Written by

Cranfield UK, 16th April 2024 – In recent years, the landscape of healthcare in the United States has been undergoing a profound transformation, with a significant shift towards outpatient imaging services. This evolution stems from a change in reimbursement habits, with insurers preferring procedures to be carried out in the outpatient setting to contain costs for non-emergency imaging. Advancements in medical technology and changing patient preferences have also fed into the current shift. While the move to outpatient settings has been ongoing across other markets, such as in Western Europe, the US is by far the most mature market in terms of what percentage of the healthcare infrastructure is made up by outpatient facilities, whether independent or hospital-associated (i.e. joint ventures).

Lay of the Land in 2024

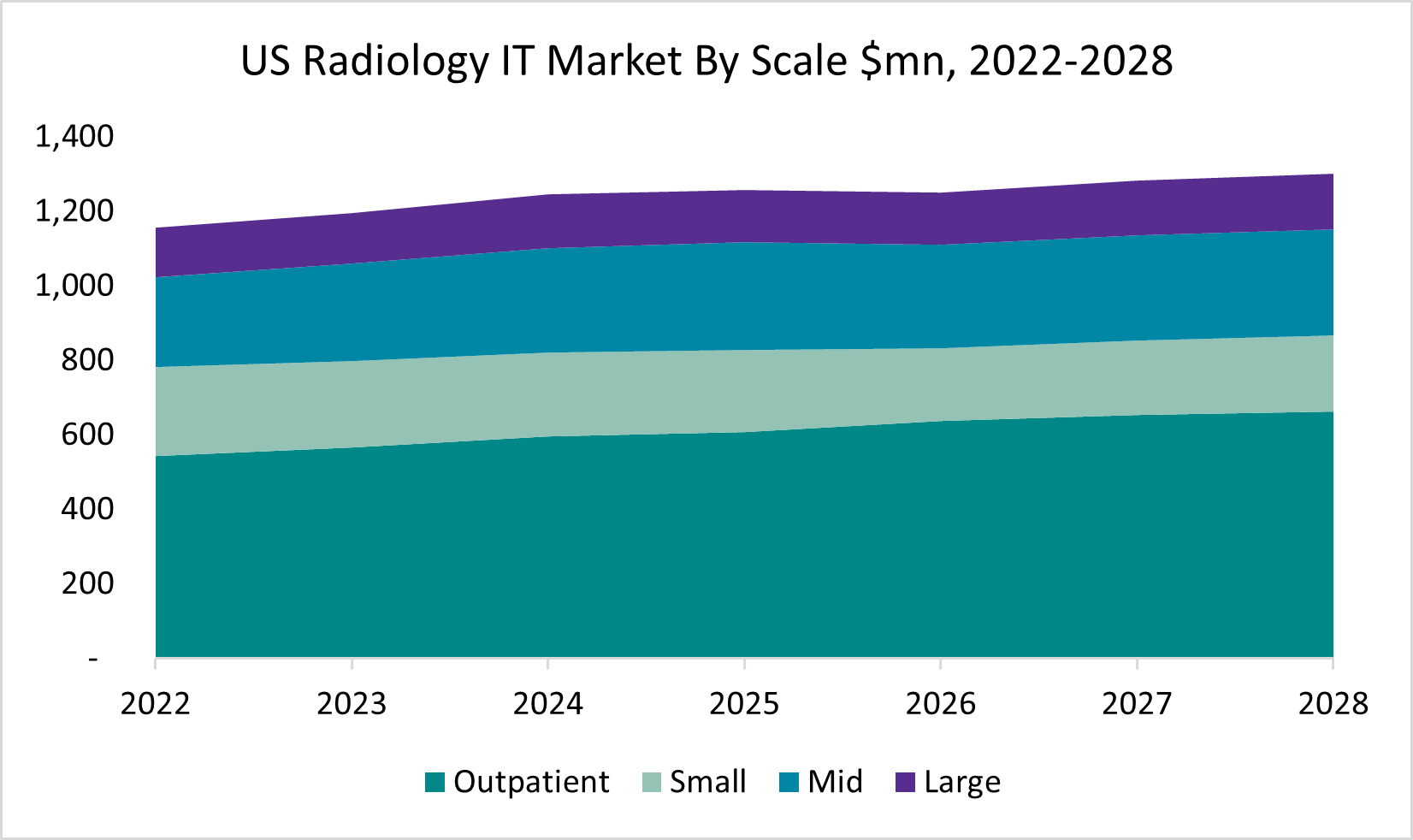

As it stands, the outpatient imaging market in the US is growing, and makes up 47% of the total radiology IT market annual spend, with this set to increase to just over half by 2028. Typically for Imaging IT vendors, the golden goose has been large hospital network IT contracts, or large national government contracts. The competition for these tenders is intense, and large contracts need a similarly large IT vendor that can rollout solutions at scale, including strong implementation and service support capabilities.

As intense competition in those larger providers and networks keeps some small to medium sized imaging IT vendors out, many have pivoted toward providing more tailored solutions for the fragmented outpatient segment. Vendors such as Intelerad, AbbaDox and Emergent Connect are entrenched in the outpatient market, and while other more acute-focused vendors also have their toes in the water in the outpatient market, we expect that over the mid-term, the incumbent outpatient specialists will begin to face more direct and challenging opposition from vendors traditionally selling into hospitals.

But what will the outpatient imaging IT market look like in the next five years? What must Imaging IT vendors consider and be aware of to successfully navigate and capitalize on this trend?

How Best to Ride-Out the Wave of Consolidation

After a couple of weak years during the pandemic, with less footfall in outpatient imaging centres , many became prime targets for acquisition, contributing to a wider consolidation of the market. Hospital networks, imaging centre networks and large radiology reading groups all took advantage of low interest rates of the period, often in partnership with private equity groups, in buying up small imaging outpatient centres. Thus, imaging IT vendors must understand how best to navigate the new market landscape and adopt product and sales strategy to suit.

For example, contracts will become larger but decrease in frequency, while their requirements will evolve to be more complex and federated. As a result, vendors may have to create solutions that can bring together the disparate and fractured legacy imaging IT systems with an overlay with easy and flexible integration. Specialist incumbents may also be displaced if the outpatient provider they’re contracted in is acquired by another provider that replaces their IT system. Furthermore, outpatient centres acquired into joint ventures with acute health networks must also consider integration and if the incumbent acute imaging IT is expanded into the outpatient centre.

Who Invited Private Equity?

Consolidation and M&A activity has not been limited to just providers, with private equity consistently showing interest in the outpatient imaging segment. This has been evident for several years, with PE investment in the overall healthcare market reaching $60bn last year. While interest rates have sharply increased of late, activity from PE firms in the outpatient sector is unlikely to slow as outpatient imaging centres represents a somewhat stable and safe bet. Ongoing increases in demand for imaging services continue to steadily increase, while new models of care in screening, such as RadNet’s direct to consumer model and the growth of popularity of whole-body imaging “health checks” leveraging imaging are expected to continue to gain traction. Reimbursement pressures will continue adding some risk, but this will also help to put more pressure on acute imaging volumes and continually push activity outside of the acute setting.

PE will look across the entire spectrum of the outpatient market, which also includes potential acquisition of outpatient-centric imaging IT vendors. Intelerad for example was acquired by Hg in 2020 and firms are actively considering other vendors within this space. The influence of PE groups on vendors may not just be the possibility of acquisition, but also may affect the dynamics of the market itself. PE is typically driven by short-to mid-term profits, often via efficiency gains and cost-saving. A need to improve bottom line performance is a key play by PE in the outpatient imaging sector, thereby outcompeting acute competition in the delivery of imaging services. Thus, demand for operational workflow tools with real-world evidence on ROI, AI (both image analysis and operational tools) and leveraging teleradiology models to improve efficiency and turnaround times within clinics, are high on the agenda of most takeover bids.

Who’s Up Next For The Outpatient Treatment?

As is usually the case, radiology is very much the front runner in terms of outpatient care adoption, with more convoluted specialties being kept in-house in the acute setting. Cardiology is already well on the way in its move to the outpatient setting, with changing reimbursement patterns pushing procedures towards the cheaper ambulatory surgical centre (ASC) route, and technology such as minimally invasive surgeries facilitating this transition.

Growth for cardiology in outpatient is currently outpacing that of radiology, but cardio IT market spend does lag in terms of relative market size, representing less than 40% of the US market in 2023. One question that cardio IT vendors need to consider is the ownership of ASCs, independent versus hospital-owned. Independent centres are more likely to want an all-encompassing, end-to-end solution, with the likes of CVIS and billing, typically cloud-hosted to avoid IT infrastructure and upkeep costs. Whereas hospital-owned centres are likely to need enterprise-level technology with an emphasis on integration with the wider hospital system, especially the CVIS and EHR. Hospitals are also motivated to acquire these ASCs to keep reimbursement for procedures “in-house”, but PE and outpatient-specific provider groups will also be looking at acquiring this kind of infrastructure in much the same way as in radiology.

The Path To Success

In light of the shifting landscape, Imaging IT vendors face important decisions in charting their course forward. With the outpatient imaging market poised for continued growth, vendors must carefully consider reorienting their strategies to capitalise.

From a solutions point of view, imaging IT vendors may consider a pivot towards developing specialized solutions tailored to outpatient settings, aligning with the increasingly federated and enterprise-led nature of outpatient imaging, including faster integration of competitively differentiating technology such as operational workflow and AI tools as outlined above. Then strategically speaking, vendors should look to make strategic partnerships with acquisitive outpatient radiology service providers that will offer vendors a strong and stable foothold in this competitive market, facilitating access to a broader client base that will grow inorganically.

As private equity firms exert increasing influence within the healthcare sector, their role in shaping the outpatient imaging landscape cannot be understated. PE’s appetite for acquisitions spans both imaging IT vendors specializing in outpatient solutions, as well as outpatient imaging practices themselves.

Vendors must navigate this changing environment, recognising the potential for partnerships to fuel organic growth opportunities, while remaining mindful of the implications of PE and reimbursement-driven consolidation on market dynamics and competitive pressures. Ultimately the shift towards outpatient imaging volumes is set to increase, albeit spread across a complex mix of independent, joint ventures and PE-owned providers. However, scalability, adaptability, and the means to bring next-generation imaging IT technology to support more efficient image acquisition and reading will be fundamental to success. Moreover, as business models shift to OpEx fee per service models, who “owns” volume in captive share terms will matter more.

For imaging IT vendors putting most attention on top tier acute markets, a blinkered focus to outpatient could well mean a substantive volume of imaging services “leaks” to outpatient settings, and with it, to their competitors.

Related Research

Signify Research’s imaging IT service provides expert market intelligence and detailed insights across radiology IT, cardiology IT, and advanced visualisation IT, alongside operational workflow & business intelligence tools. Combining primary data collection and in-depth discussions with industry stakeholders, our thorough research approach yields credible quantitative and qualitative analysis, helping our customers make critical business decisions with confidence. Throughout the course of 2024, the imaging IT team will be further assessing developments in the market through its’ Imaging IT Market Intelligence Service.

About The Author

Jake is the Senior Market Analyst on the Imaging IT team and joined Signify Research in late 2023, after over half a decade in the medical devices and healthcare market research industries.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net