Written by

Partnerships were king for telehealth vendors at HIMSS this year.

The reason? The increasing importance of being able to offer enterprise scale telehealth solutions.

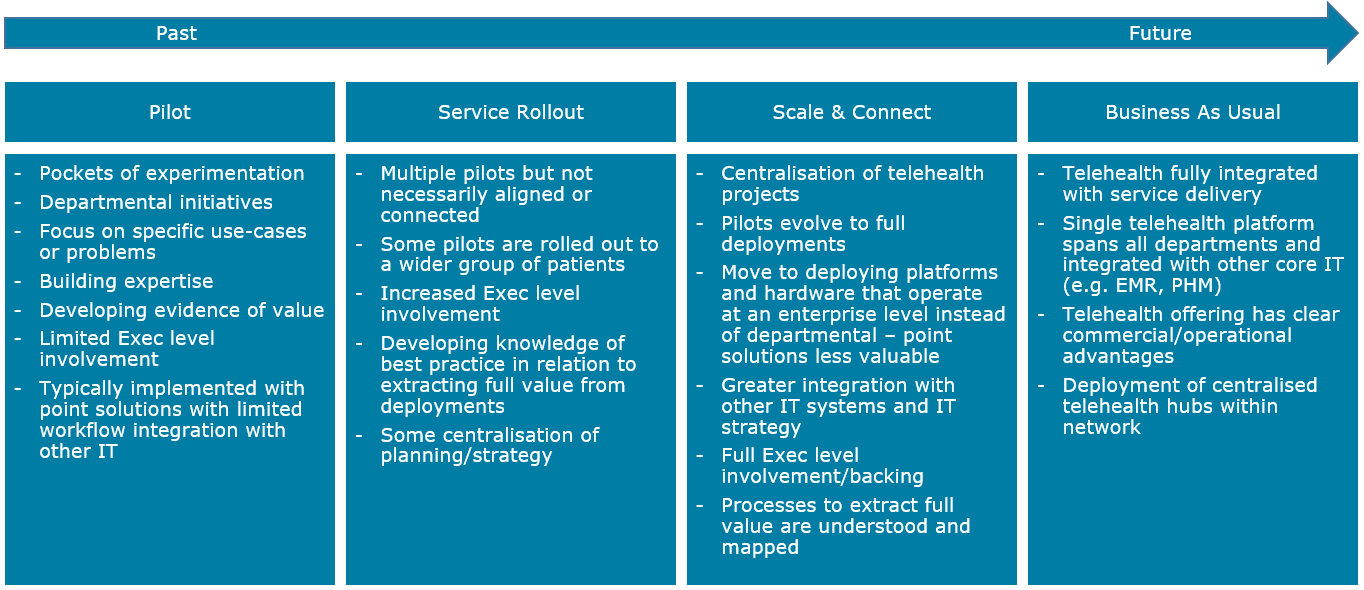

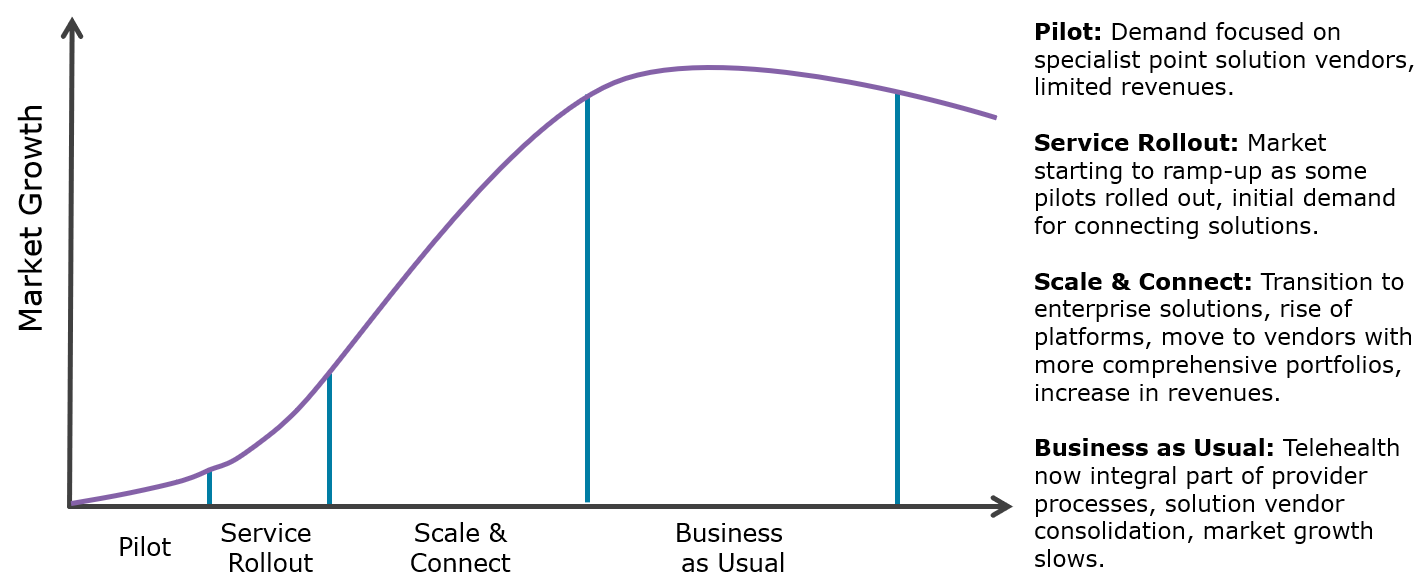

We explore some of the partnerships that were announced at HIMSS in detail a little later, but to understand what’s driving this, it’s first important to understand the evolution of telehealth in terms of maturity from small-scale, point solutions to enterprise offerings that can be used across a range of healthcare settings. The diagram below outlines this maturity model.

Although telehealth has existed for many years, until recently most providers were still at the pilot stage, particularly outside of North America. Pilot deployments are smaller scale by definition, but they were also typically focused on one specific use-case, or care setting, or are addressing one specific problem. For example, better triage of stroke victims as they arrive in the ED, reducing re-admission rates for congestive heart failure patients after they’ve been discharged from hospital or addressing the primary care needs of sufferers of musculoskeletal disorders (MSDs).

These projects were often limited to one department in terms of scale and the solutions used were often point solutions designed to address a single use-case or problem in question. At this stage, vendors that specialised in the specific use case in question were often successful.

The next step for a health care provider after this pilot stage tended to then be a ramp-up of the initial pilot to a larger scale service roll out and the deployment of new pilots in other departments. There may have been some level of coordination as telehealth expertise and knowledge started to increase across the organisation, but often these deployments were still implemented in isolation, using hardware, software, platforms and services from different vendors, with limited integration to other healthcare IT such as EHR, workflow tools or imaging IT.

As the provider’s understanding of telehealth evolved in terms of how it can be used in the most effective way, pilots started to be connected and a more strategic vision developed. It is at this point that demand started to transform from point solutions targeted at specific functions, to enterprise solutions that can be leveraged across organisations. Platform vendors that were already supporting departmental level pilot deployments, but that could also support a provider as it started to examine how it scaled up and connected its deployments were well positioned at this point.

Within the more evolved regional markets, such as the US, several providers are now at the Scale & Connect point (outlined in the diagram above) in terms of telehealth maturity. This point marks the evolution of deployments from pilot to full-scale services using centralised planning and cross departmental solutions. As more advanced markets have started to approach this point the demand for enterprise-scale platforms has really started to kick in. Many solution vendors that have had historic success are now finding themselves unable to service the demand of providers with their existing offerings and expertise, and this driving many of the recent partnership announcements. Some examples from HIMSS include:

Avizia announced it had partnered with athenahealth to offer the AviziaOne telehealth platform within the athenahealth Marketplace. The Marketplace is an app environment that allows athenahealth customers to license additional platforms to operate within its EHR environment. athenahealth has several other telehealth vendors listed on its Marketplace including Babyscripts, SimpleVisit, esvda!, The Rowe Network, iTel, eVisit, SnapMD, uCare Connect and Healthchat. However, being able to launch apps for telehealth within an EHR environment does not represent full integration into clinicians’ workflows. Whilst a step in the right direction, tighter integration is required for a truly integrated clinician experience when utilising telehealth applications from within an EHR at an enterprise level.

Teladoc announced an expansion of its collaboration with Microsoft. The two companies are developing a joint go-to-market strategy utilising Teladoc’s telehealth platform and Microsoft’s Azure cloud platform. HIMSS saw the two companies showcasing multiple demonstrations of their collaboration with Teladoc presenting case studies of the Teladoc Azure hosted solution during the Microsoft Health Forum.

Telehealth video conferencing solution provider Vidyo demonstrated multiple examples of interoperability during the show. Within the Interoperability Showcase area of HIMSS it demonstrated how it had worked with Epic and ViTel Net to develop telehealth solutions for stroke services in rural areas. It also announced it had partnered with Honeywell Life Care Solutions to provide video communications within Honeywell’s LifeStream platform, a platform historically targeted toward remote patient monitoring and less focused on video consultations.

Partnerships announced during HIMSS were an extension of several others in the months leading up to the show. Vidyo had already announced during 2017 that its solution would be integrated into Allscripts’ “FollowMyHealth” patient engagement offering and in January 2018, Philips signed a strategic partnership with American Well to support both companies’ initiatives to deliver virtual care solutions around the world. While the deal initially focused on supporting Philips in its integration of telehealth services into some of its personal health products, in the medium term it will allow both companies to better address the demand for enterprise telehealth.

The final step in terms of the maturity model is when telehealth has evolved to become a core service delivery method for the provider, with its use having permeated most departments and care settings using a common enterprise platform. At this point the platform needs to be highly integrated with other core IT systems such as EHR, PHM and imaging, and telehealth needs to be incorporated into standard workflows. EMR integration should be the priority here as it is often the environment clinicians are most accustomed to working from. However, consumer telehealth is increasingly becoming a core component of a patient engagement strategy, so overlooking integration with PHM solutions should not be overlooked.

It is essential for vendors that are looking to be able to service markets at this level of maturity that they follow a standards-based approach that allows for their telehealth platform to be integrated with other core healthcare IT solutions, a process that is far from easy, as discussed in our other show report insight covering interoperability (Interoperability: A Sheep in Wolf’s Clothing at HIMSS18). Often this will entail developing strategic relationships with EHR, PHM and imaging solution vendors as per some of the examples above. Developing a telehealth platform portfolio via M&A can support a vendor as it evolves its portfolio to address the demands of enterprise telehealth, a topic Signify Research has examined over several recent insights (see https://www.signifyresearch.net/digital-health-posts/); however, collaboration and strategic partnerships will still be required to achieve seamless workflow integration.

About the Report

The information presented in this insight is taken from Signify Research’s just published market report “Acute, Community and Home Telehealth 2018 Edition“. This report will present the market for telehealth platforms, hardware and services and will include projections and market sizings for more than 20 countries.

The report is available as a stand-alone product, but it is also a component of Signify Research’s “Population Health Management and Telehealth Service”. This is a year-round service that provides ongoing data, insights, and analysis on the global population heath management and telehealth markets. The service includes four market reports delivered over a 12-month period, regular updates of key market metrics, competitive environment and market share analysis by product type and region and quarterly analyst briefings to each subscriber firm.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

To find out more:

E: Alex.Green@signifyresearch.net , T: +44 (0) 1234 436 150

www.signifyresearch.net