Written by

Against the backdrop of artificial intelligence in medical imaging and other hyped healthcare IT technologies, market trends in core radiology IT software and services can easily be overlooked. Many of the largest markets in North America and Western Europe have reached saturation, with few new “greenfield” opportunities. Instead, the dynamics of much of the global radiology IT market revolve around long procurement cycles, replacement or contract roll-on and an entrenched customer base.

However, with over $2.5B spent per year on radiology IT and over $25B spent on medical imaging modality hardware, the future direction of the global market should not be overlooked. Below, we have provided five charts based on our extensive coverage of the global imaging IT market that highlight significant long-term trends shaping the future of radiology IT.

Enterprise Imaging Adoption for Radiology is Set to Continue

Despite the global market for radiology IT gradually declining over the next five years in terms of total revenue, a seismic shift in terms of deployment is occurring. Enterprise imaging, in which a central software platform is deployed across a healthcare network to ingest, manage, archive and allow access to all clinical and diagnostic imaging, is gaining traction. While this trend has been evident more recently in terms of vendor marketing, most revenue in the market today remains tied to standalone solutions. Moreover, the nature of contracting with long-term recurring maintenance and professional services components also skews the data towards the predominant model of the incumbent deal type. However, the influence of enterprise imaging is more pronounced today. We estimate that in 2018 approximately 32% of new revenue in the global radiology IT market was attributable to enterprise imaging deals; in North America, one of the most progressive markets for enterprise imaging adoption, it was closer to half of all new revenue. From this we should accept that for many radiology IT deals in the future, enterprise imaging is going to be front and centre of negotiations. That said, this will be a gradual change due to lengthening contracts, the complexity of implementing enterprise imaging deals and the relatively slow reaction of many leading vendors to develop new platform-based, modular enterprise imaging offerings.

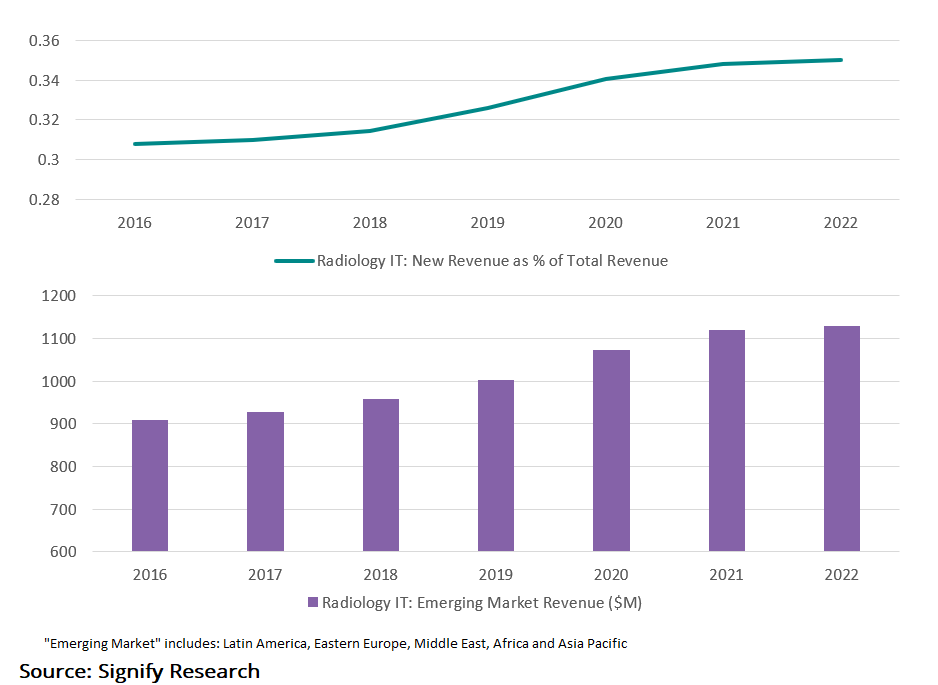

New Revenue Opportunity Increasing, Fuelled by Emerging Markets

Despite the apparent stagnation of the global market when viewed in terms of total revenue decline, that does not mean new “greenfield” opportunities do not exist. In fact, over the course of the next four years, we predict new revenue as a proportion of overall radiology IT revenue to gradually increase. Digging deeper, this trend is closely related to the forecast performance of emerging markets, especially in Latin America, the Middle East, Africa and emerging Asia Pacific regions, adding nearly $200m of new business for radiology IT by 2022. While the individual drivers and trends in each market contributing to this growth are too numerous and complex for this summary (see our Imaging IT, Archiving & Management – World – 2018 report for more detail and indepth analysis on each market), it is clearly evident that the global market for radiology IT still has some way to go before hitting peak saturation.

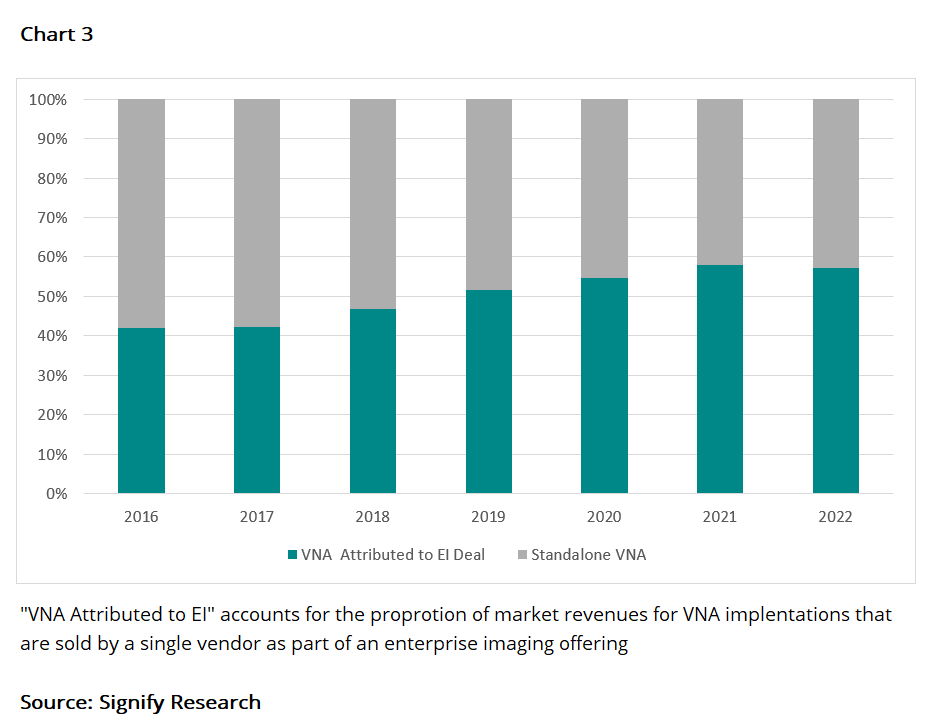

Enterprise Imaging is Having a Greater Influence on VNA

At the start of the decade, vendor neutral archives (VNAs) were first introduced to the market with great fanfare. A raft of new independent data archiving and management vendors also appeared in the halls of radiology exhibitions worldwide, promising a future of non-proprietary data management and exchange. While some of the early marketing claims around the capability of VNAs were less than scrupulous, the concept of a centralised clinical archive for imaging and associated clinical data has grown from strength to strength and now underpins most enterprise imaging solutions on the market today. At the same time, leading PACS vendors snapped up many of the independent VNA vendors and incorporated them into their radiology IT and enterprise imaging offerings.

Healthcare providers however have taken longer to come around to both understand and implement VNAs at scale. Early adopters in North America often used standalone VNAs as a “bridge” to centralise the data from disparate PACS from recently acquired hospitals and clinics. In other markets, VNAs were used as the basis for regional enterprise radiology consolidation; in most cases, use only extended to the “DICOM” realm of core radiology imaging. However, many providers are now looking at enterprise imaging as a broader, multi-ology solution to handle imaging and clinical data in a central platform. At the same time, providers are also looking to simplify supply chains and limit the number of different vendor solutions they are implementing.

Consequently, we are observing a clear increase in VNA implementation as part of an enterprise imaging deal from the same vendor, with the VNA acting as the central repository for all imaging and associated content. While this certainly calls into question the “vendor neutral” aspect of VNAs in some cases, VNA solutions from many radiology IT vendors have improved and matured in recent years to include the capability to handle non-DICOM data from a variety of different sources. As a result, we also predict that opportunities for standalone VNA deals will continue to decline as the single vendor, enterprise imaging approach gains further traction.

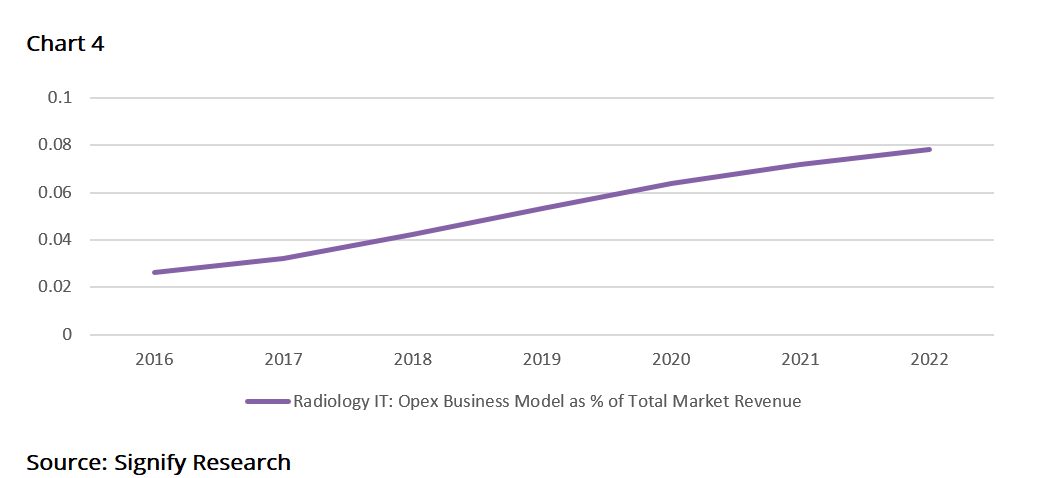

Operationalised Sales Models Are Gaining Traction, Slowly

Digitalisation across healthcare and the growing influence of IT has in some cases, brought about significant evolution in business models and procurement trends. Perhaps most discussed in recent years is the increasing focus on operationalised models for health IT software, with an increasing array of “flat-fee”, “pay-per-click” and subscription models available across the healthcare IT segment. Radiology IT has also been no stranger to this change, with many vendors now offerings a range of models. However, in practice, we have observed limited uptake of operational contracts in radiology IT so far, with gradual adoption forecast for the mid-term. The outpatient, private and small hospital segments have been the most progressive in terms of transitioning to subscription-based models, preferring increased predictability of costs. The trend in this segment has also been closely tied with the adoption of public cloud architecture, a market that is heavily biased towards operational budgeting. Looking ahead, we forecast that the speed of transition to operational procurement will remain sluggish. This is in part due to large regional and enterprise network deals continuing to be driven by capital budget cycles, especially in the public and government sectors, lengthening contract cycles and the lack of reference sites for large provider networks clearly demonstrating the benefits and return on investment of operational business models.

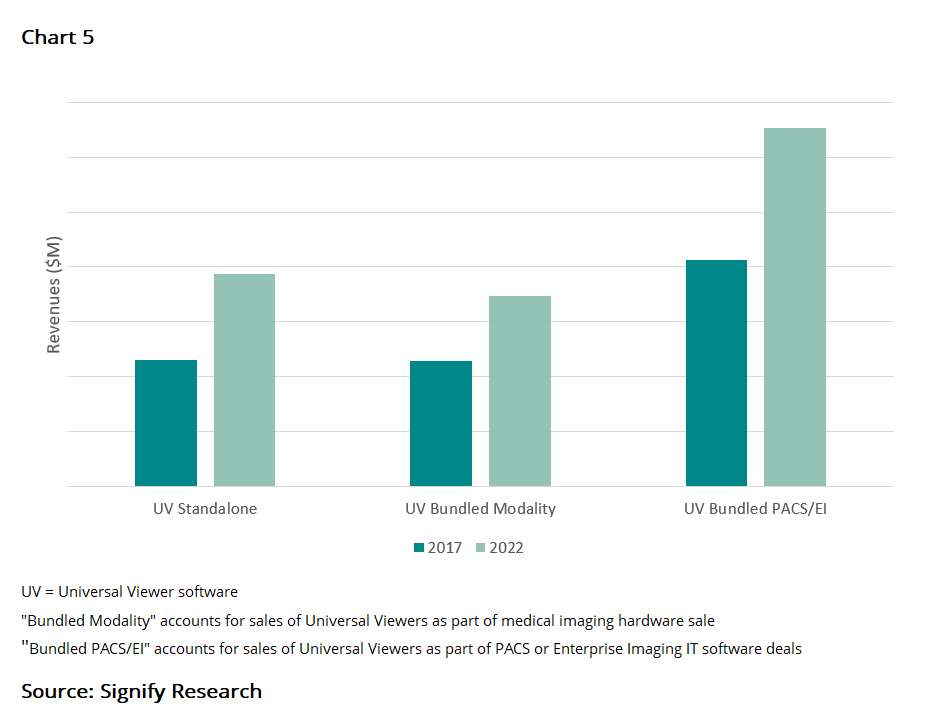

Opportunities for Standalone Universal Viewing Will Diminish

The trend for enterprise imaging in recent years has also prompted development of a new breed of universal viewer (UV) software, enabling the access and viewing of diagnostic and clinical data across healthcare enterprises. As discussed earlier with VNA, several independent UV vendors emerged early in the development of this market, selling both directly to competitors and providing “white-label” software to larger imaging IT vendors. However, in increasingly consolidated and competitive radiology IT markets, opportunities for standalone UV sales are expected to be more limited. This is in part due to the growing provider preference for consolidated supply chains, as well as the increasing influence of enterprise imaging vendors as the central partners to providers for imaging. As viewers also provide the main user interface to users, brand recognition is also a factor.

There also remains an ongoing tussle internally at healthcare providers in how to handle access to medical imaging and related content for various user groups. While some users in specific departments have unique best-of-breed needs from a specific viewer or software type, clinical generalists are increasingly using more universal viewers for access to reports, data and imaging from across multiple departments. Moreover, every provider has a different combination of users, clinical software, EMR and procedures for care. Therefore, today no UV or imaging IT vendor solution can provide complete and seamless access to all clinical content “off the shelf”. Instead, many will look to provide core capabilities and offer semi-customised interfacing with high-priority viewing software in some departments. As many providers are consolidating clinical content from radiology and other departments into central enterprise platforms, most prefer a single user interface to access most of the content. Consequently, we expect a significant increase in demand for universal viewing software integrated as part of wider imaging IT platforms, either with enterprise PACS deals, or more broadly in enterprise imaging deals.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

More Information

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 436 150

www.signifyresearch.net