Written by

Capital investment in companies who are developing machine learning solutions for medical image analysis reached $522 million by the end of the first half of 2018. There was a surge of investment towards the end of 2017, with nine deals completed in Q4 2017 worth a combined $141 million. This has continued into 2018, with deal value reaching $143 million across nine deals in the year-to-date.

You can download our free report here: Funding Analysis of Companies Developing Machine Learning Solutions for Medical Imaging

In 2017 the commercialisation of deep learning solutions for medical image analysis gained pace, as medical device regulators in several countries cleared the first wave of products. At the same time, several of the leading start-ups successfully completed later-stage funding rounds to enable them to bring products to market and scale their activities. These later-stage deals ranged from $5 million to $46 million, with an average deal size of around $20 million.

However, it may be getting harder for new start-ups to attract early-stage (Angel, Seed and Series A) funding. There was only one notable early-stage funding round in the first half of 2018 (Circle Cardiovascular) and only a handful in the second half of 2017. By comparison, there were more than 20 early-stage deals in 2016.

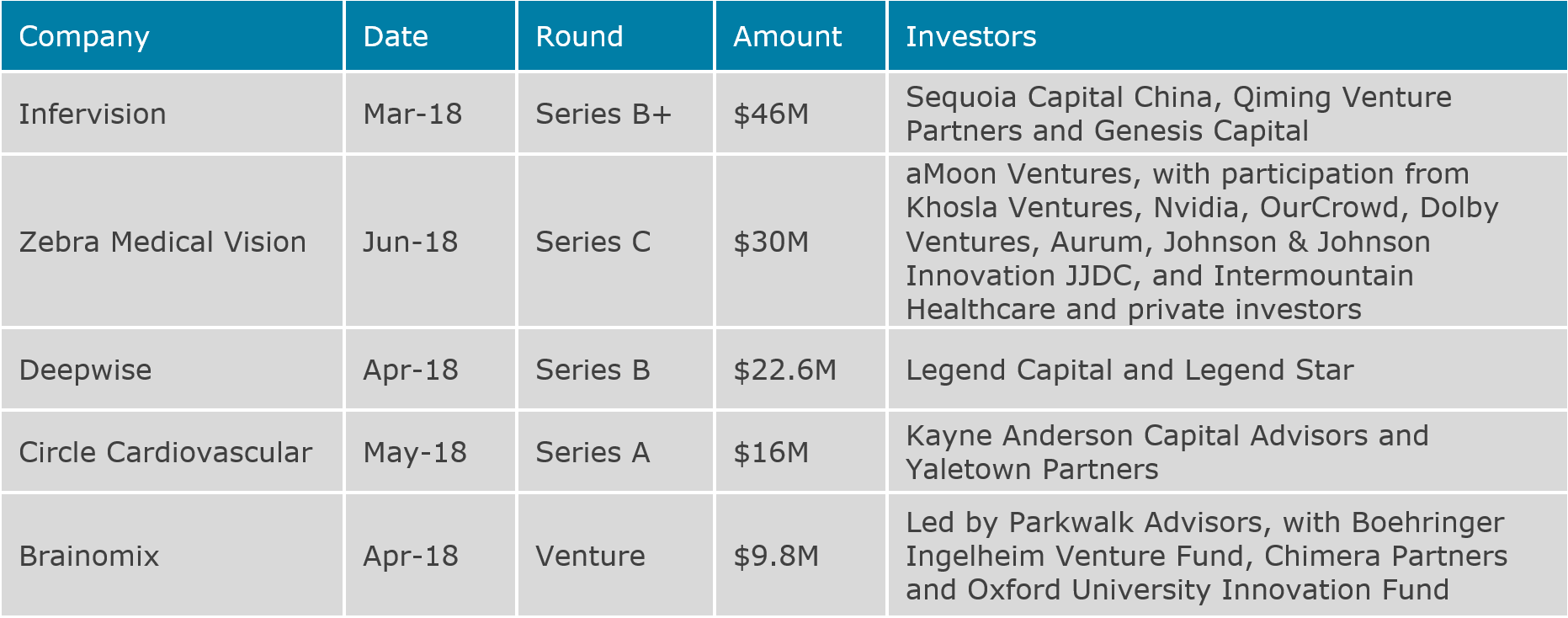

So far in 2018, the five largest deals are:

Some of the other key takeaways from our analysis are:

- There are over 80 start-ups developing machine learning solutions for medical imaging. 42 of these entered the market since the start of 2015.

- The number of new market entrants has notably slowed, from a peak in 2016.

- The average amount of funding raised per start-up is just over $10 million.

- Three of the five most funded companies are based in China.

Whilst capital investment in medical imaging AI companies is at a record level, our analysis shows that investors are shifting their focus from new start-ups to later-stage funding. New market entrants will need to identify unmet market needs and demonstrate disruptive technologies and/or innovative business models in order to attract investment. Meanwhile, for the well-funded startups, the race to commercialise their solutions and gain an early to market advantage is well and truly on.

Related Market Report

“Machine Learning in Medical Imaging – 2018 Edition” provides a data-centric and global outlook on the current and projected uptake of machine learning in medical imaging. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

More Information

To find out more:

E: simon.harris@signifyresearch.net

T: +44 (0) 1234 436 150

www.signifyresearch.net