Written by

Cranfield, UK, 10th July 2023 – The EMEA market for Electronic Healthcare Records (EHR) IT is estimated to have been worth $4.8B in 2022 (down 3.5% from 2021 in USD) according to Signify Research’s latest global EMR Market Intelligence Service update. USD to EUR exchange rate movements heavily influenced this market decline. When examined in terms of Euros, the market grew at a healthy 8.6% between 2022 and 2021, largely fuelled by major healthcare IT infrastructure projects in several countries such as Germany, France and Italy.

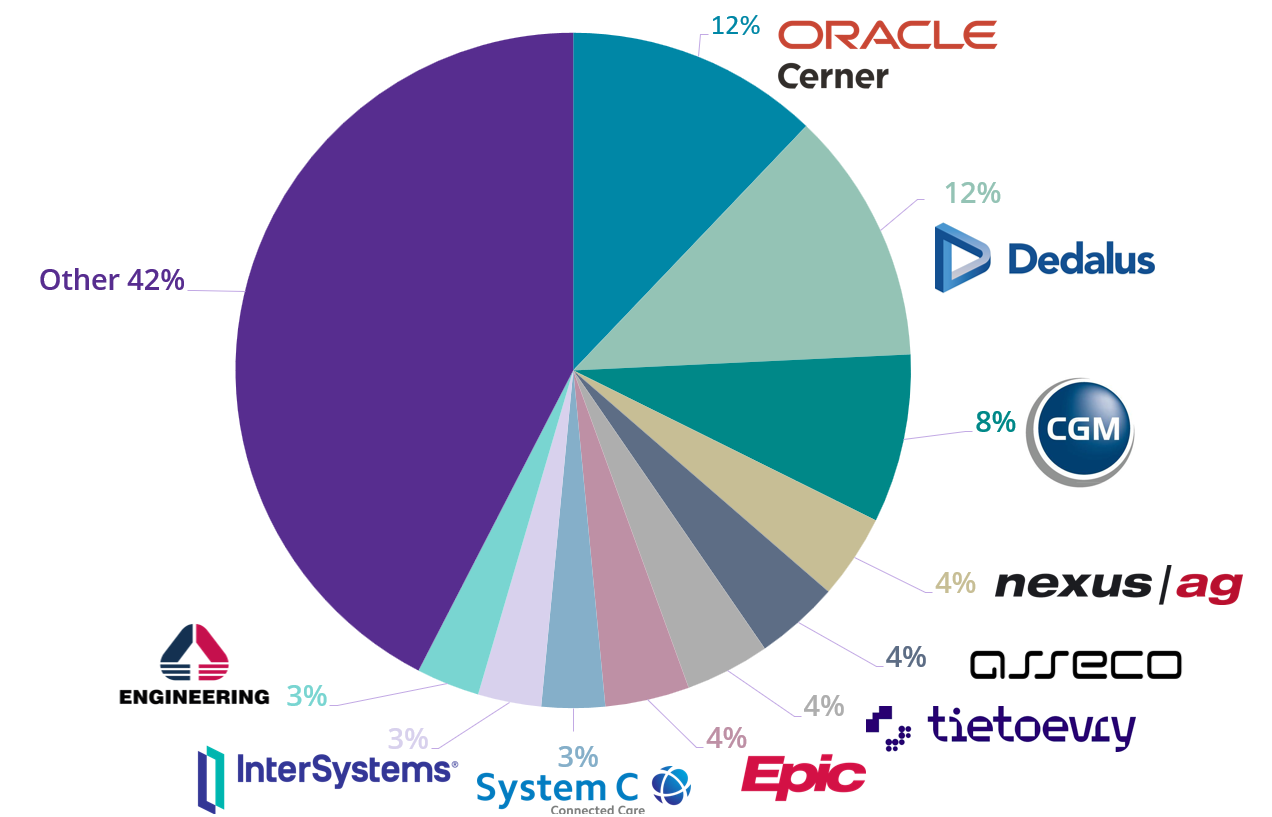

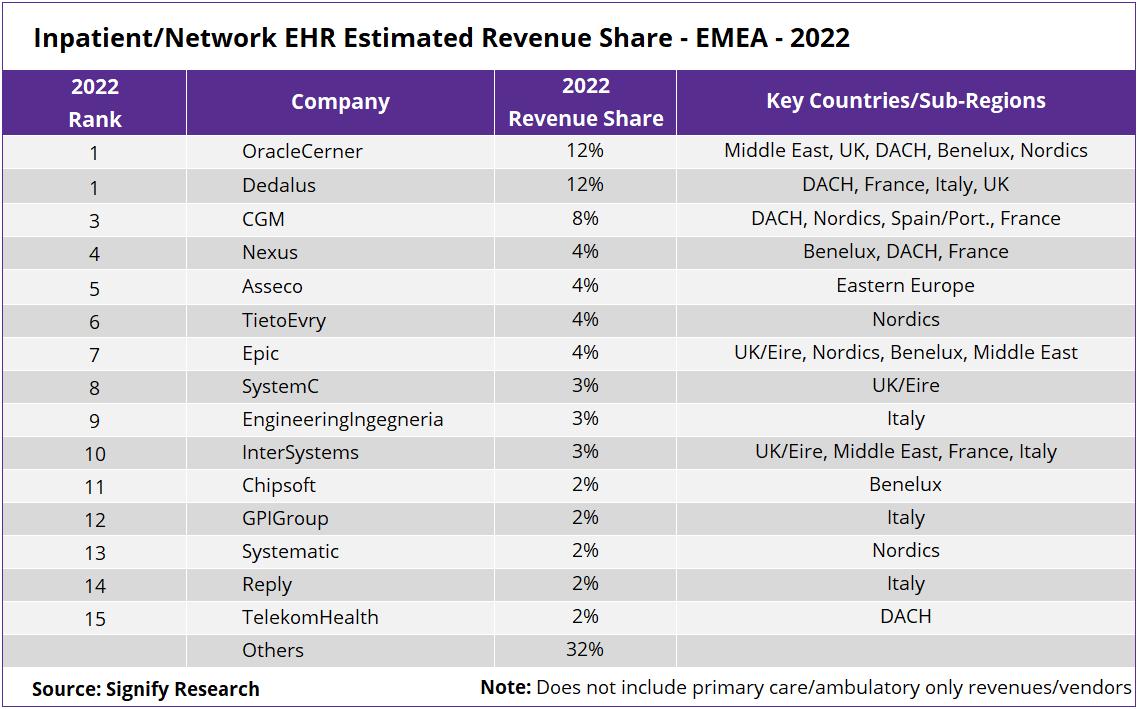

The inpatient/regional network EHR sub-sector dominates the overall market, accounting for an estimated 71% of revenues in 2022, a share that increased incrementally over the last five years. In terms of vendors, the EMEA market is still fragmented with vendors that are extremely geographically focused (e.g., TietoEvry, SystemC, Chipsoft) still featuring high on the market share table displayed below. However, several pan-EMEA vendors now occupy high positions in terms of market share rankings, notably the top three below – Oracle Cerner, Dedalus and CompuGroup Medical.

Overall, the EMEA EHR market remains highly fragmented (as illustrated by the fact that the top 15 vendors only accounted for 58% of the market in 2022) with only a gradual move toward consolidation over time. However, this picture only rings true at a regional level, particularly for the acute market.

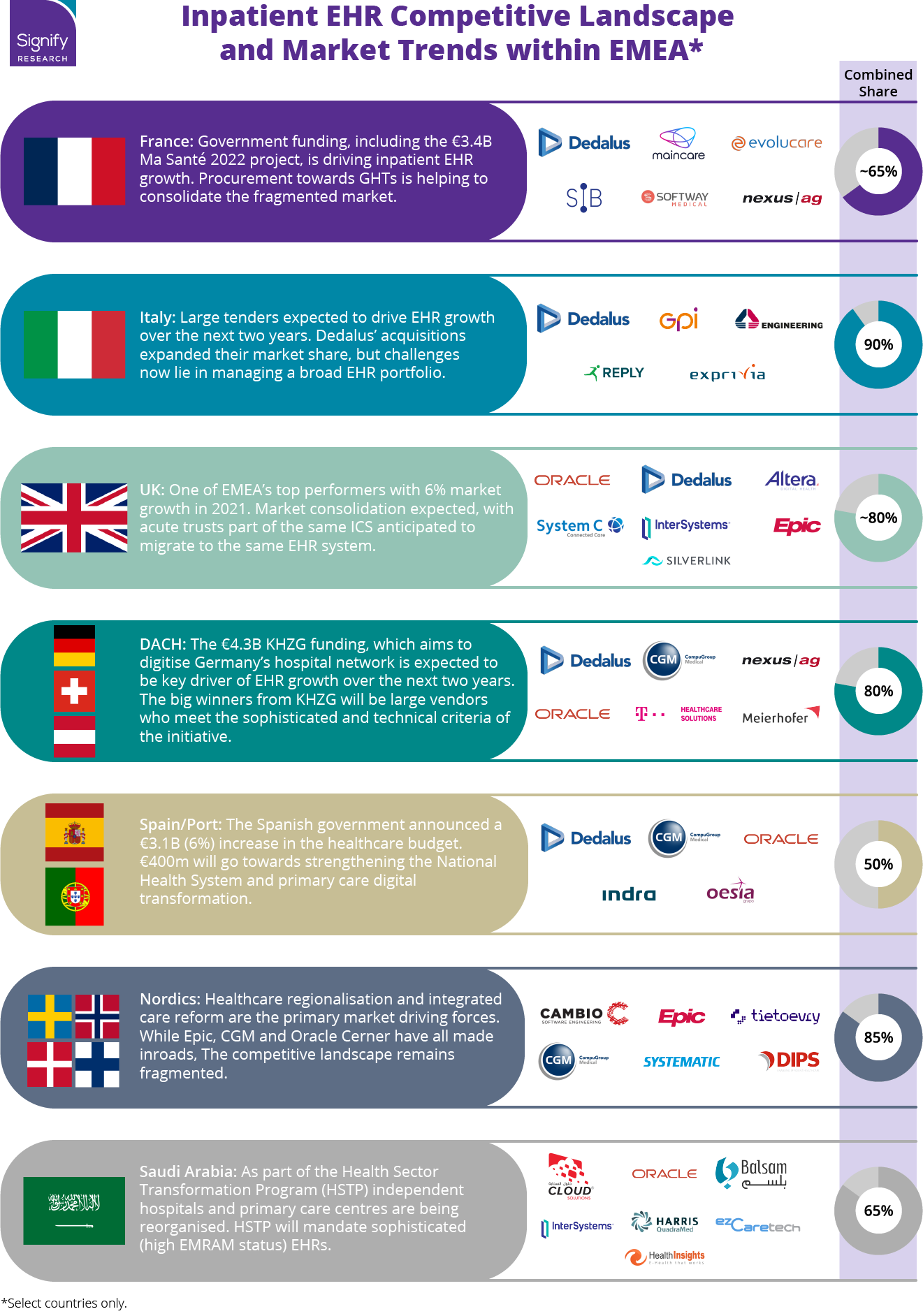

Once the competitive market is examined at an individual country level it becomes apparent that the market is relatively consolidated, particularly in terms of acute vendor market share. For most European countries, five or six vendors often accounted for more than 80% of revenue share in 2022, and in some, the consolidation is significantly further advanced (e.g. Denmark and Norway), as illustrated in the graphic below.

Key Vendor Trends

Dedalus had a relatively successful year in 2022 across EMEA growing (in Euros) both via acquisition and organic growth. In particular, it is estimated to have seen solid business growth in Germany, where it is the market leader, partly driven by KZHG funding. The Italian and UK markets were more challenging. In Italy, funding from large government tenders was still taking time to trickle down to vendor bottom lines. And in the UK, churn to competitors and a push to migrate customers from legacy DXC products, to a common Dedalus portfolio saw the company lose share.

Oracle Cerner’s 2022 EMEA business was also a tail of opposing trends. In the UK/Eire, it continued to gain share going live in several new NHS Trusts, having displaced entrenched vendors. The company is now estimated to be the most widely used vendor in the UK in terms of hospital beds. However, its contract successes in the Nordics are taking longer to have a bottom-line impact. More worrying over the medium term is the announcement that SAP will cease to support Oracle Cerner’s i.s.h.med EHR product line from 2030. As a foundational building block of i.s.h.med this leaves many Oracle Cerner customers unclear in relation to longer-term EHR plans. The situation is particularly acute in Germany, Oracle Cerner’s largest installed base of i.s.h.med customers. Here providers are at present investing heavily in hospital digitisation, and so need clarity on keystone IT, such as the EHR. Concurrently Epic is eying up German market entry via a potential contract with Charite Universitatsmedizin Berlin, so incumbent vendors need to ensure they’re building defensible market positions. The situation with i.s.h.med is not conducive for this.

CompuGroup Medical’s Hospital Information System (HIS) business line, where its inpatient EHR business sits, grew 8% in 2022 (in Euros). This was partly fuelled by acquisitions and organic growth (3% organic growth in 2022 in Euros) via drivers such as KZHG funding in Germany. It claimed at the end of 2022, it had orders of >EUR90M via KZHG, and with much of the EUR4.3B funding still tricking down to IT vendors, there is considerable upside potential here for 2023. Acquisitions (e.g. M.Doc) and the launch of the third generation of its Clinical suite of hospital IT products position the company well in its domestic market. The company’s HIS business is very much dominated by Germany, and whilst it has a broad installed base of customers in geographies such as the Nordics, Eastern Europe and Spain, the geographic diversity of its inpatient business still has some way to go to get to the level of Dedalus and Oracle Cerner.

While still not quite at the top table in EMEA, Epic has been gradually gaining share in over recent years. It holds share in UK/Eire, Nordics, Switzerland, Benelux and various geographies in the Middle East (e.g. UAE and Saudi Arabia). In particular, 2022 saw the company go live in several large UK hospitals/regions. As already mentioned, the rumour mill was in full swing during the DMEA health IT conference in Berlin earlier this year that an entrance into the German market was imminent. This may well prove to be the case. However, winning one big-spending academic hospital customer will not then guarantee that Epic will be able to gain a dominant share with the much lower-spending hospitals which make up the bulk of the German market.

Related Research

Signify Research’s EHR Market Intelligence Service provides regular data, insights and analysis on the global market opportunity for Electronic Medical Records. This includes a rolling publication program of deep-dive country-specific market reports alongside a market database that’s updated on a monthly basis and topical regional/global reports.

About Alex Green

Alex has 24 years’ experience in tech market intelligence. He leads on Signify Research’s Digital Health offerings focusing on integrated care IT, EHR/EMR and telehealth. Prior to joining Signify Research he served as a Senior Research Director at IHS and as a Business Analyst/IT Project Manager in a joint NHS/Government role.

About the Digital Health Team

Signify Research’s Digital Health team provides market intelligence and detailed insights on numerous digital health markets. Our areas of coverage include electronic medical records, telehealth & virtual care, remote patient monitoring, high-acuity clinical information systems, patient engagement IT, health information exchanges and integrated care & value-based care IT. Our reports provide a data-centric and global outlook of each market with granular country-level insights. Our research process blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net