Written by

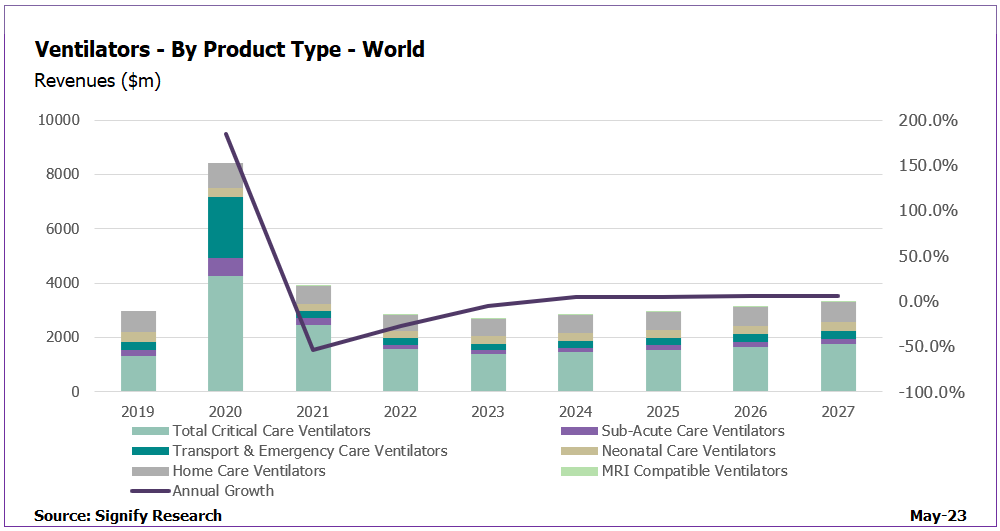

Cranfield, UK – 22nd June 2023 – The world ventilator market is estimated to have been worth $2.9 billion in 2022 and is forecast to rise to $3.3 billion in 2027. As expected, there was reduced demand in 2021 and 2022 compared to that seen in 2020, due to the excessive number of ventilators shipped during the pandemic. However, the market remained above pre-pandemic levels in 2021. 2022 saw the market fall below pre-pandemic levels. This is forecast to remain the case until 2025. Only the Emerging Asia region bucks this trend, maintaining pre-pandemic throughout the next five years.

Interest in the ventilator market exceeded the industry’s’ expectations during the pandemic, forcing many vendors to uplift production to meet the rising demand. Supply became a much bigger impacting factor, with manufacturers not only struggling to meet the surplus orders, but also struggling to source necessary components. The impact wasn’t short-lived, with many vendors continuing to struggle throughout 2021 and 2022. This pushed back delivery times with many of the traditional leading suppliers left struggling to fulfil orders.

Although Signify Research initially projected the market to see a steep decline in revenues in 2021 and 2022, the market remained relatively buoyant. Orders that were due to be fulfilled in 2020, rolled over to 2021. Additional waves of the COVID-19 virus also spread toward the emerging regions, resulting in additional demand for ventilator provision in countries that hadn’t initially seen such a significant uplift.

Several countries also jumped into action to improve ICU capacity, driving demand for both High-End and Mid-Range critical care ventilators. As many emerging regions are now focusing on meeting better bed-ventilator ratios within the ICU, the Mid-Range segment is projected with faster revenue growth, nearly reaching the same revenues as the High-End segment in 2027.

The Neonatal Care ventilator segment remained relatively unaffected by demand swings during the pandemic, and as such continues to be a focus of development in all countries. Additional supporting clinical guidelines to improve Neonatal Care practices are increasing the awareness of the need for neonatal ventilators to reduce preterm deaths. Movement of Neonatal Care towards tertiary centres is also expected to drive demand further. The Neonatal Care ventilator market is projected with the fastest revenue growth of all segments from 2022 to 2027, as budgets are refocused to improve Neonatal Care facilities globally.

Regional Trends:

Americas

The Americas market accounted for the largest regional proportion (36%) of global revenues in 2021, due to increased demand to improve ICU capacity. However, as many of the facilities are now saturated, the demand for ventilators is projected to remain lower than 2021 through to 2027. Demand in Latin America is also projected to be restrained in the coming years. As such, the Americas is projected to account for the lowest proportion of global revenues from 2022 through to 2027. With several solutions purchased during the pandemic that were not suitable, many purchasers in the North American region are looking to standardise their ventilator fleets, seeking solutions that can offer more for less. With such a big spike in demand seen in recent years, budgets are now focused on product efficiency. The US is also slowly transitioning toward operational purchasing models, to help improve the ease of business, especially when larger bundled deals of standardised fleets are being considered.

EMEA

Fiscal stimulus packages led to maintained demand for ventilators in the EMEA region in 2021, despite the mass surges seen in 2020. However, revenues declined in 2022 as support declined and are projected to fall again in 2023, with an uptick in growth projected in 2024. This is mainly driven by financial recovery which in turn is expected to fuel healthcare spending and further drive additional support for hospital provisions, and subsequent ventilator replacements. Innovation in the European region is expected to be restricted in the short term as vendors struggle to navigate their way through the MDR regulations and approval backlogs mount. However, driven by government initiatives mandating connected solutions, demand for digital solutions capable of being integrated with information systems continues to grow. A core focus here is the ICU.

Asia

The impact of the COVID-19 pandemic came much later in much of the Asia Pacific region, due to initial country lockdowns minimising the spread of the virus. However, subsequent waves of COVID-19 have driven country reforms to focus on uplifting the level of ICU provision further. In China the Government has pledged to increase the proportion of ICU beds and invested in hospitals to expand ICU facilities. This created a surge in demand in both 2021 and 2022 driven by incentives offered. The current target to increase the number of ICU beds to 10% of all hospital beds in major cities (compared to 3% in 2021) will also maintain some demand for ICU ventilators. As such, the Asia Pacific region is projected to account for the largest proportion of global revenues from 2022 to 2027.

Future Outlook

The pandemic has driven the necessary gear-change to overhaul ventilator provision. Healthcare facilities realise they need to update their fleets to enable a more flexible approach to ventilation. As healthcare resource continues to be a greater burden on the capabilities to provide high-quality care, the transition of less critical patients to lower acuity settings is now becoming a global trend. ICU facilities will look to ensure the most critical of patients are cared for with the most advanced solutions, incorporating clinical decision support in addition to patient analytics to help guide the caregiver on the best settings to improve patient comfort and survival rates. Lower acuity settings will also see expansion of ventilator provision, to ensure those patients that require respiratory support are sufficiently catered for. This is also creating the impetus to improve non-invasive ventilation provision in addition to ‘easy-to-use’ ventilators that are more intuitive and have simple dashboards. The market has been shaken by the recalls of Philips’ solutions, but the industry has been quick to respond, with many vendors stepping up to fill the void where required. As such, the interest in the ventilator market will remain piqued for several years ahead.

Related Research

Signify Research has recently published its Ventilators – World – 2023 report, which builds on our 2021 edition of the report. The report provides a data-centric and global outlook of the market. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors to provide a balanced and objective view of the market.

About Kelly Patrick

Kelly joined Signify Research in 2020 as a Principal Analyst. She has nearly 15 years’ experience covering a range of healthcare technology research at IHS Markit/Omdia. Kelly’s core focus has been on the clinical care sector, including patient monitoring, diagnostic cardiology, respiratory care, and infusion and associated IT solutions. Kelly holds a BSc degree with honours in Pharmacology from the University of Leeds. In her spare time, Kelly has a passion for running and outings with her husband and three children.

About the Clinical Care Team

The clinical care team provides market intelligence and detailed insights on the clinical care equipment and IT markets. Our areas of coverage include patient monitoring, diagnostic cardiology, infusion pumps, ventilators, anaesthesia and high-acuity IT. Our reports provide a data-centric and global outlook of each market with granular country-level insights. Our research process blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net