Written by

Cranfield, UK, 15th June 2023 – Signify Research estimated the global market for acute EHR software to be worth $16bn in 2022 and is projected to grow at a CAGR of 5% through to 2027. However, many geographies have begun to saturate, with high penetration and increasingly dwindling ‘greenfield’ opportunities for vendors. Nowhere is this more apparent than in the US. With limited opportunity for expansion here, EHR vendors are focusing on their international presence, increasing their efforts to improve data integration across EHRs, and diversifying into clinical software provision. These often come in the form of ancillary ‘add-on’ modules.

In the case of High-Acuity Clinical Information Systems (CIS), international demand from acute care providers to support departments by improving workflow and providing clinical documentation continues to grow. The transition to include clinical modules within an EHR is subsequently increasing.

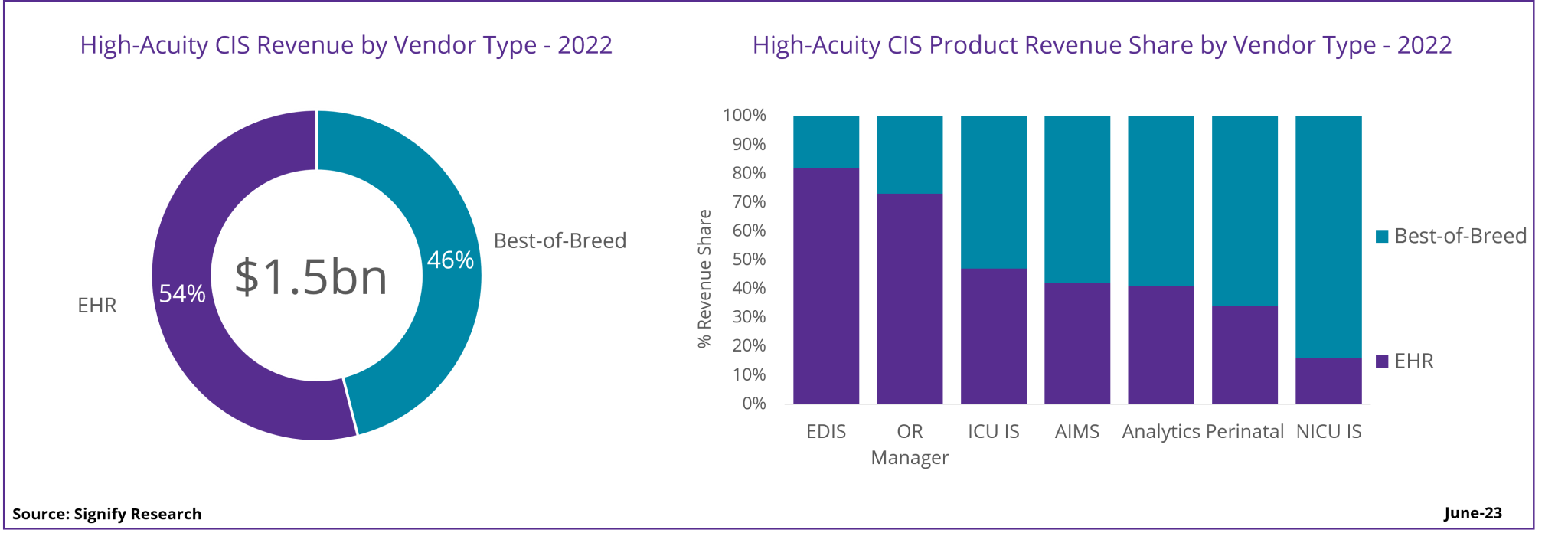

Signify Research valued the global High-Acuity CIS market at USD $1.5bn in 2022; this represented a stable market size versus 2021 in USD currency. A significant unfavourable swing in several local currencies (e.g., Euro, Japanese Yen) versus the USD currency resulted in EMEA and Asia market revenues falling slightly versus 2021. However, all geographies witnessed annual revenue growth in local currency terms. A positive CAGR of 6% is projected over the forecast period.

Where do the Opportunities Exist?

Given the global High-Acuity CIS market is dominated by local suppliers, there are several opportunities for EHR vendor expansion, namely via product development or acquisition. In the Perinatal IT segment, the latter was the preferred route for one of the UK’s leading inpatient and social care EHR providers, System C Healthcare; in February 2023 it announced the acquisition of Scottish maternity and neonatal specialist Clevermed. The solution can run as a standalone platform or integrate with an existing EHR, which to-date has included Oracle Cerner and System C. The move enhances System C’s portfolio with a maternity product that records almost half of all UK pregnancies.

The Perinatal IT market is still dominated by Best-of-Breed vendors, who typically offer additional surveillance in the form of Cardiotocography (GTG) traces, mother and baby’s heart rates, contraction rate and/or fetal movement. Best-of-Breed vendors have also focused on improving data flow between the EHR and clinical systems in the perinatal setting and enabling additional information to support the provision of perinatal care. The proportion of systems that include both surveillance and documentation will increase over the forecast period.

Conversely, the Emergency Department Information Systems (EDIS) market has a relatively higher proportion of EHR vendors that have captured share of the overall revenues. This trend is most prevalent in the US and Western Europe (e.g., the UK, DACH) where EHR vendors account for +85% share. As the first point of entry into the hospital, EDIS is the solution with most focus on documentation as an initial stage in data capture. Subsequently, many enterprise-wide solutions offer emergency department clinical modules as part of their solution offering.

There are also growth opportunities for the Best-of-Breed vendors in less developed High-Acuity CIS segments. This is most true for solutions that add value through cost efficiency and improved patient outcomes. For example, the Anaesthesia Information Management Systems (AIMS) market in many regions of EMEA is still under-developed with many anaesthesia departments still utilizing paper-based systems. With an increasing need for efficiency in the anaesthesia department, fastest growth is projected for the AIMS market.

Interest in Analytics/AI-based applications has increased in recent years, as vendors pushed clinical solutions that assisted in patient care by providing supporting data analytics to help improve care provision. Getinge’s acquisition of Talis Clinical is an example of vendor activity in this segment, as highlighted in a previous Signify Research insight. The use of analytics and to some extent AI-based applications is more mature in the US and subsequently the fastest average annual growth rate by geography is projected here. New entrants into the AI-based apps market are required to follow stringent regulatory approval processes, which require a significant amount of supporting clinical data and subsequently it can take several years to receive approval. As regulation requirements and customer demand become clearer, more solutions are expected to appear on the market.

Additional opportunities for growth are being driven by government funding and initiatives to improve healthcare IT infrastructure, especially within the High-Acuity setting. The time taken for post-COVID government funding in many countries, such as Germany’s Hospital Future Act (KHZG), to trickle down to vendors has proved frustrating for both EHR and Best-of-Breed players. However, 2023 will be the year that vendors finally benefit from the funding.

Device Integration

The importance of device integration and vendor-neutral solutions is becoming a priority consideration for healthcare providers, given that there are several different acute care IT solutions that devices from a multitude of Best-of-Breed and EHR brands need to communicate with. Solutions that can streamline the process of sharing patient data across the care settings to which they are transferred will be well received. Developments to improve interoperability between devices and information systems have been evolving at a fast pace. HL7 is now the standard used to transfer clinical information between software and devices. However, additional standards are in development to further improve accuracy of the transition and utilization of clinical information. As discussed in a recent Signify Research insight, Draeger Medical has been promoting its upcoming software solution, developed utilising Service-oriented Device Connectivity (SDC).

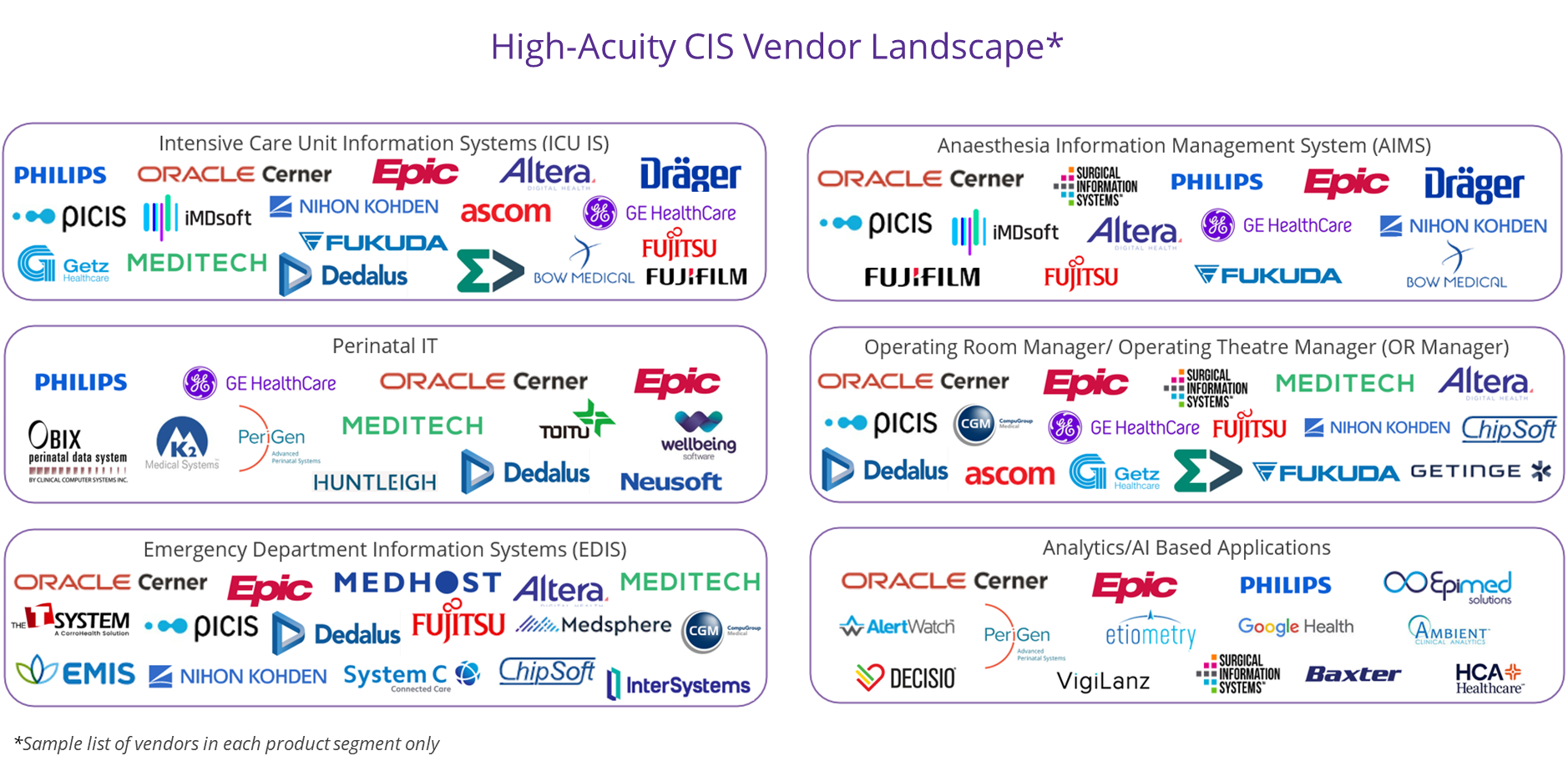

High-Acuity Clinical Information System Vendor Landscape

EHR Vendor Encroachment

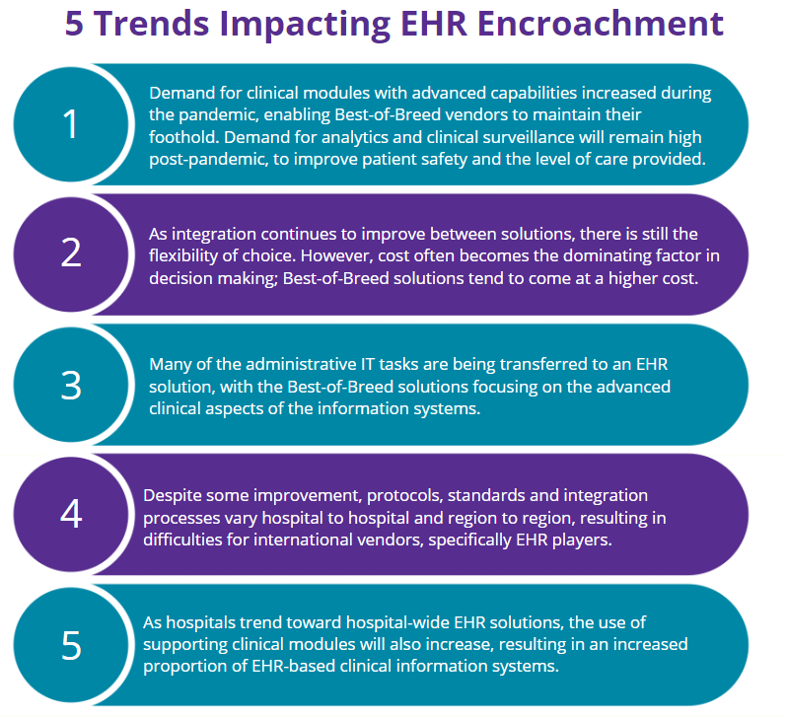

Historically, Best-of-Breed vendors have accounted for the majority of High Acuity CIS revenues across most countries globally. However, in the US, there is a stark contrast in the leading players compared to the rest of the world. There continues to be a global divide in the use of clinical modules/solutions from enterprise-wide EHR vendors such as Oracle Cerner and Epic, and the use of Best-of-Breed solutions from vendors such as Philips, GE Healthcare, PICIS and SIS. The US market has a mixture of international EHR and Best-of-Breed (BoB) specialty vendors, but EHR vendors take the lion’s share.

Outside of the US, local vendors and Best-of-Breed suppliers have greater presence, specifically in Latin America, EMEA (Benelux, France, Germany) and Asia (China, India and Japan). This is often due to their ability to cater to their local market and their understanding of the local clinical protocols and languages required to support digital solutions, and thus adding more advanced clinical functionality. International EHR vendors are starting to increase their presence in the more mature High Acuity CIS geographies such as the Nordics and the UK, however there is still preference for healthcare providers to partner with local vendors.

The selection of an EHR vendor over a Best-of-Breed vendor often depends on the hospital providers’ existing IT infrastructure. If the hospital has an enterprise-wide solution and a limited budget to integrate other solutions, they will more likely choose a clinical module from an EHR vendor. In markets where an enterprise EHR solution is not installed, the hospitals have tended to choose Best-of-Breed solutions.

The trends and challenges to consider in relation to EHR vendor encroachment are highlighted in the graphic below:

Who wins?

With High-Acuity CIS revenues projected to reach USD $2.1bn in 2027, the market will continue to present lucrative opportunities for both Best-of-Breed and EHR vendors. As geographies develop toward a more advanced level of EHR maturity, the opportunity for Best-of-Breed vendors will become more limited, with hospitals choosing ease and lower cost over clinical preference. However, the more advanced hospitals with larger budgets will continue to opt for higher-end Best-of Breed solutions, specifically in more complex care settings such as the ICU and anaesthesia. In emerging markets, Best-of-Breed vendors will continue to succeed whilst EHR maturity remains low.

About the Report

The above analysis is a summary of some of the trends assessed by Signify Research in its upcoming High-Acuity Clinical Information Systems – World – 2023 market report. This report is the second iteration, building on the previous edition published in 2021. It provides a data-centric and global outlook of the High-Acuity CIS market by product. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

For further information please contact Arun Gill.

E: Arun.Gill@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net