New findings from Signify Research’s recently released report “Advanced Visualisation and Viewing IT – World – 2017 Edition” indicate that the $1.3B (2017) market is undergoing a significant transition. Until recently, advanced visualisation (AV) has remained largely workstation based and has been used by a limited number of specialists and technicians. Yet with the advent of enterprise imaging, broader platforms have emerged, blurring the lines between diagnostic viewing, post-processing visualisation and clinical review. For AV, this has changed market demand, away from the traditional workstation towards thin-client software, often integrated with broader enterprise imaging platforms. User interfaces and tool availability are also increasingly important for users in mature markets, and it is these segments that will offer greatest growth opportunity for the market in the mid-term.

Tools and UI in Focus in Mature Markets

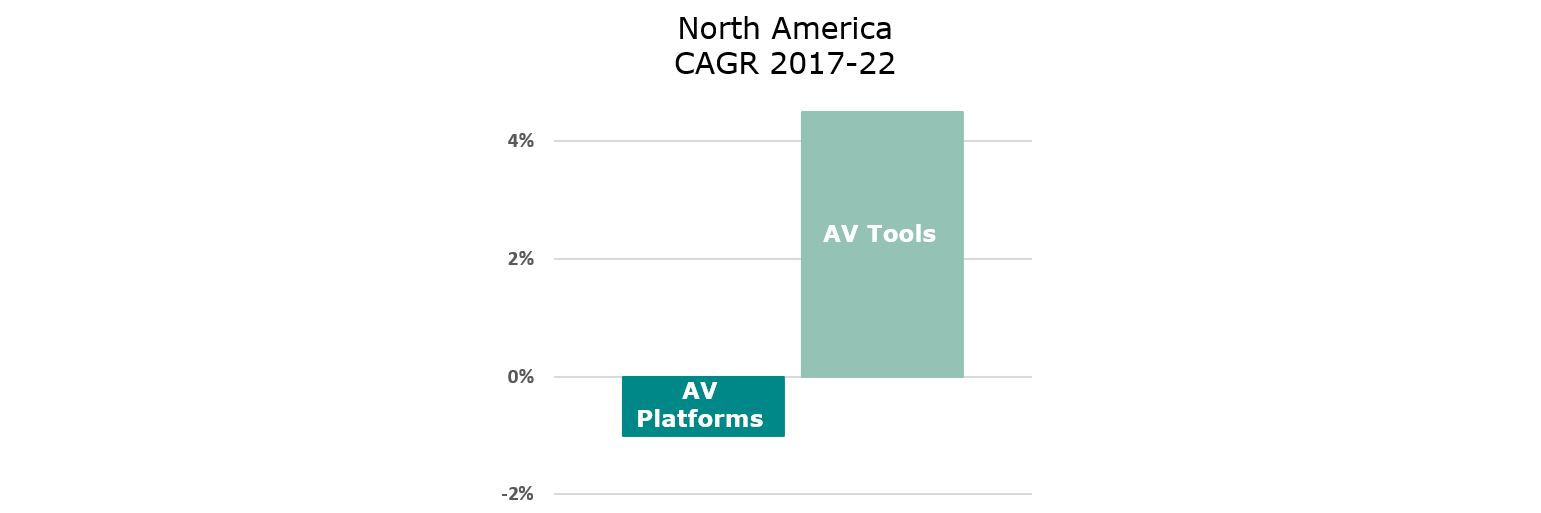

From our research it was evident that the demand for AV platforms in mature markets, such as North America and Western Europe, is no longer increasing. Growth in revenues in mature markets are instead being driven by demand for new AV tools entering the market, and users focused on improving the clinical depth and reach of existing platforms. These tools are sometimes offered by the AV platform vendors themselves, but more often through partnership between platform vendors and best-of-breed third-party tools vendors. This is creating a market that is slowly becoming more platform agnostic for AV tools and raising awareness around compatibility and integration.

The focus on partnerships and integration is also a consequence of the enterprise imaging trend. Healthcare providers are today wanting to simplify their supply chains, thereby looking for a central platform for imaging and visualisation, which can interface or act as a central “contractor” for additional third-party tools. Moreover, health providers want to share data across clinical departments and sites, pushing the case for common user interfaces across user groups, as well as more seamless integration of tools from different clinical disciplines.

Universal Viewers Gaining Popularity

Wider clinical access was also the initial driver for the increased popularity of universal viewers (UVs) in recent years. Initially, UVs were only intended for viewing images from disparate PACS for clinical review, but they have gained popularity due to their simplicity and ease of use. This has led providers to request further tools to be integrated for advanced usage. UV vendors have therefore started focusing more on improving the diagnostic capabilities of their UVs and adding additional AV tools. However, expanding the diagnostic toolset to match the depth of dedicated AV vendor solutions is both time consuming and expensive, especially given the lengthy development and clinical and regulatory challenges. Therefore, some have opted for a variety of partnerships and OEM relationships over doing their own research and development.

This strategic move from universal viewing vendors has put pressure on more traditional PACS and AV vendors to expand access and integration of their capabilities outside of radiology. In the past most have remained focused on their core markets in radiology and cardiology. PACS has also developed a poor reputation for integration with other clinical IT systems, especially non-DICOM format content, often creating an impression with users that UV vendors and enterprise imaging specialists can offer far better service in terms of interoperability and integration. Add to this the growing pressure to include workflow and operational tools as well in core diagnostic imaging, and PACS and imaging modality vendors are now competing on multiple fronts.

Convergence between AV and Universal Viewing?

Above all though, two key questions have emerged. With UVs adopting more and more AV tools, will complete convergence between AV and UV occur? And if so, which vendors will be more successful?

From the research discussions held with vendors as part of the study, it was apparent that industry and user sentiment is shifting towards a more consolidated, converged model. However, it should not be forgotten that as the reach of viewing platforms increases, so too does the diversity of user needs. Diagnostic users in radiology still have specialist needs for specific tools and functionality, not to mention the need for diagnostic viewing software to adhere to medical device class regulation. In contrast, clinical review user needs focus more around report integration, collaboration tools and workflow. Thus, even though the central platform and user interface may become more consolidated, it must also have adaptability and flexibility built-in to meet the complex needs of each group.

From a competitive view, modality and AV platform vendors are of course not standing still while universal viewing and enterprise imaging vendors creep into the AV space. AV specialists have an advantage in that they already have the breadth and depth of AV tools required by most diagnostic users, and often strong imaging modality hardware business with many customers which can be leveraged. However, many have struggled with compatibility issues between their AV platform and tools and their initial UV offerings, often as their solutions are built from a patchwork of legacy acquisitions and partnerships. Some have swerved this by opening-up to UV partnerships, though often comprising with limited integration, while others have remained focused on a full turn-key offering, but again struggled with interoperability.

On the other side, UV firms now have access to a growing array of agnostic tools they can look to include within their offerings. However, it will take some time for them to compile the same depth and breadth as the AV platform and modality vendors, even with third party partnerships, limiting their opportunity within the AV segment in the short to mid-term. Neither vendor group has an easy task in winning over the other and it is unlikely any one vendor will have the scope or scale to meet the broad complexities of health provider needs in the enterprise imaging age alone. As such, we expect to see more established partnerships form, creating “clusters” of vendor solutions, based on more established mature partnerships and integration, some of which may lead to vendor consolidation in the longer-term.

Regional Differences in Focus

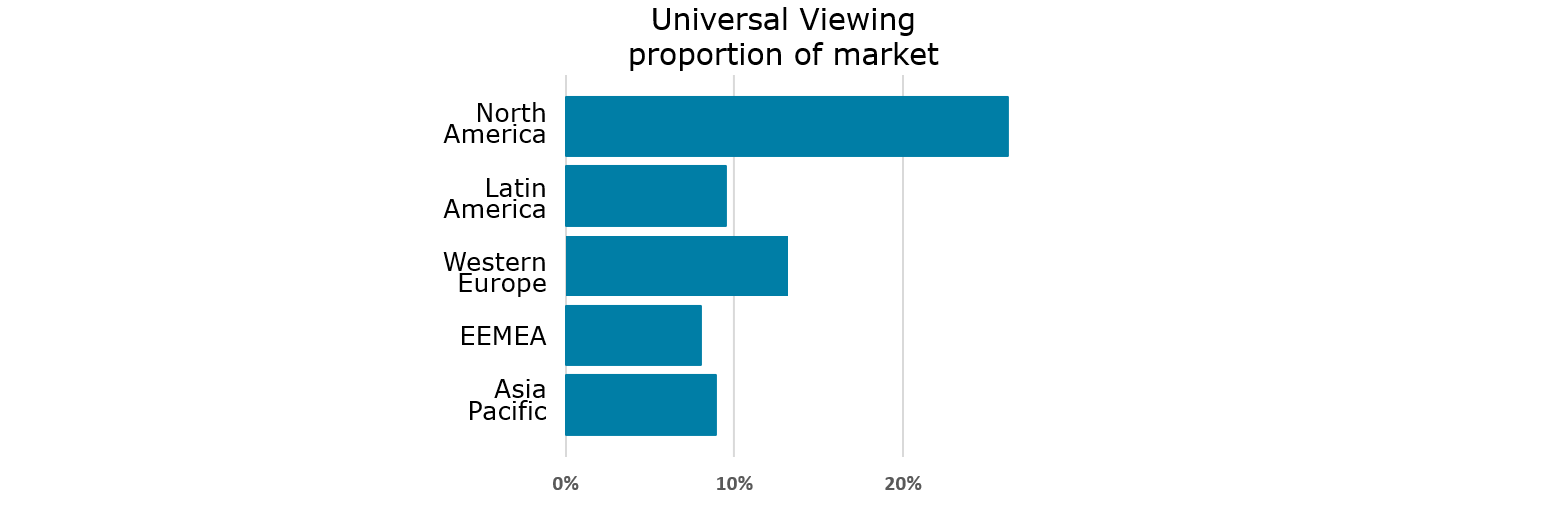

While this battle will continue to intensify in mature markets in the short to mid-term, especially as contract terms lengthen and healthcare providers consolidate, most developing markets not yet advanced in enterprise imaging adoption are not expected to see much change. However, the importance of these markets should not be underestimated either.

Most providers in emerging markets still embrace the standalone AV workstation setup, with the majority purchasing AV as part of a total solution of modality imaging hardware and PACS from the same vendor. Our research shows that these developing markets are no longer a small proportion of the total AV market, following significant growth in recent years. In 2017, they accounted for approximately 43% of global AV and viewing IT revenues. Traditional AV and imaging modality vendors still have a substantial and growing revenue stream form these markets, offsetting the more challenging market conditions they are facing in more established mature markets.

About the Report

“Advanced Visualisation and Viewing IT – World – 2017” provides a highly detailed, data-centric analysis of the world market for Advanced Visualisation and Viewing IT. Key features include market size estimates, annual growth rate forecasts for 2017 to 2022 and vendor market share analysis.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

More Information

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 436 150

www.signifyresearch.net