Written by

- The Population Health Management Market (PHM) has been driven by the Affordable Care Act (ACA) reforms in the US, resulting in North America dominating the global market

- Government led integrated care initiatives, along with health care organisations in many countries grappling with the same issues that drove much of the ACA reform, has resulted in several emerging PHM markets outside of North America

- Next week Signify Research will publish a dedicated report examining the development of PHM outside of North America

This Signify View shares a snapshot of some of the key take-aways from this report with a dive into the most evolved international PHM markets.

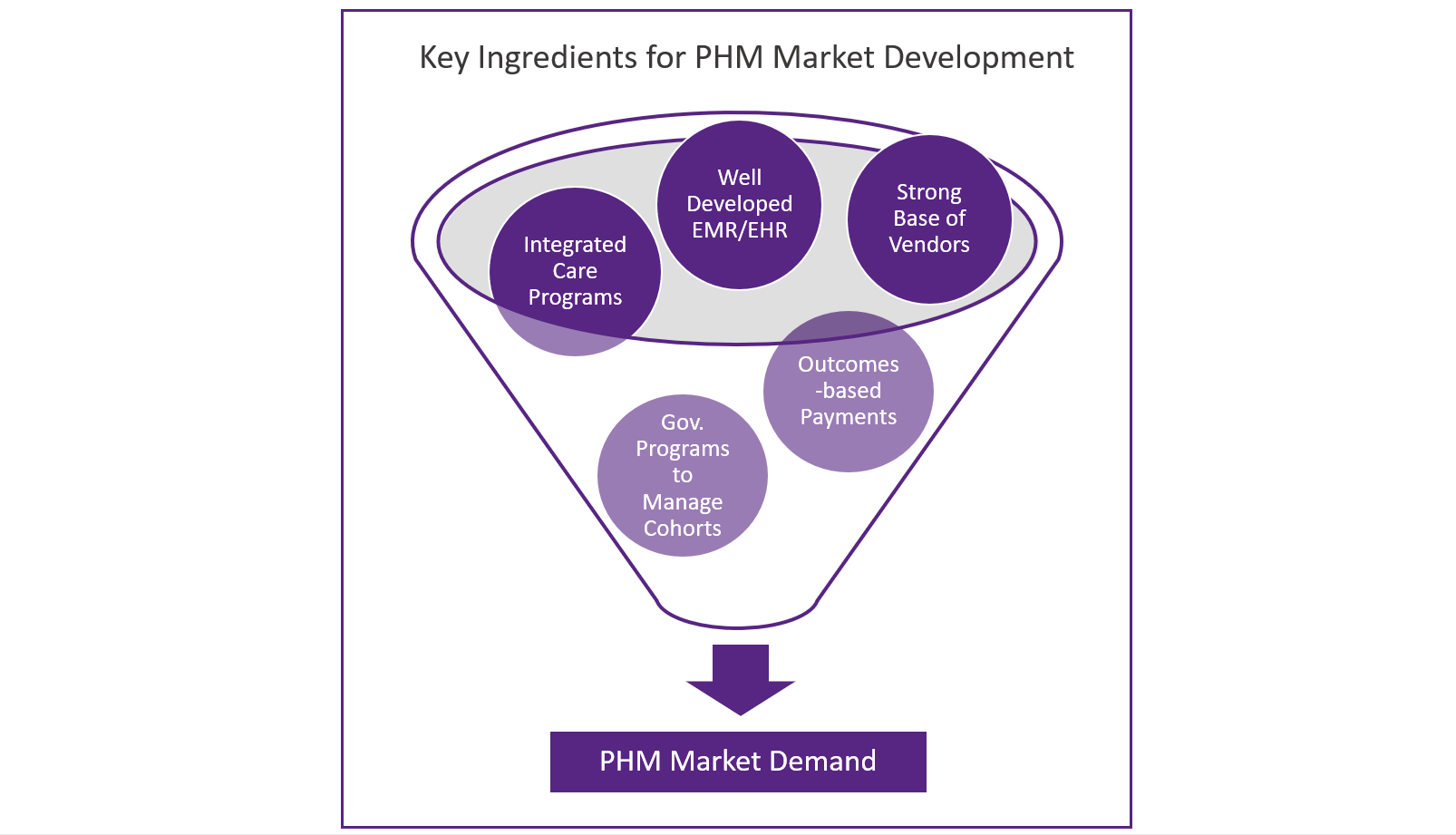

Ingredients that Drive PHM Platform Demand

There are several conditions that contribute to a healthy PHM market developing in a given country.

- Government initiatives to restructure healthcare provision towards a more integrated care approach

- A strategic approach towards the increased use of healthcare IT (in particular EMR/EHR) by local healthcare providers (along with funding to support this)

- Well defined strategies that drive local initiatives to better manage certain cohorts of the population (e.g. those managing chronic diseases)

- Healthcare provision that is compensated based on outcomes rather than fee-for-service models

- A well-developed supplier base of PHM vendors serving the local market

Each of these ingredients are explored below:

Integrated Care Programs: Governments and healthcare providers have grappled for many years to combat the siloed nature of healthcare provision that exists in many countries by introducing more integrated care structures. Primary, secondary, long-term, behavioural and community healthcare providers have operated independently with patient needs managed in isolation and with little coordination. Countries that are now forging ahead to reengineer healthcare provision to address this can offer significant opportunities for PHM vendors. In many cases solutions are required that support data integration from the variety of healthcare providers’ IT in order that integrated care can be supported by a common, longitudinal view of patients’ healthcare history. The data aggregation modules and tools that many PHM vendors have developed are well positioned to address this need. Similarly, the care coordination and care management tools offered as part of a typical PHM solution are well suited to support new integrated care networks in working together by using standard, evidence-based best practice.

EMR/EHR Development: Most PHM programs require that a population is at first “stratified” by segmenting people into cohorts based on need and risk. The is done by using data from a range of sources, some clinical, some social, to build up a picture of risk and need for each individual patient. Once a population is segmented and stratified, care management and care coordination tools are then used to execute a strategy for target cohorts. To enable this process the starting point is good data on the clinical needs and history of the patients being managed. In short this means that countries with widespread adoption of EMR/EHR solutions are those that are better positioned to have the electronic data required for this initial step of a PHM process.

Government Programs Targeted at Managing Certain Cohorts: Often population health management programs start out being specifically focussed on improving the outcomes and management of a specific cohort of the population. In many cases this may be driven by government legislation or funding. This could include better management of patients with diabetes, those recently discharged from hospital, older people or those managing certain behavioural health conditions for example. Countries where there are large-scale programs of this nature can drive PHM market development. This has been the main driver for several EU-funded initiatives that have required PHM solutions or IT modules associated with PHM. Notable EU-wide initiatives include ACT@Scale (care-coordination/integrated care upscaling to support populations with chronic condition), Sustain (care management pilots to support multi-disciplinary teams manage the frail/elderly), and Selfie 2020 (development of integrated care models to support management of multi-morbid cohorts) to name a few. While these initiatives tend to be small-scale pilots, they can sometimes be a precursor to wider market development if (and it’s a big if!) significant funding follows.

Compensation Based on Outcomes: Within the US, PHM solutions have been a key tool in the fee-for-service to value-based care transition that is currently underway. Many of the solutions that have been developed support measuring outcomes for internal performance management against value-based care criteria and reporting to government bodies/payers. Other countries that are following similar transitions toward value-based care payments or countries where bundled payment programs are being put in place will also drive market demand for PHM solutions that can measure the success of these programs.

PHM Supplier Base: To some extent this fifth ingredient can often be a product of the other four; i.e. in markets where all, or most, of the other four conditions are in place, it follows that a large PHM supplier base also exists. However, it’s not always as straightforward as that. Historically the supply of healthcare IT has been a very local affair, with individual country markets being served by local champions that focus on their core domestic market. The existence of such local champions can often be a determining factor in whether a large PHM market has developed. Another spin on this ingredient is the strategy employed by many of the large US PHM vendors as they expand internationally. For most, their starting point has been other English-speaking countries, such as Canada, the UK, Australia and Singapore, resulting in the market being served with not only local champions but a significant number of US vendors too. Of course, there has to be an existing demand, but a competitive local supplier base (whether that’s local vendors or a combination of local and international vendors) can certainly enhance a market’s development.

Top Three Markets for PHM

In no particular order, the section below outlines the three largest country/sub-regional markets in our soon-to-be published report on PHM in EMEA, Asia and Latin America, along with discussion on how these five ingredients have supported these local markets to develop.

UK/Eire – Providing a more integrated healthcare service is a key area of focus within the UK, with several initiatives driving this. These include:

- The recently updated IT strategy framework from the NHS places a priority on integrating services across health and social care.

- The Five Year Forward View puts in place several Vanguard providers that have developed new models of integrated care.

- The development of Sustainability and Transformation Partnerships (STPs) and Integrated Care Systems (ICSs), also components of the Five Year Forward View and modelled to some extent on the US ACO model. These are being set up to establish integrated care entities that have responsibility for managing the health of given populations.

The providers involved in the above initiatives have proved fruitful ground for the PHM vendors selling into the UK market.

The strong focus on integrated care is coupled with a relatively well established EMR market in the UK (albeit dominated by relatively basic, admin-focused EMR solutions) served by a long list of international and local IT vendors such Epic, Cerner, Allscripts, InterSytems, DXC Technology, Orion, Graphnet, and Patients Know Best (to name just a few). This has resulted in the UK becoming one of the largest PHM markets outside of North America with it ticking the box with each of the five ingredients outlined earlier. Late in 2017 we published a white paper diving deeper into he UK market dynamics. This can be found here.

Nordics – The rate of transition to integrated care provision varies across the Nordics. In 2015 Finland introduced its social welfare and health reform program. This has driven the development of new integrated care entities called sote-areas which are expected to drive PHM market demand. These new entitles (which will be rolled out over the next few years) will bring together health and social care and will have their responsibilities focused on the wider management of whole populations, rather than episodic care. Most of the other countries within the Nordics still manage primary, acute and social care separately, but are putting in place programs to encourage better coordination. These programs not only support integrated care but are also are putting in place IT that can be used to manage population health programs to improve the management of specific cohorts of the population. Programs include elements of Sweden’s “National eHealth Strategy”, and components of Denmark’s “Digital Health Strategy 2018-2022”.

The Nordics are particularly well advanced in terms of EMR/EHR use. Across the region EMR implementation rates are extremely high and programs to upgrade legacy solutions are now being implemented often bringing in requirements for PHM functionality such as data integration, care coordination and care management. Cerner is one vendor that has benefitted from this. Region Sk√§ne, in Sweden, recently contracted Cerner to upgrade its EMR solution across 10 hospitals and 190 primary care locations. As well as purchasing Cerner’s Millennium EMR solution it will also be implementing its PHM solution, HealtheIntent, as part of the upgrade.

The Nordic healthcare IT markets have historically been served via several well-established local vendors including Tieto, DIPS, Evry and Cambio. Some international vendors such as CompuGroup Medical, CGI Group, Fujitsu, InterSystems, Cerner (via its acquisition of Siemens EMR business) and more recently Epic have also had success in the Nordics. Many within this competitive supplier base are pushing their PHM solutions to their EMR customers, as illustrated by the earlier Cerner example.

As with the UK, the Nordics generally ticks all the boxes in terms of the five ingredients mentioned earlier. However, as original EMR deployments that were typically implemented several years ago are now being upgraded with PHM functionality incorporated in the upgrade, this helps the region punch well above its weight in terms of PHM market size.

Japan – Healthcare in Japan is largely supplied in a siloed manner with limited integration between primary, secondary and long-term care. Fee-for-service models still dominate in terms of payment to providers and EMR deployment has been slower than in many other developed countries. On the surface it would appear Japan doesn’t tick many of the boxes in terms of ingredients for PHM success. However, there is significant movement on each of the five ingredients outlined above. This coupled with the scale of Japan’s healthcare spend, pushes Japan into the top three PHM markets within Signify Research’s study.

Although providers are largely paid on a FFS-basis, the 47 prefectures that are responsible for managing overall healthcare provision are also responsible for developing plans, with a heavy focus on collaboration between providers, to manage populations with specific conditions (e.g. cancer, stroke, diabetes). These plans specify the structures and processes that need to be put in place across providers to best manage these populations. They also include outcome-based indicators to track how the prefectures are performing against specific outcomes for the given populations.

In 2012 Japan passed legislation implementing the “community-based integrated care system”. The focus of the legislation was to put in place systems to coordinate the management of acute medical care and long-term care. The implementation of the system will be adapted to each municipality and will focus not only on greater integration between health and social care, but also on greater use of preventive care services, home care, family support networks and the voluntary sector. The implementation of the community-based integrated care system has been slow. However, there are some regions where it is well advanced and scaled. For example, in Fukuoka-city where health care and long-term care has been integrated. A key element of this restructuring was using IT to support data integration, analytics and care management/coordination. Fukuoka-city worked with Accenture, alongside Hitachi, to develop IT solutions that would support the integrated care system. This included building an “integrated health hub” that acted as a care coordination tool and data repository for providers and patients and implementing a “dementia communication care methodology” that ensured coordinated evidence-based care was provided by all agencies responsible for dementia care to a given population.

EMR rollout in Japan has been slower than many other developed countries, and where systems have been put in place, they are typically not integrated across different hospitals or between primary and secondary care. This lack of integration is a barrier to PHM market development; however, initiatives are underway to put in place platforms that connect EMR solutions across hospitals to support regional cooperation amongst providers. This is a significant area of focus as Japan starts to upgrade many of its legacy EMR solutions and a key driver of the PHM market.

Japan has a strong supplier base of IT vendors serving the EMR (and now PHM) market. However, these tend to be Japanese vendors such as NEC, Hitachi, Fujitsu and NTT. Vendors from outside Japan looking to sell their PHM solutions are likely to struggle to break the hold that these vendors typically have on the Japanese market.

About the Report

This analysis presents the key trends driving PHM in three of the largest markets outside of North America. The full report “Population Health Management – EMEA, Asia and Latin America – 2018” provides a deep dive analysis on the PHM market in 16 countries/regions. In each country/region, analysis is provided on the extent to which the five ingredients are impacting PHM market development and which vendors are having local success. Market estimates and forecasts are provided for data aggregation, risk stratification, care coordination, care management and patient engagement tools for the period 2017 to 2022. Other countries examined include Benelux, DACH (Germany, Austria, Switzerland), France, Spain/Portugal, Italy, Eastern Europe, MEA, China, India, Oceania, Brazil, Mexico, Rest of Asia and Rest of Latin America.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

More Information

To find out more:

E: Alex.Green@signifyresearch.net

T: +44 (0) 1234 436 150

www.signifyresearch.net