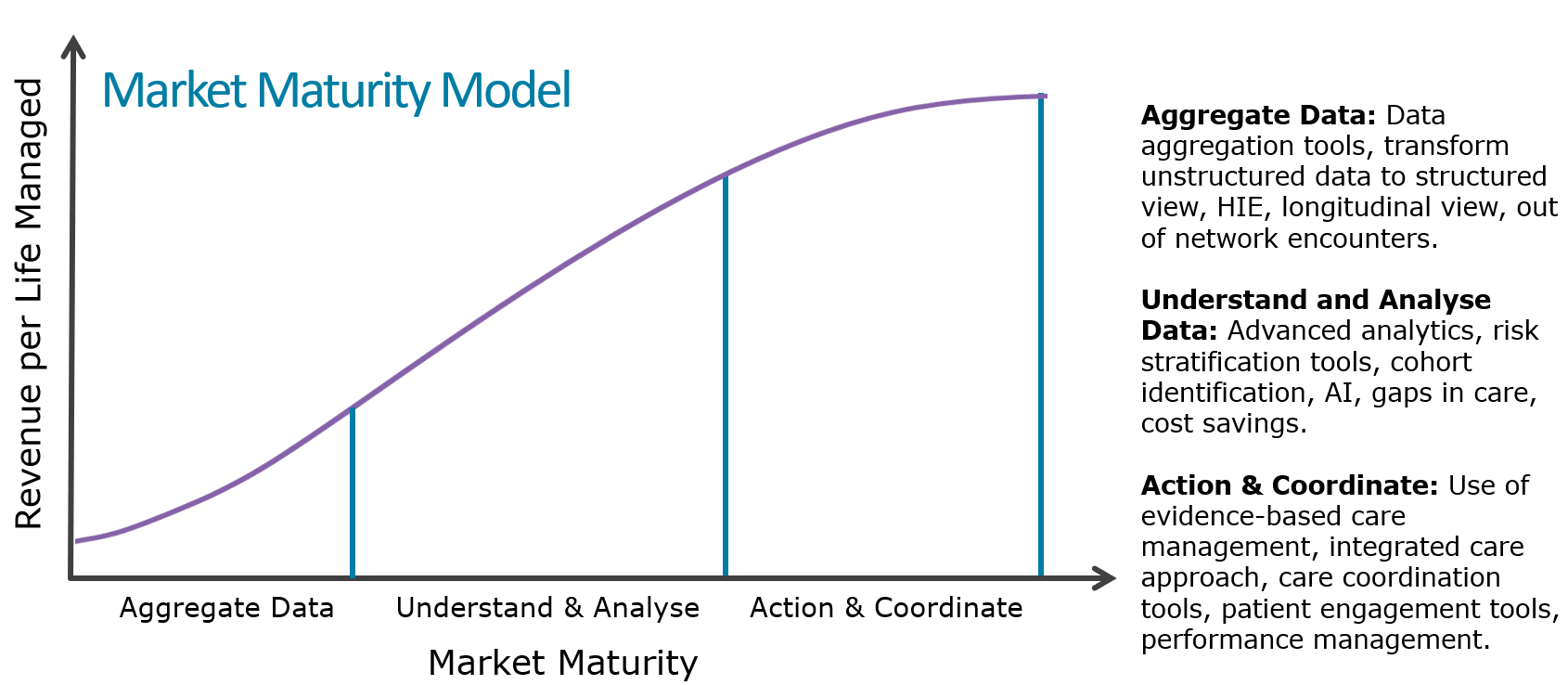

Looking at the PHM Market Maturity Model (below), tools that support data aggregation/analytics/risk stratification are estimated to have been the largest revenue generators in 2017. For many healthcare organisations data aggregation and analysis represented the first step into PHM. However, the “action” element of PHM has gained importance as the market matures, driving greater use of care management, care coordination and patient engagement tools.

Future growth for these vendors taking on the lower-acuity populations will ultimately be tied to the maturity model and the potential to upsell their “action” PHM models for preventative health within this population. While Signify Research believes that a certain level of success with this strategy is likely, there will be significant challenges as provider and payers are less willing to “spend big” managing lower-acuity populations where the potential cost-savings are much less.

That said, across all acuity levels, the aggregation/analytics/stratification market is forecast to grow at a slower rate compared to that for care coordination, care management and patient engagement solutions as providers’ and payers’ use of PHM matures.

Despite the market maturity model suggesting that future growth is tied to greater use of care management/coordination and patient engagement modules, several specialist vendors that have historically focused on data aggregation (e.g. Arcadia.io, Health Catalyst and Forward Health Group) were still able to drive significant revenue growth in 2017.

Takeaways

In summary, 2017 turned out to be quite a disruptive year for the PHM market. The days of >20% market growth are behind us now as the market starts to mature and consolidate around a smaller group of vendors.

Many vendors have medium-term business plans based on much higher PMPM rates compared to those seen today. The challenge going forward will be to reverse the decline in revenue per life managed seen in recent years by convincing providers, payers and other platform users that they require a wider set of PHM modules and services.

About the report

This article acts as a summary from some of the findings from the Signify Research 2018 Population Health Management – North America market report published in June 2018. This report is the third edition Signify Research has published, providing quarterly market estimates for 2015, 2016 & 2017, and annual forecasts by vertical, function, service type, platform delivery and country to 2022. This is part of the Signify Research “PHM & Telehealth Market Intelligence Service” and comes with a mid-year update due for publication in September.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.