Written by

8th November 2022 – Investment in imaging IT is ramping up in mature markets, with North America amidst a replacement cycle for core radiology IT deals and significant public investment across Western Europe expected in the short-term. However, converting demand to final contracts is not straightforward, due to the bureaucratic hurdles associated to distribution of public funding. Consequently, implementation of large-scale national tenders has experienced delays, such as in the UK and Italy.

Across emerging markets, the market outlook is more varied. China’s economy is expected to bounce back, following the economic slow-down earlier in 2022, as the impact of Covid-19 lock-downs on market demand eases. While the conflict between Russia and Ukraine continues to impose supply chain and deployment challenges across Eastern Europe, growth in the EEMEA region has been bolstered by the Middle East, with sizeable national tenders announced in Saudi Arabia. Latin America remains rife with unpredictability; despite the region awaiting several large public tenders in Colombia, as well as the IMSS in Mexico, persistent political uncertainty poses a threat to short term healthcare investment across the region, as many influential markets transition to new political parties.

Seizing the Moment, Securing the Future

Furthermore, as the impact of COVID-19 subsides, many healthcare systems are looking ahead to refocus on long-term strategies; to meet this need, imaging IT vendors are emphasising advancements aligned to multi-ology enterprise imaging platforms, native cloud architecture and innovation in workflow orchestration. In the short-term, those vendors able to present a strong portfolio and strategic roadmap will have the opportunity to disrupt key strategic markets, such as the US, based not only on the replacement cycle, but also the aggressive ongoing consolidation amongst the outpatient imaging market.

The drive to boost productivity, enhance collaboration across specialities and providers, as well as the fundamental improvement to patient care, is behind many of the product trends in the imaging IT market today. Imaging IT solutions are evolving beyond single ‘ology, not only in enterprise imaging, but also workflow orchestration. Although integration of different workflows is no easy undertaking, investing in technology, such as cloud, and advancing a vendors’ data management capability, will serve imaging IT vendors well, as mature markets become increasingly saturated and cost competitive.

Economic Considerations for Imaging IT

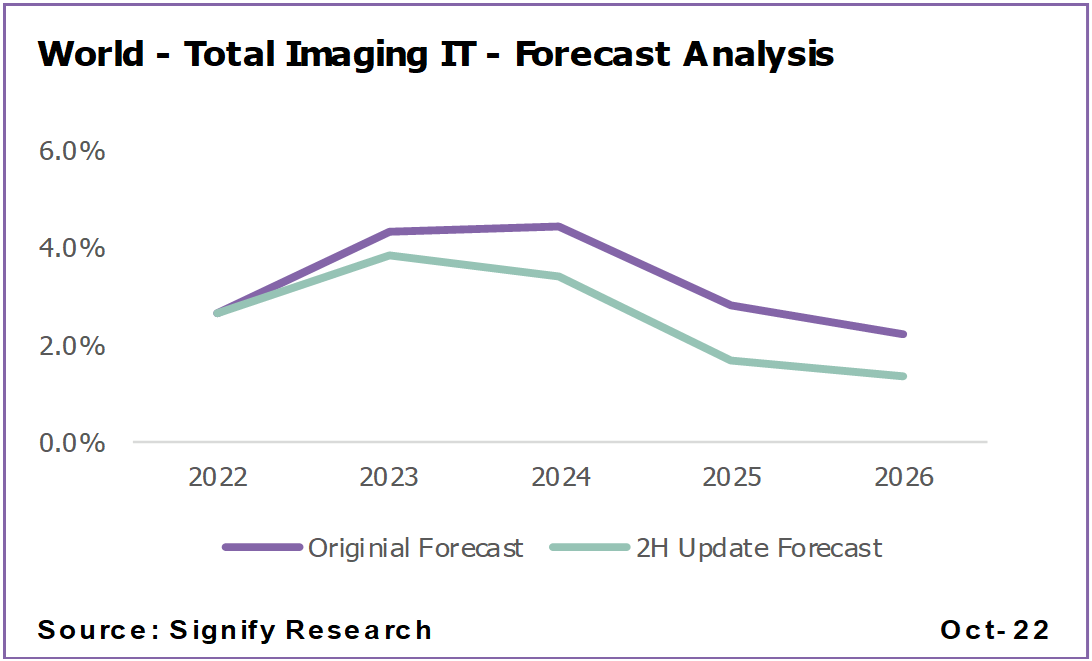

While the global imaging IT market is anticipated to remain relatively robust amidst growing economic headwinds, the latter end of the forecast period (2023-2026) is marred by a growing sense of economic uncertainty. Consequently, Signify Research have revised previous forecasts to evaluate the impact of intensifying financial constraints and economic downturn on the imaging IT market. Worldwide market growth has been downgraded between 0.5-1.5% across 2023-2026, compared to the initial forecast published in May 2022 (Imaging IT – World – Core Report – World 2022).

Total imaging IT encompasses radiology IT, cardiology IT, advanced visualisation, and operational workflow & business intelligence tools. The original forecast has been taken from the Imaging IT – World – Core Report – 2022, published May 2022. The 2H Update Forecast references the Imaging IT – World – 2H Update – 2022 report, published October 2022.

Mature markets will be shielded from immediate market volatility, due to the stability offered by recurring revenue associated with long contract cycles. Although pre-established deals and investment will serve as a buffer for opportunities in mature markets short-term, in the mid to long-term (‚’24-’26) risk aversity will undoubtedly increase, with market performance aligned to a vendors’ ability to rebuild their sales pipeline. Emerging markets are far more vulnerable, with limited digitisation and shorter contract cycles, so less protection is offered against inflation and price adjustments. As such, market contraction is somewhat inevitable. More so than ever, vendors will look to refocus and recommit to “safer” mature markets for growth, further impeding the expansion potential of emerging markets.

Market volatility is expected to manifest through a shift in healthcare providers’ product investment, with a growing emphasis on solutions that improve overall efficiency. Providers will ‘double down’ on tools such as operational workflow and clinical viewers, that are comparatively cheap to implement, whilst enabling providers to ‘do more with less’ as financial pressures loom. Some providers may also consider image analysis AI tools to improve workflow efficiencies and clinical accuracies; however, others may be more cautious given the upfront investment, challenges around deployment, and other priorities such as workflow integration and cloud adoption.. As economic instability intensifies in mature markets, providers and vendors alike will seek the security and stability afforded by managed service contracts. Price stability and the benefits associated to the outsourcing and end-to-end management of contracting will drive demand from providers, while vendors benefit from the guaranteed revenue stream.

Opportunity for Market Disruption

Despite the unchartered waters ahead for imaging IT vendors that will demand strategic planning to navigate the right product and market investment in the mid-term, there remains short-term opportunities that vendors cannot afford to miss.

Given the influence of the US replacement market, alongside the consolidation experienced across the outpatient segment, succeeding in deals in 2022 and 2023 offers a chance for “challenger” vendors to disrupt incumbent market leaders and secure revenue mid-term. However, displacing incumbent vendors will be no easy task, especially as providers lean increasingly towards the ‘easier’ option of rolling-over contracts. Therefore, as worsening economic conditions loom over the market, performance in the present has never been more important.

About the Report

The Imaging IT Market Intelligence Service is an annual subscription that provides ongoing data, insights and analysis on the global opportunity for imaging IT.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 436 150

www.signifyresearch.net